TOGETHER WITH

Hey there weekday warrior. Here’s what’s on tap today… Zuck f*cked up, Paramount has a fever and the only prescription is WBD, and SPACs are back.

Enjoy the next 3 minutes and 32 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Zuck walks it back

Who could possibly have predicted this outcome?

Meta Platforms $META ( ▼ 1.34% ) may need to consider a(nother) rebrand in what is basically the big tech equivalent of wanting to get the tattoo of your ex’s name removed.

After casually lighting $70B on fire since 2021, Zuck may finally be caving to pressure to pump the brakes on the Reality Labs division of Meta… starting with the “metaverse.”

Per “anonymous” Bloomberg sources (who apparently don’t realize that snitches get stitches), Meta execs are considering up to a 30% cut to the metaverse project (read: VR) next year.

The metaverse isn’t the only thing Zucks’s looking to roll back. Execs are reportedly being asked to find 10% cuts across the board for the 2026 budget.

Asking for a friend, has Zuck considered NOT paying every virgin with AI in the equivalent of an NBA super max?

Meta shares jumped 4% on the news of yuge cuts.

If only there were signs that this technology was going to change the world…

1440 is just what the news needs

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. They navigate through over 100 sources to bring you fact-based news on politics, business, and culture, minus the bias.

Paramount Skydance $PSKY ( ▲ 20.84% ) went ahead and wrote a strongly worded letter to Warner Bros. Discovery’s $WBD ( ▼ 2.19% ) board questioning the “fairness and adequacy” of WBD’s sale process. What a narc…

Paramount’s chief complaint is that “WBD appears to have abandoned the semblance and reality of a fair transaction process” and is favoring a single bidder (read: Netflix $NFLX ( ▲ 13.77% )).

Friendly reminder that Paramount, Netflix, and Comcast $CMCSA ( ▲ 0.36% ) have all submitted second-round bids to acquire WBD assets. So far, Netflix appears to be in the lead, and Paramount’s lawyers are so friggin’ pissed they’re gonna have a BF.

US job cuts have officially reached the million-pink-slip mark, up to 1.17M in 2025, the highest number since 2020 (read: mid-COVID). November layoffs totaled over 71k, with Verizon $VZ ( ▲ 2.56% ) leading the way (think: 13k “restructuring” jobs cut).

+ Ah sh*t, here we go again…

Future GOP candidate Donny Trump Jr. and loyal sidekick Eric Trump’s SPAC IPO’d yesterday, and shares *checks notes* went… up. Shares of New America jumped 3% on the day.

> Google taps AI vibe-coder Replit in challenge to Anthropic and Cursor (CNBC) New buzzword just dropped: vibe-partnering.

> Is this bad?

> Bill Gates’ daughter snags $30M for AI startup backed by celebs, Silicon Valley heavyweights (NY Post) Imagine your dad being worth $104B and having to go raise $30M ?

> Nvidia has a cash problem — too much of it (CNBC) They had us in the first half, not gonna lie…

> It’s not too late to change this…

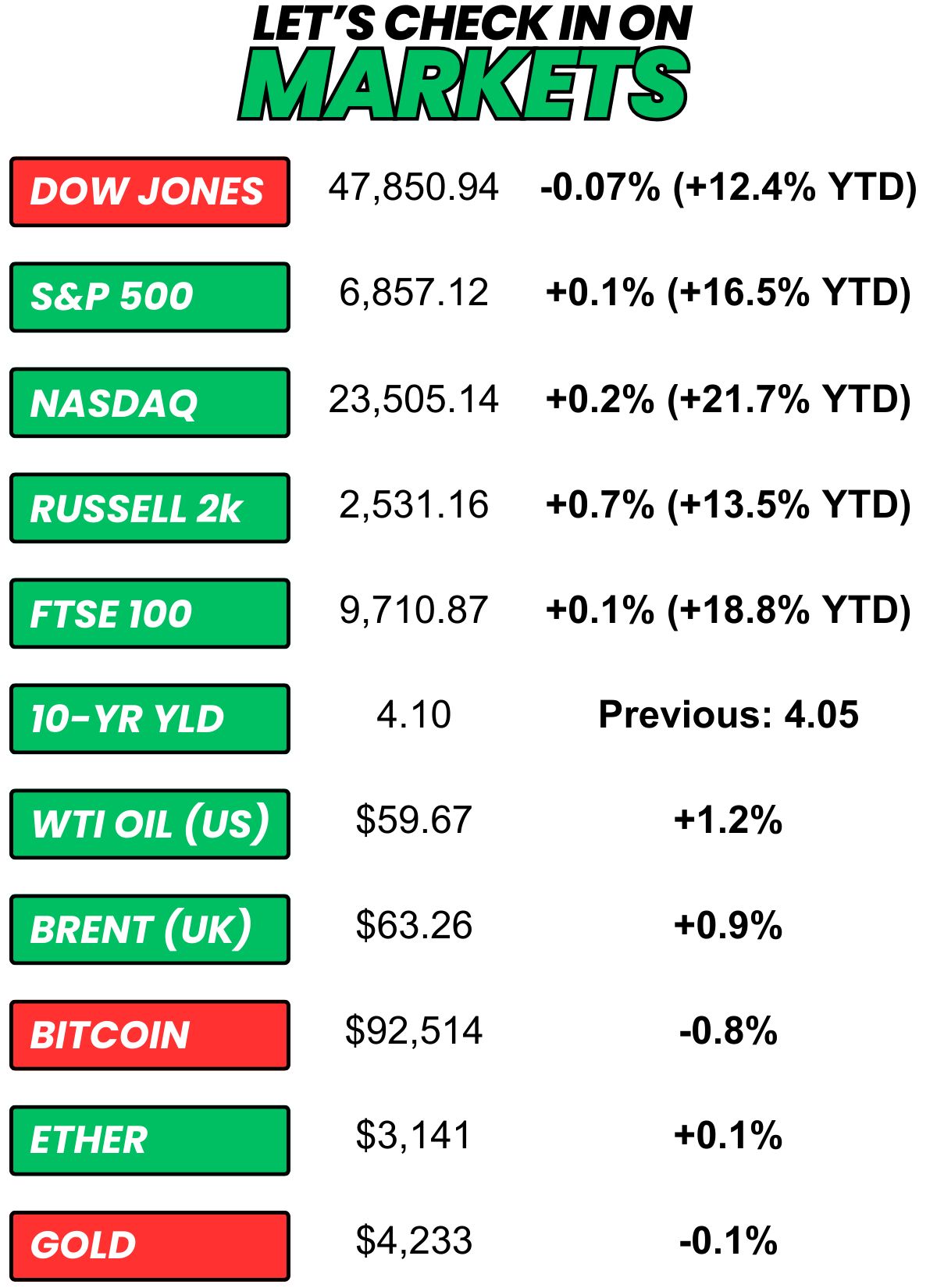

+ US stocks “closed mixed on Thursday as Wall Street digested fresh jobs data, with traders increasingly baking in expectations that the Federal Reserve will deliver a December rate cut.” (Yahoo! Finance)

+ The 10-year yield “moved higher on Thursday as investors looked at the latest layoff numbers for November and weekly jobless claims, and continued to expect an interest rate cut at the Federal Reserve’s meeting next week.” (CNBC)

+ Oil “settled up on Thursday on investors’ expectations for the Federal Reserve to cut interest rates, while stalled Ukraine peace talks tempered expectations of a deal restoring Russian oil flows.” (Reuters)

+ Bitcoin “was little changed on Thursday after rebounding to the $93,000 mark in the previous session, underpinned by positive regulatory developments and expectations of a Federal Reserve rate cut next week.” (Investing.com)

+ The “smart” money (prediction markets) thinks there’s a 44% chance that Paramount will acquire WBD. (Polymarket)

⏪ Yesterday…

+ Kroger, Dollar General, and Toronto Dominion Bank dropped earnings before the opening bell

+ Rubrik, DocuSign, SentinelOne, Ulta Beauty, Samsara, Hewlett Packard, and ChargePoint reported after the bell

⏩ Today we’re keeping an eye on…

+ ServiceNow shareholders will vote on the company's proposed five-for-one stock split

+ The delayed core PCE price index report for September will be released

Yesterday, I asked, “Which prediction market are you using to gamble away your kid's entire ‘Trump account’ balance?”

20.4% of you said, “None, I'll patronize my local casino.”

Here’s what some of you guys had to say…

None, I'll patronize my local casino: “Just will feel better losing the money in real life…”

None, gambling is a sin: “That money is getting the Bogle/Buffett treatment until kid is within 20 years of whatever the retirement age is at that time”

Other: “NASDAQ”

DraftKings/Railbird: “Gimme the OG sports app. Losing money is losing money, regardless of who you give it to.”

FanDuel: “If FanDuel runs profit boosts on their prediction market I’m all in.”

Kalshi: “If it is good enough for the guy I get my bad gambling advice from on TikTok it is good enough for me”

Here’s today’s question…

What's the best drink of the weekend?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.