Hey there weekday warriors,

Here’s what we’re getting into today…

Tesla layoffs

Retail sales come in hot

Is Goldman back?

Enjoy the next 4 minutes and 12 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

+ US stocks “flipped to sizable losses Monday as bond yields rose and investors focused on the fallout of Iran's attack on Israel and the continuation of corporate earnings season.” (Yahoo! Finance)

+ The 10-year Treasury yield “jumped Monday as investors reacted to a hotter-than-expected retail sales report and rising geopolitical tensions." (CNBC)

+ Oil “prices slipped lower on Monday after Iran's weekend attack on Israel proved to be less damaging than anticipated, easing concerns of a quickly intensifying conflict that could displace crude barrels.” (Reuters)

+ Bitcoin “continued to face downward pressure on Monday stemming from a panicky market sell-off following an Iranian strike against Israel, which also pushed the dollar up to five-month highs." (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Trump Media -18.3% 2) Tesla -5.5% 3) Nvidia -2.4%

The market moves you need to know about…

– Welp, Salesforce investors made it abundantly clear how they felt about the CRM OG’s potential acquisition of Informatica. Shares fell 7.2% on news of a possible deal.

– Trump Media & Technology’s death spiral continues. DJT fell 18.3% on news that it would allow current investors to exercise stock warrants (read: more stock will be issued).

– Cathie Wood’s Ark Innovation ETF dipped 4.5% to fall below its 200-day moving average. Oof.

You’re fired

(Source: Giphy)

Rahul Ligma has the chance to do the funniest thing (again)…

Tesla (-5.5%) is laying off nearly 10% of its workforce. That means approximately 15k employees are being sacrificed to the EV gods.

Elon had this to say about the situation on Twitter…

His (leaked) internal memo gave a bit more context…

“With this rapid growth there has been duplication of roles and job functions in certain areas. As we prepare the company for our next phase of growth, it is extremely important to look at every aspect of the company for cost reductions and increasing productivity.”

The writing was on the (Tesla Power)wall…

It shouldn't have come as a huge shock to anyone on the inside. Elon had been laying the groundwork…

Last week, managers were asked to begin ID’ing top performers. Which is probably why rumors began swirling over the weekend that it was only a matter of time.

Earlier in the year, some employees’ stock rewards were canceled. And some year-end reviews never got scheduled. So, yeah, there were signs…

I mean, it was pretty obvious from the outside that some changes were coming. Tesla deliveries declined for the first time in nearly 4 years in the most recent quarter.

And the finance team has gone all used car salesmen with Tesla pricing as demand remains softer than Elon in that one picture (you know the one I’m talking about).

MaxAI.me - Outsmart Most People with 1-Click AI

MaxAI.me best AI features:

Chat with GPT-4, Claude 3, Gemini 1.5.

Perfect your writing anywhere.

Save 90% of your reading & watching time with AI summary.

Reply 10x faster on email & social media.

Once again, Americans bought sh*t with reckless abandon. Retail sales numbers for March dropped yesterday… and came in much higher than expected (0.7% vs. 0.3% expected). Oh, and February’s print was revised upwards.

CPI came in at 0.4%, which means citizens of the US and its outlying territories did their part above and beyond inflation.

Of course, retail sales staying hot isn’t great if you’re hoping for lower interest rates. This is just another data point that could be used to justify “higher for longer.” Are you happy now, people?

+ DJ D-Sol just took the aux cord and is playing nothing but the hits.

Goldman (+2.9%) didn’t just beat earnings, it opened up a can of whoop a** on analysts up and down the Street.

For real, look at this stat line: EPS came in at $11.58 vs. $8.56 expected, on revenue of $14.21B (vs. $12.92B consensus).

The trading and investment banking units gave David Solomon a much-needed W.

+ The Biden administration is making it rain CHIPS dollars. The latest beneficiary of a grant from the $50B+ earmarked to make the US a chip-making powerhouse (or at least suck a little less) is Samsung. The South Korean company will get $6.4B to build a chip plant in Texas.

+ It appears someone at the Justice Department couldn’t get tickets to the Eras Tour. The DOJ is reportedly prepping an antitrust suit against Live Nation (-8.2% after hours when the news broke). It could drop the hammer as soon as next month. There aren’t a ton of details, but it probably has something to do with its monopoly over the entire ticket industry (oh, and the whole T-Swift debacle).

+ Real estate data reveals the best time to sell your home in 2024 (Read)

+ Mark Cuban is ‘proud to pay’ $275.9 million in taxes: ‘It’s crazy and unreal in so many ways’ (Read)

+ Google just showed us what search is going to look like from now on (Read)

Here's what I'm keeping an eye on today...

+ UnitedHealth, Johnson & Johnson, Bank of America, Morgan Stanley, Rio Tinto, and United Airlines report

+ Friendly reminder: the Bitcoin halving is expected to happen on Friday or Saturday

Yesterday I asked… Should SBF’s 25-year sentence be harsher?

79.5% of you said “yes.” Here are some of my favorite write-in punishments…

“25 years for stealing some money is pretty fair. The government does it every single day without punishment; so maybe he should actually go scot-free”

“Handwritten apology letters to everyone he stole from, IN CURSIVE. ”

"Give him a haircut."

Here’s today’s question…

Not a great day to be working for Elon. So…

Which celebrity CEO would you want to work for?

BTW…

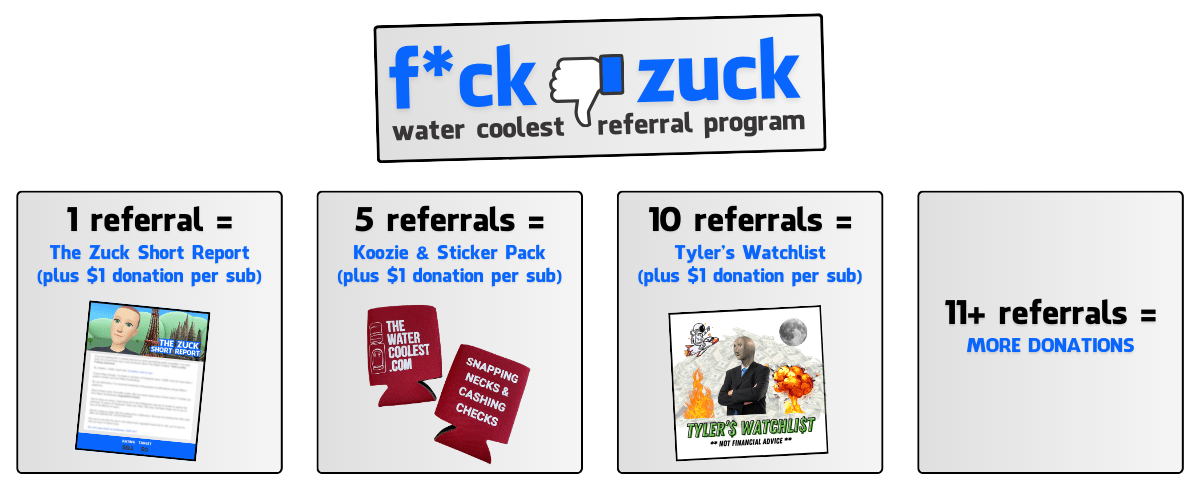

Have you referred anyone to The Water Coolest yet?

You can earn rewards and secure donations for your favorite charity by sharing your unique referral link…

Share your unique referral link (below) with anyone you think might be interested in The Water Coolest. You can email it, post it on social, etc. Get creative.

Your unique referral link: {{rp_refer_url}}

{{rp_personalized_text}}

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional