TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

Zions gets rocked, Apple lands F1 streaming rights, and Hims, Eli Lilly, and Novo have the President to thank for some fat losses.

Enjoy the next 4 minutes and 29 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

You little cockroaches

Jamie Dimon rn…

Babe, wake up, a new regional bank crisis just dropped…

On Thursday, the US financial system was collapsing, and the bull market was cancelled.

Fast-forward exactly one trading day, and every retail investor had moved money from their Kalshi account to Robinhood and bought the f*cking dip…

ICYMI, on Thursday, Zions Bank $ZION ( ▼ 7.09% ) got put in a body bag after revealing a $60M loan wasn’t getting repaid. Before you go all, “that’s ashtray money, bro,” it’s probably worth keeping in mind that the market is on edge.

Investors’ Spidey Senses are tingling about credit quality in the US (read: bad loans). It probably didn’t help that the First Brands’ collapse is still fresh in everyone’s mind and that doomsday prepper Jamie Dimon warned of more “cockroaches” (aka more credit risk) hiding in the economy during JPM’s earnings call.

But it turns out that Zions might have just gotten into bed with a bad egg (who amongst us hasn’t?). According to a lawsuit, two investors took out loans to buy distressed properties that were secured by deeds (spoiler: Zions had first dibs on that collateral).

When the “investors” stopped servicing the loan, Zions went to collect the properties that were rightfully theirs. One problem: most of them had been foreclosed on or transferred to other entities, which meant Zions was sh*t out of luck.

What we have here is a classic case of f*ckery. But it was more than enough to wake up investors who are looking for a reason for the bull market to end.

WTF could it mean for us?

Every lame stream newsletter tells you “wHaT iT MeAnS.” At The Water Coolest, we predict tomorrow’s headlines today…

“It’s called BTFD… look it up.” - Jamie Dimon, probably

🔮 WSJ headline on 10/23/25 (probably): "JPMorgan Chase announces 3% stake in Zions Bancorporation as 'vote of confidence' in regional banking sector"

Real-time results, even when you’re not at your desk

From volatility tracking to complex data models, Dell Pro Max mobile workstations let you crunch numbers and analyze trends in seconds, not hours. Powered by NVIDIA, built for movement, and designed to keep you ahead of the market, no matter where you are.

+ Apple fans: “Are we finally getting Siri with Apple Intelligence? Or at least the Apple Car?”

Apple: “Best we can do is removing the ‘+’ from Apple TV. Oh, and F1 rights.”

Listen, we get it Apple $AAPL ( ▼ 3.21% ), you guys like Formula 1. On Friday, AAPL made it official, announcing it had acquired the streaming rights to F1 for the next 5 years. They’ll pay ~$140M per year, which is just shy of double what Disney is currently ponying up.

This comes on the heels of the success of Apple’s Brad Pitt blockbuster called… wait for it… F1. In case you were wondering, that movie did $630M globally, is the highest grossing sports film of all time, and the biggest movie of Brad Pitt’s career. Ok, maybe Tim Apple is onto something…

+ Fat losses all around on Friday. Shares of Novo Nordisk $NVO ( ▼ 0.45% ), Eli Lilly $LLY ( ▲ 2.93% ), and Hims $HIMS ( ▼ 6.92% ) all took a beating on Friday after POTUS said during a presser that prices of GLP-1s will “be $150 out of pocket.”

He offered literally zero additional details and Dr. Oz (yes, that Dr. Oz), who leads the Centers for Medicare and Medicaid Services, said the US is still in negotiations with some of those companies.

+ And for its next trick, Uber $UBER ( ▲ 0.83% ) will partner with local sperm banks to allow drivers to make extra cash right inside their car…

+ Is Polymarket taking wagers for how long Kalshi will be down?

Kalshi’s website and app were down for more than half of users on Saturday, which meant they had to gamble on sports… on actual sports gambling sites.

+ You’re not going to believe this, but those narcs over at Institutional Shareholder Services are recommending that Tesla $TSLA ( ▼ 1.49% ) shareholders vote against Elon’s potential $1T (ish) pay package.

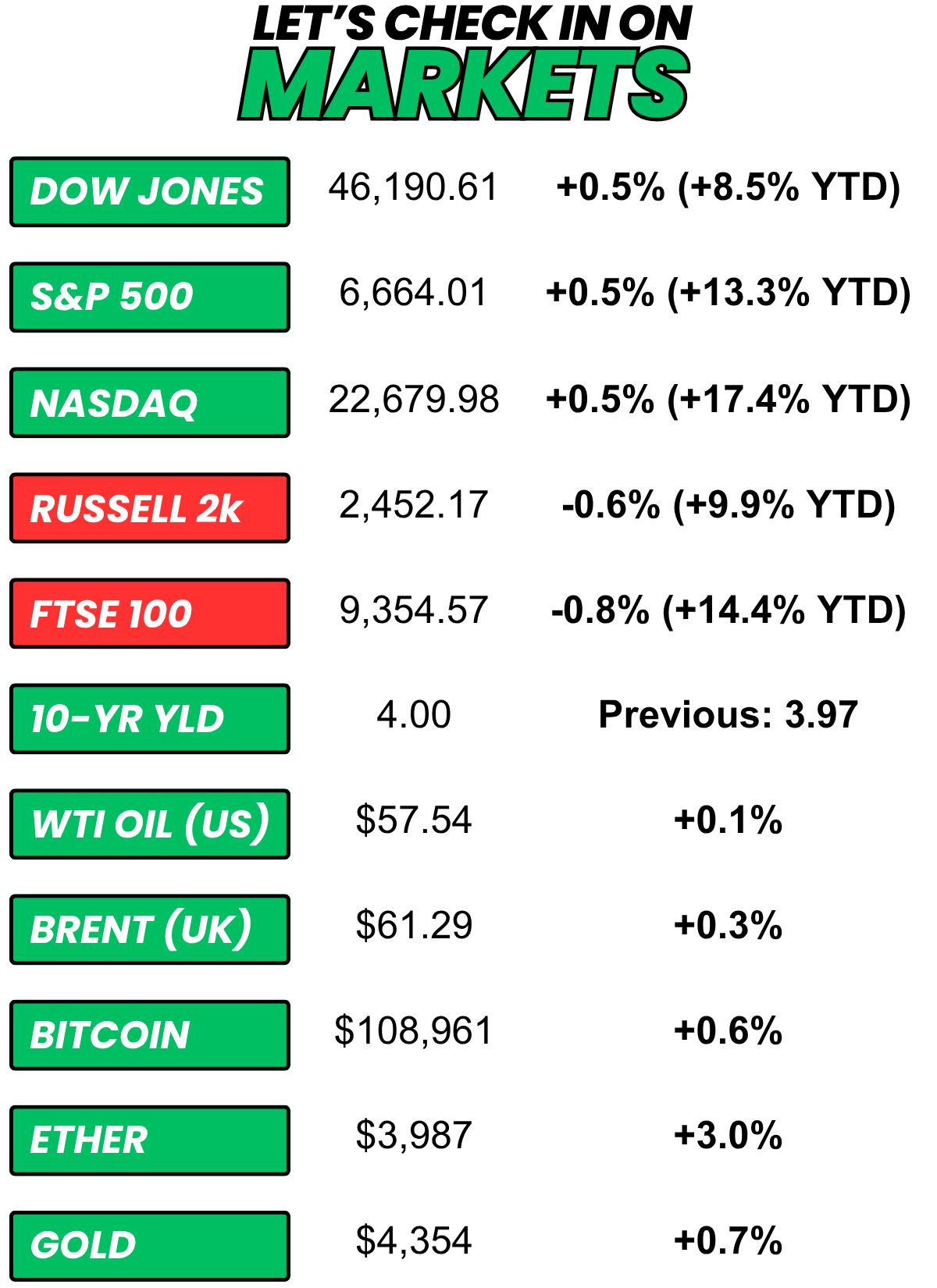

+ US stocks “bounced back Friday following conciliatory signals from Washington towards Beijing on trade while worries about regional banks receded.” (Yahoo! Finance)

+ The 10-year yield “rose Friday as investors’ jitters over a potential credit crisis in the banking sector eased.” (CNBC)

+ Oil “managed small gains on Friday but were headed for a weekly loss of nearly 3% after the IEA forecast a growing glut and U.S. President Donald Trump and Russian President Vladimir Putin agreed to meet again to discuss Ukraine.” (Reuters)

+ The “smart” money (prediction markets) inexplicably thinks there’s an 8% chance Tesla releases a gas powered or hybrid car this calendar year. (Kalshi)

⏪ On Friday…

+ Ally Financial reported before the bell

+ It was the last trading day before the beginning of the blackout period for Federal Reserve Open Market Committee members ahead of the next meeting of the central bank

⏩ Today we’re keeping an eye on…

+ AGNC Investment reports after the close

Last week, I asked, “Which of the major pro sports has the biggest skill gap between GOAT pro athlete and average rec league player?”

36.8% of you said, “PGA.”

Here’s what some of you guys had to say…

NBA: “Can't teach height...also just call you're tall, doesn't mean you can ball”

PGA: “PGA the average golfer shoots over 100. The average pga pro shoots around 70.”

PGA: “The average golfer is litterally going 0-10,000 vs Tiger in his prime.”

NHL: “Golf is close but the average beer leaguer can barely skate. Add in hitting and they won't finish a shift. ”

PGA: “Scottie thanks LIV for this question”

Here’s today’s question…

Some ground rules…

You can take people with you when you teleport, but each person counts as one of your trips

Each way counts towards your quota

The cash is a lump sum

Would you rather have $100M or the ability to teleport up to 15x per 24 hours for the rest of your life?

“Yeah, I’m a technical investor…”

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.