TOGETHER WITH

Hey there weekday warrior. Here’s what’s on tap today… Jamie Dimon got served by the Commander in Chief, November PCE is gonna have J-Poww acting so smug next week, and Lululemon gets back on track (just kidding).

Enjoy the next 3 minutes and 48 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

You better lawyer up, Jamie

“Well, well, well… how the turntables…” -POTUS, probably

You know that thing where you don’t talk sh*t about your buddy’s ex because they always get back together?

Well, turns out JPMorgan Chase $JPM ( ▼ 1.9% ) should’ve realized that #45 might eventually become #47… and hell hath no fury like an ex-President scorned.

Donny Comeback filed a lawsuit yesterday against JPM and Jamie Dimon himself. And nobody is having a worse day than JPMorgan’s General Counsel.

The $5B suit alleges that the big bank CEO closed multiple accounts tied to the President’s failed businesses for political reasons (think: unfair trade practices). And blackballed Donny from other banks… which led to “financial and reputational harm.”

Now, you may be thinking, “But hold on, didn’t all this go down right after the Jan. 6th Capitol riot in 2021? Seems kinda late to be suing now…”

And you’d be right.

Thing is, Jamie Dimon’s been putting the “free” in “free speech” lately, pushing back on the J-Poww probe, fighting the 10% credit card cap, and throwing shade at the administration’s immigration policy.

Honestly, Jamie Finance is just lucky Seal Team 6 didn’t extract him from JPM’s new midtown HQ…

Accelerate Growth with Vanta’s Compliance for Startups Bundle

To scale, you need compliance. And by investing in compliance early, you protect sensitive data and simplify the process of meeting industry standards, ensuring long-term trust and security.

Vanta helps businesses of all sizes achieve compliance quickly by automating 35+ frameworks, including SOC 2, ISO 27001, and HIPAA.

Fast-growing companies like Ramp and Writer spend 82% less time on audits with Vanta. That’s not just faster compliance, it’s more time for growth.

Start with Vanta’s Compliance for Startups Bundle, with free resources to accelerate your journey.

+ Babe, wake up, we gotta go bet against a rate cut on Polymarket…

November PCE (the Fed’s preferred inflation gauge) just dropped, and, TL;DR: we’re not getting a d*mn rate cut. Both core and headline PCE showed inflation sitting at 2.8%. That’s in line with expectations, but not great for our chances of J-Poww throwing us a bone next Wednesday.

To make matters worse, we also got October’s delayed data. Prices rose 2.7% (core and headline). That means inflation rose from October to November, because… math.

Quick reminder for those who skipped TWC yesterday (shame on you): Lululemon $LULU ( ▼ 0.5% ) had to pull its new “Get Low” leggings from the market after customers complained they were absurdly see-through.

But yesterday, the enterprising minds over at LULU fixed the glitch. The “Get Low” leggings are back on the market with no noticeable changes made… except for a disclaimer that customers should “size up” and “pair with skin-tone” underwear. Their marketing professors at the University of Phoenix must be proud.

Founder and ex-CEO Chip Wilson called the move “a new low,” which, technically, you can’t do, assuming you’re wearing these leggings in public.

+ What’s in your portfolio?

Capital One $COF ( ▼ 6.15% ) just announced that it’ll acquire fintech company Brex for, wait for it… $5.1B. The 50/50 cash/stock deal is Capital One’s biggest since acquiring Discover for $35B last year. It’s presumably still less than their celeb spokesperson budget…

> Under Armour investigating data breach which put customers’ email addresses at risk (NY Post) // “Oh no, my ZIP code and birthday got hacked.” - no one

> Rieder odds rising for Fed chair after Trump calls BlackRock executive ‘very impressive’ (CNBC) // Officially throwing my hat in the ring.

> Intel stock plunges 13% on soft guidance, concerns about chip production (CNBC) // Annnd it’s (all thos gainz heading into earnings) gone…

> Clorox to Buy Hand Sanitizer Maker GOJO for $2.25 Billion (Bloomberg) // Cleaning industry is a bubble.

> Where is the “ADDING 8-12 HOURS” of work per week?…

Yesterday, I asked, “You can only save one Kraft Heinz product. The rest are gone forever (and no, you can't just buy other brands or generic brands). Which one are you saving?”

53.6% of you said, “Ketchup.”

Here’s what some of you guys had to say…

Mayonnaise: “Fries and burgers can be great on their own when cooked right but you need Mayo for a sandwich and it also makes a good spread for Grilled Cheese instead of butter which tears the bread when spreading. Cream Cheese is not getting enough love either.”

Mac & Cheese: “My son (and I, a grown adult) would starve without Mac N Cheese aka cheesy noodles.”

Ketchup: “You will have to take the glass bottle from my cold dead hands”

Ketchup: “I already don’t get most on this list. Except Ketchup and Mayonnaise. That was a tough call.”

American Cheese Singles: “Even though they’re wrapped in whatever plastic, eating those singles on their own is a part of everyone’s childhood.”

Here’s today’s question(s)…

Stormaggedon is set to cause absolute mayhem this weekend. Who is in charge of monitoring the weather situation in the household? (think: who's got the doppler pulled up on their phone right now?)

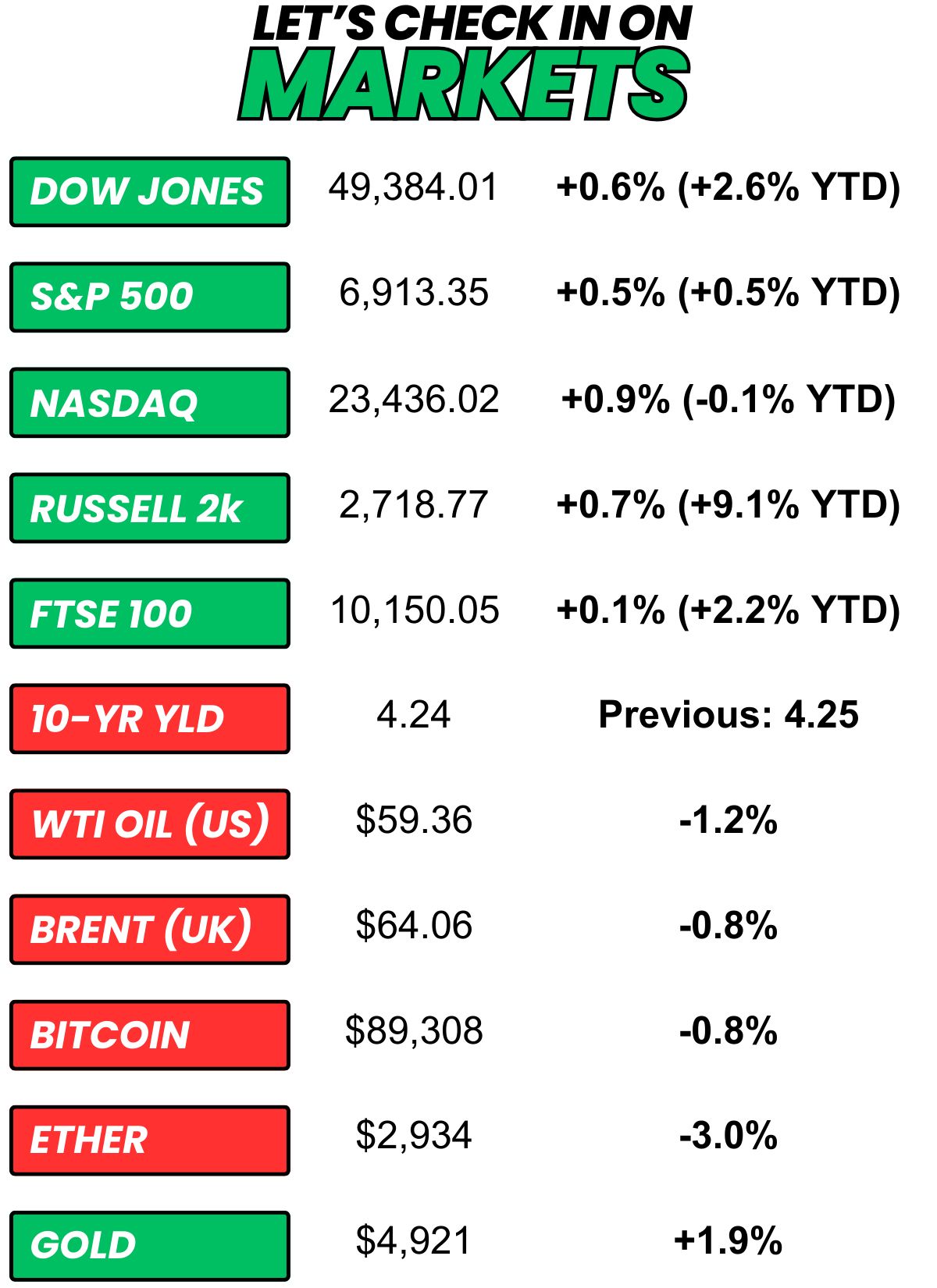

+ US stocks “rose on Thursday, extending their gains from the previous session after easing geopolitical fears sparked a broad-based market rally.” (CNBC)

+ The 10-year yield was “little changed on Thursday as investors weighed the latest economic data as well as developments in trade and geopolitics.” (CNBC)

+ Oil “slid about 2% to a one-week low on Thursday after U.S. President Donald Trump softened threats toward Greenland and Iran, and on some positive movement that could lead to a solution to end Russia’s war in Ukraine.” (Reuters)

+ The “smart” money (prediction markets) thinks Meghan Frank has the best odds (47%) of being the next Lululemon CEO. (Polymarket)

⏪ Yesterday…

+ Procter & Gamble, GE Aerospace, Abbott Labs, Freeport-McMoran, and Mobileye reported before the opening bell

+ Intel, Intuitive Surgical, and Capital One reported after hours

+ The Bureau of Economic Analysis issued its latest update on Q3 GDP

+ The core PCE price index report for October and November dropped (spoiler: this is J-Poww’s go-to inflation indicator)

⏩ Today we’re keeping an eye on…

+ Schlumberger drops earnings before the bell

+ The preliminary University of Michigan consumer sentiment/inflation expectation survey drops

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of a guy with a Nano Banana account and a wild imagination. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.