TOGETHER WITH

Join 1M+ pros at Google, Meta & OpenAI reading Superhuman AI to master tools, skills, and news in 3 minutes daily.

Hey there weekday warrior,

Here’s what’s on the agenda today…

Opendoor’s CEO says, “f*ck you, f*ck you, f*ck you, you're cool, and f*ck you, I'm out,” Lyft’s co-founders step down, and Chili’s is so (baby) back.

Enjoy the next 4 minutes and 11 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who would have Chili’s as their last meal. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste forward this to you? Subscribe here.

Whenever one door closes, I hope one more opens…

(… promise me that you'll give faith a fighting chance)

You know what they say: “when the going gets tough… cave to the pressure of a bunch of mouth breathing retail investors.”

Opendoor $OPEN ( ▲ 0.19% ) CEO Carrie Wheeler couldn’t take the heat and has gotten out of the kitchen. She “accelerated her succession plan” and stepped down effective immediately from the company that’s currently getting its ‘GameStop circa 2021’ on.

Carrie, who puts up about as much of a fight as the French in World War II, will be replaced by CTO Shrisha Radhakrishna… until the board funds its Ryan Cohen.

Ok, but why should I care about a CEO of a company that recently got the meme stock treatment?

Well, because it might be the first time in the history of capitalism that the retail crowd played activist investor… and won.

Pressure had been mounting on Carrie for weeks as investors looked for a visionary leader to match the vibes of a meme stock. Earnings were brutal, despite hopes of a turnaround. And investors are still waiting for an AI-powered master plan that will lead Opendoor to the promised land (read: double-digit stock price).

The iBuyer (which sounds more like a pawn shop in the part of town that doesn’t have a Whole Foods, if you catch my drift) CEO didn’t do herself any favors by hardly granting interviews and only recently reviving a dormant Twitter account. Not exactly memestock CEO material…

Nobody was more stoked about Carrie’s demise than the ringleader of the crayon eaters, Eric Jackson. ICYMI, Jackson is basically the Roaring Kitty of the Opendoor meme stock movement. He took a yuge stake in the company back in July that sparked interest. He became a legend in retail circles after taking a massive bet on Carvana near the bottom.

A few weeks back, Eric called for Carrie’s head: “I’m out on Carrie Wheeler. Next man or woman up.”

Actually…

… there might be one person more excited to dance on Carrie’s grave. Meet Opendoor co-founder Keith Rabois. He tweeted this last week…

So what’s next?

Is Palantir’s Alex Karp available? It appears pretty much all of Opendoor’s investors would like someone who can “meet the moment."

Shareholder Randian Capital said, “Opendoor needs a CEO with the vision and charisma to execute on what we see as the largest AI opportunity hiding in plain sight. Someone in the mold of Alex Karp has the opportunity for the next great American comeback story.”

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years, you will be working for AI or AI will be working for you (your choice)…

That's why 1M+ pros working at Google, Meta & OpenAI read Superhuman AI. Join now & learn AI skills, latest AI tools & news in just 3 minutes a day.

+ Tell me you overstayed your welcome, without telling me…

Shares of Lyft $LYFT ( ▼ 1.84% ) jumped more than 9% after the company’s two co-founders, Logan Green and John Zimmer (honestly, I could have totally made those names up and no one would have corrected me), stepped down from the board. And I think I speak for everyone when I say… it’s about damn time.

To be fair, the stock pop might have had more to do with a major change in governance. The duo who copy-pasted Travis Kalanick’s playbook will covert all of their class B shares to common stock (class A), meaning all shareholders have equal voting rights from here on out.

+ “I’m about to give you the best 12 minutes of your life.” - Joby to investors

eVTOL (electric vertical takeoff and landing) maker Joby $JOBY ( ▼ 1.66% ) mooned ahead of the open Friday after it did its best Wright Brothers impression. The company’s glorified drone cleared a major milestone by flying from one real airport to another… that was 10 miles away.

+ Ya’ll got any more of those massive IPOs?

After realizing IPOs only go up, late-stage tech bros looking to secure the bag are lining up outside of investment banks like non-target school juniors on superday. September is about to be a movie.

On Friday alone, two more big names announced plans to go public: Via (a transit software maker) and Gemini (the Winklevoss twins’ crypto platform).

+ “Deny, defend, depose.” - Warren Buffett denying claims of sick babies

UnitedHealth $UNH ( ▲ 2.31% ) just had its best day since March 2020. And the down-on-its-luck health insurer has a bunch of big swingin’ d*cks to thank. On Thursday, Warren Buffett, Michael Burry, and David Tepper all announced that they bought the f*cking dip.

+ Bah gawd, that’s Chili’s music…

The home of Chili’s baby back ribs (with barbecue sauce) is having a moment…

Viral mozzarella sticks and an absolutely savage CEO have got the casual chain back on track. And now Chili’s parent company $EAT ( ▼ 2.26% ), which managed a snag a top 5 ticker symbol (see: EAT), is planning an expansion beyond its strongholds (the south). Chili’s is about to be the hottest table in Montauk next summer…

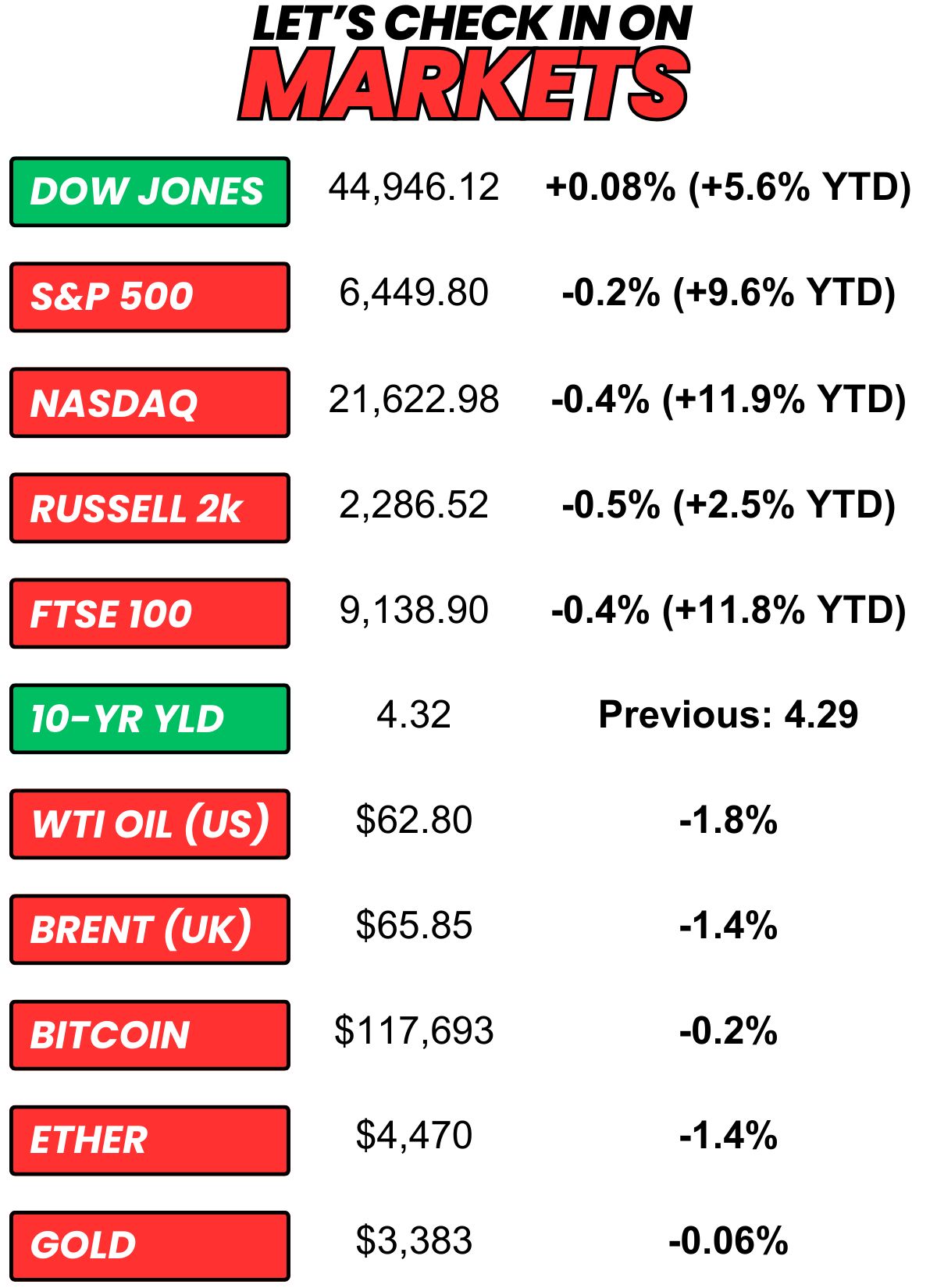

+ US stocks “were mixed on Friday as Wall Street tempered its rate-cut hopes amid economic data this week that showed higher-than-expected wholesale inflation and a rise in July retail sales. A meeting between President Trump and Russian President Vladimir Putin was also in focus as traders looked for clues on how the outcome could steer markets.” (Yahoo! Finance)

+ The 10-year yield “rose on Friday after July’s retail sales and consumer sentiment data provided two contrasting looks at the U.S. consumer.” (CNBC)

+ Oil “prices closed down nearly $1 on Friday as traders awaited talks between U.S. President Donald Trump and Russian leader Vladimir Putin, which could lead to an easing of the sanctions imposed on Moscow over the war in Ukraine.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 25% chance Arizona Iced Tea hikes its price above 99 cents in 2025. (Kalshi)

⏪ On Friday…

+ July Retail Sales dropped

⏩ Today we’re keeping an eye on…

+ Palo Alto reports after the close

Yesterday, I asked, “If you had to have one sandwich brand thrown at you, which would it be?”

27.9% of you said “Jersey Mike's.“

Here’s what some of you guys had to say…

Jersey Mike's: “Free sub!”

Other: “A PBJ with creamy Peter Pan and Smuckers grape jelly.”

Subway: “Subway: more of a projectile than food”

Pret: “Would you even notice if one of those tiny ass sandwiches hit you?”

Panera: “They are cut in half (so small), aren’t wrapped (so would fly apart midair), and are overpriced (so at least I know my assaulter’s wallet also took a hit).”

Here’s today’s question…

This one is courtesy of a weekday warrior…

Do you tip housekeeping at a hotel?

God-tier flex…

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.