Hey there weekday warrior. Here’s what’s on tap today… Paramount and David Ellison are not giving up on Warner Bros. Discovery, Nvidia just keeps stacking Ws, and Google Glass is back (sort of).

Enjoy the next 3 minutes and 21 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

We are done when I say we are done

Karen David Ellison just went all “I’d like to speak to your manager”…

It’s clear Paramount $PSKY ( ▲ 20.84% ) has absolutely no intention of letting the fat lady sing (in fact, she might be tied up in David’s basement) after Netflix “won” Warner Bros. Discovery $WBD ( ▼ 2.19% ) in a bidding war.

The creator of… (*Google’s “Paramount+ originals*) Tulsa King and Ink Master is apparently launching a hostile bid to buy Warner Bros Discovery.

Paramount is going straight to the shareholders with a cash offer of $30/share at a $108.4B valuation. That’s the same bid that WBD turned down when it went with Netflix… at a $72B valuation. To be clear, Davey Drama’s bid would include WBD’s cable assets (something that Netflix gives zero f*cks about).

Paramount shares popped 7% on the news, while Netflix shares dipped 4%.

Meanwhile, Netflix $NFLX ( ▲ 13.77% ) is over here hard-launching with direct email save the dates to every subscriber like they’re Katy Perry/Justin Trudeau going Insta-official.

What’s next?

Well, the “smart” money over on Kalshi thinks there’s a ~40% chance Paramount emerges as the winner of WBD. That was closer to 10% over the weekend.

Of course, the FTC, Justice Dept, and/or Trump administration could (and probably will) get in the way of true love.

Either way, someone’s gonna be big mad. Remember that Netflix has $5.8B on the line if regulators get in the way. And WBD will have to pony up $2.8B to Netflix if it bails on the deal.

Oh, and if Paramount ends up as the loser, we know what’s going to come up during the airing of grievances at the Ellison’s’ Festivus gathering.

F*ck it, I’m sharing The Water Coolest’s secret sauce

I’ve been writing The Water Coolest for 8 years. That included a 2-year stint at Barstool Sports. And today I consult for some of your (other) favorite newsletters - helping them create must-read content.

So now feels like the right time to finally pull together all of my thoughts about creating killer newsletter content and building an audience the right way.

Later this month, I’m launching the Chief Newsletter Officer newsletter.

Every Thursday, I’ll send a newsletter to current and aspiring newsletter operators and brands with tactics and takeaways from nearly a decade in the newsletter trenches. No filter, just like TWC.

Join for free today and start sending must-read content tomorrow.

+ Sure, you might be having a good week, but it’s definitely not as good as Jensen Huang’s…

Last Wednesday, the former Denny’s employee of the month was on Joe Rogan, sharing arguably the most inspiring story of all time. Then yesterday, President Trump gave him the green light to print (more) money.

The President announced that Nvidia $NVDA ( ▼ 4.17% ) can ship its H200 AI chips to China as long as there’s a 25% surcharge. Intel and AMD can also ship semis to China… to which the fine people of China will say “y'all got any more of those H200s?”

+ Donny Politics just went all “Farmers Only.”

Yesterday, POTUS announced a new $12B farm aid package for (you guessed it) farmers affected by the trade war (also, ironically, funded by said trade war…). $11B will go to the Farmer Bridge Assistance program, which provides one-time payments to crop farmers, with an additional $1B in reserve.

Google $GOOG ( ▲ 1.39% ) can’t stop, won’t stop coming for the competition’s jugular. After unleashing Gemini 3.0 last week and effectively curb-stomping OpenAI, the home of the Google Glass announced that it will launch Google Glass AI-powered glasses in 2026.

Up first? *checks notes* Audio-only glasses that will allow users to speak with Gemini.

TWC exclusive: A preview of Google’s audio-only glasses.

+ Better late than never…

IBM $IBM ( ▼ 0.74% ) wants in on the AI bubble (clear top indicator). Yesterday, the inventor of the TrackPoint announced that it is buying the data-streaming platform Confluent $CFLT ( ▲ 0.13% ) for $9.3B. That’s one of its largest ever takeovers… and just reeks of desperation.

The non-virgin mind simply cannot comprehend wtf Confluent claims it does: “Confluent enables a wide range of industry-agnostic data streaming use cases, including: Real-time analytics and dashboards to make faster, data-driven decisions. Event-driven applications that react instantly to business events.”

> Berkshire’s Geico Boss Todd Combs Leaves for JPMorgan Ahead of Buffett Retirement (WSJ) Imagine having to live in Omaha and change the Oracle’s Depends, then get overlooked for CEO…

> Stellantis to bring tiny Fiat car to U.S. following Trump remarks (CNBC) Remember fellas, if she tells you size doesn’t matter, she’s lying…

> And the award for least surprising headline of all time goes to…

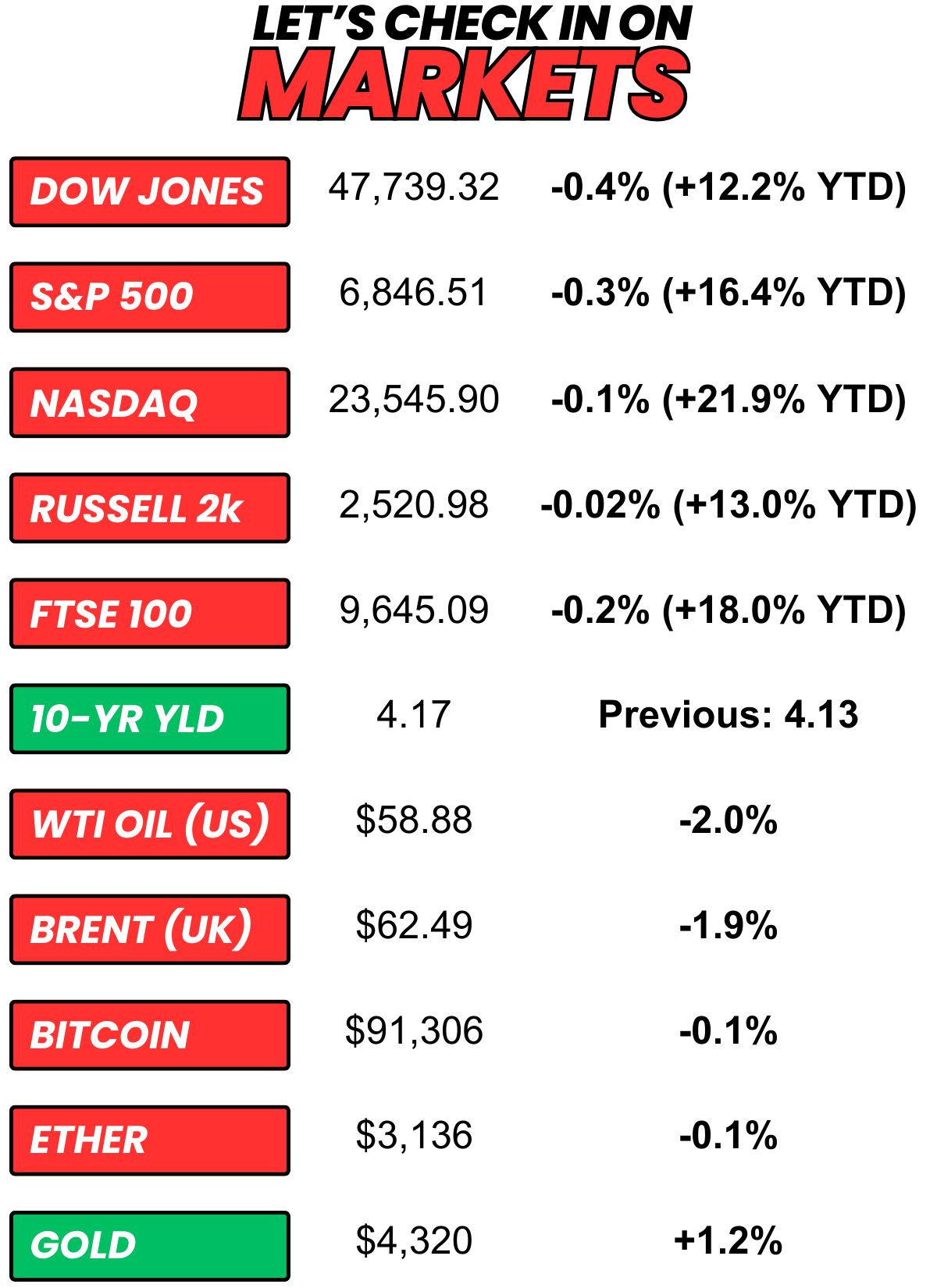

+ US stocks “pulled back on Monday as investors awaited the Federal Reserve's last meeting of the year later this week.” (CNBC)

+ The 10-year yield “climbed, with investors facing a series of auctions beginning Monday and a Fed rate decision Wednesday that may alter 2026 policy expectations.” (Yahoo! Finance)

+ Oil “slipped 2% on Monday after Iraq restored production at one of its oilfields which accounts for 0.5% of world oil supply, while investors weighed ongoing talks to end the war in Ukraine.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 57% chance that Zoom Video Communications is acquired before the end of 2027. Oh, how the mighty have fallen. (Polymarket)

⏪ Yesterday…

+ Toll Brothers reported

+ Golden Globe nominations were announced as if tensions weren’t high enough in media right now

⏩ Today we’re keeping an eye on…

+ AutoZone reports before the bell

+ GameStop, AeroVironment, and Casey’s report after hours

Yesterday, I asked, “The December slump is upon us. Too early to slack off, too late to care. Which week do we start pushing projects that require effort to 2026?”

50.1% of you said, “Next week, starting Monday 12/15 (10 days out is good).”

Here’s what some of you guys had to say…

Next week, starting Monday 12/15: “This week is to focus "really hard" on the actions needed to get your project through to the new year.”

Never, work straight through the holidays (real grinders only): “Changed jobs so I only have 16.25 hours of PTO.”

Next week, starting Monday 12/15: “We are closed the week of Christmas, so we're all kicking those cans into next year.”

I already gave up at Thanksgiving: “I even had rotator cuff surgery at Thanksgiving just so I wouldn’t feel as guilty slacking off until 2026.”

Week after next, starting Monday 12/22 (you have no chill): “I stop replying to any emails/phone calls until January 5th!”

Week after next, starting Monday 12/22 (you have no chill): “Pretty sure you already asked this Tyler, tell us you want to stop working for the year without telling us”

Here’s today’s question…

You have to quit your job tomorrow and become a farmer of one type of cash crop. You'll also need to move to the state known for producing it (and root for their college football team). Where you moving and what you farming?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.