Hey there weekday warrior. Here’s what’s on tap today… Tesla drops pole position to BYD, Saks Global is behind on its bills, and Warren Buffett clocks out at 95 years old.

Enjoy the next 3 minutes and 32 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Watch the Throne

The “we’re an AI robotics company now” narrative is starting to make a lot more sense…

Tesla $TSLA ( ▼ 1.49% ) reported its Q4 EV deliveries Friday, and the results were… well, not great, Bob.

Q4 sales were down 16% from last year, leaving Tesla’s annual vehicle deliveries at 1.64M in the year of our lord 2025.

In case you don’t commit to memory annual EV delivery numbers (do you even care about the environment, bro?), that’s an 8% drop from 2024.

Same, same, but different

Unfortunately for Elon & Co., not everyone struggled to sling battery-powered cars last year. Chinese automaker BYD $BYDDF ( ▼ 0.66% ) reported a 28% uptick in EV sales. Showoffs. That puts its annual total at 2.26M units, surpassing Tesla for the first time.

It’s a big deal for BYD, especially for those who remember that one time in 2011 when Elon LOL’d on Bloomberg TV when asked if he saw BYD as a “competitor.”

No word (read: angry X post) yet from Elon on the torch passing.

Must be busy playing Diablo IV…

F*ck it, I’m sharing The Water Coolest’s secret sauce

I’ve been writing The Water Coolest for 8 years. That includes two years as head of newsletters at Barstool. And today, I help some of your (other) favorite newsletters create must-read content (you’re welcome).

So now feels like the right time to finally pull together all of my thoughts about creating killer newsletter content and building an audience the right way.

Later this month, I’m launching the Chief Newsletter Officer newsletter.

Every Thursday, I’ll send an email to current and aspiring newsletter operators and brands with tactics and takeaways from nearly a decade in the newsletter trenches. No filter, just like TWC.

Join for free today.

+ “That’s what we call a sacked lunch…”

Saks Global is having a worse start to 2026 than a certain Venezuelan dictator. In case you missed it, Saks Fifth Avenue’s parent company missed a $100M bond interest payment due before the end of the year. And much like student loan borrowers on the SAVE plan are about to learn, you can’t just skip paying back debt…

On Friday, Saks’ CEO of three decades, Marc Metrick, bailed on the sinking ship. Executive chairman Richard Baker will take the helm aka oversee the bankruptcy proceedings.

+ Pour one out (a Cherry Coke, for the record) for a true legend…

The one and only Oracle of Omaha has officially retired, and I think I speak for everyone when I say, “it’s about damn time.” Warren Buffett has handed the Berkshire Hathaway $BRK.A ( ▲ 0.5% ) reins over to his long-time lieutenant, Greg Abel. Shares slipped on Abel’s first day, because obviously they did…

Friendly reminder that BH ended 2025 with a 10.9% gain, shy of the S&P 500’s 16.4% returns. Still, this year marks 10 straight years of positive returns for Berkshire. So they’ve got that going for them. Which is nice.

At 95 years young, Warren will hang on to his role as chairman, keep coming to the office, and, probably, continue to eat the breakfast of champions daily.

+ Zuck really saw Jensen and Masa Son’s year-end acquisitions and said, “I can beat that.”

Last week (think: right before TWC’s long a** New Year’s break) Meta $META ( ▼ 1.34% ) swooped in with a buzzer-beater acquisition. Zuck acquired AI startup Manus for a bubble-suggesting $2B. Straight cash, homie.

Manus, most recently valued at $500M, has generated about $125M in annual revenue. Regulators are already sniffing around the deal, given that Manus was founded in Beijing. To keep Johnny Law happy, Manus will shut down its China-facing products and relocate employees based in China. In other words, this one’s gonna take longer to close than the Warner Bros. deal.

> Chip stocks rally to start 2026 after third-straight winning year (CNBC) // Are you there God? It’s me, Tyler. Please let markets continue to rip in 2026.

> Huge victory for pasta lovers with Trump admin set to drastically cut planned tariffs (NY Post) // They may take our lives, but they’ll never take our penne.

> Apollo to Sell Coinstar to Alaska Buyer, Bonds Set to Be Repaid (Bloomberg) // Wait, but they’re still going to operate the machines, right? *Looks at my change jar that I’ve been meaning to take to the Coinstar for 2 years*

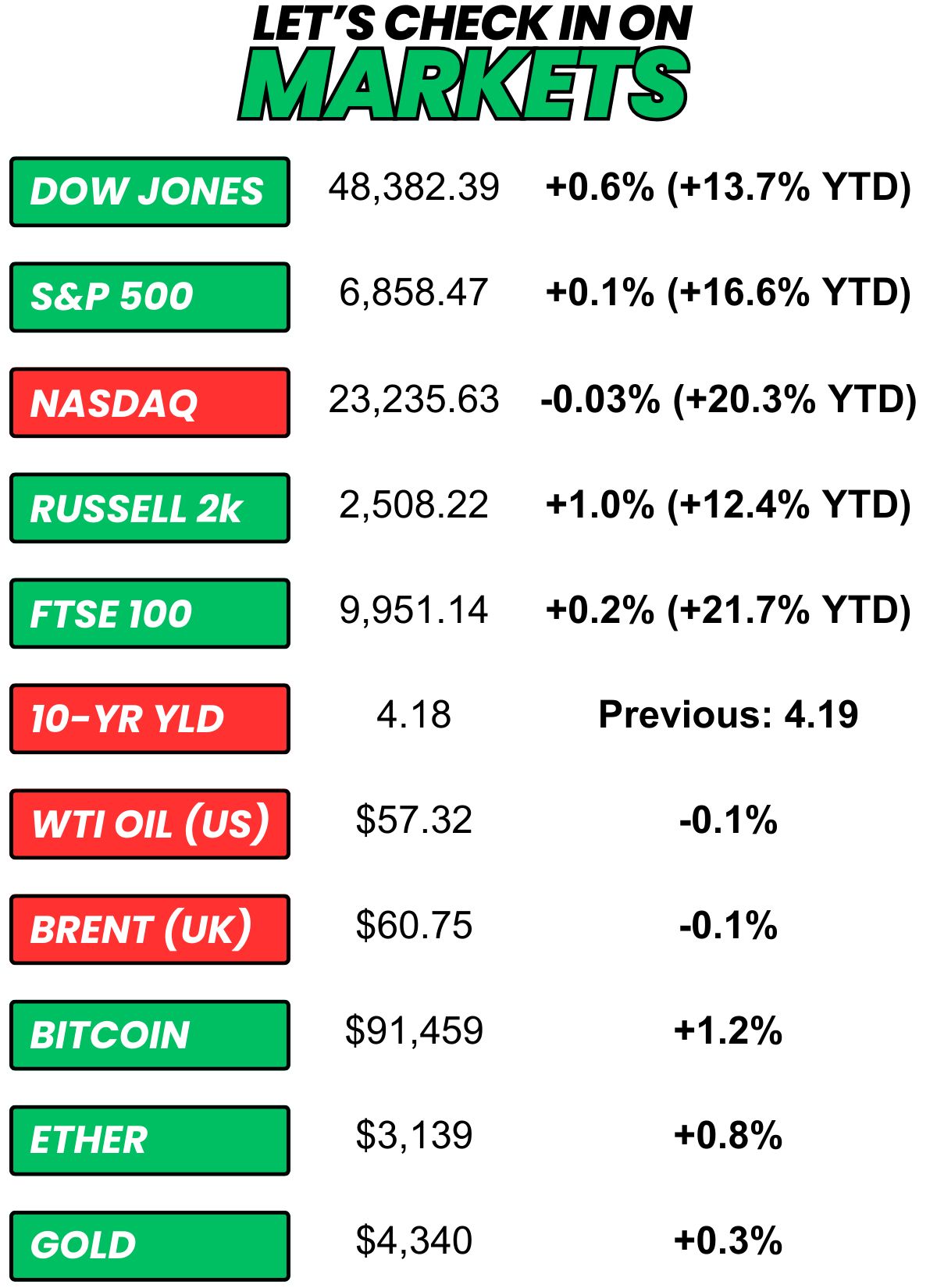

+ US stocks “mostly edged higher on Friday as Wall Street kicked off trading in 2026 after its third consecutive year of double-digit percentage gains.” (Yahoo! Finance)

+ The 10-year yield “rose on Friday, the first trading day of the year, as investors weighed the economic outlook and the prospects for further rate cuts.” (CNBC)

+ Oil “settled lower on Friday on the first trading day of 2026 after registering their biggest annual loss since 2020, as investors weighed oversupply concerns against geopolitical risks, including the war in Ukraine and Venezuela exports.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 38% chance that SpaceX’s ticker will be “$STAR”. (Polymarket)

⏩ Today we’re keeping an eye on…

+ Versant will begin trading after spinning off from Comcast

+ CES gets underway in Vegas, with Nvidia CEO Jensen Huang delivering a keynote speech

Last week, I asked, “We already covered the GOATed Christmas movie... so now, what's the GOATed New Year's movie?”

37.8% of you said, “When Harry Met Sally.”

Here’s what some of you guys had to say…

When Harry Met Sally: “Trick question: When Harry Met Sally and Sleepless in Seattle are both 11 on a 10-point scale. The real GOAT is Meg Ryan when it comes to Rom Coms, nobody else is even close.”

Other: “maybe im in the wrong here but who actually watches NYE movies?”

Other: “The Holiday - Cameron Diaz is hooootttttt!”

When Harry Met Sally: “Not even close Meg Ryan (born in Fairfield CT - right Tyler?) and her fake O in a crowded diner. The best line (I’ll have what she’s having) came from Rob Reiner’s mother. R Reiner directed the movie. Eat that NYE.”

Here’s today’s question…

We're 5 days into 2026, and now that it's Monday, it's time to start taking that resolution seriously. What category was your New Year's Resolution for 2026? (I may or may not follow up with this to keep you honest this year...)

- Health: lose weight, get stronger, higher T, quit drinking, play a sport

- Wealth: make an investment, pay off debt, grind harder

- Career: quit a sh*tty job, start a better job, switch careers, go back to school

- Personal growth: learn an instrument/language, pick up a new skill like cooking, read more books, go to therapy

- Family: more time with the kids/spouse, plan a family reunion, no TV with meals

- Travel: take a dream vacation, backpack Europe, take a bro road trip

- Other (write-in)

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.