TOGETHER WITH

Hey there weekday warrior. Here’s what’s on tap today… Truth Social is the new Bloomberg terminal, China’s got a fever for Nvidia chips, and December layoffs were honestly not that bad.

Enjoy the next 3 minutes and 22 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

War dawgs

Number of days since a Truth Social post moved global markets bigly: 1 0.

That’s right, mere hours after Donny Properties destroyed Blackstone’s $BX ( ▼ 3.88% ) American dream of owning a single-family home, the market manipulator in chief logged back on.

DJT posted on Truth Social, calling for an increase in the military budget for 2027. Think: $1.5T dollars. For those of you keeping score at home, the Pentagon’s slush fund is closer to $1T currently.

Why? To build one “Dream Military”… to rule them all, and in the darkness bind them, presumably.

Regardless of where you sit on the military-industrial spectrum, everyone’s portfolios locked in major gains yesterday.

Northrup Grumman $NOC ( ▲ 1.9% ), Lockheed Martin $LMT ( ▲ 2.56% ), and Kratos Defense $KTOS ( ▼ 6.47% ) all rocketed like a cruise missile headed straight for a Middle Eastern village of mostly women and children.

Speaking of cruise missiles… Raytheon $RTX ( ▲ 2.53% ) got left behind (kinda).

The makers of the Tomahawk® missile received the Truth Social equivalent of a bad Google Review from #47 yesterday for being unresponsive to the Department of War.

What, like taking advantage of yuge government defense contracts is a crime or something?

Get your news from 1440 and receive only the facts.

Be the smartest person in the room by reading 1440, where 4.5 million Americans find their daily, fact-based news fix. They navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet: politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight.

+ “Shun. Unshun.” - China

Beijing finally realized they’re tired of using Chinese knockoff chips. Per anonymous Bloomberg sources (because imagine being caught leaking info from the CCP), Beijing officials are planning to approve some Nvidia $NVDA ( ▼ 4.17% ) imports. Specifically, the H200 chip for commercial use. Military, government, and state-owned enterprises (so, all of them?) will still be banned from using the chip.

Friendly reminder that Jensen & Co. have been banned from selling chips to Chinese customers since 2022, despite China being the world’s largest semiconductor market. Put simply: NVDA stock always goes up.

+ New Year, new us?

Per the latest NY Fed survey, Americans are feeling bullish about 2026. But to be fair, some of us are still adhering to dry January…

Those surveyed expect short-term higher inflation, but are more optimistic about future financial conditions. On the other hand, delinquency expectations (think: perceived probability of missing a debt payment) rose to 15.3%, which is its highest level since April of 2020…

+ Employed. In our lane. Flourishing.

December layoffs rang in at a mere 35k in December. That represents a 50% drop from November’s bloodbath and an 8% decrease from December of last year.

But it wasn’t all sunshine and rainbows…

2025’s total hit 1.2M layoffs, up 58% from 2024. Rumor has it government workers are still butthurt about that whole DOGE thing…

> Wealth tax threat prompts at least six billionaires to cut ties with California, as about 20 more mull exit: report (NY Post) // Take notes: obviously don’t warn the billionaires that you’re about to tax them before you do it.

> GM Takes $6 Billion Hit Tied to Electric Vehicles as Demand Sinks (WSJ) // Mary Barra (probably): “F*ck EVs, all my homies hate EVs.”

> Rio Tinto, Glencore in Talks to Form World’s Biggest Miner (WSJ) // Together the companies are expected to unlock synergies, including increasing third-world child labor exploitation by 80%.

> Doctor’s orders…

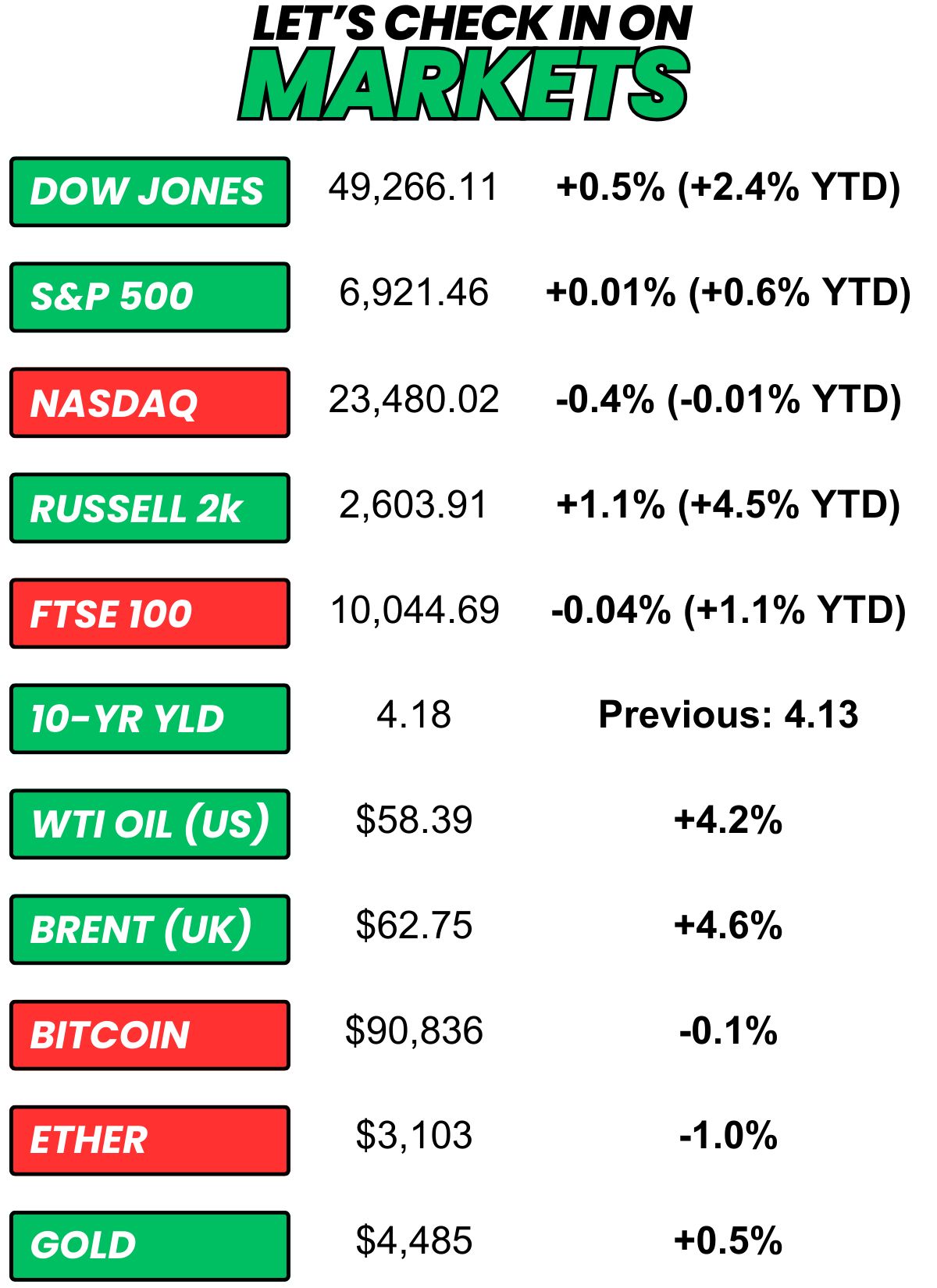

+ US stocks “closed mixed on Thursday as investors rotated out of tech as they took in fresh labor market data and grappled with President Trump's salvos on defense and Venezuela.” (Yahoo! Finance)

+ The 10-year yield “moved higher on Thursday as investors looked ahead to key jobs data and continued to monitor geopolitical developments.” (CNBC)

+ Oil “rose Thursday, bouncing after two straight losing sessions, helped by increasing geopolitical uncertainty and a bigger-than-expected weekly draw in U.S. oil inventories.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 91% chance that Google’s AI remains the top model through the end of January. (Polymarket)

⏪ Yesterday…

+ Aehr and Tilray reported after the close

⏩ Today we’re keeping an eye on…

+ The three-day Silicon Valley Auto Show will begin. Tesla is making a rare auto show appearance with its Cybertruck

+ The December Jobs Report will be released

Yesterday, I asked, “What age did you buy your first home?”

57.6% of you said, “20-30 years old.”

Here’s what some of you guys had to say…

20-30 years old: “A townhouse for $63k with a small loan from my father-in-law. Paid him back quickly and then divorced his daughter.”

30-40 years old: “Only because my mom was kind enough to give me her back yard to build!”

20 years old: “A month before my 30th, so that counts.”

I haven't bought my first house yet...: “29 in NYC and expect to move out of here before that happens.”

Here’s today’s question…

What needs to be done about NIL in college sports?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.