TOGETHER WITH

Hey there weekday warrior. Here’s what’s on tap today… SpaceX is going public (probably), Cracker Barrel f*cked around, and now they’re finding out, and JPMorgan is blowin’ money fast.

Enjoy the next 3 minutes and 19 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, interested in advertising with TWC? Reply directly to this newsletter or fill out this form, and I’ll be in touch.

To the moon

Picture this: the year is 2029, Elon announces on the Joe Rogan Experience that he will colonize Mars by 2031... but you can’t trade SpaceX stock because Kalshi is down (Cloudflare crashes 2-3 times per day)…

According to sources familiar with the matter (who are about to go the way of that guy who snitched on Boeing), SpaceX will IPO in the year of our lord 2026... or maybe ‘27, pending market conditions and Elon’s relationship with the Shortseller Enrichment Commission.

Of course, Elon has vehemently denied the rumors, which almost certainly means it’s happening.

If and when NASA-but-make-it-capitalist does take its talents to the public markets, it could raise as much as $30B at a $1.5T valuation. That is not a typo.

That would put SpaceX just ahead of Saudi Aramco’s record-setting 2019 IPO ($29B).

Oh, and more importantly, it would allow Elon to cuck his arch nemesis Sam Altman, who may or may not be looking to IPO OpenAI at a roughly $1T valuation.

Finally, skincare made for men’s skin

Stop borrowing your partner’s moisturizer. Men’s skin is thicker, tougher, and needs a formula built just for it. That’s why over 1 million men worldwide trust Particle Face Cream, a 6-in-1 anti-aging solution designed specifically for men. It reduces eye bags, wrinkles, and dark spots while moisturizing and soothing skin after shaving. Start today and save 20% with promo code WATER20. If you don’t see results in 30 days, get your money back.

+ Go to Huntsville, AL, then try to tell me there’s a better location on God’s green earth for a GLP-1 factory… I’ll wait.

Eli Lilly $LLY ( ▼ 1.55% ) announced a new $6B manufacturing plant coming to Huntsville. The new plant will boost production of Eli’s new obesity pill “orforglipron” once it receives FDA approval. Somebody tell the marketing department that we need a street name for that sh*t.

+ “Well, well, well, if it isn’t the consequences of my own actions…” - Cracker Barrel’s CEO

Cracker Barrel $CBRL ( ▼ 2.97% ) f*cked around… and now it’s finding out. The Old Country Store got its teeth kicked in during the most recent quarter. Shares cratered nearly 8% after hours following a miss and a cut (think: the troubled cousin of a beat and raise).

The preferred restaurant of the people of Huntsville, AL (when the line is too long at the Waffle House) missed the street’s expectations on the top and bottom line and slashed its guidance for the year. Woof.

In case you’ve been in a coma since the summer (btw, look up Coldplay Kiss Cam… you’re welcome)… Cracker Barrel found itself on the wrong end of cancel culture in September. It changed its logo, restaurants, and menu… and got more panties in a bunch than that time Dylan Mulvaney shotgunned a Bud Light.

+ OpenAI is hiring Slack’s CEO to run point on revenue… and Sam Altman knows Slack is free, right?

Denise Dresser will become OpenAI’s first CRO, which makes sense since it ditched that non-profit baggage. Dooneese was a long-time executive at Salesforce and took over as Slack’s CEO when Marc Benioff and his Ohana bought the love child of email and AIM in 2023.

+ JPMorgan: “Our expenses are going to come in a bit higher than expected in 2026 because of AI and competition in the credit card space.”

Also, JPMorgan: *opened a $3B HQ in Manhattan and has plans to build a similar tower in London*

Shares of the big swingin’ bank got rocked after Marianne Lake (Jamie Dimon’s heir apparent) said expenses will come in closer to $105B next year. That’s above analysts’ $100B consensus, and a jump from the bank’s initial estimates.

> Hinge founder leaves CEO role to launch AI-powered dating startup (CNBC) Super original, bro…

> Name a more San Francisco headline (you can’t)…

Ever wonder how the (TWC) sausage gets made?

It feels like the right time to finally pull together all of my thoughts about creating killer newsletter content and building an audience the right way.

Later this month, I’m launching the Chief Newsletter Officer newsletter.

Every Thursday, I’ll send a newsletter to current and aspiring newsletter operators with tactics and takeaways from nearly a decade in the newsletter trenches. No filter, just like TWC.

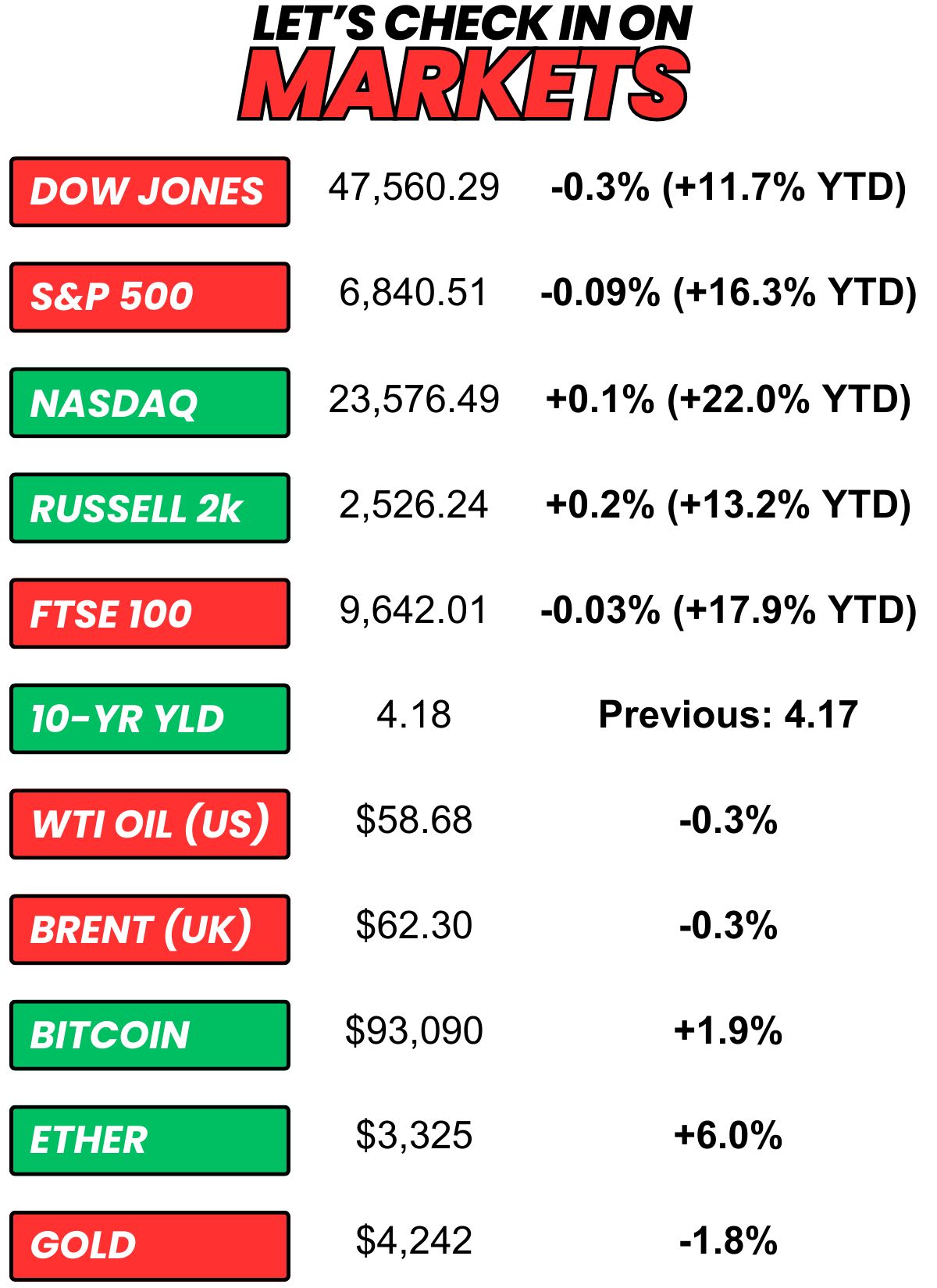

+ US stocks “were mixed on Tuesday as the Federal Reserve's December policy meeting kicked off and federal data showed job openings unexpectedly ticked higher even as layoffs jumped.” (Yahoo! Finance)

+ The 10-year yield “was little changed on Tuesday as investors digested the latest jobs and employment data and awaited the Federal Reserve’s interest rate decision this week.” (CNBC)

+ Oil “edged lower Tuesday, adding to the previous session’s sharp losses, as traders digested renewed supply from Iraq and developments in Ukraine peace efforts ahead of the last Federal Reserve meeting of the year.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 97% chance that we’re getting a 25 bps rate cut today. (Polymarket)

⏪ Yesterday…

+ AutoZone reported before the bell

+ GameStop, AeroVironment, and Casey’s reported after hours

⏩ Today we’re keeping an eye on…

+ We’ll get the Fed’s rate cut decision and a J-Poww presser as the FOMC meeting wraps

+ Chewy and Uranium Energy dropped earnings before the bell

+ Oracle, Adobe, Synopsys, and Planet Labs report after hours

+ Electronic Arts shareholders will vote on the $55B leveraged buyout offer from Saudi Arabia's Public Investment Fund

Yesterday, I asked, “You have to quit your job tomorrow and become a farmer of one type of cash crop. You'll also need to move to the state known for producing it (and root for their college football team). Where you moving and what you farming?”

27.9% of you said, “Tobacco (North Carolina).”

Here’s what some of you guys had to say…

Tobacco (North Carolina): “purely a weather-related answer”

Other: “Wisconsin dairy farmer. I hate all the other football teams and food choices.”

Corn (Iowa): “I am already in Iowa. Go Cyclones!”

Corn (Iowa): “Insert Luke Bryan Lyrics”

Potatoes (Idaho): “Million ways to cook a potato.”

Other: “Meth (Kentucky). Go Cats!”

Here’s today’s question…

All this talk about student loans, "Trump savings accounts," and AI eating entry-level jobs has got me thinking...

Are we still telling the kids to go to college when they grow up or nah?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.