Hey there weekday warriors,

Here’s what we’re getting into today…

RIP TikTok

China cracks down on chat apps

Happy Bitcoin halving day

Enjoy the next 4 minutes and 11 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, want to get smarter about residential real estate investing? You'll love The Pocket List, a brand-new newsletter I’ve been working on. It’ll keep you up to date on the industry and help you make more money. Check out last week’s newsletter and subscribe for free with one click (Read & subscribe)

+ US stocks “retreated on Friday as dimming hopes for a coming interest rate cut and geopolitical uncertainty intensified a sell-off in Big Tech.” (Yahoo! Finance)

+ The 10-year Treasury yield “slipped on Friday as investors assessed a strike by Israel against Iran, while also considering the latest economic data and remarks from Federal Reserve officials." (CNBC)

+ Oil “settled slightly higher on Friday, but posted a weekly decline, after Iran played down a reported Israeli attack on its soil, a sign that an escalation of hostilities in the Middle East might be avoided.” (Reuters)

+ Bitcoin “traded higher Saturday following the so-called halving, an event that sharply cut the issuance of the world’s largest cryptocurrency.” (Barron’s)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia -10.0% 2) C3.ai -0.7% 3) Intel -2.4%

The market moves you need to know about…

– Super Micro Computer fell 23.1% on Friday after it announced when it would release its earnings. The problem? Seven of the last eight times SMCI announced its earning date, it also pre-announced a beat…

+ Paramount closed up 13.4% on Friday following a report that Apollo is teaming up with Sony to acquire the studio.

– Shares of Nvidia plummeted 10.0% on no real news other than Super Micro Computer not preannouncing an earnings beat. What bubble?

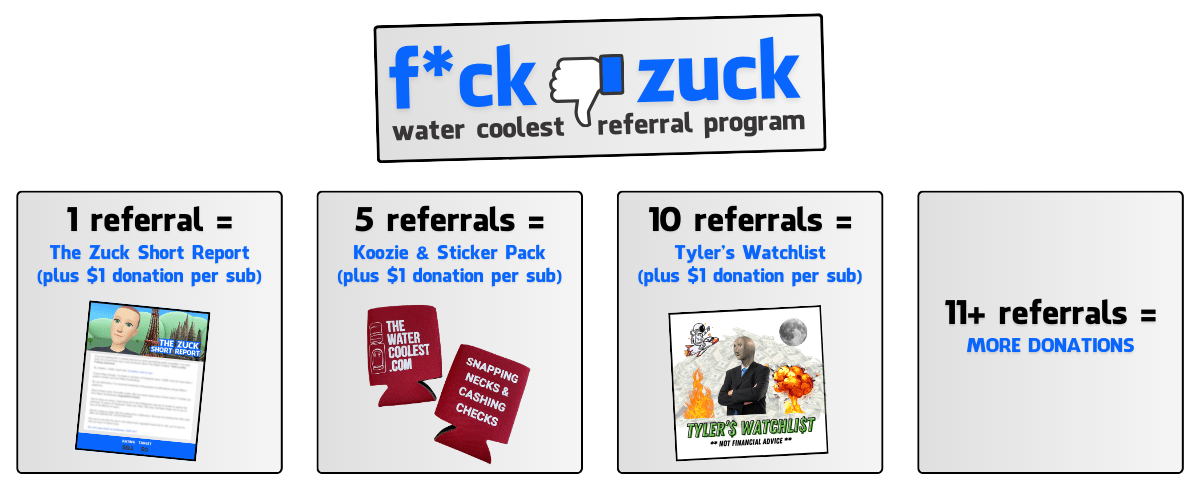

Have you referred anyone to The Water Coolest yet?

You can earn rewards and secure donations for your favorite charity by sharing your unique referral link…

Share your unique referral link (below) with anyone you think might be interested in The Water Coolest. You can email it, post it on social, etc. Get creative.

Your unique referral link: {{rp_refer_url}}

{{rp_personalized_text}}

Shadowbanned

(Source: Giphy)

Nobody had a better weekend than Evan Spiegel…

Why? Because on Saturday the House passed a foreign aid bill that will send $60B to Ukraine, $26B to Israel, and $8B to Taiwan.

Wait, what?

Why does the founder of Snap give a damn?

Because the 3 packages were bundled with the TikTok ban that has been floating around DC for the past few months. Speaker of the House Mike Johnson (honestly, if I was going to make up a fake name, this is what it would be) saw his opportunity and jammed the bill in.

Lawmakers didn’t seem to give a damn. The bill passed 360-58.

What’s next?

The bill will head to the Senate, where it could be voted on as soon as Tuesday. Some bills are DOA when they make their way from the House to the Senate. But this one is not. It’s expected to get the green light.

The next stop? President Biden’s desk, where he gets to decide if it becomes law. Spoiler: Joey Politics already said he plans to sign the bill.

After Biden’s John Hancock makes it official, Bytedance would have up to 1 year to sell the app to a non-Chinese buyer. Friendly reminder: the original bill only gave ByteDance 6 months.

China has already said it won’t allow ByteDance to sell the app. If that’s the case, any outright ban of TikTok would go into effect exactly 1 year after the bill was signed.

That would mean the nearly 170M TikTok users in the US would need to find somewhere else to waste their time. Instagram and Snap are seen as the most likely beneficiaries…

+ Probably just a coincidence… but just a few hours before the House approved a bill that would ban TikTok, China forced Apple to remove WhatsApp, Telegram, Signal, and other chat apps from the App Store.

Technically, all of those apps were already banned in China, but were still available to download via VPN. I imagine getting caught in China with a VPN is like being a WNBA player getting caught with a vape pen in Russia.

China cited “national security risks.” An Apple spokesperson pointed out that it was obligated to follow the rules of all the countries it slings product in.

+ Happy Bitcoin halving to those who celebrate (and by “those who celebrate,” I mean virgins)…

From here on out, the reward for mining one block will be 3.125 bitcoins. Down from 6.25… because math.

Bitcoin had been volatile heading into the weekend, but was relatively calm in the aftermath of the halving.

+ Trump Media CEO Devin Nunes out here getting his “Pepe Silvia” on…

The paranoia is real. Just a few days after DJT (+9.6%) told investors how to make sure their shares weren’t shorted, the company hinted that there may be some naked short selling going on.

Nunes alerted the Nasdaq exchange of market manipulation by way of naked short selling.

Desperate times call for desperate measures. Shares are trading at about half of the SPAC merger price.

+ “This is fine.” - Elon Musk

Tesla (-1.9%) is limping into earnings this week. The company just dropped disappointing delivery numbers and laid off 10% of its workforce. The Street is concerned about it abandoning the Model 2. It just recalled thousands of Cybertrucks. And its stock is down 40% this year…

So it did what any desperate EV maker would do when it needs to move units… slash prices. TSLA cut the price of its Model X, Y, and S by $2k each on Friday.

+ 4 travel secrets of the mega-rich, from a vacation planner for billionaires (Read)

+ Can you afford to be a bridesmaid or go to that destination wedding? (Read)

+ Why the viral trend ‘chronoworking’ is making waves among employees and employers (Read)

+ Here’s where the world’s top 0.001% are putting their money, according to wealth experts (Read)

On Friday, I was keeping an eye on P&G’s and Amex’s earnings…

+ Amex (+6.2%) beat on the top and bottom line.

+ P&G’s (+0.5%) top line missed the Street’s expectations after pumping the brakes on price hikes.

Here's what I'm keeping an eye on today...

+ Verizon, Truist, and Albertsons report… and I really hope whoever decided that the combined BB&T and SunTrust should be renamed Truist never got another re-branding gig…

Yesterday I asked… For companies in your portfolio... do you give a damn about who/what they do business with?

76.1% of you don't give a f*ck about what companies do. Here are some of my favorite responses…

“I cannot afford morals, ethics, and conscience. Only nepo babies get that luxury. Rest of us out here humping for the myth that we can retire."

"The good news is most of the truly reprehensible companies out there are privately owned."

"All major companies have skeletons. If you focus on that, you’ll have no one."

"I wish I was a better person and cared. I'm sure that some of my mutual funds have large tobacco in them and other stuff that I don't approve of directly.”

"My wallet lacks morals."

"I am a capitalist pig."

"As Michael explained to Sonny Corleone, 'It’s not personal, Sonny, it’s strictly business.'"

Here’s today’s question…

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional