Hey there weekday warrior,

Today, we’re getting into OpenAI’s biggest acquisition ever, Target’s brutal day, and Walmart’s layoffs. But first...

In the May 22, 2020 edition of The Water Coolest, we covered Zuck’s decision to extend work from home for some roles even as stay-at-home orders were lifting. And get this… he said that within 10 years, as many as half of FB’s 45k employees will be remote... or would at least have the option to be.

LOL. Like pretty much every other major company, Meta mandated a return to office by 2023. That was right around the time Zuck got his “year of efficiency” on. The company laid off ~20k employees in 2022 and 2023.

Enjoy the next 4 minutes and 32 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

The OpenAiPhone

“F*ck my life.” - the kids making iPhones in China seeing orders come in from some non-profit in the US

OpenAI just made its second, multi-billion-dollar acquisition in a month (see: $3B Windsurf deal a few weeks back).

And this time around, Sam is getting hard(ware). The company that gave us ChatGPT (and came this close to giving us ‘Her’) just bought io, a hardware design agency, for $6.4B.

Sound familiar?

That’s because io is Jony Ive’s company. Yes, the Jony Ive who designed arguably the most iconic hardware device not named the Fl*shlight. See: the iPhone. Oh, and when he wasn’t making bigger contributions to telephone communications than Alexander Graham Bell, he was busy designing the iPod, iPad, and MacBook Air. Perhaps you’ve heard of them?

He was also instrumental in conceiving Apple Park, AAPL’s iconic Cupertino HQ. You know, the one with the field in the middle where Tim Cook stands to announce the company is adding 3 more megapixels to its new camera.

OpenAI already had a stake in the design agency. And you might recall that last year, rumors began swirling about Ive and an Altman teaming up on a product. Altman confirmed the hardware device, but promised it wasn’t a phone (and that sound you could hear was Tim Cook’s butthole unclenching a little bit…).

So what should we expect?

io and OpenAI dismissed the smartphone and hinted at something totally new. Ive said, “People have an appetite for something new, which is a reflection on a sort of an unease with where we currently are.”

Altman echoed the sentiment, promising a “totally new kind of thing” when the product launches in 2026-ish. This just has “beginning of a Black Mirror episode” written all over it…

Allow me to let you in on a little secret about paying down debt…

It might sound crazy, but there's a much easier way to pay down debt faster: using a credit card.

Here’s EXACTLY how to do it…

Find a card with a “0% intro APR" period for balance transfers

Transfer your debt balance

Pay it down as much as possible during the intro period

No interest means you could pay off the debt faster.

Now it’s time to find the right card…

Some of the top credit card experts identified one of their favorites that puts interest on ice until nearly 2027 AND offers up to 5% cash back on qualifying purchases.

+ Things you hate to see as an investor: things getting so bad that a company resorts to creating something called the Enterprise Acceleration Office in hopes of stopping the bleeding. After yet another brutal quarter (and no relief in sight) Target $TGT ( ▼ 0.87% ) is creating a bunch of bureaucracy with the goal of getting its sh*t together. Tell me your CEO is on the hot seat without telling me…

Just how bad was it?

Walmart-for-people-who-think-Stanley-Cups-are-a-personality-trait missed on the top and bottom lines and saw sales fall 3% YOY. But wait, there’s more (bad news)! Target is bleeding market share. It only gained or maintained market share in 15 of its 35 merch categories *CEO Brian Cornell contemplates adding the #OpenToWork badge on LinkedIn*

And Tarzhay has plans to keep the bad times going. It slashed its full-year sales forecast “bECauSE TaRIfFs, YoU GuYs!”

+ A security presentation at Microsoft’s $MSFT ( ▼ 2.24% ) Build conference was interrupted by protestors. But that’s not even the biggest story here (mostly because this was the third time some blue-haired Buzz Killingtons had interrupted the event)…

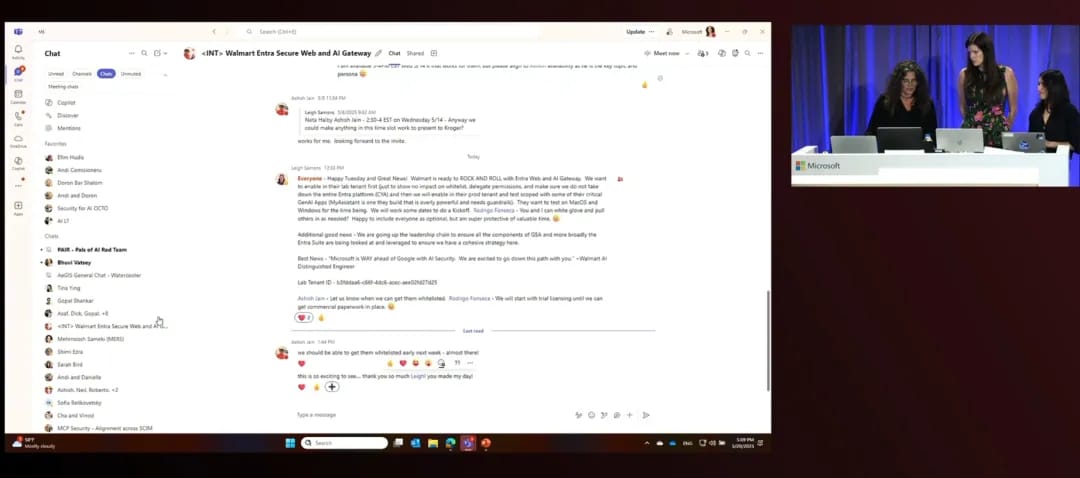

While Microsoft’s head of security for AI, Neta Haiby, was trying to get the presentation back up and running following the kerfuffle, her confidential Teams messages were accidentally broadcast to the world.

The Slack knockoff revealed a previously unknown AI partnership with Walmart that is about to put Target in a body bag (Google also caught a stray…).

+ “Told you so.” - your friendly neighborhood mouth breather. Bitcoin hit a new all time high on Wednesday, topping $109k. And I’m just glad Charlie Munger isn’t alive to have to see this. The past few weeks have been a perfect storm for crypto: easing trade tensions, softer inflation #s, Moody’s downgrade of the US, and continued institutional adoption of the official currency of Silk Road.

+ Just me, or is UnitedHealth quickly becoming the Boeing of the healthcare industry?

Last year, hackers gained access to hundreds of millions of UnitedHealth $UNH ( ▲ 2.31% ) users' personal data. Then, of course, there was the murder of UnitedHealthCare CEO Brian Thompson. And just last week, UnitedHealthGroup’s CEO stepped down just a day before news broke that the company was being investigated for Medicare fraud.

And just when you thought things couldn’t get any worse… yesterday, reports shed light on the UNH’s latest f*ckery: it was reportedly bribing nursing homes to not transfer patients to hospitals. Spoiler: health care costs tend to pile up for old people at hospitals…

+ Klarna $KLAR ( ▼ 4.1% ) really reported that its losses doubled last quarter… with an AI avatar of its CEO…

+ Probably just a coincidence that Walmart $WMT ( ▲ 2.84% ) is laying off 1.5k employees a few days after POTUS warned them not to raise prices…

+ US stocks “sold off on Wednesday, pressured by a sharp spike higher in Treasury yields as traders grew worried that a new U.S. budget bill would put even more stress on the country's already large deficit.” (CNBC)

+ The 10-year yield “moved back to levels that have pressured the economy and financial markets in the past as investors feared a new U.S. tax bill could worsen the country’s budget deficit, a risk highlighted in a Moody’s downgrade of the U.S. credit rating to end last week.” (CNBC)

+ Oil “prices settled lower on Wednesday, after Oman’s foreign minister said a fresh round of nuclear talks between Iran and the U.S. would take place later this week.” (Reuters)

⏪ Yesterday…

+ Target, Lowe's, Baidu, TJX, WIX, Medtronic, and XPeng reported before the bell

+ Snowflake and Zoom reported after the bell

⏩ Today we’re keeping an eye on…

+ Analog Devices, TD Bank, Williams-Sonoma, and Nano-X Imaging report before the bell

+ Intuit, Workday, Autodesk, Deckers Outdoor, Copart, and Ross Stores drop earnings after hours

+ Seagate Technology will hold an Analyst Day event

+ Fastenal will begin trading on its split-adjusted basis following the 2-for-1 stock split

+ Existing Home Sales report will be released by the National Association of Realtors

Yesterday, I asked, “Have you ever used Google's 'I'm feeling lucky' button?”

82.5% of you said “Nope.”

Here’s what some of you guys had to say…

Nope: “I'm not really sure what it does, and at this point I'm too afraid to ask”

Yes: “Is that still a thing? I thought that button went away during the Bush Administration”

Nope: “Ain't nobody got time for that.....”

Yes: “This was back in like 2002. I was on active duty in the Marine Corps and a guy working with me clicked "I'm feeling lucky" and it took him to a p*rn site... Set off a bunch of monitoring alerts at the firewall. It was a whole big thing - my buddy got in some serious shit.”

Nope: “I don’t trust it. I can’t explain why though.”

Here’s today’s question…

Good news, short kings…

Alright fellas. How big is it (your height)?

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.