Hey there weekday warrior. Here’s what’s on tap today… Fanatics has entered the (prediction markets) chat, a brutal jobs report, and Zuck continues to Hoover up talent.

Enjoy the next 3 minutes and 37 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

The degen tech race

The AI tech race has a degenerate sibling…

While OpenAI, Google $GOOG ( ▲ 1.39% ), and others (except Apple) face off to decide which company will usher in the end times, another arms race is heating up: “prediction markets” (read: gambling).

Yesterday, Fanatics announced that it’s entering the arena with its own prediction market in 24 states, with contracts for sports, finance, economics, and politics. And presumably when Jesus will make his triumphant return…

Per CEO Matt King, “This is really the top of the first inning on a market that’s going to grow exponentially over the next five to 10 years, so we’re not worried about being a couple months behind…” Which is probably what the 150th guy in the Bonnie Blue queue told himself.

Friendly reminder that the prediction market OGs, Polymarket and Kalshi, were already anticipating competition in the event contracts space. You might recall DraftKings $DKNG ( ▲ 1.49% ) entered the fray via its acquisition of Railbird back in October, and Flutter $FLUT ( ▼ 13.8% ) aka FanDuel will launch this month.

Oh, and in case you were wondering, “what’s the worst that could happen?”… I’ll just leave this right here…

+ Might be time to dust off that résumé. Live look at how the pros do it.

The November ADP jobs report is here, and it’s looking… well, it’s not great, Bob. Private-sector payrolls decreased by 32k. That’s the biggest drop since 2023. Small businesses (so < 50 employees) gave up 120k jobs. Woof.

On the bright side (for those still employed…), this is the last piece of data the Fed gets before meeting early next week (friendly reminder: the government shutdown means we won’t get official government data until later this month). The piss poor job data points towards the Fed cutting. Futures traders are assigning an almost 90% probability of another rate cut in 2025.

+ “I ain’t passed the bar, but I know a little bit…” - Scott Bessent, probably

Treasury Secretary Scott Bessent went full Bob Loblaw Law Bomb onstage at the NY Times DealBook Summit, citing direct sections of the 1962 Trade Act that give the president some widespread powers when it comes to import duties…

“We can recreate the exact tariff structure with [sections] 301, with 232, with 122.” In other words, even if the Trump administration loses the pending tariff Supreme Court case, tariffs aren’t going anywhere.

+ Poachers gonna poach…

Alan Dye, head of user interface design at Apple $AAPL ( ▼ 3.21% ) is the next big tech exec to get scooped up by Zuck. Dye, who’s been a major force in Apple design (you can thank him for liquid glass) since around 2015, will be joining Meta $META ( ▼ 1.34% ) to head up a new design studio. It appears that Apple is as good at drafting non-competes as they are at iPhone innovation…

> Microsoft stock sinks on report AI product sales are missing growth goals (CNBC) The Bing of AI products, if you will…

> Waymo self-driving cars go full NYC cabbie, are making illegal U-turns, zigzagging through tunnels and rolling past stops: report (NY Post) What’s next? Driving into the middle of police standoffs?

> Congressional stock ownership is 'outrageous,' says Rep. Mike Levin, calling for ban (CNBC) Tell me you suck at insider trading without telling me.

> That’s someone’s daughter…

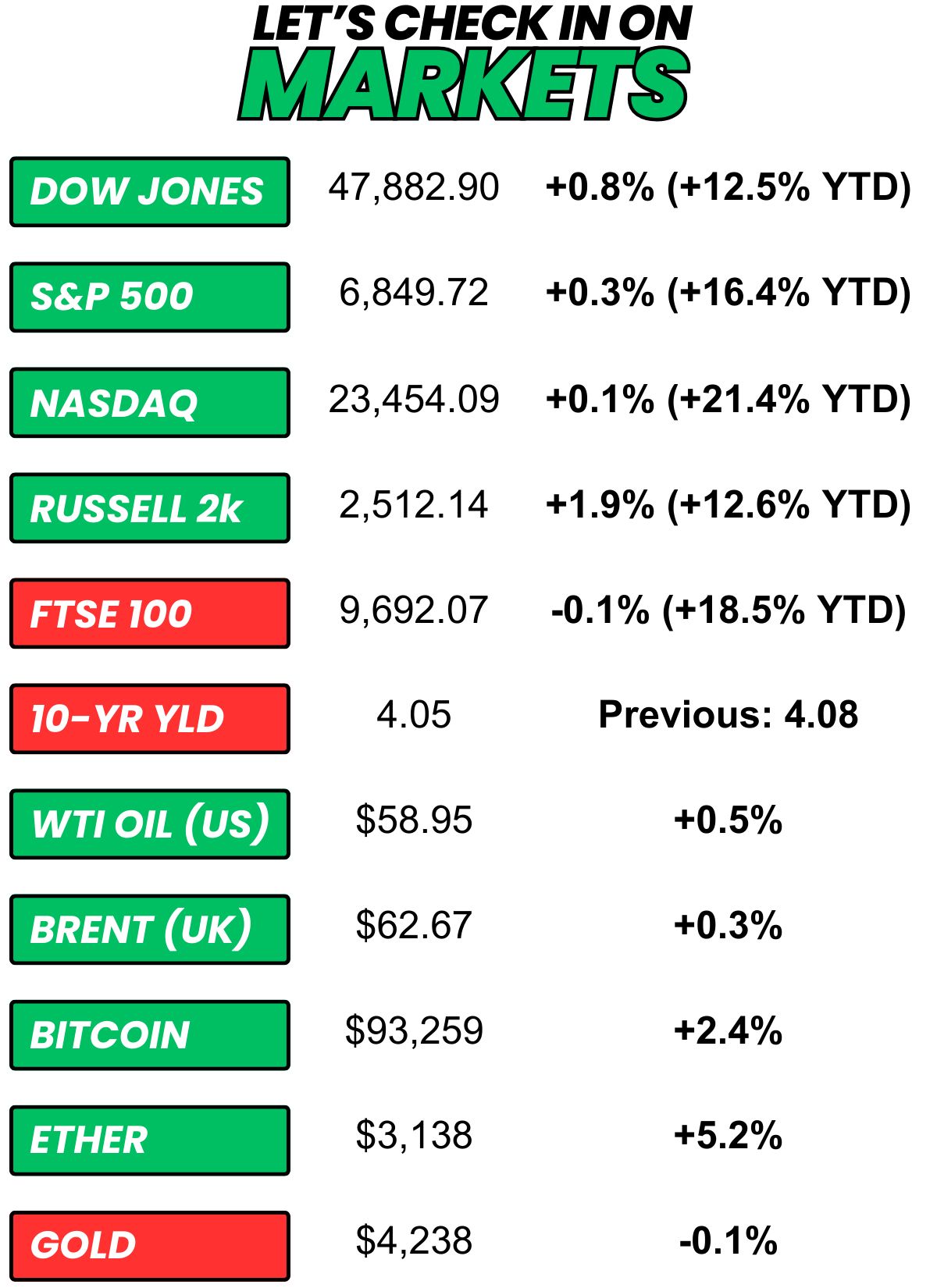

+ US stocks “closed higher on Wednesday as the latest jobs data from ADP strengthened investors’ conviction that the Federal Reserve will cut interest rates next week.” (CNBC)

+ The 10-year yield “ticked lower on Wednesday on the latest signs of a weaker jobs market as shown in private payroll data, reinforcing a conviction that the Federal Reserve will lower interest rates another quarter percentage point at its final meeting of the year next week.” (CNBC)

+ Oil “prices settled higher on Wednesday after the U.S. and Russia failed to reach a deal to end the war in Ukraine that could have eased sanctions on Moscow’s oil sector, though gains were held back by fears of oversupply.” (Reuters)

+ Bitcoin “recovered to the $93,000 mark on Wednesday, bouncing back from Monday’s steep drop near $84,000, as investors drew confidence from positive regulatory developments in the U.S. and increasing hopes for a near-term interest rate cut.” (Investing.com)

+ The “smart” money (prediction markets) thinks there’s a 26% chance the Supreme Court will rule in favor of Trump tariffs. (Kalshi)

⏪ Yesterday…

+ Dollar Tree, Macy's, and Royal Bank of Canada reported before the open

+ Salesforce, Snowflake, UiPath, C3 Ai, and Five Below reported after the bell

+ The New York Times DealBook Summit got underway

⏩ Today we’re keeping an eye on…

+ Kroger, Dollar General, and Toronto Dominion Bank drop earnings before the opening bell

+ Rubrik, DocuSign, SentinelOne, Ulta Beauty, Samsara, Hewlett Packard, and ChargePoint report after the bell

Yesterday, I asked, “Which chatbot you got winning the AI race ultimately?”

41.8% of you said “Gemini.”

Here’s what some of you guys had to say…

Gemini: “Bet against Google at your own peril.”

Grok: “Great tool for writing your own code to create things like a stock bot or sports betting bot - all to make some monies!”

ChatGPT: “I feel like its the "Kleenex" or "Q-tip" of the AI game....Branding is everything”

Siri (imagine): “But only in the British voice ;)”

Gemini: “Bring back “Clippy”!”

Here’s today’s question…

Which prediction market are you using to gamble away your kid's entire "Trump account" balance?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.