Hey there weekday warrior,

Here’s what’s on the agenda today…

Target is trimming the fat, Clippy is back, and CZ Binance gets a Presidential pardon.

Enjoy the next 4 minutes and 19 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Target on their back

Look on the bright side… Target usually hires like 100k seasonal workers at stores across the country…

Target $TGT ( ▼ 0.87% ) is cutting about 1.8k roles. Walmart Jr. will lay off more than 1k corporate stiffs and let ~800 roles go unfilled in a move that screams “yeah, I’m gonna need you to come in on Saturday” for all the poor b*stards left in HQ.

For those of you keeping score at home, this is the first major restructuring at the retailer in a decade… which probably explains the piss poor sales and tumbling share price.

“It’s about damn time…” - investors

Sales have either fallen or been of the “not great, Bob” variety for 11 consecutive quarters. To say things are bleak would be an understatement. Earlier this year, the sales slump cost CEO Brian Cornell his job.

The only shocking thing about the bloodbath is that it took new CEO Michael Fiddelke this long to make moves (he was presumably waiting on a McKinsey consultant to generate a report on ChatGPT).

You see, Mikey Big Box wasn’t exactly the top pick among investors, considering he was part of the problem. Fiddelke was an internal hire who joined Target as an intern. Spoiler: the Street was looking for an outsider to shake things up.

No, pressure Mike…

WTF could it mean for us?

Every lame stream newsletter tells you “wHaT iT MeAnS.” At The Water Coolest, we predict tomorrow’s headlines today…

I think we can all agree that Target will manage to alienate half of the country with a graphic t-shirt at some point soon, so I’ll spare you that headline…

🔮 Wall Street Journal headline on 3/5/26 (probably): "Target Reports Brutal Holiday Season; Fiddelke Replaced By [The Person Who Runs TikTok Shop]”

+ Clippy, that you?

Microsoft $MSFT ( ▼ 2.24% ) hosted its Fall Copilot event (does that imply they justify four of these every year?) and literally only one thing mattered: Mico (short for “Microsoft Copilot”). MSFT gave its chatbot a “face.”

The avatar is giving major Clippy vibes… and OpenAI’s sugar daddy is in on the joke. If you click on Mico enough, it transforms into Clippy.

+ Get you a woman who can do both…

Citi $C ( ▼ 5.16% ) is making it rain on CEO Jane Fraser. On Wednesday, she was named Chair of the Board, in addition to her chief executive duties. Meanwhile, you can barely meet most expectations at your middle management gig.

The additional duties come with a fat pay raise, as you might have guessed. She was granted $25M in equity that vests over the next 5 years.

Jane’s in good company: JPMorgan and Morgan Stanley have bestowed the Chair/CEO dual role on Jamie Dimon and Ted Pick.

+ We’re at the point where you get a stock price bump when investors so much as remember you’re working with Nvidia…

Shares of Uber $UBER ( ▲ 0.83% ) popped 2.6% after a Nvidia marketing intern dropped a social post elaborating on the partnership between the two to develop autonomous tech. Spoiler: the stock jumped when it was first announced, too.

+ JPMorgan $JPM ( ▼ 1.9% ) be like “yeah, we’re going for Mumbai call center aesthetic…”

+ SBF is down bad (or, worse, I guess)…

Yesterday, POTUS gave Binance founder/SBF’s arch nemesis Changpeng Zhao aka CZ Binance a pardon (not quite a get out of a jail free card since he already served his time). He was found guilty of enabling money laundering and sentenced to 4 months in prison. Probably just a coincidence that the Trump family’s crypto ventures work closely with Binance.

Ok, now do Tiger King…

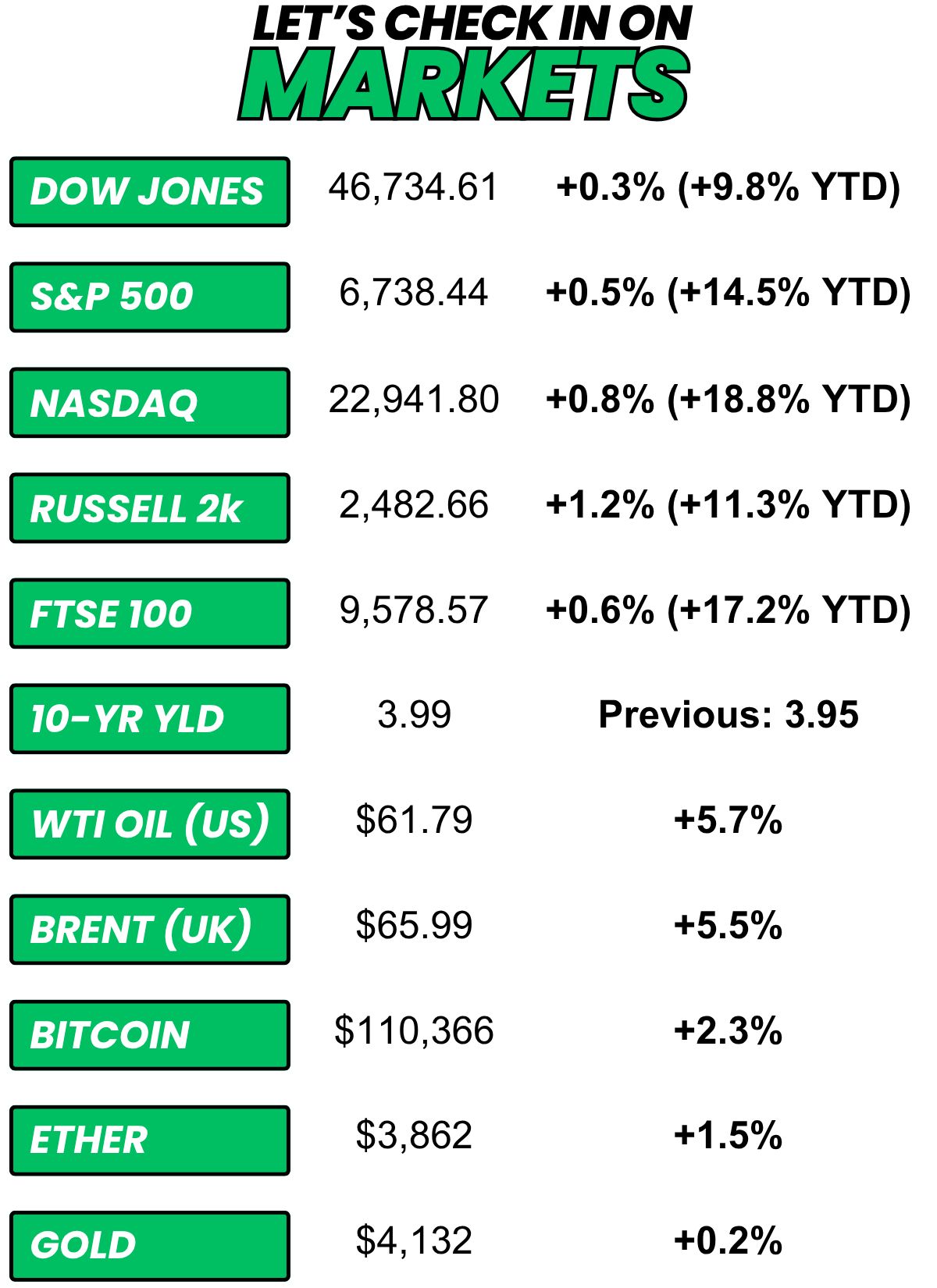

+ US stocks “rose on Thursday, boosted by tech stocks, as investors stepped in to buy after a batch of strong earnings results.” (CNBC)

+ The 10-year yield “moved higher on Thursday, with the 10-year Treasury yield moving back above the 4% level, as investors weighed the latest trade news and looked ahead to key inflation data.” (CNBC)

+ Oil “surged around 5% to a two-week high on Thursday after the U.S. imposed sanctions on major Russian suppliers Rosneft and Lukoil over Moscow’s war in Ukraine, prompting energy firms in China and India to consider cutting Russian imports.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 16% chance SBF gets a Presidential pardon. (Kalshi)

⏪ Yesterday…

+ T-Mobile, Blackstone, Honeywell, American Airlines, Union Pacific, Freeport-McMoran, and Mobileye reported before the bell

+ Intel, Ford, Deckers, Newmont Goldcorp, Nexttracker, Digital Realty Trust, Comfort Systems, and Kinsale Group reported after hours

⏩ Today we’re keeping an eye on…

+ Procter & Gamble, General Dynamics, and HCA Holdings report before the open

+ The September CPI report drops

Yesterday, I asked, “If a friend loans you $200 to gamble and you win $100M, how much do you give them?”

29.2% of you said, “$1M.”

Here’s what some of you guys had to say…

$1M: “I would also kick in college and graduate school education for their children, so closer to $2M.”

$10M: “The old school philosophy here is 10 percent. The old guys who used to hang around the track to cash tax tickets for underaged bettors are known as “ten percenters”. ”

$1M: “They get to 500,000x their investment, and I keep the rest for crafting the world's greatest 28-leg parlay.”

$50M: “Karma it would be fair to split it with them. If they want more then unfriend them.”

Other: “I pay their house and other outstanding debts and "hire" them to travel, go to games, etc. what good is money if your friends can't experience it with you?”

Here’s today’s question…

Let’s assume this is for a meal

Yes, there is a side of fries

You’re hungry. Not starving, but also not still kinda full from a big breakfast.

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.