TOGETHER WITH

Hey there weekday warrior. Here’s what’s on tap today… Taiwan came in hot, Amazon can stop will stop, and Spotify raises prices… again.

Enjoy the next 3 minutes and 30 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, I sent out a 5-minute survey over the weekend with one goal in mind: making TWC even better. If you didn’t have a chance, I’d really, really appreciate it if you took just a few minutes to complete it. Help me help you.

PPS, interested in advertising with TWC? Reply directly to this newsletter or fill out this form, and I’ll be in touch ASAP.

Taiwinning

Yuge day for Taiwan yesterday.

First, the US Department of Commerce announced a big swinging trade deal with the Republic of China, aka Taiwan (long story, don’t ask).

Taiwanese chip companies will invest $250B in production within the US, backed by the Taiwanese government. A good chunk of that internet artificial intelligence money will be earmarked for developing a few hundred acres of property that Taiwan Semiconductor $TSM ( ▼ 0.59% ) recently snagged out in East Bumf*ck Arizona.

In exchange, Donny Deals will limit reciprocal tariffs on Taiwan to 15%, down from 20%. Oh, and the US will commit to no reciprocal tariffs on generic pharmaceuticals, aircraft components, and a handful of natural resources.

Plus, companies that build chips in the US (so… TSM) will be able to import up to 2.5x capacity while factories are under construction, tariff-free.

Art. Of. The. Deal.

Surely, that was the only W Taiwan scored yesterday, right?

Wrong. And don’t call me Shirley.

Taiwan Semiconductor put the chip industry on its back after reporting killer earnings. The chip fab that does something Intel can’t quite get the hang of (read: actually make chips) reported a 35% Q4 profit increase and expects more capital spending in 2026.

Nvidia $NVDA ( ▼ 4.17% ), AMD $AMD ( ▼ 1.7% ), and Broadcom $AVGO ( ▼ 0.67% ) shares all popped on TSM’s earnings news.

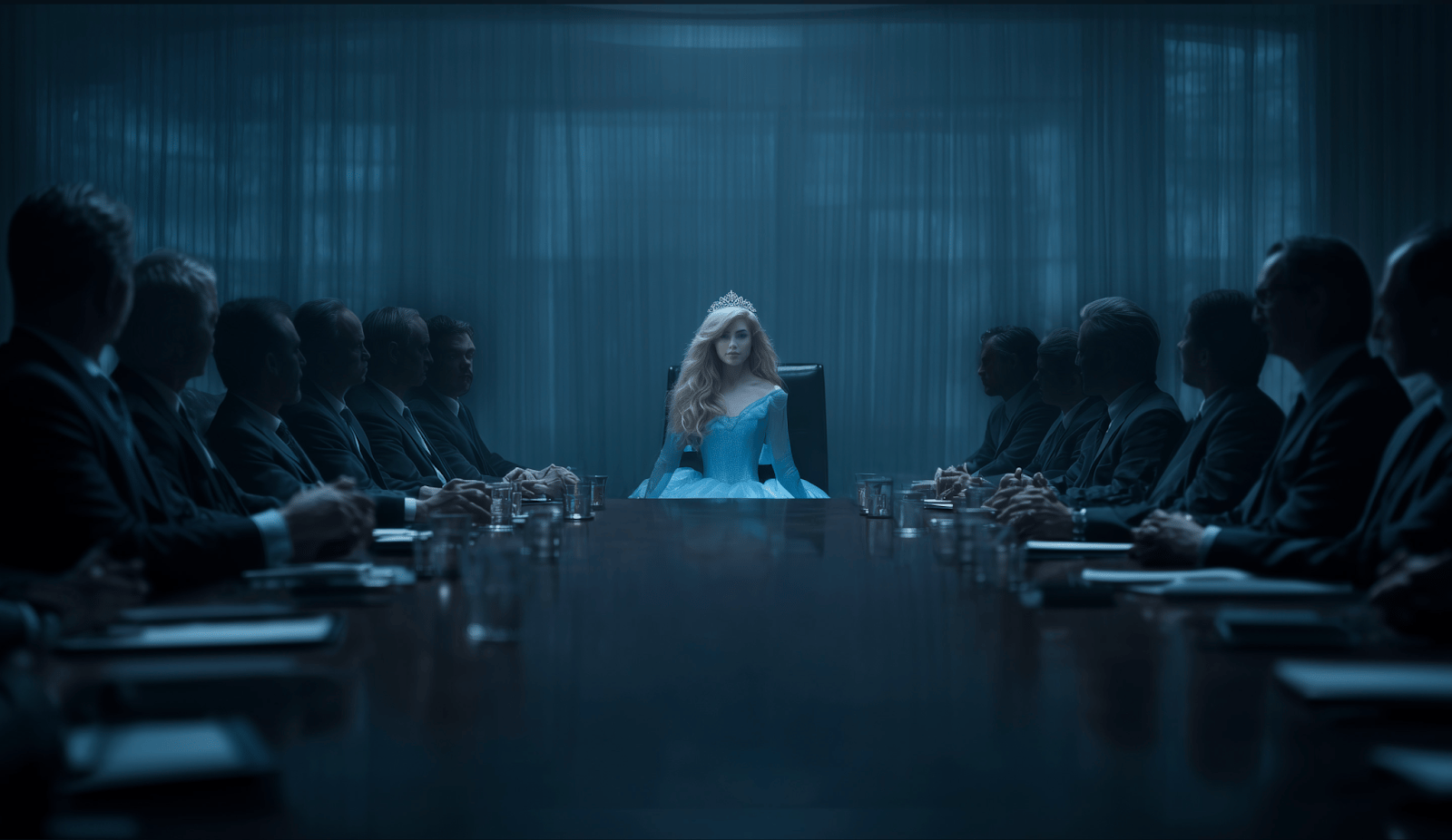

Disney didn’t reach a $200B market cap by accident.

They did it by owning globally recognized character IP.

Now, after a 10-year legal effort, Elf Labs has secured historic rights (500+ assets) to iconic characters like Cinderella and Snow White.

They’re bringing them to life through multi-patented immersive technology across entertainment, gaming, and consumer products — a market estimated at over $2 trillion.

Valuation has grown 17X (a 1,600% increase) in under 24 months, and the company just reserved its NASDAQ ticker: $ELFS.

For a limited time, everyday investors can still participate at $2.25/share (plus up to 35% bonus shares) while the company remains privately held.

+ Saks: *declares bankruptcy*

Amazon: *proceeds to make it all about them*

Andy Jassy f*cked around, and now he’s finding out (spoiler: he doesn’t like it very much). Yesterday, Amazon $AMZN ( ▲ 1.0% ) requested that a federal judge reject Saks Global’s bankruptcy plan. It hopes the judicial system will give it more preferential treatment in recouping its equity investment (you might recall that debt holders are typically first in line)…

Wait, what?

Well, you see, back in the year of our lord 2024, when Saks acquired Neiman Marcus for a cool $2.7B, Amazon dumped $475M into the business in exchange for Saks selling luxury products on Amazon. But now that Saks went t*ts up, that half-billion is worth about as much as Amazon’s stake in Pets.com.

The price of a brick Prime subscription going up.

+ Speaking of subscription price inflation…

Spotify $SPOT ( ▲ 3.89% ) is raising prices. Again. Monthly Spotify Premium subs are jumping up another $1 to $12.99 for the US (and Estonia and Latvia, apparently). New pricing is set to take effect in February. Shares closed down nearly 4% yesterday.

In case you still listen to CDs (actually, not a burn… that’d be sick), Premium users got hit with a price bump in June 2024 AND July 2023. Bring back Napster.

Vibe-coding startup Replit just introduced a new feature that lets any group of guys sitting around at a bar who just said, “dude, we should build an app for that” users create and publish mobile apps. “From idea to working app in minutes, and to the App Store in days.”

Now you just gotta figure out how to make money on this thing…

> Wikipedia parent partners with Amazon, Meta, Perplexity on AI access (CNBC) // My 8th-grade English teacher (sup, Ms. Cook), who wouldn’t let us use Wikipedia as a source, has gotta be punching air right now.

> Dimon Says ‘Absolutely, Positively No Chance’ on Fed Chair Job (Bloomberg) // Makes sense… it would be tough to be Fed chair and President of the United States at the same time…

> Verizon offers ‘pathetic’ $20 credit, sparking more outrage over hours-long outage: ‘Are you kidding me?’ (NY Post) // Honestly, seems fair when you consider CrowdStrike only gave out $10 Uber Eats gift cards after it brought down 8.5M computers running Windows…

> Bank CEOs Say Record $134 Billion Trading Haul Is Just the Start (Bloomberg) // Middle class Americans be like…

Yesterday, I asked, “After Verizon's big fumble today, I got to thinking... which phone provider has the best all-time advertising?”

47.1% of you said, “AT&T: Any commercial with Lily, the AT&T girl... (bonk).”

Here’s what some of you guys had to say…

AT&T: Any commercial with Lily, the AT&T girl... (bonk): “Watching Lily trying to hide those sweater puppies in a button down shirt is like trying to whisper in a thunderstorm.”

Verizon: "Can you hear me now?": “If they didn't nerf Lily so quickly, she wins in a landslide”

AT&T: Any commercial with Lily, the AT&T girl... (bonk): “Wait, Lily was in an AT&T commercial?”

Other: “I cannot vote for any of the options. My personal hell would be me strapped to the couch in my living room being forced to watch phone provider commercials on an endless loop”

Mint Mobile: Ryan Reynolds... duh: “Ryan Reynolds is doing a good job making burner phones funny.”

Here’s today’s question(s)…

What subscription category can you not live without (even if they jack up the prices constantly)?

+ US stocks “climbed late Thursday as Wall Street looked to build on gains driven by strength in financials and technology shares, with winning weeks for the major averages still in play.” (Yahoo! Finance)

+ The 10-year yield “gained Thursday after the latest jobless claims data pointed to an improving labor market. Investors also assessed ongoing geopolitical uncertainty.” (CNBC)

+ Oil “slumped Thursday, snapping a five-day winning streak as U.S. President Donald Trump indicated a more restrained stance on Iran, easing fears of near-term supply disruptions.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 54% chance that California drives out all its billionaires Californians pass a one-time wealth tax on billionaires in 2026. (Polymarket)

⏪ Yesterday…

+ TSM, Goldman Sachs, BlackRock, and Morgan Stanley reported before the opening bell

+ Costco held its annual meeting

+ Topgolf Callaway officially reverted to its old name, Callaway Golf. The end of an error.

⏩ Today we’re keeping an eye on…

+ It is the last day before the FOMC blackout period. Buckle up.

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of a guy with a Nano Banana account and a wild imagination. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.