TOGETHER WITH

Hey there weekday warrior. Here’s what’s on tap today… RIP Roomba, pour one out for Zillow, and the word of the year is…

Enjoy the next 3 minutes and 24 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Sucks to suck

Imagine trying to explain “customers are worried their smart-vacuums will stop working if iRobot goes bankrupt” to the Founding Fathers.

The robot vacuum bubble has finally burst (told ya so).

iRobot $IRBT ( ▼ 67.11% ), the maker of the Roomba, has gone full Chapter 11. Pour one out. Then sit back and let your robot maid clean it up.

Your dog’s arch nemesis will be handed over to Shenzhen Picea Robotics, iRobot’s biggest supplier, to settle its literal f*ck ton of debt.

Friendly reminder that iRobot’s been searching for a deal since Amazon nearly acquired it for $1.7B in 2022. That deal blew up in 2024 over regulatory concerns, courtesy of the fun police over at Lina Khan’s FTC and the EU.

iRobot announced that its products should still work, and its app will continue to function (read: live-mapping American homes for Chinese companies), despite being flat broke.

The $4 Billion Deal Everyday Investors Missed

In 2012, Disney acquired Lucasfilm for $4B — one of the most profitable entertainment deals ever made. But everyday investors never had the chance to participate, missing the upside.

Elf Labs spent a decade securing 500+ trademarks and copyrights featuring Cinderella, Snow White, and other iconic characters to ensure that dynamic changes.

The company is building a tech-powered character universe, using AI, immersive technology, and 12 patents to activate these globally recognized characters across entertainment, gaming, and consumer products — a market estimated at over $2 trillion.

Analyst interest increased even before any national rollout, following multiple unsolicited $70M+ offers.

And unlike the Lucasfilm deal, investors can get in while the company is still private.

Timing matters here — a limited allocation remains, and up to 25% bonus shares expire tomorrow.

Disclosure: This is a paid advertisement for Elf Labs’ Regulation CF offering. Please read the offering circular at elflabs.com

+ Annnnd it’s gone (Zillow’s entire moat)…

Google $GOOG ( ▲ 1.39% ) remains on the warpath. This week, it’s got its sights set on the best website for finding out your friends’ net worth. Zillow $Z ( ▼ 4.35% ) shares fell over 9% on the news that Google Search is running tests to put real estate listings directly into search results (so, Gemini). Also, how was this not already a thing?

Google’s test listings appear to allow users to see property details, request tours, and contact agents. But they can never take Zestimate®…

Tesla $TSLA ( ▼ 1.49% ) shares *double checks notes* surged on Monday after Elon Mucks announced that the EV maker robot manufacturer is now testing its robotaxis without any safety monitors in the front passenger seat, which feels… late.

Meanwhile, Alphabet’s $GOOG ( ▲ 1.39% ) Waymo is already flexing 450k paid rides (sans hall monitor) per week. But if we’ve learned anything today, it’s that first-mover advantage for autonomous robots is BS…

+ Fans of Space Force, get ready for…

Donny Technology just unveiled the “Tech Force,” and Netflix is probably already scripting the series. The new government group will be comprised of 1k virgins (read: engineers) dedicated to working on federal AI infrastructure and other technology projects that Congressional aides are tired of explaining to 86-year-old legislators.

And I think we can all agree that it’s so over for the land of the free and the home of type 2 diabeetus. Imagine the federal government competing for talent with Zuck’s Publisher’s Clearing House-sized checks…

> Ford to record $19.5 billion in special charges related to EV pullback (CNBC) This is bullish for the the gas station roller dog industrial complex.

> Merriam-Webster’s 2025 word of the year is ‘slop’ (AP) The irony is that 97% of the articles written about the word of the year being ‘slop’ are AI slop.

> PayPal Applies to Become a Bank as US Loosens Regulatory Reins (Bloomberg) Finally, the debanking crisis facing the nation’s drug dealers and bookies is coming to an end.

> Finally, making d*ck jokes about the Federal Reserve is about to pay off…

Ever wonder how the (TWC) sausage gets made?

It feels like the right time to finally pull together all of my thoughts about creating killer newsletter content and building an audience the right way.

Later this month, I’m launching the Chief Newsletter Officer newsletter.

Every Thursday, I’ll send a newsletter to current and aspiring newsletter operators with tactics and takeaways from nearly a decade in the newsletter trenches. No filter, just like TWC.

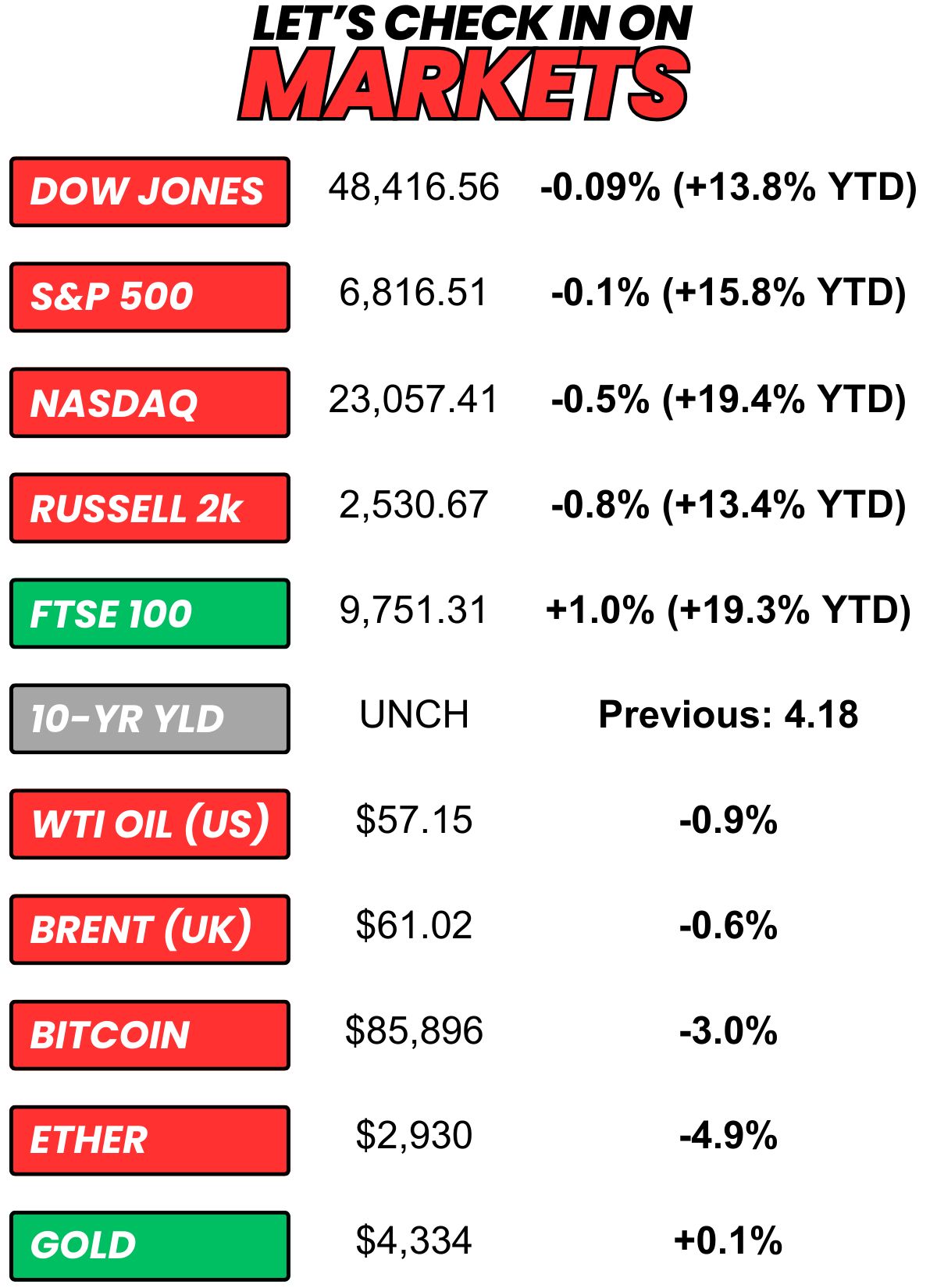

+ US stocks “ended Monday slightly lower as key stocks in the artificial intelligence trade came under pressure.” (CNBC)

+ The 10-year yield “moved lower on Monday as investors looked ahead to several economic reports this week, which will offer insight into the state of the jobs market, inflation and retail sales.” (CNBC)

+ Oil “slipped slightly lower Monday, adding to the previous week's sharp losses as concerns over a global supply glut and weak demand outlook continued to dominate market sentiment.” (Reuters)

+ The “smart” money (prediction markets) thinks we have a new leader for Fed Chair nom: Kevin Warsh at 48%. (Polymarket)

⏪ Yesterday…

+ Nothing to see here…

⏩ Today we’re keeping an eye on…

+ Lennar reports after the close

+ The October and November jobs reports will be released

+ October Retail Sales drop

Yesterday, I asked, “Who was the GOAT OG (think: 1999 first 151) Pokemon?”

34.4% of you said “Charizard.”

Here’s what some of you guys had to say…

Pikachu: “The anime made Pikachu the famous one, the one with endless costumes, the one that has the same species name everywhere in the world... He's still clearly the star.”

Bulbasaur: “98.6% of your audience are all noobs.”

Charizard: “happy to say I have zero idea but chose the one I have heard the most about being rare I think.”

Charizard: “losing his flame that one episode...tears.”

Mewtwo: “There is only one Pokemon who has multiple movies.”

Here’s today’s question…

You can bring back only ONE of these bankrupt companies for the next generation to experience. Which one you resurrecting?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.