Before we get into it… the editors at FinanceBuzz reviewed and dropped a list of some of the best credit cards for balance transfers. You should check it out…

Hey there weekday warriors,

Here’s what we’re getting into today…

Intel is coming for Nvidia’s crown

Google making AI moves

Boeing’s brutal quarter

Enjoy the next 4 minutes and 35 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

+ US stocks “stocks stumbled on Wednesday after a key inflation report showed an unexpected uptick in consumer prices last month.” (CNBC)

+ The 10-year Treasury yield “jumped back above 4.5% on Wednesday after March inflation data came in hotter than expected, adding to the likelihood of higher-for-longer interest rates from the Federal Reserve." (CNBC)

+ Oil “settled up $1 on Wednesday after three sons of a Hamas leader were killed in an Israeli airstrike in the Gaza Strip, feeding worries that ceasefire talks might stall.” (Reuters)

+ Bitcoin regained $70k despite the brutal CPI report.

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia +1.9% 2) TSMC +0.5% 3) Tesla -2.8%

The market moves you need to know about…

+ At one point on Wednesday, telehealth company Mobile-health Network Solutions was up as much as 90%. It closed up 34.0% on its first day of trading following a $9M IPO (that’s not a typo, its IPO was measured in the single-digit millions).

– Shares of SoundHound AI dropped 7.0% following the hotter-than-expected CPI report. Turns out, a “growth story” can’t overcome just $17M in revenue (in the most recent quarter) when sh*t gets real.

+ Rent the Runway mooned 57.8% following a blowout earnings report where management promised a “transformative” 2024. No pressure…

Rate cuts are canceled

(Source: Giphy)

“You’ll get nothing and like it.” - Jerome Powell, probably

Rate hikes are getting canceled quicker than Hollywood execs circa 2018.

We got (another) brutal inflation report yesterday. For March, the Bureau of Labor Statistics’s Consumer Price Index rose 0.4% month over month. And 3.5% vs. the same period last year.

To put that in perspective, both of those numbers were above economists’ consensus. And the annual price gains were larger than February’s 3.2%. You hate to see it…

For the “core” CPI purists like J-Poww and the Fed, the print was equally bleak. Both annual and monthly inflation numbers (with food and energy stripped out) came in above expectations…

Listen, I don’t like to point fingers, but WTF is going on insurers?

Shelter also did its part to put the economy in a body bag. Housing, which jumped 5.7% on an annual basis, accounted for 60% of total monthly price increases.

What does it all mean?

You might want to take a seat if you were hoping your portfolio of “cutting-edge high-tech firms out of the Midwest, awaiting imminent patent approval” would benefit from lower interest rates…

Following the CPI report, the probability of no rate cut in June jumped from 40% to 80%. And the Street is reallllly starting to think we’re a few bad data points from zero cuts in 2024.

Markets reacted how you’d expect (spoiler: all three major indices tanked).

Put Interest On Ice Until (Nearly) 2026…

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Find out how you can pay no interest on balance transfers until nearly 2026 with this top credit card.

Sponsors are the reason I can bring The Water Coolest to you for free every day. The only thing I ask is that you show them some love by clicking and taking a look around.

+ Define “hostile takeover.”

Macy’s (+2.5%) just rolled over and died in its months-long proxy fight vs. Arkhouse Management. It added two of Arkhouse’s nominees to its board. And, welp, this is the beginning of the end for the retailer that owns 100% of the Thanksgiving Day parade market.

Friendly reminder: Arkhouse and Brigade Capital Management have an outstanding bid to buy the remainder of the Macy’s shares they don’t own.

+ You cannot make this sh*t up. Serial copy-cat Mark Zuckerberg rolled out Meta’s (+0.5%) new in-house AI chip just a day after Google did the exact same thing. The “Artemis” chip will power the AI capabilities built into Facebook, IG, and, I guess, Threads…

+ Ok, don’t freak out, but Nvidia (+1.9%) briefly entered correction territory (down 10% from its all-time high) on Wednesday morning…

Of course, it proceeded to do what it does best… end the day up almost 2%.

Still, NVDA has been under pressure over the past few weeks. Why? Well, it might have something to do with competitors catching up (we see you, Intel). But it probably has more to do with investors taking (massive) profits. Friendly reminder: the shares are up like 220% over the past year...

+ Blink twice if you’re under duress, Jack…

“Jack Ma” from the clouds. Yesterday, Ma made his first public statement in months. He praised Alibaba’s (+2.1%) team in an internal memo. Shares jumped on the news, but they’re still down ~25% over the past year.

You might recall that in 2020 Ma nearly got himself Epstein-ed when he criticized the Chinese government.

In response, Beijing pulled the plug on Ant Group’s (Alibaba’s fintech) spinoff/IPO and launched a massive crackdown on China’s tech industry.

Alibaba has been clawing its way back ever since. Last year, it split the company into 6 divisions and overhauled management.

+ Ahead of its earnings next week, Taiwan Semi said revenue rose 16.5% year over year in Q1. To which investors replied, “That’s it?”

That beat its internal projections and analyst estimates. What makes it even more impressive is that Q1 is typically slower for TSMC following the holiday rush, when demand for phone and tablet chips spikes.

+ Shocker… New York Community Bank’s online arm is paying the nation’s highest interest rate (Read)

+ 6 Ways People Are Boosting Their Bank Account (Read)

+ Here's How Many Americans Actually Retire Early (Read)

+ 3 zodiac signs most likely to be billionaires revealed — did you make the cut? (Read)

BTW, some of these include affiliate partnerships.

Here's what I'm keeping an eye on today...

+ Constellation Brands, CarMax, and Fastenal report

+ The European Central Bank shares its interest rate decision

+ Producer Price Index data drops. And it can’t be any worse than the CPI print, right? Right?!

Here’s today’s question…

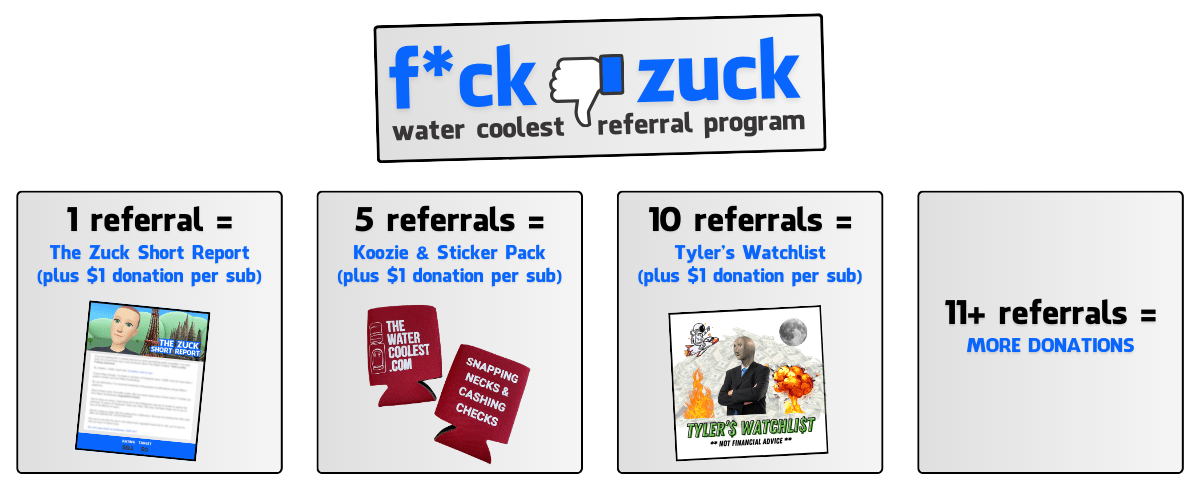

Friendly reminder: every month, I’ll donate $1 to charity for every valid TWC referral. This month we’re donating to the Shriner’s Hospital for Children.

There are still a few days before this month’s cutoff (the 15th) to do God’s work, so…

Have you referred anyone to The Water Coolest yet?

You can earn rewards and secure donations for your favorite charity by sharing your unique referral link…

Share your unique referral link (below) with anyone you think might be interested in The Water Coolest. You can email it, post it on social, etc. Get creative.

Your unique referral link: {{rp_refer_url}}

{{rp_personalized_text}}

(BTW, for those of you who earned koozies & stickers, they’ll ship on April 15th)

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional