TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

DraftKings is getting into the predictions game, Travis Kelce is an activist investor now, and Netflix tanks.

Enjoy the next 4 minutes and 14 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Predictable

DraftKings is now offering degens two ways to lose money on the same exact bet (er, prediction)…

DraftKings $DKNG ( ▲ 1.49% ) just bought a company you’ve probably never heard of: Railbird. The reason you never heard of it? Because it hasn’t launched yet, and has zero users, zero revenue, and zero track record.

Financial details weren’t disclosed, but I can assure you that they overpaid.

Why though?

Because DraftKings didn’t have a choice…

You see, Railbird is (or, at least, will be) a Kalshi competitor. AKA a "prediction market" where you can bet on anything from whether inflation hits 3% by December to if Marilyn Manson actually removed a rib and can suck his own d*ck (never forget the OG internet rumor).

But what Railbird can do doesn’t really matter. What does matter is that it has CFTC approval to take predictions. Turns out getting approval is really hard. So hard, in fact, at one point, DKNG filed paperwork for something called "DraftKings Predict" with the National Futures Association... but said f*ck it and withdrew the request.

Cry for help…

Kalshi has been eating DraftKings’ lunch. The original prediction market has become a juggernaut in the sports “betting” space. Mostly because it can operate in states where sports gambling is still illegal because it’s got approval on the federal level (sup, CFTC).

The risk of being made irrelevant and the opportunity to enter states without having to bribe gaming commissions/local Native American tribes were just too big to ignore for DraftKings. Your move, FanDuel…

WTF could it mean for us?

Every lame stream newsletter tells you “wHaT iT MeAnS.” At The Water Coolest, we predict tomorrow’s headlines today…

🔮 Bloomberg headline on 10/29/25 (probably): "FanDuel Announces 12% Stake in Kalshi to Counter DraftKings' Railbird Play"

News. Without motives. That’s 1440

Be the smartest person in the room by reading 1440, where 4.5 million Americans find their daily, fact-based news fix. They navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet: politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.

+ Nothing says it’s over quite like getting added to the Roundhill Meme Stock ETF…

The good news is that Beyond Meat $BYND ( ▲ 15.32% ) is no longer a penny stock. The bad news? It’s only because it became a meme stock. BYND has fallen from grace following its 2019 IPO. Turns out, making a terrible product no one consumes is bearish…

But, yesterday, shares popped more than 125% after news dropped that the fake meat maker had inked a deal for additional distribution at Walmart stores and was added to the Meme Stock ETF.

This, of course, helped fuel an ongoing short squeeze (*2021 PTSD sets in*). According to FactSet, more than 60% of shares outstanding are shorted…

+ Trade school > Wharton…

+ Today in headlines I had to read twice: ‘Travis Kelce joins activist investor Jana Partners in push to revive Six Flags’…

For some reason, Jana Partners added Travis Kelce to its investor group that took a 9% stake in Six Flags $FUN ( ▼ 0.93% ) (HOF ticker symbol) and is demanding change (read: the investment is of the activist variety).

TK said, “I am a lifelong Six Flags fan and grew up going to these parks with my family and friends. The chance to help make Six Flags special for the next generation is one I couldn’t pass up.” Taylor’s people are punching air rn…

+ *NFLX’s CFO adds "OpenToWork” to LinkedIn profile pic*

Live look at Netflix’s CFO…

A $619M “tax dispute” crushed Netflix’s $NFLX ( ▲ 13.77% ) otherwise pretty decent quarter. Earnings missed yugely thanks to, you know, actually having to pay taxes in Brazil. Meanwhile, revenue met expectations.

The top line jumped 17% in the quarter, driven largely by ad sales. Co-CEO Greg Peters said ad revenue is on track to double this year. And did I mention the new season of Stranger Things and a new Knives Out movie drop this quarter?

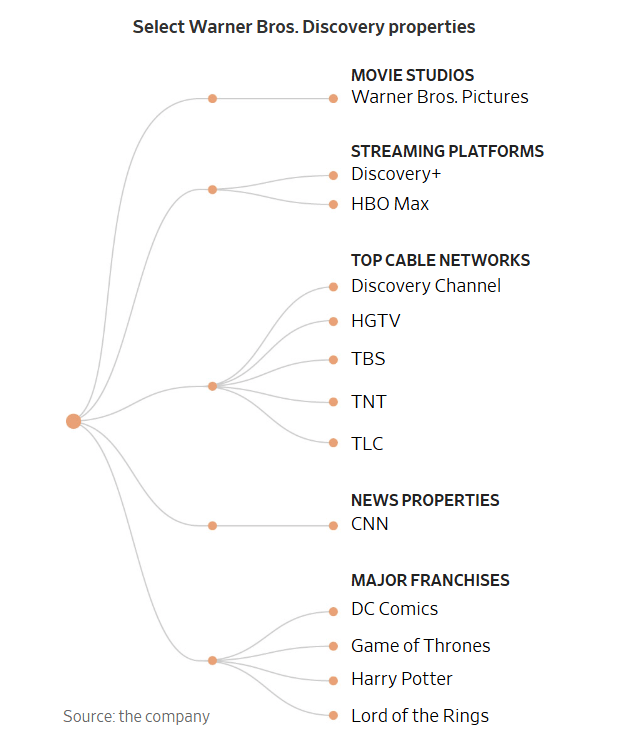

+ David Zaslav be like “everything must go…”

In what was the next logical step following Paramount’s $PSKY ( ▲ 20.84% ) unsolicited bid for Warner Bros. Discovery, David Zaslav has put up a for sale sign on the owner of HBO, CNN, and the Harry Potter franchise… in hopes of getting even more money out of Paramount. This is the most exciting thing to happen in the media industry since Waystar Royco sold to Gojo.

+ Name something more American than GM $GM ( ▼ 2.58% ) soaring 15% on news that demand for gas guzzling vehicles is girthy af. I’ll wait…

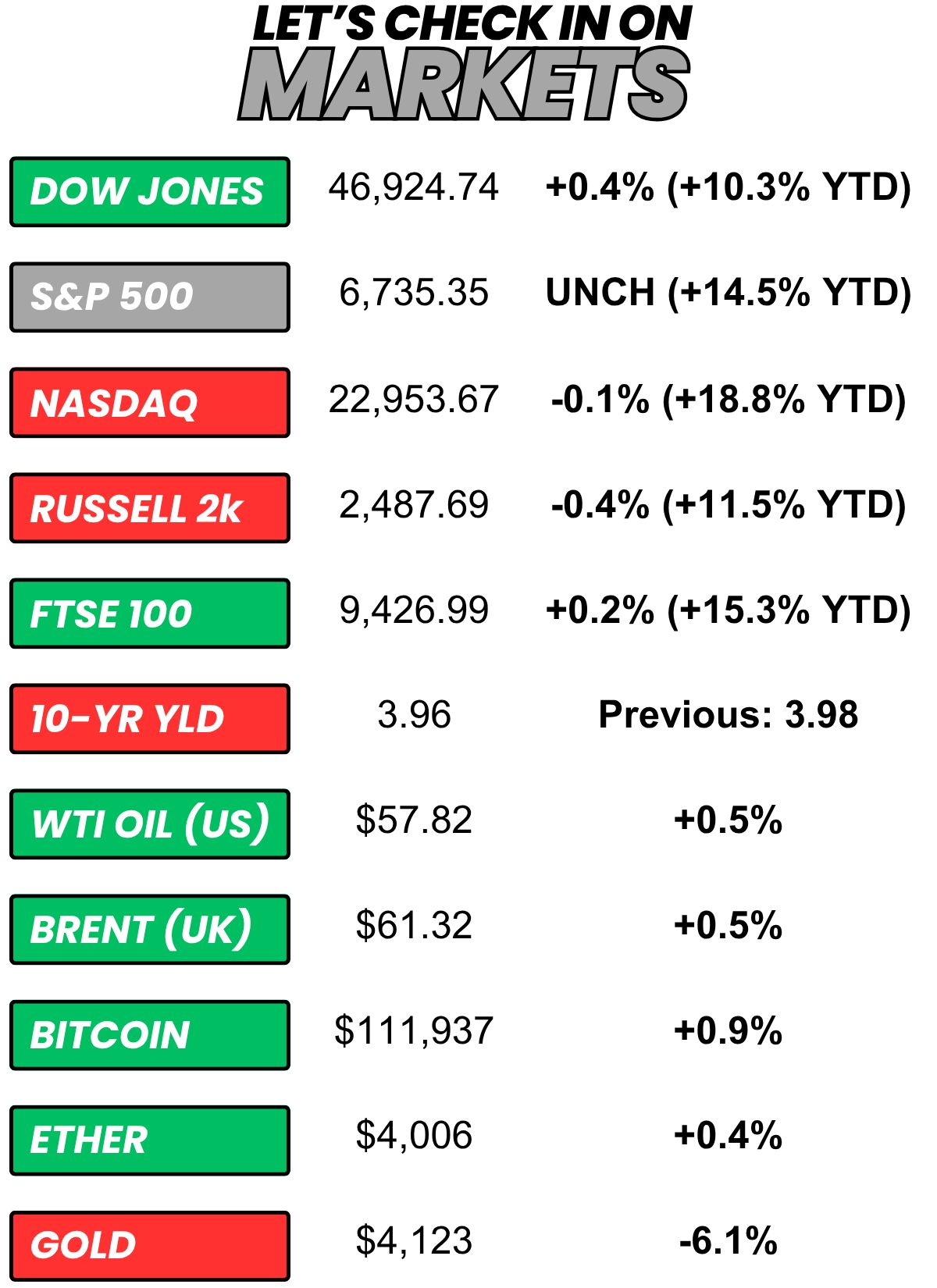

+ “First time?” - crypto fiends to gold bugs after the metal fell 6% in one day

Hate to break it to anyone who bought some gold bars from Costco over the weekend, but the precious metal just had its worst day in more than a decade, plummeting more than 6%. The reason? Well, it could be profit-taking… or it could be expectations that the government shutdown and trade tensions with China will be resolved soon.

+ US stocks “had a record-setting session on Tuesday, boosted by strong earnings reports from companies such as Coca-Cola and 3M, while the S&P 500 was relatively unchanged.” (CNBC)

+ The 10-year yield fell “further from the 4% threshold, as investors grew optimistic on a resolution on the ongoing U.S. government shutdown.” (CNBC)

+ Oil “settled higher on Tuesday, bouncing off the previous session’s five-month lows, as investors reassessed expectations of a looming glut and sought clarity on the trade dispute between the U.S. and China, the world’s two biggest oil consumers.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 61% chance Starbucks says “Pumpkin Spice” during its next earnings call. (Kalshi)

⏪ Yesterday…

+ Coca-Cola, Lockheed Martin, GE Aerospace, Raytheon Tech, 3M, General Motors, Philip Morris, Nasdaq, Elevance, Northrop Grumman, Danaher Corp, and Halliburton reported before the bell

+ Netflix, Intuitive Surgical, Texas Instruments, Capital One Financial, and Chubb reported after the close

+ Samsung Galaxy held its Worlds Wide Open media event

⏩ Today we’re keeping an eye on…

+ Vertiv, GE Vernova, AT&T, Moody's, Thermo Fisher, Amphenol, Boston Scientific, Hilton, and CME Group drop earnings before the bell

+ Tesla, IBM, Lam Research, SAP, Viking Therapeutics, Quantumscape, Southwest Airlines, O'Reilly, Kinder Morgan, and Crown Castle report after hours

Yesterday, I asked, “Rather be stuck with your current phone for the rest of your life or your current car for the rest of your life?”

61.8% of you said, “Car.”

Here’s what some of you guys had to say…

Car: “Because I despise car salesmen”

Car: “I drive til it the wheels fall off anyway. Year 14 baby!”

Phone: “Getting a new phone f*cking sucks and you have to re-login, it forgets wifi shit, etc. Maybe I’m just hopeful for an Elon flying car”

Car: “As long as I can keep replacing stuff as it wears out I love my 2017 Chevy Suburban. First thing is the seat.”

Phone: “My Lexus will last nearly forever. My iPhone 13 won’t may not last another month.”

Here’s today’s question…

Is it officially red wine season?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.