Hey there weekday warriors,

Here’s what we’re getting into today…

Your new favorite publicly traded company

RIP Red Lobster

Jerome Powell needs to STFU

Enjoy the next 4 minutes and 9 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

BTW, if you want to get smarter about real estate investing, you'll love a brand-new newsletter I’ve been working on.

The Pocket List has two goals: 1) keep investors updated on the industry, and 2) help them make more money

The next Pocket List goes out tomorrow morning. You can check out last week’s AND subscribe by clicking below.

+ US stocks “slipped on Tuesday after Federal Reserve Chair Jerome Powell said interest rates may need to stay elevated.” (CNBC)

+ The 10-year Treasury yield “rose Tuesday, with the 2-year’s at one point surpassing the 5% mark, after Federal Reserve Chair Jerome Powell said inflation has yet to ease back to the central bank’s target." (CNBC)

+ Oil “settled flat to marginally lower on Tuesday after economic headwinds pressured investor sentiment, curbing gains from geopolitical tensions with eyes on Israel and its pending response to Iran's attack on Israeli territory over the weekend.” (Reuters)

+ Bitcoin “fell as crypto investors entered a risk-off mode amid stagnating ETF demand." (Cointelegraph)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Tesla -2.7% 2) Trump Media -14.1% 3) TSMC -0.2%

The market moves you need to know about…

– Let’s have a moment of silence for Dr. Martens. Shares fell 30.8% in London and were halted after the company shared an absolutely brutal 2025 outlook.

– No, I didn’t just forget to update this section… Trump Media & Technology really dropped another 14.1% yesterday. The drop came just a few hours after the company announced a new streaming platform…

– Shares of Planet Fitness tumbled 2.8% on news that it found a permanent replacement to take over as CEO. Colleen Keating will come over from FirstKey Homes… whatever the f*ck that is.

The perfect ticker doesn’t exi—

I don’t know who made this ad, but they deserve a raise. (Source: Giphy)

Everyone else can stop trying. The perfect ticker symbol has been claimed…

Everyone’s third or fourth favorite fast-casual chain, TGI Fridays, is going public. And, obviously, its ticker is going to be TGIF.

The home of Endless Apps will merge with its UK franchisee Hostmore, which is publicly across the pond. Have no fear, Americans, the mall staple’s headquarters will remain in Dallas and the sitting CEO will stay on board.

The all-stonk deal is valued at $220M.

The brand that did for potato skins what Outback did for Bloomin’ Onions boasts 189 company-owned restaurants and 400 franchise locations. Sadly, the company closed 36 underperforming stores in the US earlier this year *pours out $5 happy hour drink*

Oof

TGI Fridays has been owned by TriArtisan Capital Advisors since 2014. It bought the chain for more than $800M. Define “down bad.”

It appears that TriArtisian is run by 15-year-old boys who came of age in the 2000s because its portfolio also includes stakes in PF Changs and Hooters. Their holiday parties must go so hard.

+ Me: “What’s wrong babe, you’ve barely touched your Cheddar Bay Biscuits?”

It’s easy to lose your appetite under these circumstances. Rumors are swirling that Red Lobster, a top 5 Times Square eatery, is considering filing for Chapter 11 bankruptcy protection. Because nothing is sacred anymore.

The company is struggling with pricey long-term leases and the rising costs of hiring top-notch talent. Or maybe it was that $20 Ultimate Endless Shrimp deal…

+ You either die a hero or live long enough to see yourself become the villain… isn’t that right J-Poww?

Hide yo kids, hide yo wife, because Jerome is coming for your portfolio. At a policy forum, the Fed Chair said he’s not happy with the progress in the fight against inflation…

“The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence.”

Just in case it wasn’t totally clear what Jerome’s about to do to your 401k… he dropped this: “We can maintain the current level of restriction for as long as needed.” Translation? HIGHER. FOR. LONGER.

+ “How’s my Pick taste?!” - Morgan Stanley CEO Ted Pick

Morgan Stanley’s (+2.4%) new CEO is off to a hot start. The bank beat on the top and bottom lines in his first quarter at the helm. Like pretty much every other bank on the Street, MS had its trading and banking groups to thank.

But it also put up big numbers in arguably its most important division, wealth management. It beat the Street’s estimates… despite the decline in interest income.

+ Not unlike JPMorgan, Bank of America (-3.5%) is suffering from success. Despite a top and bottom line beat, analysts held B of A to a higher standard than its peers. The Street was really hoping for an even bigger surprise to the upside.

Of course, it probably didn’t do itself any favors by pointing out that net interest income will likely dip in Q2 (… like literally every other bank).

+ Remember when announcing an AI chip was a stock price cheat code? Take me back. AMD (+1.9%) rolled out a new line of AI PC chips yesterday. And get this… shares only rose 2% on the day.

+ Who should pay for the first date? Dating coaches and a couples therapist weigh in (Read)

+ 12 Simple Questions You Should Ask Before Making Investing Decisions (Read)

+ American workers want record wages to change jobs, NY Fed finds (Read)

+ Caitlin Clark wore a $17,000 Prada outfit to the WNBA draft. That's about 22% of her expected first-year salary. (Read)

Here's what I'm keeping an eye on today...

+ Abbott Laboratories, U.S. Bancorp, Kinder Morgan, Las Vegas Sands, and CSX report

+ A Senate subcommittee is going to grill Boeing CEO David Calhoun on the company’s recent issues. So just remember… if you’re having a bad day tomorrow, it’s definitely not as bad as Dave’s…

Yesterday I asked… Which celebrity CEO would you want to work for?

I’m gonna need all of you to get off of Warren’s d*ck. 47.8% of you chose the Oracle of Omaha. Elon came in second, followed by Jamie Dimon.

Here’s today’s question…

Not a great day to be a fast-casual chain. Red Lobster is on the brink, and TGI Fridays is going public at 25% of its 2014 acquisition price. So…

What's the greatest casual chain in the game?

BTW…

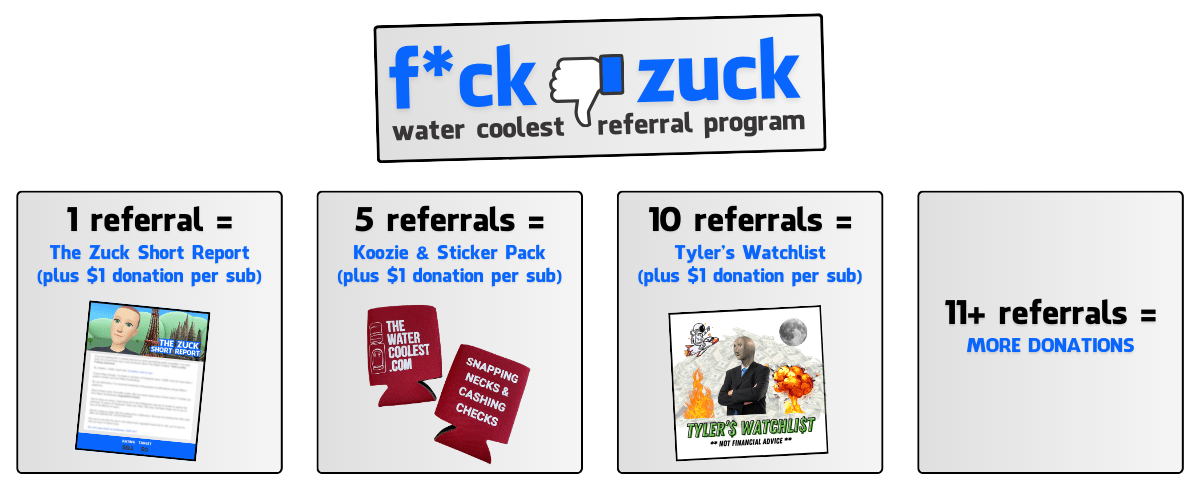

Have you referred anyone to The Water Coolest yet?

You can earn rewards and secure donations for your favorite charity by sharing your unique referral link…

Share your unique referral link (below) with anyone you think might be interested in The Water Coolest. You can email it, post it on social, etc. Get creative.

Your unique referral link: {{rp_refer_url}}

{{rp_personalized_text}}

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional