Hey there weekday warrior,

Here’s what’s on the agenda today…

OpenAI is coming to the public markets (allegedly), J-Poww cuts rates, and Zuck gets rekt.

Enjoy the next 4 minutes and 34 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Slasher movie

“Thank you, Captain Obvious.” - everyone who just got laid off by UPS or Amazon to J-Poww after he said the job market is softening

As expected, Jerry Interest Rates announced that the Fed would cut rates by 25 bips.

The increasingly bleak employment situation certainly factored into the Fed’s decision, but the cut was all but guaranteed after the better-than-expected CPI data last week.

What did Jay have to say?

During his presser, Jerome shared what we all already knew: inflation is dropping (…but the fat lady has yet to sing), and employment is getting softer than a blue-haired liberal arts student when confronted with real adversity.

He also shared that he believes tariffs are beginning to trickle down and impact prices (and I mean that in the worst way possible). Trump TRUTH Social post loading…

So, what’s next?

He sent a bit of a shockwave through the market when he said a December cut is far from a done deal…

In his remarks, Jay mentioned two barriers: 1) lack of agreement among his peers (there were two dissenters at yesterday’s meeting) 2) lack of official data thanks to the government shutdown (he said, “You know, what do you do if you're driving in the fog? You slow down.").

WTF could it mean for us?

Every lame stream newsletter tells you “wHaT iT MeAnS.” At The Water Coolest, we predict tomorrow’s headlines today…

🔮 Bloomberg headline on 12/10/25, aka the next Fed meeting (probably): "Big Fat Liar Gives Investors Big Fat Cut: Powell Slashes 50 Basis Points"

+ Oh my God! Okay, it’s happening. Everyone, stay calm! STAY F*CKING CALM.

In what has to be the least surprising news EVER, just a day after it became a for-profit, rumors have begun swirling that OpenAI will take its talents public… at a $1T valuation. Imagine explaining this to yourself 5 years ago…

+ We are balls deep in earnings season. But not all AI plays are created equal...

Meta $META ( ▼ 1.34% ) had what on the surface looked a lot like a quarter you'd expect from Zuckerbot. But despite an easy beat on the top and bottom lines (plus monthly active people), shares got rocked, tumbling nearly 9% at one point.

It probably didn't help that earlier in the day, J-Poww told everyone to pump the brakes on baking in rate cuts for December. Nor did the $15.9B one-time tax charge (thanks a lot, One Big Beautiful Bill...). But the real concern appears to be Meta's expected capex growth in 2026 (think: "significantly more than 2025"... which it also hiked yesterday).

Meanwhile, CAT $CAT ( ▼ 1.34% ) went sicko mode on news that it was benefitting from massive AI capex spend (see above). In fact, it said that the boom linked to all the new buildings being erected to house racks of Nvidia chips has more than offset any tariff-related costs.

Meanwhile, back here on earth...

Chipotle $CMG ( ▼ 2.18% ) got its d*ck kicked in. The burrito barons said that the youths have begun slowing their roll and making fewer trips to the Mexican Grille (grown a** adults already know better).

Speaking of Chipotle. The chain’s former CEO has gotten his new company back on track. The pride of Seattle (think: Starbucks $SBUX ( ▼ 0.06% ), not Cal Raleigh), returned to the promised land. After a two-year drought, same-store sales finally grew in the most recent quarter.

+ “Anything is possible.” - KG Jensen Huang

The next time you think you can’t hit ambitious goals, just remember that you probably can’t because you’re not Jensen Huang.

Nvidia $NVDA ( ▼ 4.17% ) took just 78 days to go from a $4T valuation to a $5T valuation. The company became the first to surpass $5T market cap after an absolutely outrageous conference where it announced countless investments (including mainlining $1B into Nokia), partnerships (think: Uber and Palantir), and huge revenue projections ($500B through 2030).

+ Pour one out for the OG of the internet. AOL just sold to tech company Bending Spoons for $1.5B. To make matters worse, America Online will now be owned by an Italian Company. You might recall BS also bought Vimeo in September.

+ Dad, what was it like when John Malone was still the Cable Cowboy?

A legendary figure who shaped the US cable industry is stepping down as chairman of the company he founded in 1991. John Malone will ride off into the sunset after stepping down from the board of Liberty Global.

+ Tell me you’re about to lose your job and be blackballed from the industry without telling me…

Talking to man on the street influencers is the new getting caught on the Coldplay kiss cam. Snowflake’s $SNOW ( ▼ 2.69% ) recently appointed CRO is having a bad day. He gave out revenue expectations about his company in an IG video with a business influencer. That forced Snowflake to issue an SEC filing reiterating its actual forecast. Woof.

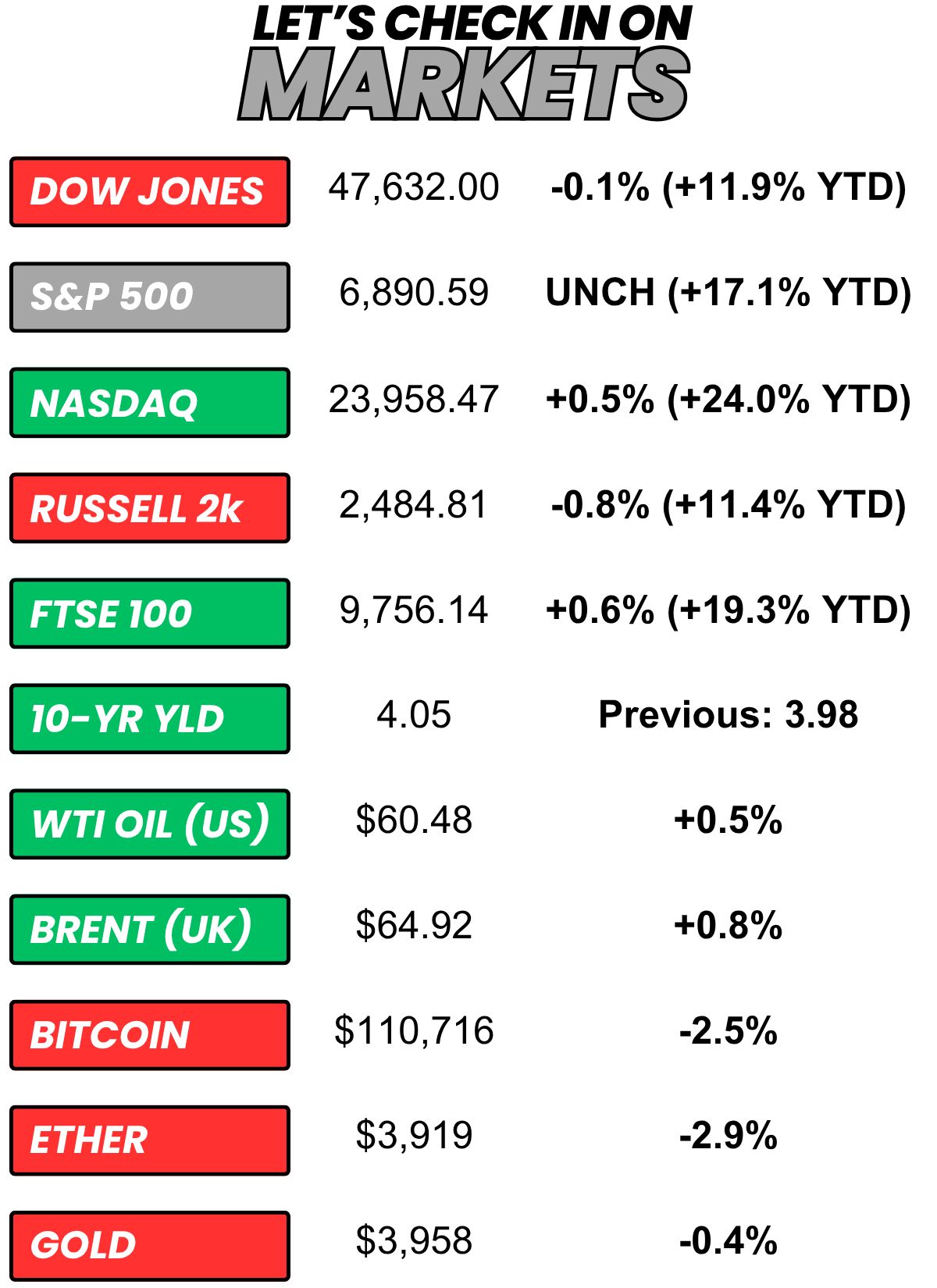

+ US stocks “ended mixed on Wednesday after the Federal Reserve's decision to cut interest rates for the second time this year. Stocks erased some momentum after Fed Chair Jerome Powell indicated a December rate cut is "far from" a forgone conclusion.” (Yahoo! Finance)

+ The 10-year yield “gained even after the Federal Reserve cut rates for a second time this year as central bank chief Jerome Powell indicated another easing in December was far from certain.” (CNBC)

+ Oil “prices rose on Wednesday after data showed U.S. crude and fuel inventories drew down more than expected last week, and as U.S. President Donald Trump’s optimistic tone over upcoming talks with his Chinese counterpart helped ease economic jitters.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 69% chance the Fed cuts interest rates in December. That’s down from 90% prior to yesterday’s meeting. (Polymarket)

⏪ Yesterday…

+ Caterpillar, Boeing, Verizon, CVS Health, Fiserv, Automatic Data Processing, Etsy, GE HealthCare, Garmin, Kraft Heinz, UBS, Phillips 66, Centene, GSK, and Brinker reported before the bell

+ Microsoft, Meta, Alphabet, Starbucks, MercadoLibre, Chipotle, ServiceNow, TransMedics, Carvana, Coca-Cola, eBay, KLA-Tencor, Wolfspeed, Sprouts, Teladoc, Equinix, and Canadian Pacific Railway reported after hours

+ J-Poww announced a rate cut and held a press conference

⏩ Today we’re keeping an eye on…

+ Eli Lilly, Mastercard, Roblox, Merck, S&P Global, Altria, Shell, Estee Lauder, Crocs, Bristol-Myers Squibb, Hershey's, Cigna, Comcast, Howmet, L3Harris, Enterprise, Cheniere Energy, Sirius XM, TotalEnergies, and Southern Company report before the bell

+ Amazon, Apple, Coinbase, MicroStrategy, Reddit, Cloudflare, Roku, VICI, First Solar, Twilio, Atlassian, Riot Blockchain, Western Digital, Gilead Sciences, Stryker, Rocket Companies, Lumen, DexCom, Monolithic Power Systems, Zillow, Motorola, and GoDaddy report after the bell

+ The 2025 Asia-Pacific Economic Cooperation summit will kick off in South Korea. President Trump and President Xi Jinping are expected to discuss trade.

+ Core Scientific shareholders will vote on the $9B acquisition offer from CoreWeave

+ The European Central Bank will release its monetary policy statement. ECB officials will also hold a press conference

Yesterday, I asked, “Is paying off your 2.65% mortgage early a good idea or bad idea?”

73.8% of you said, “Bad.”

Here’s what some of you guys had to say…

Good: “Just one less bill and one less thing to lose if things go south.”

Bad: “That's free money in today's world”

Bad: “If you can't make at least 10% on your money in this economy, you must be a poetry major from Wellesley.”

Bad: “You can earn more than that in a high-yield savings account”

Good: “This isnt taking into account risk. Its a fact 100% of foreclosures happen on houses with mortgages...pay it off”

Good: “well clearly the non-homeowner picks the less popular answer!”

Here’s today’s question…

What is the GOAT Pop-Tart?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.