TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

OpenAI invests in AMD, The White House invests in another miner, and we’re getting a Tesla “Decision.”

Enjoy the next 4 minutes and 15 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who likes miners. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste forward this to you? Subscribe here.

OpenAMD

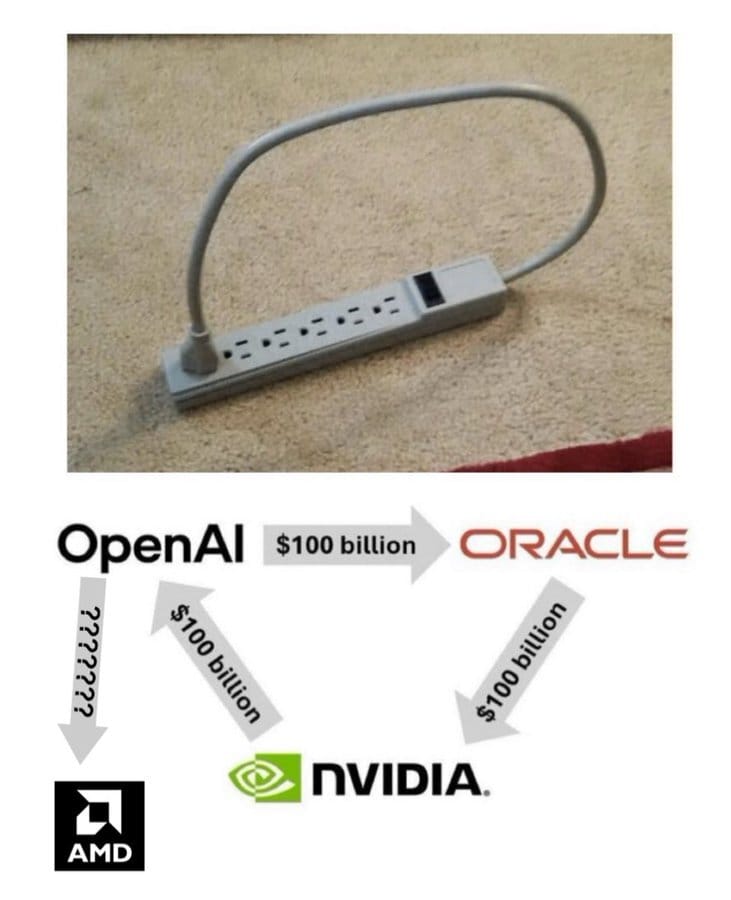

You can’t make this sh*t up (H/T: @TrungTPhan)

“Non-profit supports struggling local business...”

Sammy Altman has a fever, and the only prescription is more compute. The non-profit founder is planning to take (up to) a 10% stake in chipmaker AMD $AMD ( ▼ 1.7% ) as part of a new partnership that further complicates the incestual clusterf*ck that is the AI ecosystem.

The deal will earn OpenAI some AMD equity for what it’s already doing: buying a f*ck ton of chips. It committed to deploying 6 gigawatts of AMD’s Instinct GPUs over the next few years. For its troubles, OpenAI will get its hands on warrants for up to 160M shares of AMD common stock.

No choice

The move makes sense…

AMD was rewarded handsomely (see: stock popping 30%) for filling its pipeline for the next half-decade or so. And the access to AMD’s chips will help solve two of OpenAI’s biggest problems: 1) relying too heavily on Nvidia 2) the lack of compute power.

OpenAI’s president, Greg Brockman, sounded like he’s ready to start doling out handies in return for compute power on CNBC yesterday. He highlighted just how desperate the ChatGPT maker is: “We have to do this. This is so core to our mission if we really want to be able to scale to reach all of humanity, this is what we have to do.

WTF does it mean for us?

Is Sam Altman about to become more acquisitive than the White House? OpenAI’s gonna end up on SMCI’s board and staging a violent coup of a TSMC fab at this rate.

Spoiler alert: Q4 is your last chance to make meaningful tax moves for 2025

Good news, procrastinators… there’s still time to lock in meaningful tax strategies that can make a real difference. Gelt’s team of experts helps you optimize contributions, restructure smartly before year-end, and maximize the opportunities from Trump’s One Big Beautiful Bill.

Finish up stronger than you started, and set up 2025 for even greater savings.

Gelt will pair you with a dedicated CPA and a kick-ass platform that keeps you on track so you focus on what you do best (whatever that is).

+ Ok, hear me out… Ice Road Truckers and The Apprentice crossover…

Another day, another investment by the White House in a mining company. The US took a 10% stake in Canadian (wait, what?) minerals explorer Trilogy Metals $TMQ ( ▼ 0.9% ) for ~$35M (or as Uncle Sam calls it: “ashtray money, bro”).

Probably just a coincidence that the deal was made the same day POTUS signed off on the development of the 211-mile Ambler Road, which is the stuff that Ice Road Truckers’ wet dreams are made of. Think: Oregon Trail, except it’s in Alaska and at the end is a remote mining district with boatloads of copper, cobalt, gallium, germanium, and other minerals. Did I mention Trilogy owns a bunch of those mining rights?

+ It’s a toss-up as to what will be more disappointing… LeBron Decision 2.0 or whatever Tesla is about to unveil (then fail to deliver on time). Elon’s carmaker teased something over the weekend with a video that ends with “10/7”…

The Tesla $TSLA ( ▼ 1.49% ) fanboys and girls think it will either be the much-anticipated Roadster or that “affordable EV” Elon has been promising since he was only worth like ¼ of a trillion dollars.

+ What a time to be alive, you guys… we got Substack writers taking over as Editor-in-Chief of one of the big 3 TV networks…

Paramount Skydance $PSKY ( ▲ 20.84% ) (how long until we can just start calling it ‘Paramount’ again?) is buying Bari Weiss’ The Free Press for ~$150M. To be fair, it’s more of an acquihire. Larry Ellison’s kid is less interested in 150k Substack subscribers paying $9.99 a month, and a whole lot more excited about adding Weiss to his roster. She’ll take over as EIC of CBS News.

+ Happy Merger Monday to all who celebrate. Fifth Third Bancorp $FITB ( ▼ 4.81% ) is buying Comerica $CMA ( ▼ 4.51% ) for $10.9B. With $288B in AUM, Fifth Third Bancomerica will slide into the top 10 biggest banks in America (#9).

WTF does it mean for us?

Bank mergers are like lone wolf shootings… there’s bound to be copycats. What’s more surprising is that banking consolidation took this long to start, given the much more chill regulatory environment under the new-ish administration.

+ Zuck just went all “you’ll get nothing and like it.” Top Instagram $META ( ▼ 1.34% ) creators will earn gold rings to display in their profile (and Sonic would like a word…). Notably, they won’t be rewarded with any actual money.

+ “Who among us hasn’t violated partner terms of agreement to create shareholder value?” - AppLovin leadership, probably

According to Bloomberg, the SEC has been “reviewing” whether AppLovin $APP ( ▼ 2.28% ) violated its partners’ terms of agreement. And it’s all thanks to some snitch whistleblower (and a handful of short sellers that smelled blood in the water).

The haters claim AppLovin has been using its broad access to platforms it partners with to better target ads… and violate the ever-loving sh*t out of the policies and T&Cs of Meta, Google, Snap… you name it.

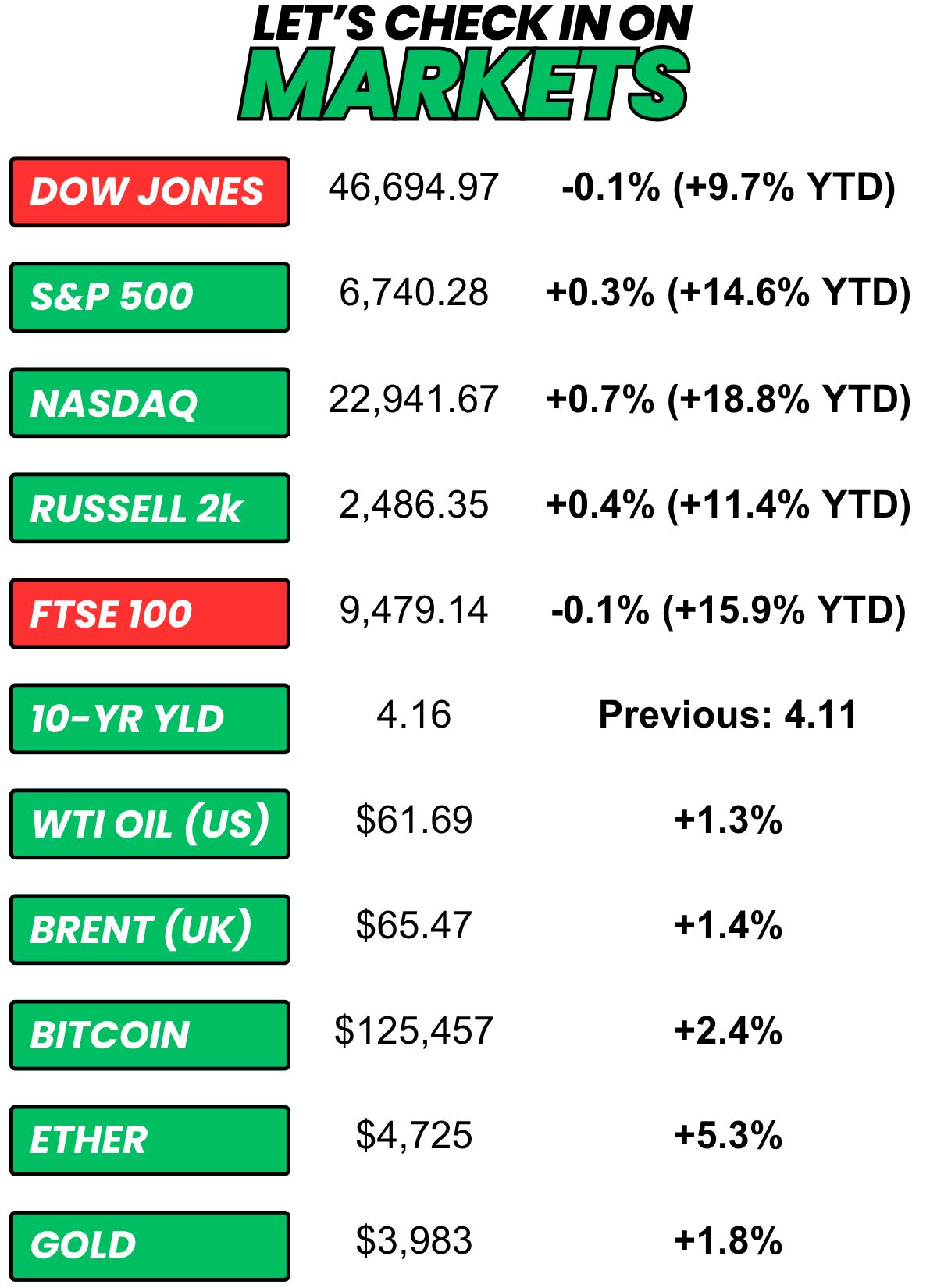

+ US stocks “mostly gained on Monday as the federal government shutdown entered another week, while a megadeal between AMD and OpenAI lifted hopes for the AI trade.” (Yahoo! Finance)

+ The 10-year yield “moved higher on Monday as the U.S. government shutdown continued and investors monitored the state of the U.S. economy.” (CNBC)

+ Oil “gained about 1% on Monday after the OPEC+ production increase planned for November was more modest than expected, tempering some concerns about supply additions, though a soft outlook for demand is likely to cap near-term gains.” (Reuters)

+ Bitcoin’s “price just hit an all-time high at $124,688, pushing its market cap past $2.47 trillion. As Wall Street debates whether it’s a risk-on or risk-off asset, BlackRock says it’s something else entirely.” (Forbes)

+ The “smart” money (prediction markets) thinks there’s an 82% chance LeBron’s “Decision” today is a marketing stunt. (Polymarket)

⏪ Yesterday…

+ Constellation Brands and Aehr reported after the bell

+ OpenAI held its third annual DevDay

⏩ Today we’re keeping an eye on…

+ The holiday shopping season kicks off (yes, really) with the two-day Amazon Prime Deal Days event

Here’s today’s question…

Back to our regularly scheduled programming tomorrow.

Did you help shape the future of TWC by completing a 2-minute survey?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.