Hey there weekday warrior,

Here’s what’s on the agenda today…

Peloton surprises everyone (spoiler: not the good kind), investors DGAF about the government shutdown, and Zuck gonna Zuck.

Enjoy the next 4 minutes and 18 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who bought a Peloton in 2021, made it their entire personality, and rode it like 3 times. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste forward this to you? Subscribe here.

OK, Peloton

Hope she’s doing ok…

Sorry, poors… Peloton is only for the upper middle class (and up)… again.

Peloton $PTON ( ▼ 1.47% ) unveiled a new lineup of overpriced stationary bikes, treadmills, and fitness software. And you’ll never guess the technology powering all of it…

The company debuted Peloton IQ, “your AI-powered personalized workout planner and tracker.” How original. IQ will reportedly integrate with an onboard camera to provide real-time feedback and personalized training plans.

And nothing says we spent wayyy too much money on AI devs and engineers (thanks, Zuck) quite like jacking up prices by nearly 20%. Peloton hardware prices will jump by 20% on average, and subscription prices will increase by 11%.

“So, what’s in it for me?” - the prospective Peloton buyer who’s rightfully skeptical of the yuge price hikes

You mean besides all the AI features that will be more useless than Copilot in PowerPoint?

Well, the company has taken a page out of Apple’s playbook (which makes sense, given the company’s newest CEO has “ex-Apple” in his Twitter bio): it’s passing off marginal improvements as “game-changing…”

Stuff like an integrated fan, a more comfortable seat (or “saddle” if you dress up like Lance Armstrong to go on a 3-mile bike ride around your neighborhood), more immersive speakers, and, get this… a tablet holder. So, all things that come standard on prison yard work out equipment…

But that’s not all. They’ll also implement tech that would have been cutting-edge in 2014. Think: voice control that can be prompted with “OK, Peloton” and Swivel Screens so you can use the $3k bike you bought to work out on the floor next to it.

WTF does it mean for us?

Dave Ramsey is about to yell at so many of you for financing an AI-powered bike that can’t even get your sorry a** to work so you can pay off the Klarna loan you took out for a DoorDashed burrito.

And from an investment standpoint, markets told us all you need to know: they didn’t buy into the AI hype… and they’re having a hard time understanding how Peloton can justify jacking up prices when it’s still trying to convince consumers it won’t kill them (RIP Mr. Big).

This man needs help

I need your help.

It’s time to plan for 2026. And I want your input.

Completing this quick survey (seriously, it’s 10 multiple-choice questions) will help me make The Water Coolest even better (I know… seems hard to imagine).

Since I’m not above bribery, I am giving away two (2) $250 Amazon gift cards to 2 random weekday warriors who complete the survey.

Thanks in advance, you guys.

+ Investors be like…

Stonk investors gave exactly zero f*cks about the government shutdown. Despite the government officially shutting down at midnight yesterday, both the Dow and S&P 500 hit record highs. Turns out, no one is too concerned about government employees being furloughed for a few days (which is only slightly less than their current contributions…).

If history is any indication, the shutdown should be a nothingburger. During the one and three-month periods following the last 20 shutdowns, markets have actually jumped 1.2% and 2.9%, respectively. So we’ve got that going for us, which is nice.

+ Nobody… and I mean NOBODY, is more excited about the government shutdown than ADP. You see, with the doors locked at the Bureau of Labor Statistics, the ADP jobs report is the only show in town.

According to the payroll processor, which manages to be even more incompetent than the government at counting jobs, the US lost 32k jobs in September. That print was well below expectations and is of the “not great, Bob” variety.

+ Reddit $RDDT ( ▼ 3.6% ) got rekt on a report that its traffic is plummeting, and ChatGPT citations have dried up…

+ If you’ve been asking Meta’s $META ( ▼ 1.34% ) AI bot things like “what does an OnlyF*ns subscription show up as on my company’s credit card statement?” don’t be surprised when you start being served ads for generic b*ner pills over on Reels or self-help books hoping to cure the male loneliness epidemic on FB.

Zuck has plans to start tapping interactions with Meta’s AI tools to better target ads… and Sam Altman has entered the chat. In case you were wondering, Zuckerbot didn’t explicitly address whether this includes data collected via its AI-powered Ray-Ban smart glasses… which almost certainly means it will.

+ 2025 IPOs remain undefeated. Yesterday Fermi, an energy real estate investment trust that was formed in January and has yet to generate a cent, let alone a gigawatt, popped 55% in its Nasdaq debut. That gives it a roughly $19B valuation. The company founded by former Energy Secretary Rick Perry is currently building a 5k acre “advanced energy” and data center campus (read: it’s an AI play).

+ Amazon is getting its Kirkland Signature on. The e-commerce brand that promised us drone delivery during the Obama administration is rolling out its own store brand (that’ll only be available online).

Amazon $AMZN ( ▲ 1.0% ) will offer more than 1k private-label grocery essentials, like, say, knock off Pop-Tarts (an essential part of the average American diet). Who is going to remind Andy Jassy that Whole Foods’ 365 already exists?

As is tradition when Amazon announces literally anything, the entire grocery industry got its d*ck kicked in. Albertson’s $ALB ( ▼ 3.39% ), Kroger $KR ( ▲ 1.58% ), Costco $COST ( ▲ 2.44% ), and Walmart $WMT ( ▲ 2.84% ) all fell on the news.

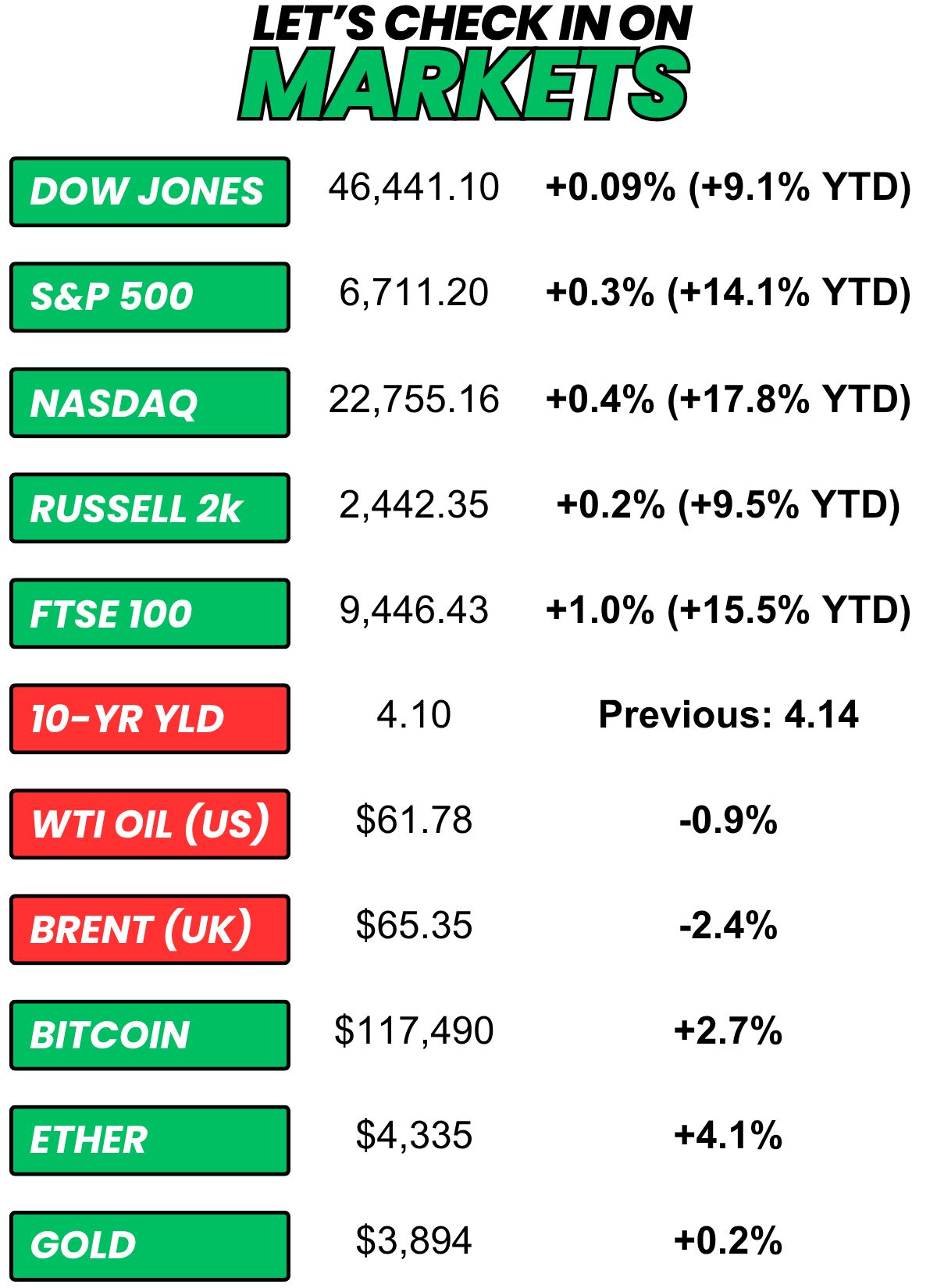

+ US stocks “rose to fresh records on Wednesday after the US government entered its first shutdown in seven years. Investors turned their focus to weak ADP jobs data, which helped cement bets on near-term rate cuts.” (Yahoo! Finance)

+ The 10-year yield “fell Wednesday after new data showed a surprise decline in private payrolls, while traders monitored the consequences of the government shutdown after lawmakers failed to reach an agreement on the federal funding bill.” (CNBC)

+ Oil “slid for a third day in a row to a 16-week low on Wednesday as a U.S. government shutdown fed worries about the global economy, while traders expected more oil supply to come on the market with a planned output boost by OPEC+ next month.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 45% chance Tesla delivered more than 450k cars in Q3 2025. (Kalshi)

⏪ Yesterday…

+ Cal-Maine Foods reported before the bell

+ Google held a Gemini hardware event… in case you didn’t get your fill from Amazon

⏩ Today we’re keeping an eye on…

+ The Fed will issue its latest balance sheet report

+ We should get Tesla’s delivery numbers

Yesterday, I asked, “Your flight (domestic) leaves at 11:30 AM. You board at 11:00 AM. You live 30 minutes from the airport. What time do you leave your house?”

37.9% of you picked “9:30 AM.“

Here’s what some of you guys had to say…

Earlier than 8:00 AM (you are a sicko): “Like the sick fuck I am, I just want to check out some new novels in the book store before my flight.”

9:30 AM: “I'm just guessing. I actually live 8 minutes away from the airport and have my entire life. I don't know how to calculate longer drive times.”

10:15 AM: “10:15 because DTW is the GOAT of airports. I'll roll up to the airport at 1045, go through TSA precheck and still have time to sit and read the water coolest before my gate opens.”

9:30 AM: “Gives you enough time to park, get through security (with Pre-Check duh), and put down an ice cold breakfast beer before boarding. ”

Other: “When I am ready....don't really care about being late...retired”

Here’s today’s question…

Did you help shape the future of TWC by completing a 2-minute survey?

Happy Q4!

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.