Hey there weekday warriors,

Here’s what we’re getting into today…

Earning szn is underway

China retaliates in the chip wars (finally)

The Skydance/Paramount deal is hanging on by a thread

Enjoy the next 4 minutes and 30 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

+ US stocks “dropped on Friday as investors digested the first batch of first-quarter earnings with the major banks reporting results.” (Yahoo! Finance)

+ The 10-year Treasury yield “declined on Friday as investors considered the state of the economy after the release of inflation data and weighed the path ahead for interest rates." (CNBC)

+ Oil “rose around 1% on Friday on geopolitical tensions in the Middle East but posted a weekly loss on a bearish world oil demand growth forecast from the International Energy Agency (IEA) and worries about slower U.S. interest rate cuts.” (Reuters)

+ Bitcoin “and the broader cryptocurrency market fell nearly 10% on Saturday, with the price of the largest digital asset briefly falling below $62,000 before recovering to around $64,000." (Coindesk)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia -2.6% 2) C3.ai -5.2% 3) Taiwan Semi -3.1%

The market moves you need to know about…

– Animal drug manufacturer Zoetis got put in a body bag after a WSJ investigation claimed its arthritis med is killing cats and dogs. It’s honestly shocking that shares only fell 7.8%.

+ America, f*ck yeah. Aluminum producer Alcoa rose 5.1% in extended trading after the US and UK put new restrictions on Russian aluminum, nickel, and copper.

– You hate to see it. Dave & Busters has been getting dragged by analysts as of late. On Friday, shares dropped another 7.6%.

We are not the same

(Source: Giphy)

On Friday, earnings szn officially kicked off. JPMorgan, Citi, and Wells Fargo dropped Q1 results.

And, well, not all banks are created equal…

You see, both Wells and JPMorgan beat on the top and bottom lines. But Wells' net interest income fell by 8% in the quarter, while JPMorgan's rose by the same amount…

Oh, and Wells is expecting NII to drop between 7% and 9% in 2024. Meanwhile, JPMorgan said net interest income is expected to stay flat. Both bank’s numbers were in line with previous forecasts.

So, Wells was the one that got rekt… right? Right?

Wrong.

Shares of WF were roughly flat on the day, while JPM dropped 6.5%.

Turns out that being a sad excuse of a financial institution has its perks… like everyone having low expectations. Right, Wells Fargo?

The Street came in with high hopes that JPMorgan would go all Steve Jobs and hit us with a surprise upward forecast revision. It did not, and investors unloaded shares.

And what would a JPMorgan earnings call be without Jamie Dimon being a Debbie Downer?

JD was pretty bullish on JPMorgan… probably because he gets paid to be. But he did a good job of laying the groundwork for excuses if anything goes wrong. You know, just in case.

He echoed the warnings covered in his shareholder letter that dropped earlier in the week. Think: overseas conflicts and inflationary pressures.

Put Interest On Ice Until (Nearly) 2026…

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Find out how you can pay no interest on balance transfers until nearly 2026 with this top credit card.

Sponsors are the reason I can bring The Water Coolest to you for free every day. The only thing I ask is that you show them some love by clicking and taking a look around.

+ In arguably the least surprising news ever, China is banning American chips in its telecom infrastructure ASAP…

(And it looks like China is about to become the worldwide leader in dropped calls and spotty service…)

The only surprising thing is that it didn’t happen sooner. China actually tried to, but they didn’t have the semiconductor firepower to do so. Luckily, their manufacturing capabilities have caught up to their ambitions.

Intel (-5.1%) and AMD (-4.2%), the two biggest players in the space, got their cheeks clapped on Friday.

Friendly reminder: this had nothing to do with AI chips… China will take what they can get on that front. Hence why Nvidia was spared.

+ Mario Gabelli is that dude that stands up at a wedding when they say “Speak now or forever hold your peace…”

The hedge fund manager, who is the second-largest voting shareholder of Paramount (-2.7%) (second by a wide margin behind Shari Redstone), hates Skydance’s proposed deal for the studio. To be fair, he also doesn’t want Paramount to take Apollo’s offer.

Gabelli believes Redstone should let Paramount CEO Bob Bakish execute his turnaround plan.

+ “We are selling to willing buyers at the current fair market price.” - StubHub every time someone complains about overpriced tickets

Rumor has it that StubHub could go public as soon as this summer. The one caveat? It’ll only pull the trigger if it thinks it can IPO at a $16.5B valuation. That’s the amount it most recently raised at back in 2021.

Friendly reminder: Reddit IPOed at a lower valuation than its most recent private raise…

+ Welp, it didn’t take Elon long to respond to Ford’s shots fired (reminder: F slashed EV prices and offered rebates to convert Tesla owners last week). Tesla (-2.0%) cut the cost of its Full Self Driving packages in half (from $199 to just $99).

Of course, Elon has said multiple times that the price of FSD will only go up. But this is the same dude that named his glorified cruise control “FULL SELF Driving.”

+ You can boost your bank account in these 6 unusual ways (Read)

+ ‘Buffett really was not a great stock picker’: Financial researcher Larry Swedroe on how investors can emulate the billionaire investor (Read)

+ Why your rich friend Venmo requests you for $4: People with more money ‘struggle with generosity,’ expert says (Read)

+ $850 Millennium Falcons and $680 Titanics: Grown-Ups Are Now a Gold Mine for Lego (Read)

BTW, some of these include affiliate partnerships.

Here's what I'm keeping an eye on today...

+ The Bitcoin halving is expected to happen on Friday or Saturday so volatility could be even higher than usual

+ We can probably expect oil and defense contractors to make moves following the weekend’s extracurriculars (read: Iran launching a bunch of drones and missiles at Israel)

+ TED2024 gets underway. A bunch of prominent investors and CEOs take the stage (think: Bill Ackman).

+ Goldman, Charles Schwab, and M&T bank report

+ The March retail sales report drops

Here’s today’s question…

Last week a Vietnamese property tycoon, Truong My Lan, was sentenced to death for the largest ever embezzlement/bribery crime in the country…

So…

Should SBF's 25-year sentence be harsher?

BTW…

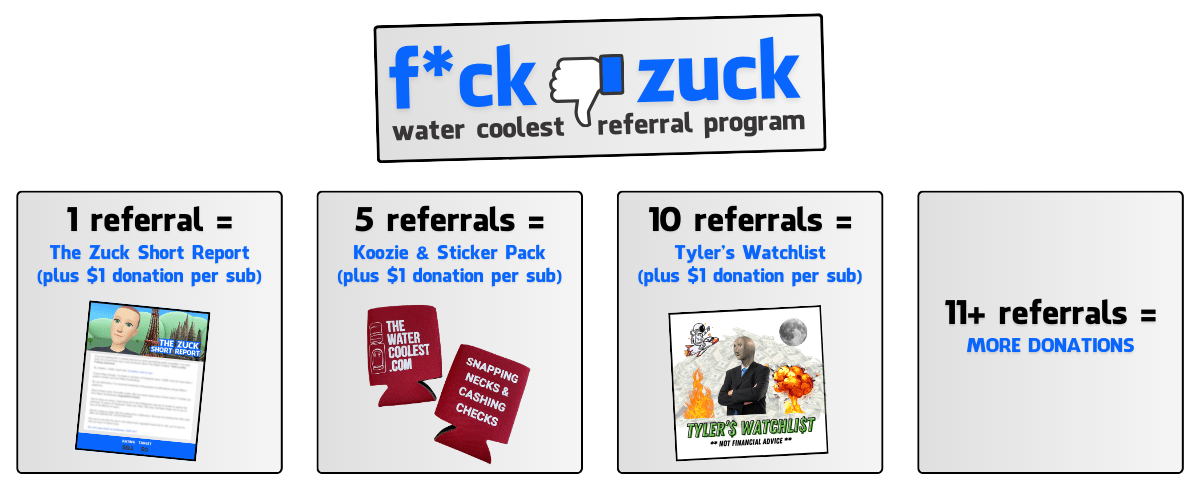

Have you referred anyone to The Water Coolest yet?

You can earn rewards and secure donations for your favorite charity by sharing your unique referral link…

Share your unique referral link (below) with anyone you think might be interested in The Water Coolest. You can email it, post it on social, etc. Get creative.

Your unique referral link: {{rp_refer_url}}

{{rp_personalized_text}}

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional