Hey there weekday warriors,

Here’s what we’re getting into today…

Netflix enters the upside down

23andMe wants to go private

Google fires 28 morons

Enjoy the next 4 minutes and 18 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

+ US stocks “finished largely in the red on Thursday as April's doldrums lingered in the market.” (Yahoo! Finance)

+ The 10-year Treasury yield rose “after the Philadelphia Federal Reserve’s manufacturing survey came in much higher than economists forecasted. It jumped to 15.5 for April, well above the consensus estimate of 2.5 from economists polled by Dow Jones." (CNBC)

+ Oil “held near a three-week low on Thursday as investors weighed mixed U.S. economic data, U.S. sanctions on Venezuela and Iran and easing tensions in the Middle East.” (Reuters)

+ Bitcoin “saw limited relief in the face of higher-for-longer U.S. interest rates, which battered risk sentiment. The focus was also on the halving event, which appeared imminent, and what its effects would be on the long-term supply of Bitcoin.” (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) TSMC -4.8% 2) Trump Media +25.7% 3) Netflix -0.4% AH: -4.8%

The market moves you need to know about…

+ Welcome to the big leagues. Duolingo shares rose 5.3% on news that it was getting called up to the S&P MidCap 400 index.

+ Shares of Nordstrom were up 4.4% on news that members of the Nordstrom family had shown interest in taking the company private and that the retailer had formed a special committee to discuss the offer.

+ Theybotta f*ck ton of stock. Consumer cashback platform Ibotta just had a yuge IPO. Shares gained 19.3% during its first day of trading.

Start speaking a new language by May

More than 200 language experts built Babbel to teach you the skills you need to have real-world conversations.

Not the stuff they taught you in high school. Read: no random words and phrases.

5–10 minutes a day is all you need to start speaking a new language in just 3 weeks.

Sponsors are the reason I can bring The Water Coolest to you every day for free. The only thing I ask is that you show them some love by clicking and checking out their offer.

“I am never going to financially recover from this.” - Disney+, Max, Peacock, etc.

(Source: Giphy)

Save some for the rest of us, Netflix (-0.4% and -4.8% after hours)…

Sure, the home of WWE Raw beat on the top and bottom line when it reported after the bell. But what really had investors more horned up than your girl after binging Bridgerton were those girthy subscriber gains.

Subs rose 16% to 269.6M. Analysts were expecting just 264.21M. It was the best Q1 for growth since 2020 when ‘rona boi had us locked up, hate-watching Tiger King.

But don’t get used to it…

You see, NFLX plans on going out on top.

From here on out, the company will be sticking to the G-code (it won’t release sub #s quarterly anymore). ‘Investing Is Blind’…

Wait, but why?

Well, according to Netflix, it’s a sign of maturity. It wants the Street to recognize that it’s all grown up and to focus on metrics like revenue, profit, and free cash flow.

Of course, if you ask the haters (read: me), they’ll say it’s because Netflix’s momentum is slowing, and it probably knows this is the last big quarter of subscriber growth. Do you mean to tell me the Mike Tyson vs. Jake Paul fight isn’t going to be yuge subscriber event?!

A slowdown wouldn’t be surprising, given its most recent wave of subs driven by a password crackdown, and the new ad-supported tier is expected to fall off a cliff.

And there’s some real evidence that the end is near (…for exponential sub growth). Like the company’s top line outlook for the year coming in below expectations…

+ “Ok, hear me out… I take the company private, and we forget all this ever happened.” - 23andMe (+41.9%) founder and CEO, Anne Wojcicki

According to an SEC filing, Anne is trying to take the genetic testing company private before she has to update her LinkedIn profile to “Former CEO.”

The Hail Mary is probably the best possible outcome for the company, which has lost 95% of its market cap since IPO’ing in 2021. It currently trades at ~50 cents and risks getting kicked off the Nasdaq. Keep in mind that’s after yesterday’s 40% jump…

Turns out investors don’t love the business model (think: a one-and-done DNA test… which only gets press when it helps solve some SVU cold case).

+ A bunch of kids who got stuffed in lockers in high school got fired from Google yesterday…

28 Googlers lost their jobs after they staged protests and sit-ins at offices in NYC and CA. What were they so butt hurt about? Google had signed a $1.2B cloud computing deal with the Israeli government and military.

Enjoy moving back into your childhood bedroom, which is almost certainly filled with participation trophies…

+ Welp, Zuck did it. He found an even more efficient way to Hoover up personal data. That’s right, AI is coming for us.

You might see an AI-powered search bar across Meta’s (+1.5%) suite of apps (think: Facebook, Messenger, Instagram, and WhatsApp).

Meet Meta AI (super original name, Zuck). You can use it to search the platforms and even ask it to create images and GIFs… and what could possibly go wrong? JK, we already know…

A suddenly cool, chain-wearing Zuck talked a big game in a video that made him feel eerily human…?

+ Tell me your shares are totally f*cked without telling me…

Trump Media (+25.7%) updated its shareholder FAQ to provide a VERY (I can not emphasize this enough) thorough explainer on how to stop short sellers from doing what they do best to DJT.

The answer to “How do I prevent my shares from being loaned for a short interest position?” provides a laundry list of options for protecting your shares. Like holding it in a cash account, or moving it to your retirement portfolio.

It even offers instructions and a template for a note to your brokerage explicitly opting out of share lending programs.

Interestingly enough, an analysis shows only about 5M of the 136M outstanding DJT are short. To put that in perspective, in January 2021, more than 100% of GameStop’s outstanding shares were shorted (spoiler: shares can be shorted more than once).

Of course, DJT could use any help it can get. Shares are down 55% since the company went public earlier this month.

+ Mortgage rates surge past 7%, reaching highest level since November (Read)

+ Want to get smarter about real estate investing? You'll love The Pocket List, a brand-new newsletter I’ve been working on. It’ll keep you up to date on the industry and help you make more money. Check out yesterday’s newsletter and subscribe for free with one click (Read & subscribe)

+ I have 5 income streams and make $142,000/mo from Amazon alone: Top 3 side hustle mistakes I always tell others to avoid (Read)

Here's what I'm keeping an eye on today...

+ P&G and Amex report

+ More Fed speeches = more high for longer chatter

+ Fallout from Israel’s retaliation…

Yesterday I asked… How much do you keep in your CHECKING account?

Here’s where we landed…

$3k-$5k

$1k-$2k

$5k-$10k

Shoutout to everyone who likes to dance with the devil like me (maintain a low balance and constantly risk overdraft fees).

Here’s today’s question…

Wild story about Googlers going all January 6th on their office because they didn’t like that the company signed a contract with Israel. Got me thinking…

For companies in your portfolio... do you give a damn about who/what they do business with?

BTW…

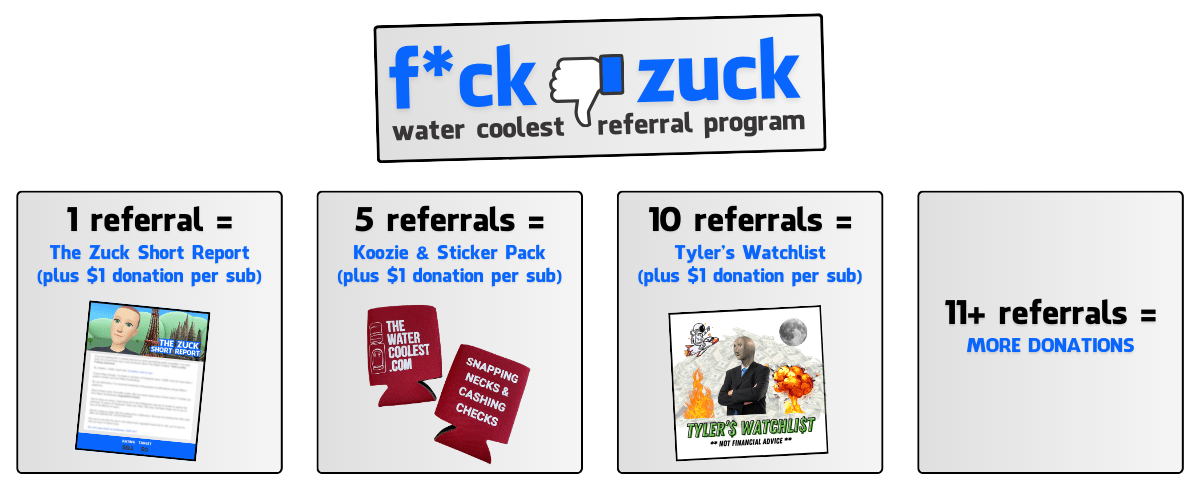

Have you referred anyone to The Water Coolest yet?

You can earn rewards and secure donations for your favorite charity by sharing your unique referral link…

Share your unique referral link (below) with anyone you think might be interested in The Water Coolest. You can email it, post it on social, etc. Get creative.

Your unique referral link: {{rp_refer_url}}

{{rp_personalized_text}}

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional