TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

USA Rare Earth gets a boost from the White House, Diddy does AI, and DJ D-Sol goes full Debbie Downer.

Enjoy the next 4 minutes and 37 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, I need your help.

Completing this quick survey (seriously, it’s 10 multiple-choice questions) will help me make The Water Coolest even better (I know… seems hard to imagine).

Oh, and I’m giving away two (2) $250 Amazon gift cards to 2 random weekday warriors who complete the survey. Thanks in advance, you guys.

Medium rare

Hope she’s doing ok…

New stock market cheat code just dropped, you guys…

USA Rare Earth $USAR ( ▼ 6.11% ), which sounds like an amethyst shop in Myrtle Beach (between the Hooters and Margaritaville), popped nearly 15% after CEO Barbara Humpton (what a brutal name to grow up with) said the company held discussions with the White House about an “investment” in the miner.

No word on wtf that actually means. And there has been no official word from the federal government. Babs is just begging for a shareholder class action lawsuit.

WTF is USA Rare Earth?

USA Rare Earth is a miner of, well, rare earth metals (obviously). Or at least it wants to be when it grows up.

They’re building out a facility in Texas that will eventually (Barbara pinky promises) mine the sort of metals we need for phones and EVs. You know, the kind that China has a monopoly on at the moment. They’re also building out a magnet plant that produces “neo magnets,” which sounds like something made by Stark Industries, but is all part of the development process.

Not unprecedented

In Barbara’s defense, her comments might not be the market equivalent of “yeah, I have a girlfriend, but she goes to school in another town.” You see, the White House has been building a portfolio of rare earth players, citing a national security threat (did I mention China has a stranglehold on this sort of stuff?)

POTUS has already added MP Materials and Lithium Americas to his brokerage account.

WTF does it mean for us?

“An investment from the US government” is the newest catalyst in the game. You might recall that up until very recently, Uncle Sam’s equity stakes were reserved for bailouts (see: GM, Fannie, and Freddie).

Learning season is here. Your new language is waiting.

We know that everyone learns differently. That’s why Babbel has something for every type of learner, from bite-sized lessons and grammar exercises to podcasts, speaking practice, and more.

+ Deciding to shelve an IPO of an AI chipmaker in the fall of 2025 is like getting your hands on a bottle of Limitless pills, and deciding to flush them down the toilet…

On Friday, Cerebras Systems said it was planning to officially withdraw its IPO. It didn’t give a reason, but the writing was on the wall. It announced it had raised $1B via private markets earlier in the week.

+ Today is “ok, maybe there’s a bubble”…

Ahead of Diddy’s sentencing Friday (he got 4 years, BTW), a fellow inmate wrote a letter to the judge, vouching for Puff, claiming he was on the straight and narrow. In his letter, the convict said the rap mogul approached him about building an "AI platform so that we can help the people." Tell me you know nothing about a subject, without telling me…

Who was that inmate, you ask? Not SBF (although they were boys). It was Miles Guo, who was found guilty of scamming his followers out of $1B through multiple investment schemes.

+ Goldman’s resident Buzz Killington brought down the mood at Italian Tech Week. Someone get this David Solomon a Negroni. DJ D-Sol took a page out of Jamie Dimon’s playbook, warning of a “drawdown” in stocks that’s “due” while comparing the current AI arms race to the dot-com bubble. How original, Dave.

Solomon said, “I wouldn’t be surprised if in the next 12 to 24 months, we see a drawdown with respect to equity markets... I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.”

The Goldman CEO didn’t explicitly call AI a bubble… he left that to Jeff Bezos, who showed up to the event looking like Lauren Sanchez forgot he was chained to the cuck chair in the stateroom of the Koru for like 3 days.

On the bright side, Jeffrey Commerce reminded everyone, “But it doesn't mean that anything that is happening [with AI] isn't real."

+ Imagine telling someone 20 years ago that an internet coin invented by a mysterious, unknown creator would hit an all-time high because it’s Uptober. Bitcoin reached a new record on Sunday, breaking $125k. BTC has historically outperformed in October and is getting a boost from the rush to “safe haven” assets (it’s hard to say that with a straight face) as the government shutdown drags on.

+ Name a worse fate than your movie dropping the same weekend as T-Swift releases a limited-run cinematic experience to celebrate her new album. “The Official Release Party of a Showgirl,” that ran exclusively at AMC, did $33M domestically… in 3 days. Not even the Taylor Swift for dudes (read: Dwayne Johnson) could dethrone Mrs. Travis Kelce. The Rock just had the worst opening weekend of his career with ‘Smashing Machine’ (which inexplicably is not his biopic).

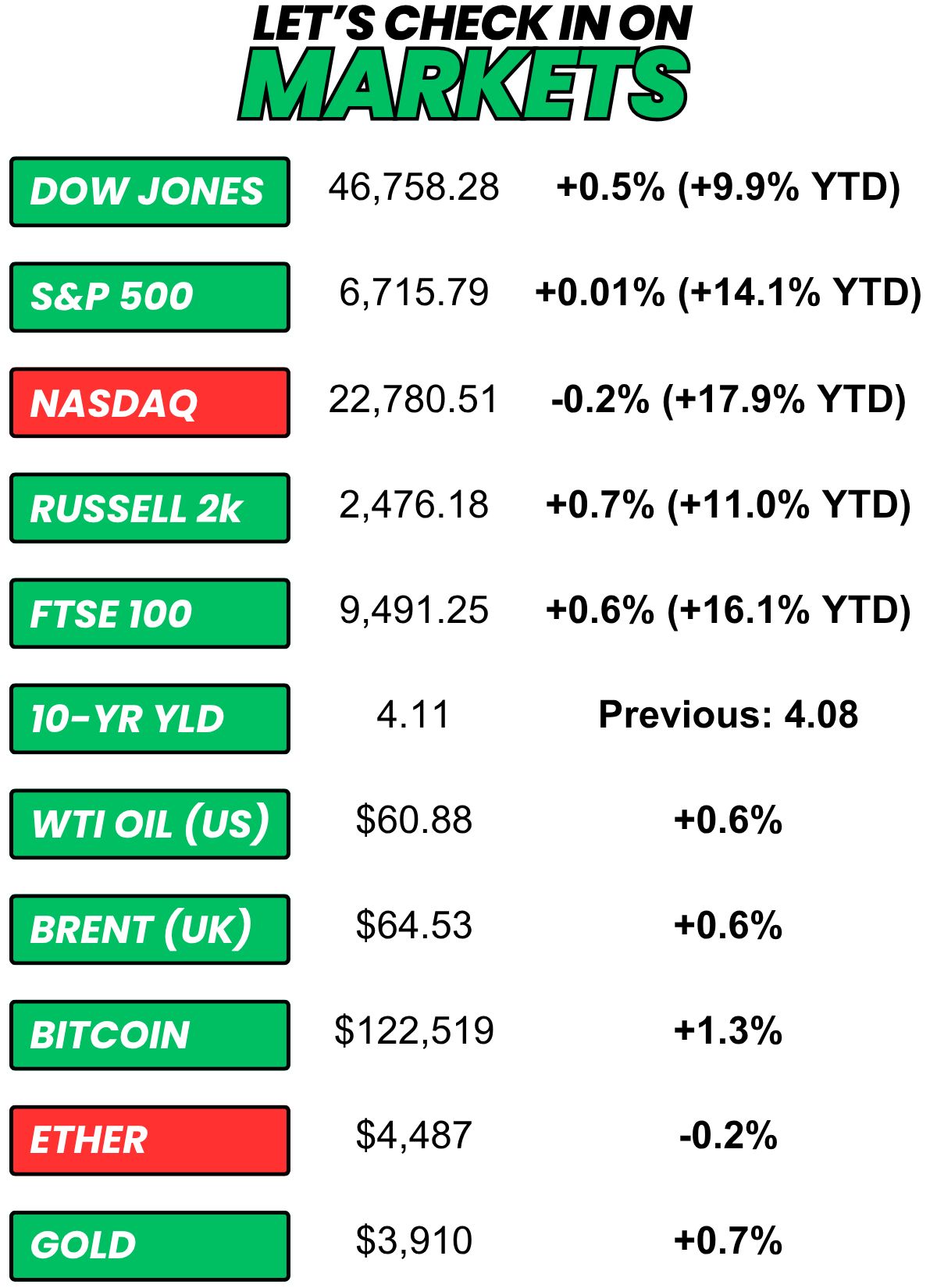

+ US stocks “eked out a record closing high in a volatile session Friday, with interest rate-cut expectations holding up as the U.S. government shutdown went on for a third day. The Dow also posted a record closing high, but the Nasdaq ended lower.” (Reuters)

+ The 10-year yield was “higher on Friday despite the latest services data missing Wall Street’s expectations. The government shutdown also reached its third day, and investors weighed its potential impact on the U.S. economy.” (CNBC)

+ Oil “settled higher on Friday but posted a weekly loss of 8.1% after news of potential increases to OPEC+ supply.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 69% chance One Battle After Another (sup, Leo) wins Best Picture at the 2026 Oscars. (Polymarket)

⏪ On Friday…

+ The September Jobs Report wasn’t released. Thanks, government shutdown.

⏩ Today we’re keeping an eye on…

+ Constellation Brands and Aehr report after the bell

+ OpenAI will hold its third annual DevDay

Here’s today’s question…

Did you help shape the future of TWC by completing a 2-minute survey?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.