Hey there weekday warrior,

We don’t deserve Jensen Huang.

Enjoy the next 4 minutes and 21 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Jensen is HIM

Jensen Huang has got that dog in him.

Nvidia (+3.6% // AH: -1.4%) is once again dripping with main character energy after putting on another earnings masterclass. The chipmaker reported Q4 earnings ($22.09B) and revenue ($39.3B) beats that single-handedly saved the global stock market. Alexa+, play ‘Pink Pony Club’ hype mix.

Even better? Jensen says demand for the new Blackwell chip is “amazing,” and he has receipts. Blackwell products accounted for $11B of revenue in Q4. Those sales make up 50% of Nvidia’s Data Center revenue.

Between the Blackwell and previous generation Hopper AI chips, the Data Center biz accounts for 91% of Nvidia’s sales. Double down on your strengths… noted.

But it wasn’t all good news… there was some incredible news too.

The Magnificent 7 final boss expects $43B in revenue for Q1, crushing estimates ($41.7B).

“Well, maybe next time you will estimate me.” - Nvidia sales team

DeepSeek? lol

Despite the DeepSeek market shakeup that had investors panicking, Chinese companies are buying NVDA’s H20 AI chip faster than your girl can say “Jensen! Sign my b**bs!”

Oh, and Obi Huang Kenobi predicts that next-gen AI algorithms might need millions of times the current amount of computing capacity. 10x thinking is weak. Try 1,000,000x.

+ “Alexa+, buy Amazon puts.”

Amazon (+0.7%) revealed the new face of Alexa. And spoiler: it comes with a monthly subscription for peasants non-Prime members. The company dropped Alexa+ at their Amazon Devices event in NYC. The long overdue Alexa “overhaul” turns the creepiest robot voice on the market into a personal assistant that can purchase things from Amazon (because, duh), give recipe instructions, and help your kids with their homework. AKA “disruptive fatherhood.”

With Alexa+, Amazon enters the AI agent space, meaning your Echo will be able to rip off Operator to do exciting things like booking a service appointment…

To be fair, some of the capabilities SVP Panos Panay hyped up do seem useful, and Amazon does have the market penetration (ay) to back it up. At this point, Andy Jassy would do anything to make Alexa profitable… except for making it useful.

+ AI data centers and fat-loss drugs: that’s what American capex does.

With Eli Lilly (+1.4%) (and more recently Novo Nordisk (-1.5%)) back in the FDA-approved semaglutide monopoly driver’s seat, the Zepbound hounds are on the loose. LLY is investing at least another $27B to build four new manufacturing plants in the US. Eli has been dropping fat stacks (think: $23B) on investments in new sites since 2020 to ease shortages on its massively popular injections Zep and Mounjaro. And knockoff GLP-slinger Hims immediately regrets spending $8M on a Super Bowl spot.

No word on where the new sites will be located… but if the AI capex rush has taught us anything, it’ll be Texas. The expansion will create over 10k construction jobs and 3k jobs for scientists and engineers. So, of course, Eli announced the move at an event in DC that featured Trump Cinematic Universe characters blessing the blueprints. Martin Shkreli was too early.

+ No coffee for Agentforce (it can’t close)…

Salesforce (+0.4% // AH: -5.4%) is fumbling the bag on AI-powered sales. Q4 earnings beat ($2.78 EPS) but a revenue miss ($9.9B) had shareholders shook. The CRM overlord is forecasting weak revenue for 2025 that missed expectations and cast some doubt on AI sales.

CEO Marc Benioff (who kinda looks like he could be a stunt double for Big Ed) name-dropped a few of Agentforce’s 3,000 early adopters like Pfizer (-1.2%) & Singapore Air (+0.8%), but sales growth has been stuck in single digits for the last 3 quarters at this point…

+ Ad software company AppLovin (-12.2%) shares tumbled Wednesday after 2 short sellers released reports crying fraud. Friendly reminder that AL shares jumped over 700% in 2024… so Palantir isn’t the only child star who grew up to be a disappointment.

+ Anything Home Depot can do, we can do better. Lowe’s (+1.9%) reported a (slightly girthier than HD) beat on the top and bottom lines for Q4.

+ GM (+3.7%) is boosting its quarterly dividends by 25% and has initiated a new $6B buyback program. Love a mid-week cash flow flex.

+ Third-party apps offering hard-to-get NYC restaurant reservations fuming over Hochul crackdown. Hell hath no fury like an Upper East Side mom scorned…

🔥Fiverr CEO: I always look for these 3 traits in job candidates—people who have them ‘don’t fail’. Today I learned Fiverr has FTEs…

FYI, TWC might be compensated if you click on the links above. So, what are you waiting for? Start clicking.

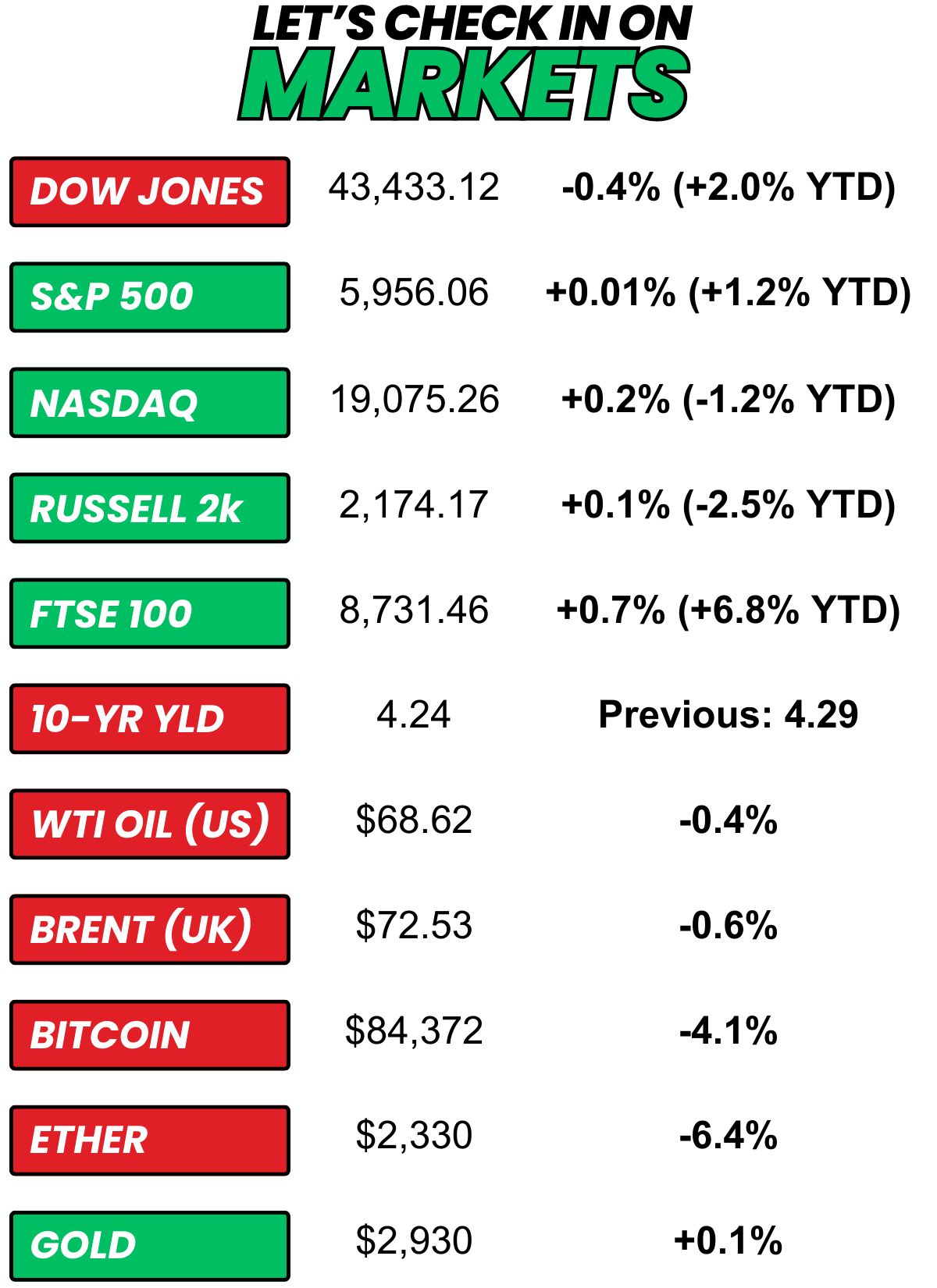

+ US stocks “closed mixed to end another volatile trading session after President Trump spoke about his tariff plans at a cabinet meeting Wednesday afternoon and investors also braced for Nvidia's after-the-bell earnings, which beat on both the top and bottom lines.” (Yahoo! Finance)

+ The 10-year yield “slipped on Wednesday as concerns over an escalating trade war and weak economic growth led traders to send bond prices higher.” (CNBC)

+ Oil “prices fell to two-month lows on Wednesday as a surprise build in U.S. fuel stockpiles signaled demand weakness and a potential peace deal between Russia and Ukraine continued to weigh on prices.” (Reuters)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Visa -0.4% 2) Nvidia +3.6% // AH: -1.4% 3) Hims & Hers Health +5.0%

⏪ Yesterday…

+ Lowe's and TJX reported before the bell

+ Nvidia, Salesforce, Snowflake, IonQ, MARA, C3.ai, Synopsys, eBay, Pure Storage, Teladoc Health, Joby Aviation, Paramount, Kratos, The Honest Company, Sweetgreen, Nutanix, and Petrobras reported after the bell

⏩ Today we’re keeping an eye on…

+ Vistra, TD Bank, Royal Bank of Canada, Papa John's, J.M. Smucker, and Novavax report before the bell

+ Rocket Lab USA, Dell, SoundHound AI, Duolingo, HP, Archer Aviation, NuScale, Autodesk, Monster, Elastic., NetApp, and Redfin report after the bell

Yesterday, I asked, “If you think about your current financial situation and the overall economy, do you feel more confident, less confident, or about the same as you did six months ago?”

Less confident won with 42.9% of the vote.

Here’s what some of you guys had to say…

More confident: “I base it on the fact that I still have money in my Draft Kings account.”

About the same: “I personally feel confident but I think I’m somewhat insulated. I think the emotional whiplash from recent political chaos is bleeding over into the economy. ”

And here’s today’s question…

You HAVE to switch lives with one of them. Which Mag 7 CEO are you becoming?

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.