Hey there weekday warriors,

This is your LAST CHANCE to help The Water Coolest defeat big tech…

Some precious TWC emails have been going to spam… or worse… the “Promotions” tab.

The best way to make sure The Water Coolest hits your inbox every day is by responding to a TWC email. It tells email providers that we’re friends (it’s cool because we are).

So here’s what I need you to do…

STOP scrolling

Reply to this email with “TWC”

That’s right, just three little letters. Reply with “TWC." And hit send.

I appreciate the help more than you know.

Enjoy the next 4 minutes and 18 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

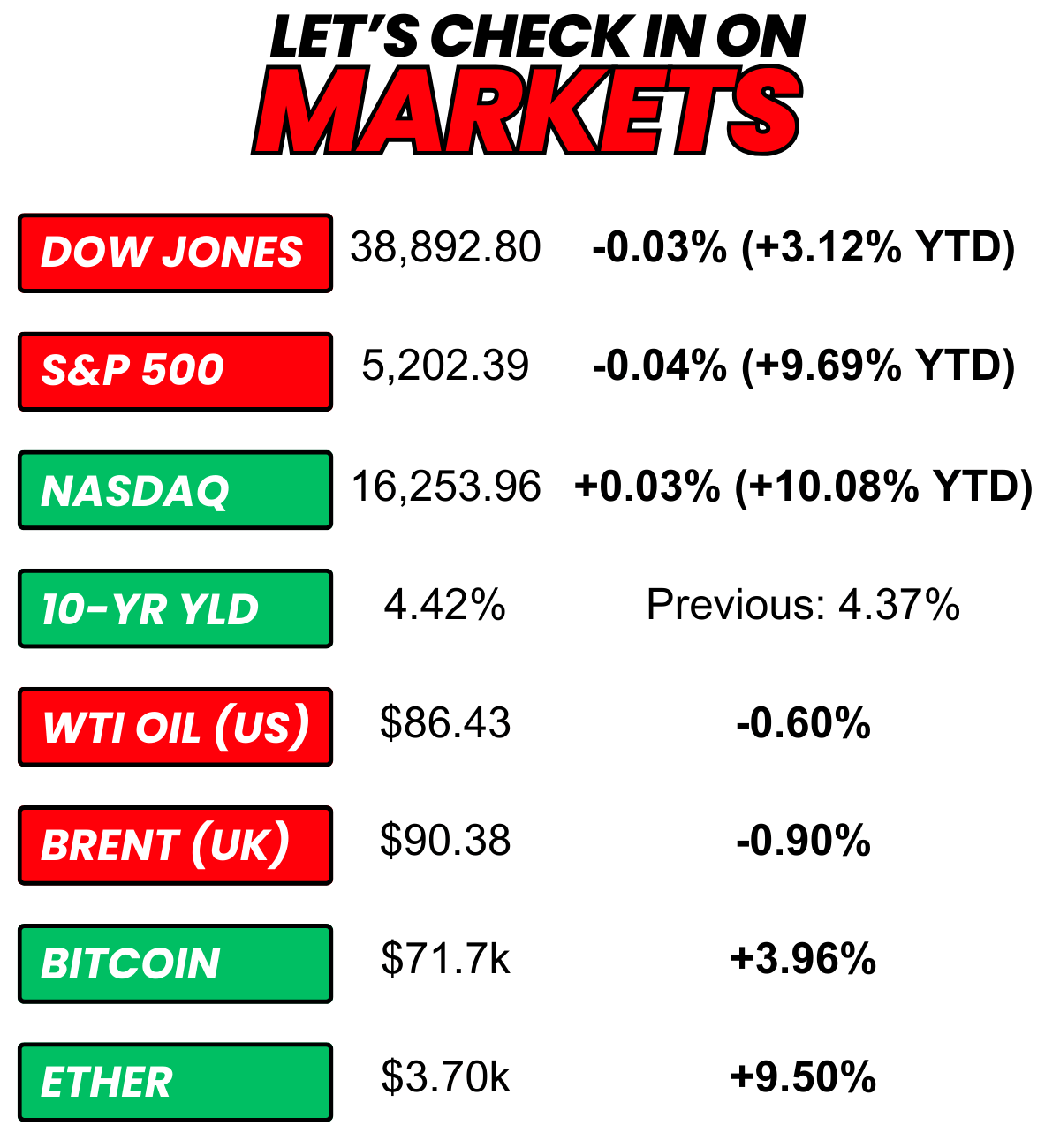

+ US stocks “ended Monday little changed as another uptick in interest rates kept investors from making big moves ahead of key U.S. inflation data.” (Reuters)

+The 10-year Treasury yield “were higher on Monday as investors digested Friday’s jobs report and looked ahead to key data slated for the week that could provide hints about the outlook for interest rates.” (CNBC)

+ Oil “fell on Monday, ending a multi-session rally after Israel reduced its troops in southern Gaza and began a fresh round of ceasefire talks with Hamas.” (Reuters)

+ Bitcoin “rallied on Monday following its rebound over the weekend despite some questioning the further strength in the token following strong U.S. payrolls data last week that saw traders price out chances of early interest rate cuts.” (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) ALTC Acquisition Corp +22.8% 2) Nvidia -0.9% 3) Tesla +4.9%

The market moves you need to know about…

+ GE Vernova is having some beginner’s luck (finally). The “new” stock rose 5.9% after getting some love from JPMorgan (read: upgrade to overweight).

– The Truth hurts. Trump Media tumbled another 10.7% following Friday’s 12% decline.

+ Shares of Entain soared 5.0% yesterday on news that the European gambling company behind PartyPoker, BetMGM, and others has been fielding interest from private equity buyers.

Hurricane warning

(Source: Giphy)

Honestly, the only thing more disappointing than the solar eclipse might’ve been Jamie Dimon’s outlook…

In his entirely too-long letter to shareholders (see: 60+ pages) JPMorgan CEO Jamie Dimon shared a pretty, pretty bleak outlook. Who hurt you, Jamie?

Hard knocks

Jamie addressed the “soft landing” markets are betting on…

“These markets seem to be pricing in at a 70% to 80% chance of a soft landing – modest growth along with declining inflation and interest rates. I believe the odds are a lot lower than that."

JD believes that interest rates might actually need to go up. And not just a little bit. He sees a scenario where rates need to be hiked to “8% or even higher.”

Those higher rates will help offset the (even) higher inflation JD predicts. And before you go all “i thOugHT inFLaTiOn WAs UNDer COnTrOl,'“… I’ll just leave Jamie Downer’s thoughts right here…

“Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world, and the restructuring of global trade—all are inflationary.”

On the bright side, he didn’t use the word “hurricane"… so we’ve got that going for us.

BFD

Oh, and in case you were wondering, Jamie thinks AI is a big f*cking deal. This matters coming from a dude who called Bitcoin a “pet rock.”

He certainly does not think AI is a fad…

"We are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years: Think the printing press, the steam engine, electricity, computing, and the Internet, among others."

Get off AI’s d*ck, Jamie…

+ 6 Unusual Ways People Are Boosting Their Bank Account (Read)

+ Here’s how to make key college decisions amid FAFSA delays (Read)

+ Biden’s new student loan forgiveness plan could erase up to $20,000 in interest for millions of borrowers (Read)

+ The 6 best balance transfer credit cards (Read)

BTW, some of these include affiliate partnerships.

+ “USA, USA, USA!” - Taiwan Semi’s management, probably

TSMC (+1.0%) is getting its hands on $6.6B in US funding to build three chip fabrication plants in Arizona. Because f*ck China, amirite?

The grant (aka they don’t have to pay it back) as well as $5.5B in loans will be made available to TSMC as part of the US CHIPS Act. The money will help offset the ~$65B investment by TSMC.

+ Spirit Airlines (+6.5%) out her furloughing pilots like it’s a Boeing 737 customer. Spoiler: it’s not… it operates an all-Airbus fleet. It just really stinks at being a profitable airline.

The budget airline, which is still dealing with the hangover from its JetBlue breakup, is furloughing (read: vacation without the pay) 260 pilots. Why? Because it’s deferring delivery of a bunch of Airbus jets. Oh, and did I mention its business model sucks?

The moves will reportedly increase Spirit’s liquidity by $340M over the next two years. Read: it will delay the inevitable.

+ UberEats (-2.7%) is rolling out a Reels-like feed to boost discovery (and sell ad space… obviously)… and I’ve never been more bullish on anything in my life.

Uber wants to bring the TikTok shop experience to hungry people everywhere (well, technically just people in New York, San Francisco, and Toronto for now). The DoorDash competitor’s goal is to replicate the in-restaurant experience of seeing what everyone around you is eating. Well, that, and increasing ad revenue…

+ During an interview yesterday, Elon said he thinks AI will be smarter than the smartest human within a year or two. To be fair, this is the same guy who’s been saying full self-driving is right around the corner since the (first) Obama administration.

Here's what I'm keeping an eye on today...

+ Tilray reports

+ The Google Cloud Next event gets underway (read: SO many AI mentions)

Here’s today’s question…

(Last chance on this one…)

Did you reply to this email yet?

ICYMI above…

Some precious TWC emails have been going to spam… or worse… the “Promotions” tab.

The best way to make sure The Water Coolest hits your inbox every day is by responding to an email. It tells email providers that we’re friends (it’s cool because we are).

So here’s what I need you to do.

Reply to this email with “TWC” to show your support

That’s right, just three little letters.

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.