Hey there weekday warriors,

Here’s what we’re getting into today…

Intel is coming for Nvidia’s crown

Google making AI moves

Boeing’s brutal quarter

Enjoy the next 4 minutes and 35 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

+ US stocks “stocks closed mixed after a bouncy (and uneventful) trading session on Tuesday. The moves come as investors bide their time until a key inflation report lands and potentially sheds light on the path of interest rates.” (CNBC)

+ The 10-year Treasury yield “fell Tuesday, as investors looked ahead to fresh inflation insights due later this week — which could provide clues about the path ahead for monetary policy." (CNBC)

+ Oil “settled lower Tuesday, as traders weighed Middle East tensions amid little sign of progress on talks for a ceasefire in Gaza and fresh signs that Israel hasn't given up on plans to launch an offensive in Rafa.” (Reuters)

+ Bitcoin “stayed indecisive after the April 9 Wall Street open amid a warning that macro data could spark further BTC price downside.” (Cointelegraph)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia -2.0% 2) Tesla +2.2% 3) AltC Acquisition -12.0%

The market moves you need to know about…

+ BlackBerry be like “it’s called pivoting… look it up.” BB jumped 7.6% on the news that the maker of the CrackBerry was partnering with AMD on a robotics platform.

– Go call your friends who invested in Tilray. Shares of the weed and alcohol company fell 20.6% after reporting a larger-than-expected quarterly loss and lowering its guidance.

+ You might want to sit down hypochondriacs. Today I learned that “head and neck cancer” is a thing. Moderna unveiled positive Phase 1 data for a drug that treats the disease. Shares rose 6.1% on the news.

Intel woke up feeling dangerous

(Source: Giphy)

“You come at the king, you best not miss.” - Nvidia CEO, Jensen Huang

Yesterday, Intel (+0.9%) unveiled its latest AI chip, the Gaudi 3.

During an AI event, Intel shared that the Gaudi is 2x as power efficient and 1.5x faster than Nvidia’s H100 GPU, the current industry standard. Shots fired.

If you’re wondering why the stock didn’t go parabolic, it’s because INTC announced the Nvidia killer late last year. Oh, and because investors know Intel will probably figure out a way to screw this up.

Unfortunately for the red-headed stepchild of the US semi sector (spoiler: Intel)…

It brought a knife to a gunfight. Just a few months after the Gaudi 3 is expected to be available, Nvidia’s H100 successors should start shipping.

And as you might have guessed, NVDA’s B100 is expected to be harder, better, faster, stronger.

But that’s not the only reason Nvidia is winning the AI chip d*ck measuring contest (reminder: it owns ~80% of the AI chip market currently)… and probably will be for a long time.

You see, Nvidia has taken a page out of Apple’s playbook and has built a walled garden of sorts. Its suite of complimentary software products makes it difficult for a customer to switch providers.

Crash the Venture Capital party...

Wearing a Patagonia vest and saying things like "product-market fit" doesn't make you a VC. Believe me, I've tried.

You'll need to, you know, actually deploy capital.

One problem: since the dawn of time, VC funds have been reserved for the wealthy and elite. No regular investors allowed.

But Sweater is changing the game. Its financial technology platform is making venture capital accessible to anyone, not just the wealthy. Sweater enables partners to launch VC funds to the masses.

And you can be part of the movement.

You guys, this is a sponsored post. Sponsors are the reason I can bring The Water Coolest to you every day. The only thing I ask is that you show them some love by clicking and taking a look around.

+ “Hold my beer.” - Google after seeing the Intel chip news

At its Cloud Next conference in Vegas, Google (+1.2%) was doing its best to make investors forget all about its consumer-facing AI product being a complete dumpster fire.

The company unveiled its new Axion semiconductor, which will help power its AI and cloud ambitions. The chip meant for in-house use will be based on Arm’s architecture.

If the move sounds familiar, it’s because Alibaba, Amazon, and Microsoft are doing the exact same thing. Super original, Sundar.

+ “You gotta pump those numbers up. Those are rookie numbers in this racket.” - Airbus to Boeing, probably

Turns out, when you f*ck around, you find out. Boeing (-1.8%) delivered just 83 jets in the past 3 months. Spoiler: that’s bad. And I’ve got receipts. It’s down from 157 during the last quarter of 2023 (read: before the Alaska Airlines catastrophe).

The worst part? Its biggest competitor, Airbus, delivered 142 over the same period. Oof.

+ Bad news for all the parents who were really hoping their kids give up on their dreams of being a YouTube star…

Dude Perfect just raised as much as $300M to take their talents beyond the creator economy. The dude-bros, who you could easily mistake for the Duke lacrosse team, plan to use the straight cash homie to build a theme park, launch more merch in partnership with Walmart, and roll out their own streaming platform.

+ Costco (+0.9%) is the hottest new commodity trading shop on the Street. Wells Fargo says that COST is slinging more than $100M in gold bars every month.

Just one problem… it might actually be losing money on the sales. It only marks up the bars ~2% from the spot price… while offering 2% cash back to most of its members.

+ 6 Unusual Ways People Are Boosting Their Bank Account (Read)

+ Warren Buffett’s favorite indicator says stocks are overpriced: Here’s what actually may be going on (Read)

+ Viral shop sold $9,800 of NYC earthquake T-shirts in 21 hours—it’s run by an ex-JPMorgan Chase banker who quit from burnout (Read)

+ $1 million homes are now ‘typical’ in a record number of U.S. cities, analysis finds. Here’s where they are (Read)

BTW, some of these include affiliate partnerships.

Here's what I'm keeping an eye on today...

+ Delta Air Lines, Applied Digital, and Rent the Runway report

+ DocuSign holds a two-day event

+ CPI data drops bright and early… and has the chance to ruin everyone’s day before markets even open

+ The Fed releases the minutes from its March meeting

Here’s today’s question…

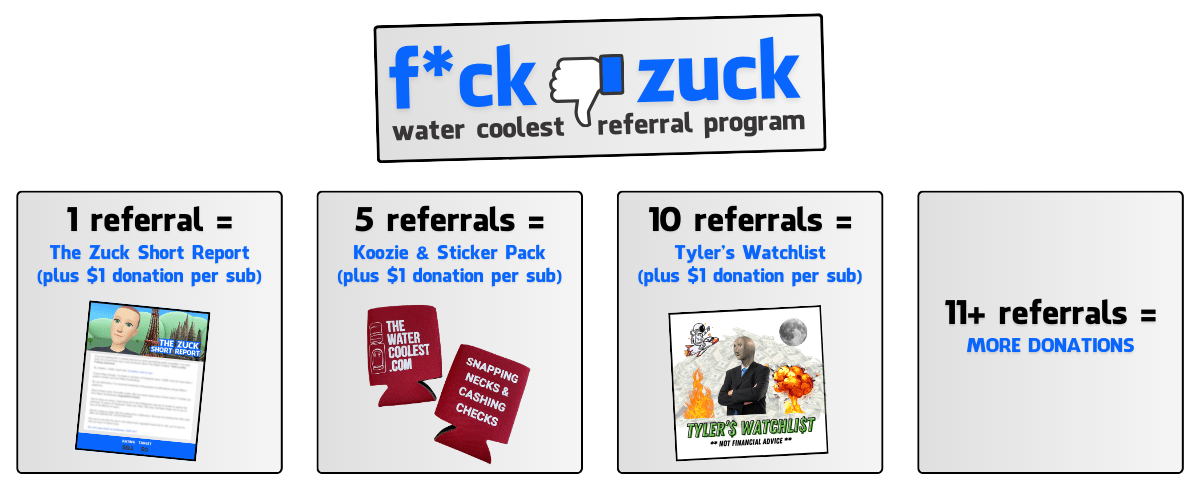

Friendly reminder: every month I’ll donate $1 to charity for every valid TWC referral. This month we’re donating to the Shriner’s Hospital for Children.

There are still a few days before this month’s cutoff (the 15th) to do God’s work, so…

Have you referred anyone to The Water Coolest yet?

You can earn rewards and secure donations for your favorite charity by sharing your unique referral link…

Share your unique referral link (below) with anyone you think might be interested in The Water Coolest. You can email it, post it on social, etc. Get creative.

Your unique referral link: {{rp_refer_url}}

{{rp_personalized_text}}

(BTW, for those of you who earned koozies & stickers, they’ll ship on April 15th)

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional