Hey there weekday warrior,

Here’s what’s on the agenda today…

Qualcomm is coming for Nvidia’s crown, The Oracle of Omaha catches a rare downgrade, and Airbnb goes full fun police.

Enjoy the next 4 minutes and 9 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

How do you do fellow GPUs?

“Room for one more?” Qualcomm asks as it steps into the sauna with Nvidia and AMD (and removes its towel)…

Someone told Qualcomm $QCOM ( ▼ 2.22% ) that you can just build things. The company best known for its phone chips is getting into the AI game.

It plans to drop the AI200 in 2026 and the AI250 a year later. And Jensen Huang has gotta be big mad Nvidia's been naming its chips stuff like Blackwell this whole time.

Qualcomm claims its chips are bigger, faster, and stronger than its competitors. They've got 768 gigs of memory and are more efficient from a power consumption perspective.

Like its competitors (not you, Intel), Qualcomm will sell its GPUs in 72-packs (aka "full rack systems").

Why now?

There are 6.7 trillion reasons. McKinsey estimates that more than $6.7T will be spent on data center capex through 2030.

Of course, it's going to be an uphill battle. Nvidia (perhaps you've heard of them?) still owns nearly 90% of the GPU market. Godspeed Qualcomm.

+ "I'll hit an old man in public." - KBW analyst, Meyer Shields

It appears Meyer never learned to respect his elders. The KBW analyst hit Berkshire $BRK.B ( ▲ 0.45% ) with an underperform rating. Spoiler: not many people on Wall Street bet against Berkshire.

He said, "Many things are moving in the wrong direction," pointing to a handful of headwinds impacting Berkshire's insurance biz. It doesn't help that interest rates are dropping (think: the Oracle will earn less on his $300B cash pile).

Oh, and Meyer said what we're all thinking: WTF happens when Warren is really gone?

+ Rumor has it there’s a bloodbath brewing at Amazon $AMZN ( ▲ 1.0% )…

Snitches familiar with the matter believe that mass layoffs will begin today. But not just any layoffs… the biggest job cut in the history of the company. More than 30k Amazon employees could be impacted.

+ "I'm taking my talents to NBCUniversal" - Taylor Sheridan

This has to be the biggest thing to happen to Peacock since The Office left Netflix. Taylor Sheridan, the maker of Yellowstone (and all 15 spinoffs) and Landman, will leave Paramount and head to NBCUniversal to copy-paste the same plot lines with carbon copy strong male leads.

+ The Taylor Swift effect…

+ It appears that Airbnb $ABNB ( ▼ 1.36% ) CEO Brian Chesky is going to be a narc for Halloween.

Once again, Airbnb is cracking down on Halloween parties. It will use proprietary technology (so, a bunch of people in a call center in Central Asia) to identify users trying to rent houses for parties. Power user tips: don't try to rent Airbnbs in your town (have a pal from out of town do it), don't rent the house for just the evening of Friday, October 31st, and whatever you do, don't ask the host how many grown, consenting adults the shower fits.

+ iRegrettakingthejobattherobotvacuumcompany

That’s pretty much all she wrote for iRobot $IRBT ( ▼ 67.11% ), the maker of Roomba. According to a filing yesterday, the company’s last potential suitor went all “and for that reason, I’m out” (the reason is it’s a terrible company with hardly any redeeming qualities). Shares plummeted 30% on the news.

You might recall that things got bleak for iRobot after regulators forced Amazon to scrap a deal to buy it. And in March, iRobot said it had substantial doubt it would survive without a buyer.

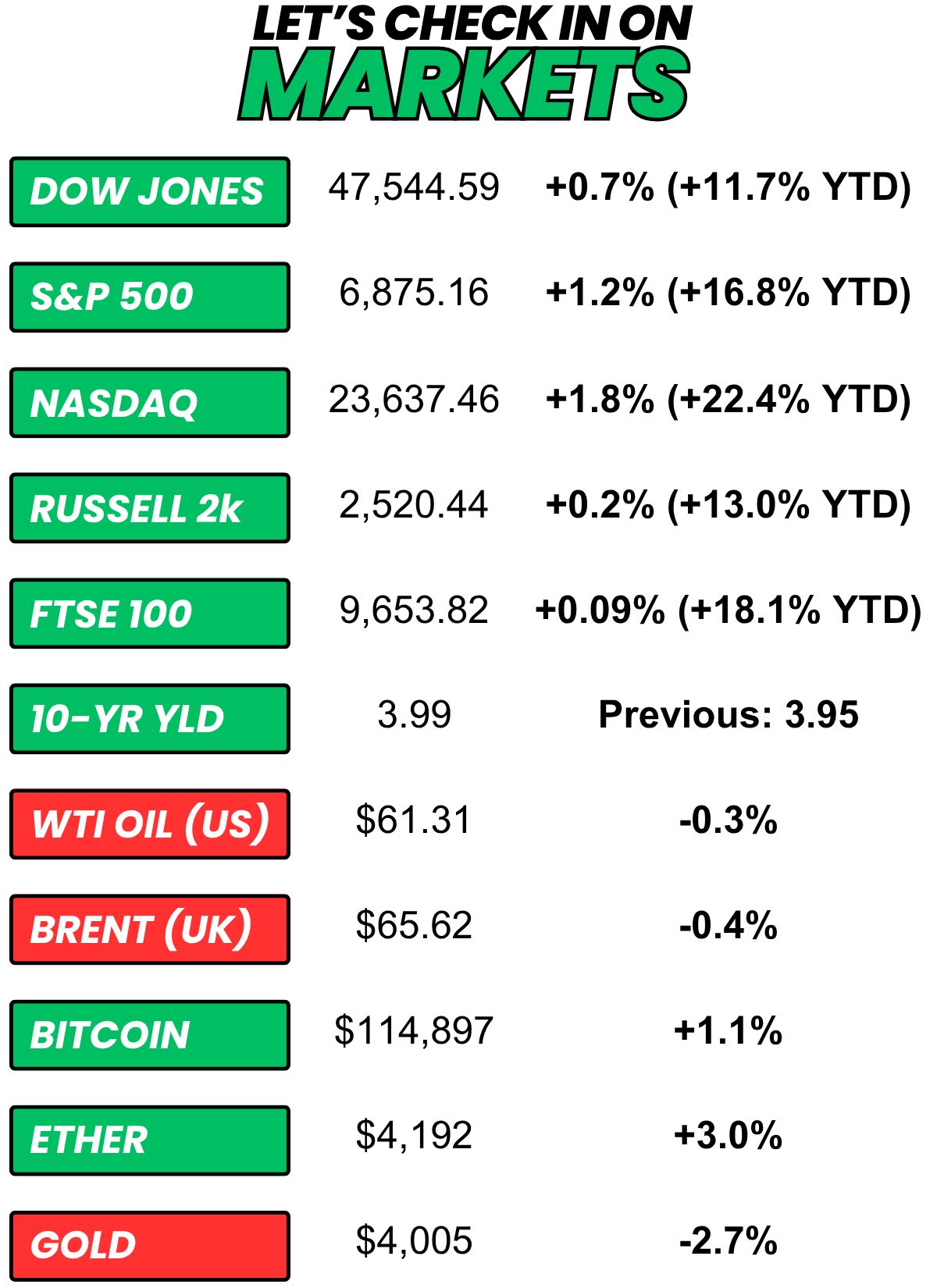

+ US stocks “jumped to new records on Monday after U.S. and China officials cooled tensions over the weekend, laying the groundwork for President Donald Trump and China President Xi Jinping to clinch a trade deal this week.” (CNBC)

+ The 10-year yield “was relatively unchanged on Monday as investors looked ahead to the Federal Reserve’s meeting this week where policymakers are widely expected to cut interest rates a quarter percentage point.” (CNBC)

+ Oil “prices settled marginally lower on Monday as OPEC’s plans to increase oil output once again outweighed hopes of a trade deal framework between the U.S. and China and renewed U.S. sanctions on Russia.” (Reuters)

+ Bitcoin “gained on Monday, tracking a broader rally in risk-driven markets after the U.S. and China announced a framework deal aimed at stemming further escalation in their ongoing trade conflict.” (Investing.com)

+ The “smart” money (prediction markets) thinks there’s a 3% chance POTUS confirms the moon landing was faked before the end of the year. (Polymarket)

⏪ Yesterday…

+ Waste Management, Celestica, Cadence Design Systems, NXP Semiconductors, Confluent, Nucor, and Brown & Brown dropped earnings after the close

⏩ Today we’re keeping an eye on…

+ SoFi, PayPal, UnitedHealth, UPS, Nextera Energy, MSCI, DR Horton, Royal Caribbean Cruises, Corning Inc., American Tower Corp, and Sherwin-Williams report this AM

+ Visa, Enphase Energy, Booking Holdings, Seagate Tech, Electronic Arts, The Cheesecake Factory, Bloom Energy, Mondelez, Teradyne, and Aurora Innovation report after the bell

Yesterday, I asked, “As a grown a** adult, where does Halloween rank as a holiday?”

30.5% of you said, “#8.”

Here’s what some of you guys had to say…

#5: “#8 leading the pack... wtf??? Must have a lot of bankers on this poll... Halloween is never a day off work.”

#8: “I don't like getting up from the coach fifty times to answer the door.”

#1: “Low extended family expectations, candy all around, and it’s another excuse to hang out with friends and party”

#8: “if I don't get the day off work it ain't a holiday.”

Here’s today’s question…

You just had a long day at a conference. You just got back to your hotel room. You have to meet your team in 30 minutes in the lobby for drinks and dinner. What are you doing for that 30 minutes?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.