Hey there weekday warriors,

Sick and tired of trying to find Adderall, which has been in short supply since last year? Want to see through walls and smell colors? Well, you’re in luck… Dunkin just released its Panera Charged Lemonade competitor. Meet SPARKD’.

Here’s what else we’re getting into today…

Intuitive Machines gets a little sideways

Berkshire reports

Jamie Dimon is a sellout

Enjoy the next 4 minutes and 30 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

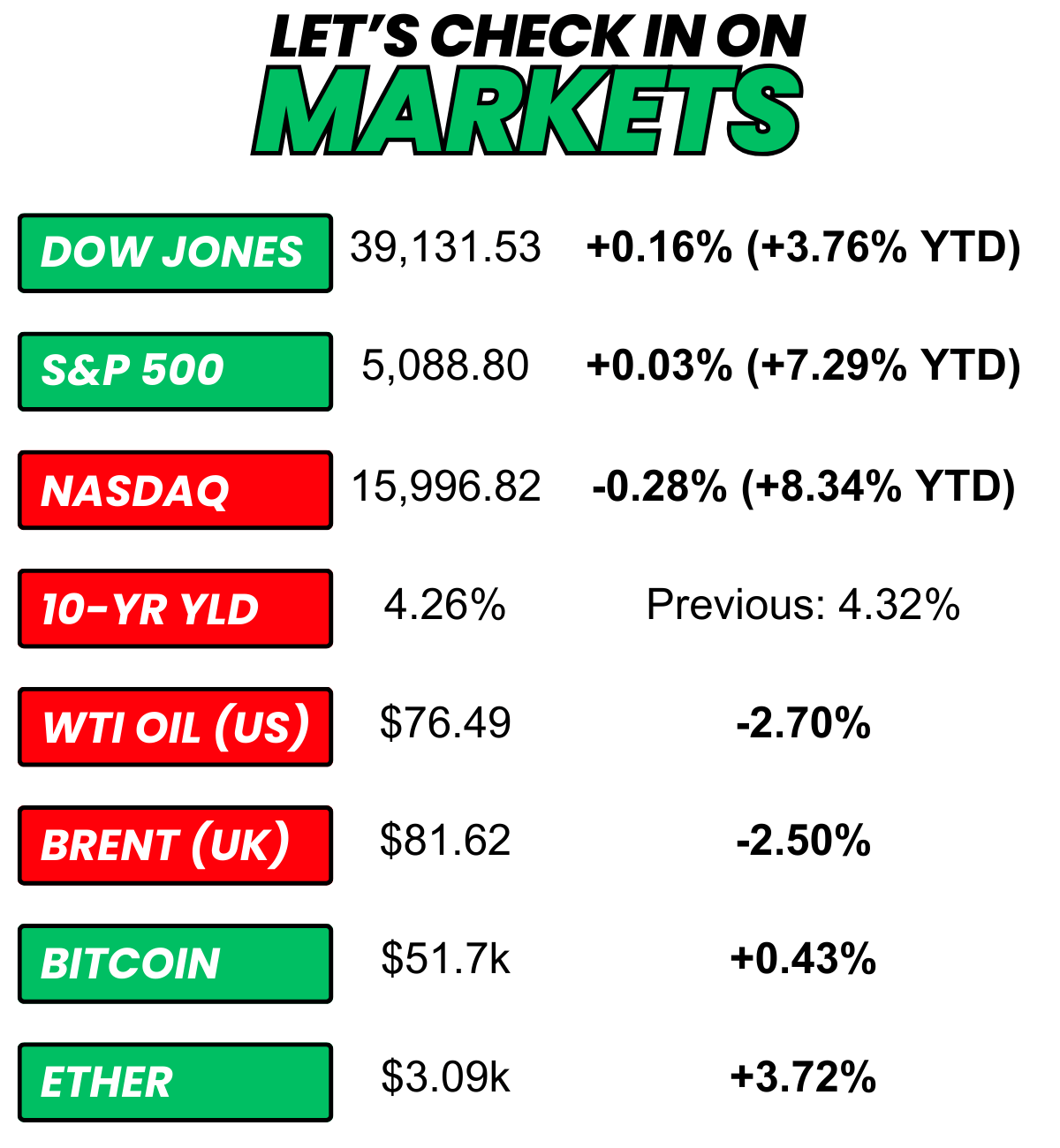

+ US stocks “lost steam Friday but powered through a dizzying week of record-breaking stoked by AI chipmaker Nvidia's blowout earnings.” (Yahoo! Finance)

+ The 10-year Treasury yield was “mostly lower on Friday as investors considered the path ahead for interest rates after fresh comments from Federal Reserve speakers." (CNBC)

+ Oil prices “fell nearly 3% lower on Friday and posted a weekly decline after a U.S. central bank policymaker indicated interest rate cuts could be delayed by at least two more months.” (Reuters)

+ Bitcoin climbed for most of the weekend, coming up just shy of $52k.

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia +0.3% 2) Super Micro Computer -11.8% 3) C3.ai -1.8%

You just got done sweating out Nvidia's earnings…

You wipe the sweat from your forehead. You take a deep breath.

Now it's time to recover with LMNT.

LMNT is a delicious electrolyte drink that replenishes your body with its science-backed ratio of 1000mg sodium, 200mg potassium, and 60mg magnesium to help prevent dehydration.

Check out their chocolate medley for a limited time and get a FREE sample pack with any purchase.

This is a sponsored post. The best way to support The Water Coolest is by showing our ad partners some love (think: clicking, taking a look around, etc.).

The market moves you need to know about…

– Name something investors hate more than a surprise quarterly loss. On Friday, shares of Piedmont Lithium fell 10.7% following a brutal earnings report, thanks largely to a recent drop in lithium prices.

+ Hyatt hit an all-time high Friday. The stock climbed 10.7% after an earnings beat and strong guidance, driven largely by international travel.

– Warner Bros. Discovery got put in a body bag following its most recent earnings. Shares dropped 9.9% after a big miss.

Houston, we have a problem

(Source: Giphy)

Annnnd it’s gone…

On Thursday, the US put a spacecraft on the moon for the first time since 1972. It’s not a contest, but if it was, we’d be winning…

Intuitive Machines (+15.8%, -31.7% after hours), a private company (I love the smell of free-market capitalism in the morning) landed its $100M Odysseus lunar explorer on the moon’s surface.

To nobody’s surprise, the publicly traded company’s stock went parabolic. It shot up more than 50% following the confirmation that its lander had touched down successfully.

Just one problem…

The Odysseus tripped and fell. The craft made it ~239k miles to the moon’s surface… and tipped over after catching one of its 6 legs on a rock. I bet the engineer who was pushing for 5 legs is running around the office saying “told you so.”

So, now, Odysseus is sitting on its side. And investors are not happy. Shares fell 32% after hours on Friday.

But maybe some of you need to take a deep breath. Because according to Intuit leadership, Odysseus is “alive and well” and should be able to carry out the experiments it has planned.

Why should I care? This is still a huge achievement. One might call it “a giant leap for mankind.” Especially after Astrobotic’s failed attempt last year. Shares of other publicly traded players in the space industry also benefitted from Intuitive’s “success.” We see you, Astra Space and Satellogic.

+ 16% of Americans Think It's OK to Cheat on Taxes. Here's What Could Happen if You Do (Read)

+ These are the 10 U.S. cities with the best quality of life—none are in Florida (Read)

+ NJ TikToker bizarrely asked to sleep in the same bed as her colleague on overseas work trip: ‘HR loves a good rom-com’ (Read)

~ ICYMI... I'm a HENRY financial planner who makes $125,000. Here's how I manage my money — and the mistakes I see others making. (Read)

+ Is someone cutting onions?

On Saturday in his annual letter to shareholders, Warren Buffett paid tribute to the homie, Charlie Munger, who passed away late last year.

But that wasn’t the only thing Warren Buffett had to say in his love letter to Berkshire Hathaway shareholders. He kept it real, warning investors that Berkshire might only be able to outperform the average American company slightly. That’s because he doesn’t see a ton of opportunities to invest or acquire given the current market… and his high standards.

Which is why Berkshire is sitting on $167B worth of cash that it refuses to unleash. For those of you keeping score at home, that’s a new high score for the conglomerate.

BRK put up huge numbers in Q4. Its operating earnings (read: earnings excluding its investments) jumped 28% year over year. And not that Warren wants you to look at its earnings, including its investments… but if you did, you’d see that they nearly doubled in the quarter.

Why should I care? Warren warned that there isn’t a whole lot on his watchlist right now. Translation? There aren’t any well-run companies with strong balance sheets that are undervalued. Sucks to be a value investor…

+ Jensen Huang out here playing ‘just the tip, just to see how it feels…’

Nvidia (+0.3%) briefly topped a $2T market cap on Friday during trading. It didn’t have the stamina to close above $1,999,999,999,999.99, though. ICYMI, on Wednesday, Nvidia reported a blowout quarter and shared an outlook that had investors all horned up.

Why should I care? Honestly, you probably shouldn’t. A nice, round number for a market cap is just that. Unless you’re CNBC. Then it’s breaking news.

+ If you had aluminum industry consolidation on your 2024 card, you’re in luck. Alcoa (-4.4%) is buying Australia’s Alumina for $2.2B. The two companies are already partners in a JV, so Alcoa got to try it before they bought it. (Read)

+ Tell me you’re about to retire without telling me…

Jamie Dimon sold $150M worth of JPMorgan shares last week. That’s the first time he’s unloaded JPM stonk since he took over in 2005. To be fair, Jamie has previously reported his plans to get liquid. (Read)

Here's what I'm keeping an eye on today...

+ Workday, Li Auto, Zoom Video, iRobot, and Agora report. iRobot’s gonna have to answer some tough questions. Friendly reminder: Amazon walked away from a deal to acquire the Roomba maker after antitrust backlash.

+ Amazon joins the Dow

Friday I asked, “What’s the going rate for the tooth fairy?”

$1-$4 and $5-$9 tied for the top spot. $20+ came in third, and I can already tell your kids are going to say things like “do you know who my father is?”

Here’s today’s question…

What's your go-to upper for work?

Oh, and two more things…

Did you check out today’s partner LMNT? It’d be a lot cooler if you did.

What did you think about today's newsletter?

Want to advertise in The Water Coolest? Fill out this form and I’ll be in touch.

Looking to work with the best newsletter consultant in the game? Let’s talk.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional