Hey there weekday warrior,

Here’s what’s on the docket today…

I’m pretty sure Jamie Dimon just hates change, the Fed’s meetings will remain the closed-door variety, and Samsung just beat out TSMC for a yuge contract. But first…

Let’s take a look back at the July 29, 2021 edition of The Water Coolest…

In the lead-up to its IPO, Robinhood officially priced its shares at $38. That was the good news…

Shares fell more than 8% during its first day of trading and continued to death spiral until June 2022, when the stock hit an all-time low below $7.

But Vlad didn’t hear no bell. Shares have mooned more than 700% since the beginning of 2024.

Enjoy the next 4 minutes and 8 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who thinks we should be able to watch the Fed meeting. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste (who knows you think the Fed meeting should have an open-door policy) forward this to you? Subscribe here.

Too much information

When will Jamie Dimon’s reign of terror stop? First, he came for bitcoin. Then it was return to office. Now it’s fintechs.

Earlier this month, Jamie and JPMorgan $JPM ( ▼ 1.9% ) decided that they were done footing the bill for those freeloaders in Silicon Valley. From here on out, fintech middlemen playing air traffic controller with user funds and data are going to need to pony up for access to JPMorgan’s grid. The bank is currently negotiating fees with the biggest players in the space, like Plaid and MX.

That’s right, the companies that make the pipes that connect traditional financial institutions and their cooler, younger cousins with computer science degrees from Stanford, have been suckling at the teet for free.

But the gravy train just got derailed…

An internal memo at JPMorgan showed that these middlemen are a bigger drain on the system than Frank Gallagher.

According to the internal communications, “Aggregators are accessing customer data multiple times daily, even when the customer is not actively using the app,” and they are “massively taxing our systems” (… says the bank that had the money printer turned up to 11 in Q2).

Hips Numbers don’t lie

Jamie came correct with receipts. The data shows that of the 1.89 billion requests from the fintechs in June, only 13% were initiated by customers. Ok, maybe JD’s got a point…

The rest of the API calls were for stuff like Robinhood updating its app or running security checks. JPM even claims some of the data was pulled to sell to third-party data aggregators. Honestly, pretty genius…

What does it mean?

Silicon Valley is clapping back at the Pierponts and Pierce & Pierces of the world. Duh. The masters of the tech universe claim the big bank fat cats are shaking them down for more cash. And the technocrats are concerned other banks will copy JPMorgan’s homework (… for good reason).

Obviously, the real losers here will be… us. Fintechs will pass on the fees, and some vibe coder at Plaid will figure out how to implement surge pricing if you want your money to make it from JPMorgan to Kalshi in 7-10 business days instead of 14.

It might sound crazy, but there's a much easier way to pay down debt faster…

Spoiler: using a credit card.

Here’s EXACTLY how to do it…

Find a card with a “0% intro APR" period for balance transfers

Transfer your debt balance

Pay it down as much as possible during the intro period

No interest means you could pay off the debt faster.

Now it’s time to find the right card…

Some of the top credit card experts identified one of their favorites that puts interest on ice until nearly 2027 AND offers up to 5% cash back on qualifying purchases.

+ “I hear Jackson Hole is beautiful this time of year.” - Azoria CEO James Fishback

I think I speak for all of us when I say, “thank you for fighting the good fight, Jimmy.” Fishback’s hedge fund sued to force the Fed to open up the closed-door FOMC meetings. And if you thought Nvidia earnings were electric, just imagine live-streamed Fed meetings…

Turns out, the Fed isn’t subject to the “Sunshine Act,” since it’s “independent” and all.

Fishback, a Trump ally, probably didn’t do himself any favors by making the rounds on TV to discuss the suit. The judge actually questioned if J-Fish was just trying to talk to his book vs. actually giving a damn about getting access to the Fed meeting.

+ Samsung from the clouds…

The company that ruins group chats with green text bubbles just beat out the Scottie Scheffler of chip fabs (see: TSMC) for a $16.5B contract. The buyer? Tesla. Perhaps you’ve heard of them. The proud owner of the chips was a bit of a mystery until Elon took credit on Twitter… because of course he did.

+ It appears that the Vegas Sphere’s $SPHR ( ▲ 2.31% ) entire marketing strategy revolves around catering to people with an insatiable appetite for psychoactive drugs. You might recall that the Sphere can’t stop re-upping the Dead & Co. residency. And now they’re playing a digitally enhanced version of ‘The Wizard of Oz.’ We’re one bad quarter from James Dolan saying f*ck it and giving the people the “Dark Side of the Rainbow” experience.

+ “It’s so f*cking big.” - investors looking at Figma’s IPO

Figma (think: Canva, but with a massive learning curve) just Supersized its IPO. It hiked its expected share price range from $25-$28 to $30-$32. That probably has something to do with it being more oversubscribed than Lily from the AT&T commercial’s “OnlyF*ns.” At the top end, the company would raise more than $1.2B at an $18B valuation.

+ We are so back…

+ “I would say it’ll be somewhere in the 15 to 20 range…” - me explaining to my wife how many beers I plan to consume (responsibly) during 18 holes of golf

Yesterday, while the dust was still settling from the US-EU trade deal over the weekend, POTUS said the agreement reset the global standard: “For the world, I would say it’ll [tariffs] be somewhere in the 15% to 20% range.”

I teamed up with some awesome newsletters to give you a little summer shopping spree.

One lucky winner will get a $2,000 Nike gift card to rebuild their entire sorry a** closet.

Entering to win is so easy your intern (you know, the one whose dad is your boss) could do it (although they would probably ask ChatGPT)…

Head to the giveaway website

Patiently wait (one lucky winner will be selected at random on August 8th)

So what are you waiting for? Enter right now.

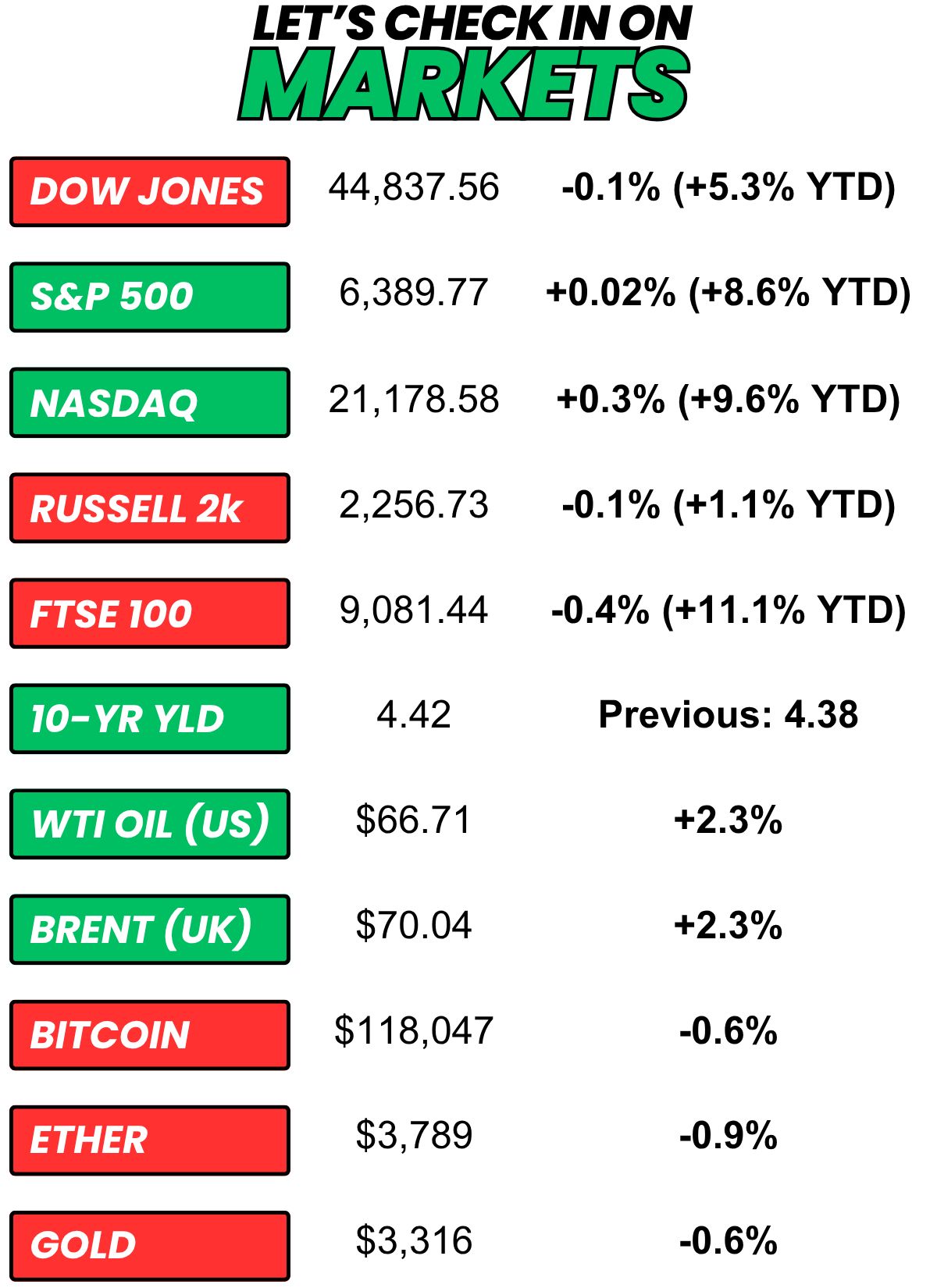

+ US stocks “eked out records Monday in relatively muted trading session as the US and European Union struck a trade pact. The market action kicked off a packed week of Big Tech earnings, a Federal Reserve meeting, inflation data, the July jobs report, and President Trump's Aug. 1 deadline to lock in key trade deals.” (Yahoo! Finance)

+ The 10-year yield was “higher on Monday as investors anticipated the Federal Reserve's interest rate decision later on Wednesday at the end of a two-day policy meeting, as well as a key inflation reading that will shed light on the effect of tariffs on the economy.” (CNBC)

+ Oil “rose 2% on Monday after a trade deal between the U.S. and the European Union, and U.S. President Donald Trump’s announcement that he would shorten the deadline for Russia to end its war in Ukraine or face sanctions.” (Reuters)

+ The “smart” money thinks there’s only a 9% chance daylight savings time becomes permanent this year. (Kalshi)

⏪ Yesterday…

+ Abercrombie & Fitch, Dick's Sporting Goods, and Macy's reported before the bell

+ Nvidia, Salesforce, e.l.f., C3.ai, Synopsys, SentinelOne, HP, Veeva, and Pure Storage reported after hours

+ Target officially ended its price-matching program after a ten-year run of matching prices that customers found for the same item at Amazon and Walmart

⏩ Today we’re keeping an eye on…

+ Best Buy, Royal Bank of Canada, Burlington Stores, Kohl's, Foot Locker, and Li Auto report this AM

+ Costco, Dell, Marvell, Zscaler, Ulta Beauty, Uipath, Elastic NV, NetApp, Ambarella, and The Gap report after hours

+ US Treasury Secretary Scott Bessent will meet with his Chinese counterparts in Stockholm to talk trade

Yesterday, I asked, “Is 37 mid or late 30s? Asking for a friend who is on the brink of a mid-life crisis.”

71.7% of you said “Late.“

Here’s what some of you guys had to say…

Mid: “30-33 early, 34-37 mid, 38-39 late.”

Late: “Ear hair and bulging eye brows begin their dominion at 37”

Mid: “58 is the new 50”

Late: “Mid life crisis only happen in your 40s, otherwise that's just a mental breakdown.”

Mid: “At that age, it just skips from "mid-30's" to "I'm 40".”

Here’s today’s question…

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.