TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

Metsera finally has a new home, RJ Scaringe (aka Rivian’s Elon) gets paid, and the slopcession has gone from bad to worse.

Enjoy the next 4 minutes and 3 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Heavyweights

IYKYK

Listen, I would never accuse the US FTC of purposefully c*ck-blocking a foreign company to ensure a bidding war was won by the good guys (a US company)…

Pfizer $PFE ( ▲ 2.03% ) (a US company) is the proud new owner of Metsera $MTSR ( ▼ 0.35% ) after a dog fight with Novo Nordisk $NVO ( ▼ 0.45% ) (a Danish company). The pissing match, which reached “Game of Thrones-level” according to one analyst, drove the purchase price up nearly 40%.

Pfizer’s first bid for the small pharma in late October was $7.3B. Novo Nordisk jumped in with a rival offer, which kicked off a bidding war. When the dust cleared on Friday, Metsera accepted Pfizer’s $10B bid and Novo bowed out with its tail between its legs.

So, what’s so special about Metsera?

Nothing… yet. Metsera’s weight loss drugs (think Ozempic on steroids) aren’t even approved by the FDA. And they’re not particularly close. One is still in Phase 1. And their “leading candidate” is in Phase 2.

Alley oop

Of course, Novo going all “and for that reason I’m out” might have had less to do with the price point and more to do with the FTC’s assist.

You see, the Federal Trade Commish made a call to Novo, raising concerns about “antitrust matters.” Perhaps you’ve heard of Novo’s drug Ozempic?

Pfizer, on the other hand, has yet to break through on its fat loss journey, hence its willingness to back up the Brinks truck.

State of Trust: AI-driven attacks are getting more sophisticated

AI-driven attacks are getting bigger, faster, and more sophisticated—making risk much more difficult to contain. Without automation to respond quickly to AI threats, teams are forced to react without a plan in place.

This is according to Vanta’s newest State of Trust report, which surveyed 3,500 business and IT leaders across the globe.

One big change since last year’s report? Teams falling behind AI risks—and spending way more time and energy proving trust than building it.

61% of leaders spend more time proving security rather than improving it

59% note that AI risks outpace their expertise

But 95% say AI is making their security teams more effective

Get the full report to learn how organizations are navigating these changes, and what early adopters are doing to stay ahead.

⚠️ Imagine scrolling by the ad above without supporting Vanta. They’re the reason the show goes on. Please show them some love by clicking here and checking them out.

+ “Aw, how cute.” - Elon

It appears that some of the classically trained “journalists” at CNBC and other “respected” financial publications couldn’t pass remedial math at the University of Phoenix. You see, Rivian $RIVN ( ▼ 1.79% ) CEO RJ Scaringe’s pay package announced Friday is being compared to Elon’s…

Here’s the problem… RJ’s package is worth up to $4.6B over the next decade. You might recall that Elon could make as much as $1T if everything goes according to plan. Technically, your paycheck is closer to RJ’s than RJ’s is to Elon…

To unlock said f*ck you money, RJ will need to get the EV maker’s share price to above $140 in the next ten years. It’s currently trading closer to $15. Did I mention they scrapped his previous pay package because the goals were too aggressive? Godspeed, RJ.

+ Ok, but how did they let someone get this close to the guy who has the fate of the human race in his hands?

+ I’m just glad Dave Thomas isn’t around to see this…

First, they took the sunroom from us. Now, Wendy’s $WEN ( ▼ 1.03% ) is looking to close as many as 300 locations entirely. We don’t know which locations will shutter, but CEO Ken Cook (yes, that’s his real name) said it will be in the “mid single-digit percentage.”

To be fair, it shouldn’t come as a surprise. The last time Wendy’s was down this bad, people were finding fingers in their chili. Despite a turnaround at some of its fast-food competitors, same-store sales at Wendy’s fell nearly 5% in the most recent quarter.

+ Is that bad?

The University of Michigan Consumer Sentiment survey plummeted in November, settling near its lowest level… ever. Participants claim that the government shutdown is their top concern. And I didn’t realize I was living in a country full of Buzz Killingtons…

+ Imagine thinking Americans want to treat their bodies like a temple.

The slopcession is real for Sweetgreen $SG ( ▼ 9.61% ). Shares fell more than 7% to an all-time low on Friday after reporting piss-poor earnings on Thursday. The overpriced salad joint can’t catch a break…

Literally anything that could have blown up in its face did. Like it “healthy” fries (which were removed from the menu after 5 months) and increasing its portion sizes by 25% (which led to no meaningful increase in sales, but lots of added cost).

+ I don’t know how much this head of HR is being paid, but it isn’t enough…

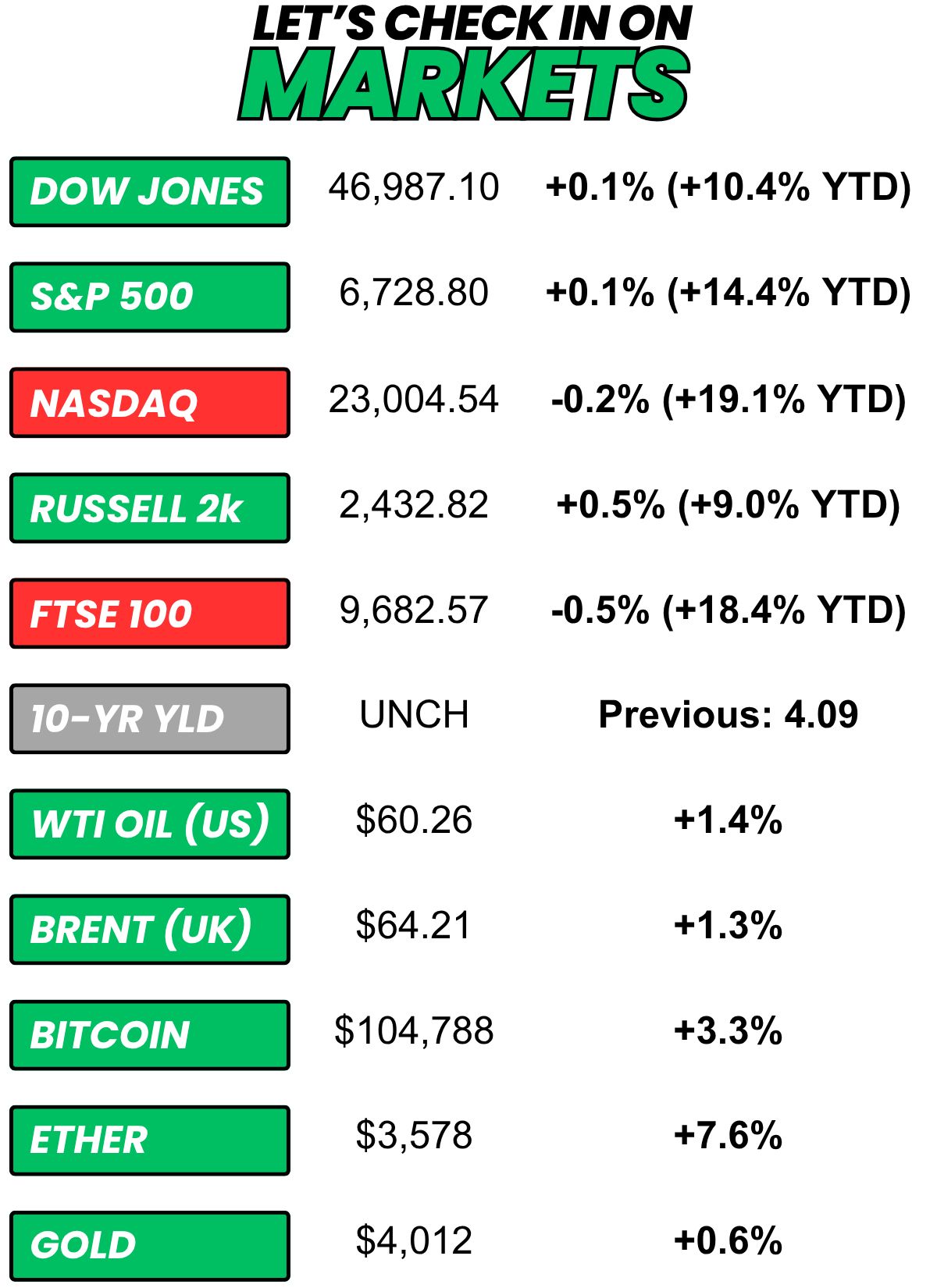

+ US stocks “came off session lows on Friday as investors weighed bearish consumer sentiment data and odds that the AI investment boom will pay off, while monitoring the ongoing US government shutdown for any signs of an end.” (Yahoo! Finance)

+ The 10-year yield was “little changed on Friday as investors continued to face an economic data blackout amid the U.S. government shutdown.” (CNBC)

+ Oil “prices rose Friday, reversing some recent losses on a softer dollar, although concerns over a supply glut and weakening demand still put crude on course for a weekly decline.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 48% chance of a major meteor (10 kilotons TNT equivalent or greater) hitting Earth before 2030. (Kalshi)

⏪ On Friday…

+ Constellation Energy, Enbridge, KKR & Co, and Duke Energy reported before the opening bell

⏩ Today we’re keeping an eye on…

+ Monday.com, Maplebear, Barrick Mining, and Pagaya report before the bell

+ Rocket Lab, CoreWeave, Rigetti, AST Spacemobile, BigBear.ai, Occidental, Plug Power, Terawulf, Microvast, and Paramount report after hours

Friday, I asked, “You have 90 minutes to kill at the airport. What are you doing?”

45.3% of you said, “Going to the bar.”

Here’s what some of you guys had to say…

Other: “Constantly checking the status of my flight to make sure it's not canceled. From the bar”

Doing laps: “Doing laps while constantly worrying that I've walked too far and I won't be able to make it back by the time my flight leaves.”

Going to a lounge (so, bar): “Using the some what cleaner and more private bathroom and eating way too many cubes of cheese. ”

Going to a lounge (so, bar): “Same answer even if I only have 9min…”

Going to the bar: “I sometimes choose flights with longer layovers just to hang at airport bars.”

Here’s today’s question…

You can only keep one Wendy's food item. Everything else disappears off the face of the earth. What you saving?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.