Hey there weekday warrior,

Here’s what’s on the docket today…

Palantir cannot be stopped, Elon’s yuge payday, and American Eagle gets its meme stock on again. But first…

Let’s take a look back at the August 5, 2020 edition of The Water Coolest…

You might recall one of the more outrageous stories from the pandemic (which is saying a lot)…

Back in July 2020, Kodak (yes, that Kodak) was awarded a $765M loan to begin manufacturing… generic pharmaceutical ingredients. For context, supply chains were a clusterf*ck, and bringing drug manufacturing on shore was top of mind. But even by 2020 standards, the pivot was a bit of a head scratcher.

The whole thing unraveled almost immediately, in pretty spectacular fashion. Kodak’s CEO (who managed to keep his job all these years) bought a f*ck ton of the company’s beaten-down shares the day before they submitted a proposal for the loan… without getting approval from the powers that be.

Kodak also leaked the story to the press the day before the official announcement, sending shares mooning and attracting the ire of the SEC.

Speaking of the SEC, two Kodak contractors who caught wind of the deal (and bought a boatload of stock) got hit with insider trading charges.

As you might have guessed, the White House hit pause on the loan and distanced itself from the dumpster fire. Uncle Sam eventually pulled the funding, and Kodak was left to continue its slow, painful death.

Enjoy the next 4 minutes and 39 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who recently started shopping at American Eagle again. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste forward The Water Coolest to you? Subscribe here.

God ‘tir

“F*ck if I know.” - the average Palantir investor when asked what they actually do

I mean, does it really matter if we know what Palantir $PLTR ( ▲ 0.92% ) does if they keep producing results like this?

In the words of DJ Khaled, all PLTR and its founder/CEO, Alex Karp, do is win. The company crushed the Street’s estimates on the top and bottom lines. And for the first time ever, it topped $1B in revenue for the quarter. BTW, analysts weren’t expecting that until Q4. In case you’re still not convinced of how epic a quarter it was, that represents 48% top-line growth…

Oh, and Palantir plans to keep doing whatever the hell it does at an extremely high level for the foreseeable future. The Peter Thiel-backed company hiked its full-year sales guidance from a range of $3.89B-$3.90B to $4.14B-$4.15B.

So what did Alex Karp’s crazy a** have to say?

Well, in his letter to shareholders, he took a shot at the haters (… per usual): “The skeptics are admittedly fewer now, having been defanged and bent into a kind of submission. Yet we see no reason to pause, to relent, here.”

He then proceeded to quote CS Lewis and kinda go off the rails, which is par for the course at this point and kinda adds to the mystique of it all.

Meanwhile, back on Earth…

In a CNBC interview, Karp said, “We’re planning to grow our revenue … while decreasing our number of people. This is a crazy, efficient revolution. The goal is to get 10x revenue and have 3,600 people. We have now 4,100.” We get it, Alex, you went to a Grant Cardone mastermind…

Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

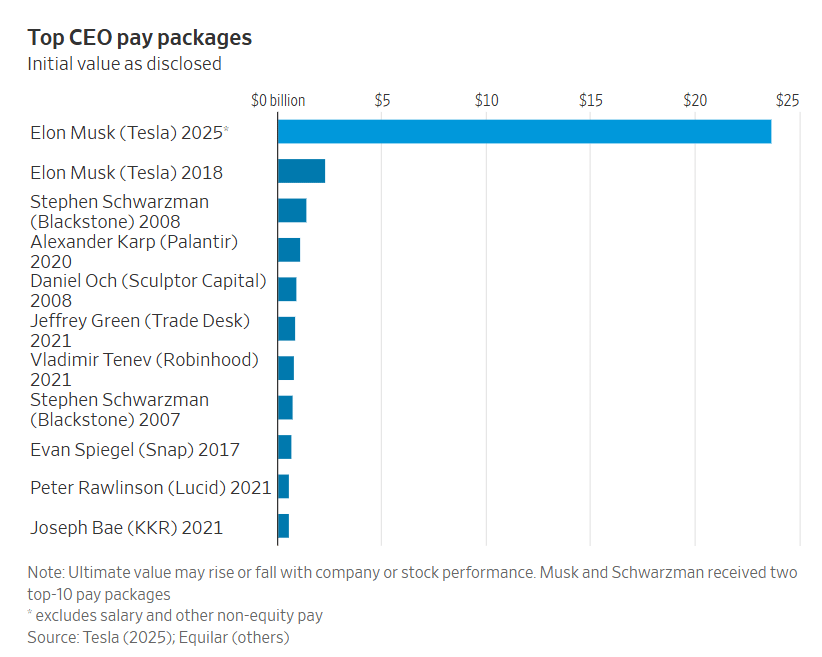

+ It appears Tesla’s board has never heard of Adderall…

Because it’s dangling a new $23.7B stock award in front of Elon to keep him “focused.” The Tesla $TSLA ( ▼ 1.49% ) CEO will secure the bag… as long as he sticks around for at least two years.

Before your inner Occupy Wall Street makes you go all “that’s entirely too much money for one human being,” keep in mind that Elon has run Tesla without a comp package for more than a year.

Friendly reminder: Elon’s $50B 2018 pay package was overturned twice by a Delaware judge. You might recall that a butthurt shareholder brought a suit against the former head of DOGE.

Side note: it’s hard to pick the most outrageous part of this chart…

+ “Look at me, I’m the captain now.” - Sydney Sweeney and American Eagle

Sure, GameStop $GME ( ▼ 0.29% ) was the original, but American Eagle $AEO ( ▼ 1.37% ) is this close to dethroning GME as King of the Meme Stonks. It’s got it all: brutal financials, one of the most famous women on Earth as a spokesperson (not you, Taylor Swift), a controversy that transcends markets, and, now, a Truth Social post from POTUS.

Shares of American Eagle popped 23% after POTUS said, “Sydney Sweeney, a registered Republican, has the ‘HOTTEST’ ad out there. It’s for American Eagle, and the jeans are ‘flying off the shelves.’ Go get ’em Sydney!” ICYMI, rumors were swirling over the weekend that Sydney is a registered Republican.

+ They can’t keep getting away with this. Shares of Spotify $SPOT ( ▲ 3.89% ) popped on news that the company was hiking subscription prices in the Middle East, Africa, Europe, Latin America, and the Asia-Pacific region. I’ll save you the click and *Ctrl-F “United States”*… have no fear, the US was spared… because prices in the States got a similar adjustment upwards last year.

+ Ok, maybe we all owe Vlad Tenev an apology. Remember that time Robinhood only granted retail boys and girls one singular share of Figma $FIG ( ▼ 2.75% ) at the IPO price? Well, maybe, just maybe, Robinhood and Vlad were trying to save us from ourselves all along. Shares of the Photoshop rip off plummeted 27% on Monday. Of course, it’s still trading well above its IPO prices of $33 after an epic first day.

+ This might be the best news millennials have gotten since JNCO jeans made a comeback. Elon is bringing back Vine. Yes, that 6-second video platform. He said that he recently “found” the full library of Vines. In addition to making those public again, users can make new Vines… via Grok’s text-to-image tech.

+ US stocks “jumped Monday as investors clawed back the steep losses seen in the previous session that were sparked by concerns over the U.S. economy and a new round of tariffs from the Trump administration.” (CNBC)

+ The 10-year yield “was little changed Monday as investors assessed the state of the U.S. economy and weighed the impact of President Donald Trump’s latest tariff rates.” (CNBC)

+ Oil “prices fell to their lowest levels in a week on Monday after OPEC+ agreed to another large output increase in September, adding to oversupply concerns after U.S. data showed lackluster fuel demand in the top consuming nation.” (Reuters)

+ The “smart” money thinks there’s a 43% chance the Minecraft Movie ends 2025 as the highest-grossing film of the year. (Polymarket)

⏪ Yesterday…

+ ON Semiconductor, Wayfair, BioNTech, and Tyson Foods reported before the bell

+ Palantir, Hims & Hers, MercadoLibre, Axon, Navitas, Vertex, Simon Property Group, Diamondback Energy, and Vimeo reported after hours

⏩ Today we’re keeping an eye on…

+ Pfizer, Caterpillar, Lemonade, Recursion Pharmaceuticals, BP, Marriott, Zoetis, DigitalOcean, Shift4, Archer-Daniels-Midland Company, Eaton, Duke Energy, Marathon Petroleum, Dupont, and Leidos report this AM

+ Advanced Micro Devices, Super Micro Computer, Arista, Rivian, Astera Labs, Upstart, Toast, Lucid, Zeta, Snap, Amgen, Coupang, Opendoor, Powell, Devon Energy, Centrus Energy, and Aflac report after hours

+ Alibaba will hold its annual meeting

+ The Treasury Department will make a buyback announcement

Yesterday, I asked, “What's your go-to work bag?”

65.3% of you said “Backpack.”

Here’s what some of you guys had to say…

Shoulder bag: “Old school Tumi. Not one of these backpack nerds.”

Backpack: “It is at least a heavy duty Milwaukee one and not a Jansport (I am in the construction industry)”

Tote Bag: “As a woman, only one of these answers is correct.”

Other: “Golf Bag - I hate work.”

Backpack: “How else will I hide my contraband?”

Shoulder bag: “Laptop bag. Can be hand carried, cross bodied, or shoulder. Or thrown in frustration in the backseat.”

Here’s today’s question…

You can only be entertained by one music streaming service or one TV streaming service for the rest of your life. If you choose a music platform, it means you pretty much get access to ALL music and podcasts available. Choosing a TV streaming platform means you only get what’s on the one streamer you choose. No, you can’t switch platforms.

Oh, and YouTube is off the table. That’s too easy of a choice.

Which one are you keeping?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.