Hey there weekday warrior,

TikTok is ready to take its case to the highest court in the land.

Enjoy the next 4 minutes and 27 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

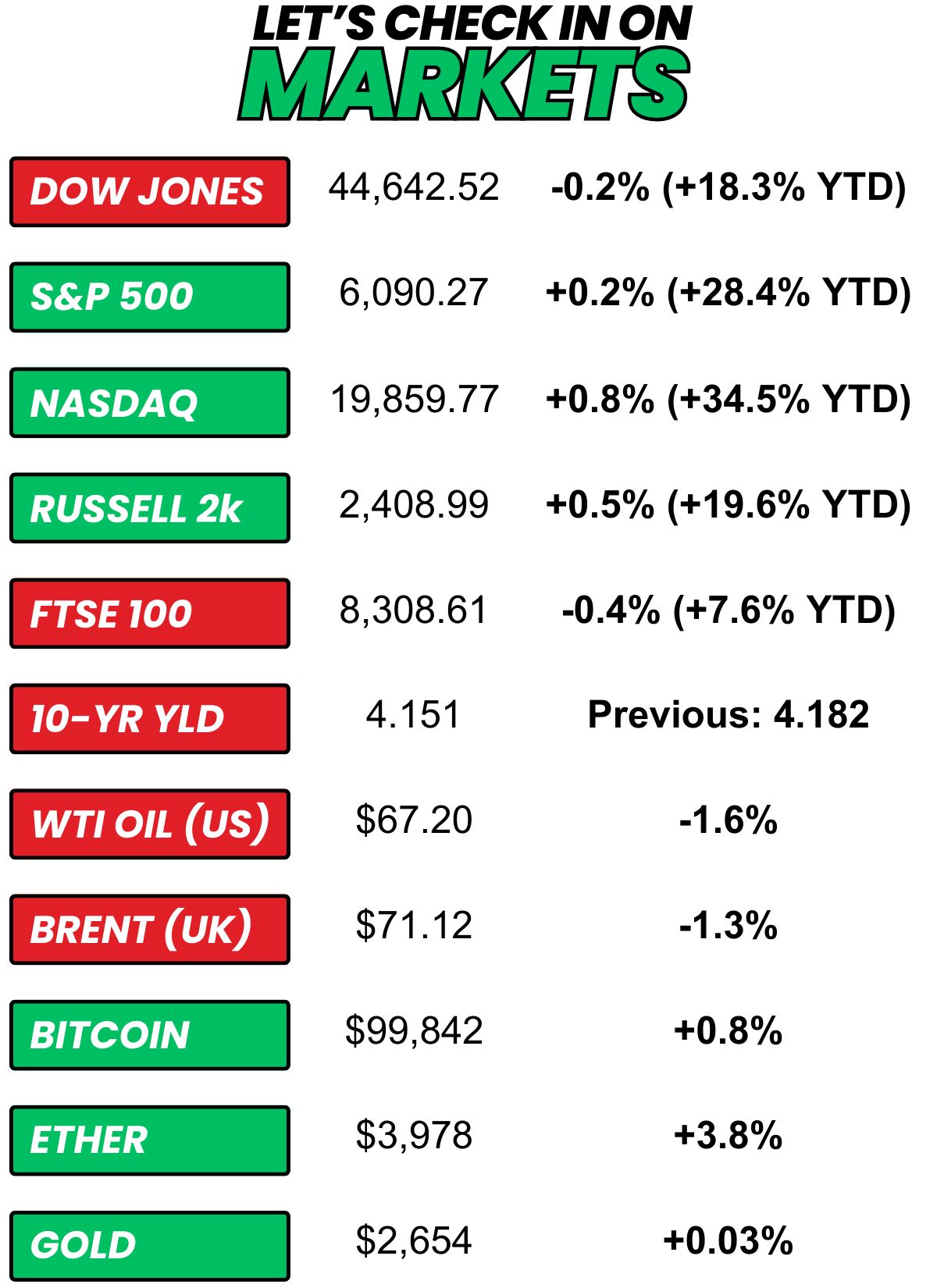

+ “The S&P 500 and Nasdaq rose to fresh records on Friday after November jobs data came in slightly better than expected, but not so hot as to deter the Federal Reserve from cutting rates again later this month.” (CNBC)

+ The 10-year yield “declined 3 basis points to 4.15%, from 4.18% on Thursday, and finished at its lowest level since Oct. 18. For the week, it fell 4.2 basis points.” (MarketWatch)

+ Oil “fell by more than 1% on Friday and cemented weekly losses as analysts projected a supply surplus next year on weak demand despite an OPEC+ decision to delay output hikes and extend deep production cuts to the end of 2026.” (Reuters)

+ Bitcoin “hopped back above the $100K mark early Friday afternoon, breaching the six-figure realm around 12:45 pm ET.” (Decrypt)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Tesla +5.3% 2) MicroStrategy +2.2% 3) C3.ai, Inc. +8.0%

The market moves you need to know about…

+ So, who’s going to tell DocuSign investors that you can sign documents online for free now? Shares of DOCU (real bummer they didn’t secure SIGN) mooned 27.8% on news of a huge top and bottom line beat.

+ Super Micro Computer lives to fight another day. SMCI popped 8.9% after hours on Friday following the Nasdaq’s decision to grant it an extension on the time it has to submit its outstanding financials. SMCI is at risk of being booted from the Nasdaq exchange thanks to its plummeting stock price and inability to produce financials for last year.

Natural Is planning to list on the Nasdaq

This is a paid advertisement for Med-X’s Regulation CF Offering. Please read the offering circular at https://invest.medx-rx.com

Natural solutions are already better for the environment. Med-X is taking it a step further: their natural pesticides outperform various chemical alternatives. Better yet, they’re taking on private investors as they plan their Nasdaq listing (ticker: MXRX). And you now have a limited time to invest before it happens. Med-X has had 200% revenue growth in five years. And with the pesticide market expected to grow 3X by the end of the decade, now is the perfect time to join them.

Get ready with me to go to the Supreme Court

TikTok is about to go the way of Google+ in the US…

On Friday, a panel of three judges, who are presumably long Meta, went all ‘not on my watch.’ They upheld a lower court’s judgment that would force ByteDance to sell TikTok or face a ban on January 19th.

And can we all agree the 18th of January is going to be like ‘The Purge’ but instead of murder it’s just unhinged social media content?

You might recall that back in April, POTUS inked a bill into law that would force TikTok to sell its US operations to a friend of Uncle Sam. Why, you ask? Well, Congress isn’t stoked that ByteDance is in bed with the Chinese Community Party.

Politicians have real concerns that TikTok presents a national security threat (a weapon of mass destruction if you will…). China and Bytedance stand accused of brainwashing the American populace and hoovering up the data of more than 170M US users. If you thought the Ashley Madison leak was bad, just wait til President Xi makes your TikTok search history public…

So, what’s next?

ByteDance is going to put some of that internet money to work by appealing the appellate court’s decision. Next stop: the Supreme Court.

TikTok said: “The Supreme Court has an established historical record of protecting Americans’ right to free speech, and we expect they will do just that on this important constitutional issue.” Friendly reminder: the Supreme Court has to agree to take a case…

If the Supreme Court does hear what TikTok has to say, it certainly wouldn’t be on the docket before January 19th. This means, that unless the social platform gets a stay (think: Zack Morris timeout, but for laws), it’ll be banned (assuming it hasn’t lined up a buyer).

Technically, President Biden can give TikTok 90 extra days to get its sh*t together. And there’s a chance Donny Politics steps up to support TikTok, although legally it’s not entirely clear how he’d be able to lend a hand.

Of course, Bytedance could find a buyer. Preferably, someone whose money reeks of American exceptionalism.

Or they just let time expire and go quietly into the night. That would mean app stores could no longer offer TikTok for download, and the company wouldn’t be able to fire off updates to current users (spoiler: the app would eventually become unusable).

+ “It’s so f*cking big” - everyone seeing the November jobs report

According to the Bureau of Labor Statistics, the US economy added 227k jobs in November. That was above expectations of 214k (because, math). Oh, and October’s figure was upwardly revised in a big way.

It appears that J-Poww might have gotten a sneak peek at Friday’s data. You might recall last week that Jerome indicated the US economy was in great shape and the Central Bank planned to be patient with interest rate changes.

+ If you come for the [Draft]King, you best not miss

DraftKings (-1.2%) and FanDuel may soon be facing some antitrust heat from the FTC and/or DOJ. Pitchforks in hand, Senators Mike Lee (R, UT) and Peter Welch (D, VT) have joined forces to request a witchhunt an investigation into potential collusion on the part of the online gambling juggernauts. Vlad Tenev must be salivating at the timing (friendly reminder: Robinhood is considering entering the sports gambling space).

+ It could be worse, AMC investors, Adam Aron could have bought another gold mine…

Despite a killer holiday movie szn, with Wicked, Moana 2, and Gladiator II all hitting theaters, AMC (-9.0%) still kinda sucks. Shares dipped on the news that AMC is out here holding space to issue and sell 50 million new shares by way of their friends at Goldman Sachs.

AMC plans to use the new liquidity to pay down debt and invest in their AMC Go Plan, which apparently has nothing to do with creating bathroom breaks during 3-hour movies.

+ Remember when Starbucks’ biggest problem was the color of their ‘holiday’ cups? HQ wishes they had it so good…

*Rocky music starts playing* Starbucks’ (+0.8%) comeback is in full swing. Its latest plan? Speed. CEO Brian Niccol, of big burrito fame, wants his blue-hair baristas to deliver your cup of Joe faster than you were on prom night (read: 30 seconds or less).

This goal is the latest in Niccol’s playbook to bring efficiency back to Starbs. In addition to pursuing a speedier customer XP, Niccol recently slashed corporate bonuses by 40%… because jet fuel ain’t cheap, you guys.

+ This week on Reddit: Should you open a PayPal Savings account? I would take investment advice from the Hawk Tuah girl before I took it from Reddit…

🔥 A crypto millionaire has launched a nationwide ‘treasure hunt’—and hidden multiple bitcoin worth more than $100,000 each. Sign. Me. Up.

FYI, TWC might be compensated if you click on the links above. So, what are you waiting for? Start clicking.

⏪ Friday we got the November jobs report.

⏩ Today we’re keeping an eye on…

+ Oracle, C3.ai, and MongoDB report after the close

Friday, I asked, “You get $20k a month for the rest of your life, but you can't take a warm shower/bath (it's not freezing, but let's say just below room temperature, so it kinda sucks) for the rest of your life. You taking the deal?”

79.3% of you are taking the money. And FAR too many of you already take cold showers. What is wrong with you people?

And here’s today’s question…

You get paid $3M per year to be the CEO of one of the major health insurers in the US (think: UnitedHealth, CVS, Cigna) but the first thing have to do is increase claim denials by 10%. And you cannot have personal security detail. Do you take the job?

🔥 Billy Long (Donald Trump’s pick to lead the IRS) is a former auctioneer. This video of him going full auctioneer mode on Capitol Hill while discussing the national debt is awesome…

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.