Hey there weekday warriors,

Tesla put the Nasdaq on its back yesterday… and Dominos just outpizza’ed the Hut. Enjoy the next 4 minutes and 3 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

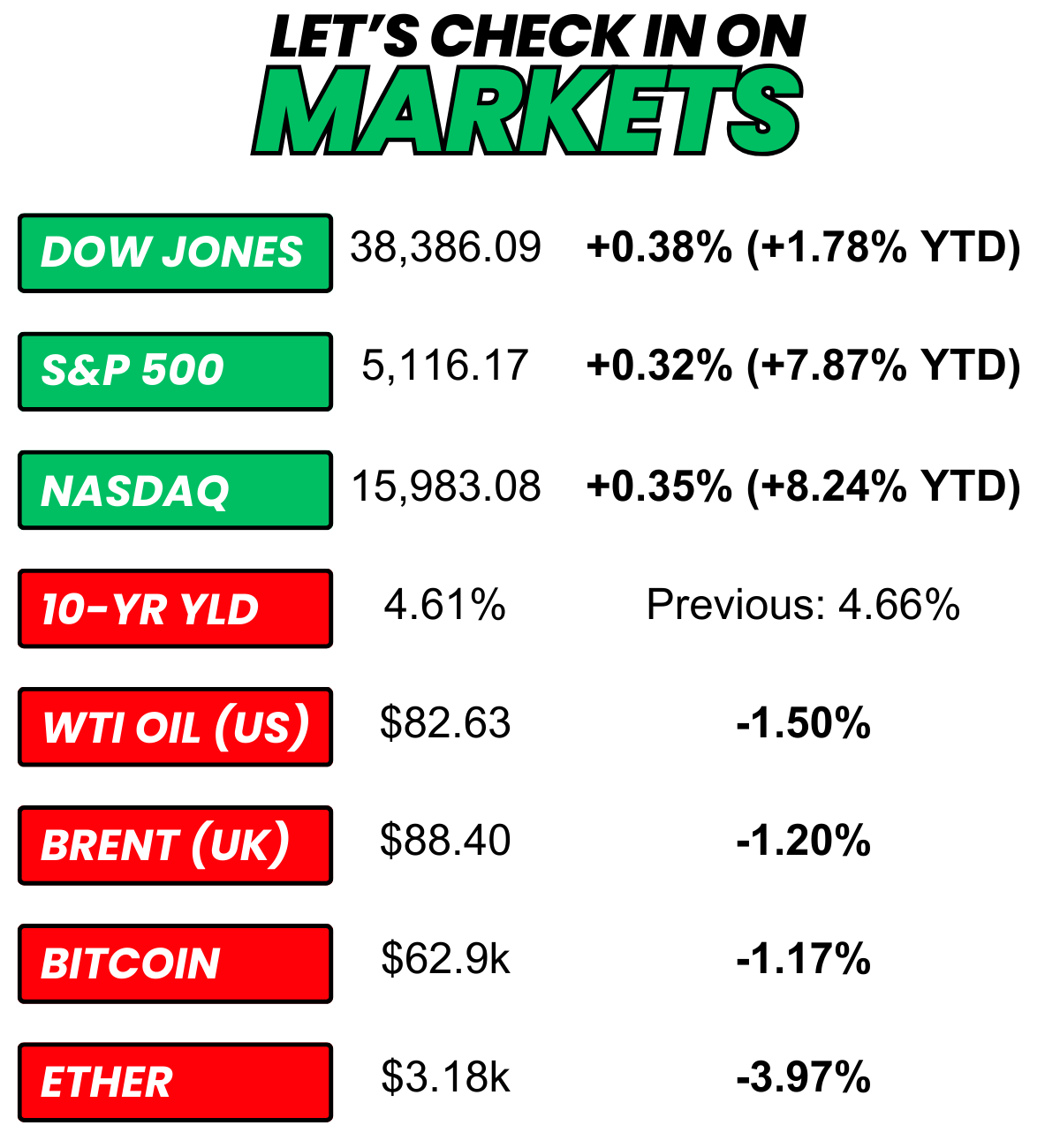

+ US stocks “closed higher on Monday to kick off a big week filled with a Federal Reserve rate decision, the monthly jobs report, and earnings from more ‘Magnificent Seven’ tech heavyweights.” (Yahoo! Finance)

+ The 10-year Treasury yield “declined on Monday as investors looked ahead to the Federal Reserve policy meeting and economic data scheduled for this week." (CNBC)

+ Oil “lost more than $1 a barrel on Monday as Israel ceasefire talks in Cairo tempered fears of a wider Middle East conflict, while U.S. inflation data dimmed the prospect of imminent interest rate cuts.” (Reuters)

+ Bitcoin “slipped on Monday as sentiment towards cryptocurrencies remained dour in the face of higher-for-longer U.S. interest rates, while changes to collateral rules by the DTCC also presented some headwinds for crypto.” (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Tesla +15.3% 2) Nvidia +0.0% 3) SoFi -10.4%

The market moves you need to know about…

+ Fulton Financial rose 7.5% on Monday after the bank took over Republic First Bank, which was closed down by the FDIC on Friday.

– What else would expect from Chamath-backed SPAC? SoFi fell 10.5% after reporting top and bottom line beats… but a disappointing outlook.

+ Fintech Dave jumped 10.3% thanks to an upgrade from JMP Securities. DAVE is up more than 450%… this year.

Full service

(Source: Giphy)

I’m not entirely sure what Elon did on his trip to China over the weekend, but it’s really starting to feel like he pulled an Andy King…

Because following his surprise visit on Sunday, Tesla (+15.3%) announced that full Full Self Driving would be available in China. FSD has technically been an option in China for years. But the capabilities have been, well, limited. Think: super missionary stuff like lane change assist that a base-model Hyundai can probably do.

The decision is suspicious, considering the same people who signed off on letting Tesla kill people in China had banned Elon’s EVs from certain government properties, claiming they could be used to collect data for the US.

But there’s a catch…

Did you really think the People’s Republic was about to let a loose cannon like Elon do whatever he damn well pleases?

Tesla “signed a deal” (read: was forced at gunpoint) with China’s Baidu to access the company’s mapping and navigation services. Was TomTom not available?

Turns out that having this type of navigation system is a requirement for operating any sort of advanced autonomous driving tech in China. Clearly, a squeaky-clean safety record is not a prerequisite…

Huge W

Elon can’t stop racking up trophies after a brutal start to 2024.

First, he indicated that the Model 2 project was alive and well. Then, this coup… in a competitive market full of (domestic) talent, no less.

+ Paramount (+2.8%, +0.4% after hours) CEO Bob Bakish just got “stepped down” by the real-life Logan Roy…

The move was widely expected. Bob had pissed off Shari Redstone, the matriarch of the family that owns a majority voting stake in Paramount.

You see, Shari wants to sell Paramount to nepo baby David Ellison (spoiler: Larry Ellison’s son) and Skydance. Bob was against the deal, and was apparently willing to die on that hill.

From here on out, a “special committee” will act as CEO. Of course, the job should be pretty easy… sign on the dotted line when the sale agreement is put in front of you.

+ Philips (+26.7%) could never put a price on a human life, but if it had to, it’d definitely be $1.1B.

Shares of the medical device maker (which should probably just stick to toothbrushes…) soared nearly 30% after it settled with the US to make a bunch of personal injury suits go away. The three-comma settlement marks the end of litigation related to its shoddy sleep apnea machines.

A component in the machines was linked to cancer… allegedly. Of course, we’ll never know for sure because Philips didn’t need to admit guilt or indicate whether the Respironics machines actually made snorers take dirt naps.

+ Welp, you guys can all stop trying… someone just outpizza’ed the Hut…

Domino’s just posted a huge quarter. Revenue was in line with expectations, while profit beat the Street’s estimates. Same-store sales growth of 5.6% was also girthier than expected.

The less racist Papa John’s put on a masterclass in marketing… again. It made tweaks to its loyalty program, including the “Emergency Pizza” promo, that helped increase sales among all income groups. That’s a bfd considering chains have reported falling sales among lower-income consumers.

+ In what is arguably the most un-American thing since terrorism was invented, Comcast’s (+0.7%) Peacock is jacking up its prices right before the Olympics. Both its ad-free and ad-supported tiers will increase by $2 per month.

+ Family offices are looking beyond the stock market for higher returns, new report finds (Read)

+ Harvard professor who teaches a class on happiness: The happiest people balance and prioritize 3 things (Read)

+ Hands Down Some of the Best Credit Cards for Balance Transfers (Read)

BTW, some of these links include affiliate offers.

Yesterday, earnings reports from ON, Microstrategy, SoFi, Domino’s, and Paramount were on our radar. Here’s how they did…

+ ON Semiconductor rose 4.0% after reporting a top and bottom line beat before the bell yesterday. Investors didn’t seem to give a damn about the company’s lackluster outlook.

+ Microstrategy fell 2.6% in extended trading after reporting a much (and I do mean much) bigger-than-expected loss.

+ Check out more on SoFi, Domino's, and Paramount above…

Here's what we’re keeping an eye on today...

+ Eli Lilly, Coca-cola, McDonald's, PayPal, 3M, and Sirius XM report this AM

+ Amazon, AMD, Starbucks, Super Micro Computer, and Pinterest report after the close

+ It’s the close date for the Russell 2000 restructuring

+ The FOMC (read: rate decision) meeting gets underway. We’ll have to wait until Wednesday to be disappointed by J-Poww.

Yesterday I asked… Are you cool with day trip fees for cities?

67.8% of you think it’s a weird move.

Here’s today’s question…

What's your go-to pizza move?

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional