Hey there weekday warriors,

Today we’re talking FTX bankruptcy, Disney & Warner Bros. collab, and a whole lot more. Enjoy the next 4 minutes and 8 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

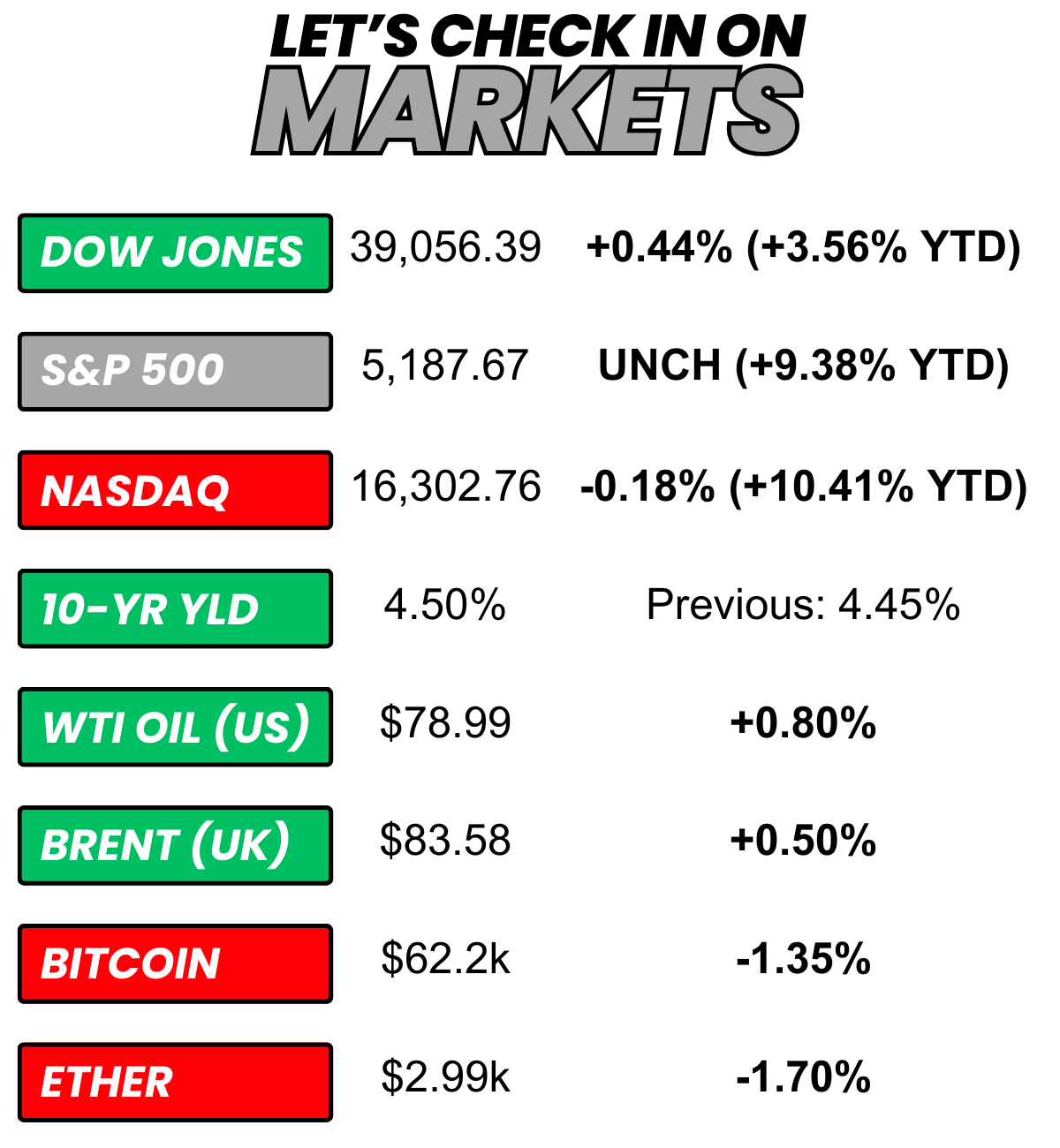

+ US stocks “were a mixed bag on Wednesday as investors tried to read the rate-cut runes and weighed a fresh batch of earnings reports for insight into the chance of a corporate America-spurred revival.” (Yahoo! Finance)

+ The 10-year Treasury yield “rose slightly Wednesday as investors weighed the latest remarks from Federal Reserve officials and looked for clues on the path ahead for interest rates." (CNBC)

+ Oil “settled higher Wednesday even as U.S. oil supplies fell less than expected, though signs of a pick up in refining activity ahead of the U.S. summer driving season boosted sentiment.” (Reuters)

+ Bitcoin “slid on Wednesday, further reversing a rebound seen over the weekend as persistent concerns over more regulatory scrutiny against the cryptocurrency industry kept traders largely wary of buying in.” (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia -0.1% 2) Arm -1.6% // -8.9% after hours 3) Robinhood -0.7% // +4.2%

The market moves you need to know about…

– We all know how this movie ends. Despite an earnings beat, shares of AMC dipped 3.7% on news that its cash pile shrunk by nearly 30% in the quarter… and the company isn’t even remotely close to profitable.

– Shopify just got its d*ck kicked in. The company beat on the top and bottom lines but tumbled 18.5% because of investors’ sky-high expectations. SHOP expects 19.5% sales growth, which was in line with expectations, but below the 20%+ that markets have come to expect…

– Imagine not being impressed by 55% growth in daily active users. Duolingo surpassed 30M (31.4M to be exact) DAUs… and investors gave exactly zero f*cks. DUOL fell 11.7% after coming up shy of the Street’s lofty growth expectations.

Paid in full

(Source: Giphy)

Put some respect on his name…

FTX CEO John Ray has posted some girthy returns since taking over from former CEO Sam Bankman Fried (perhaps you’ve heard from him).

And that’s good news for FTX customers. The financially (and morally) bankrupt crypto firm said it plans to return 100% of customer’s holdings (as of November 2022)… plus interest. Bro, stop showing off.

Friendly reminder: creditors are typically able to collect pennies on the dollar (at best) in bankruptcies.

Just one problem…

It’s probably worth noting that even though FTX bag holders will be made whole and earn some interest (the number is expected to be ~118% of their original balance), the figure will be based on 2022 crypto prices.

So, if you held Bitcoin, which has nearly quadrupled since November 2022, you won’t realize any of that upside. Oof.

Of course, that’s the reason everyone’s getting their money back…

The new FTX has benefitted from the run-up in crypto… following the collapse that caught SBF with his pants down back in 2022.

Before the FTX house of cards crumbled in November 2022, bitcoin was trading near $16k. As of last night, it was changing hands for more than $60k.

FTX also cashed in on AI mania. SBF had invested ~$500M (of stolen money) into Anthropic, an OpenAI competitor. FTX recently unloaded its stake for $884M. And some of us owe SBF an apology…

+ Ok, hear me out… ‘cable’… - Don Draper

Disney (+0.04) and Warner Bros. Discovery (+0.3) are collabing to double-team Netflix… again. Friendly reminder: DIS and WBD are also launching a sports super-app with Fox.

The most recent product has a broader appeal. Think: a bundle including Disney+, Hulu, and Max. The companies didn’t announce pricing, but it will likely be cheaper than buying individually. It’ll be available as ad-supported or ad-free.

For those of you unable to keep up with the clusterf*ck that is the streaming landscape, that means TNT, TBS, CNN, Discovery Channel, Food Network, Disney Channel, plus HBO, Disney+ and Hulu will all be available for one monthly fee. Sorry, fans of obscure sports, ESPN+ won’t be part of the offer…

+ Well, well, well, how the turntables…

Just a day after Lyft shares popped after it posted a huge quarter, its big brother Uber (-5.7%) did its best Dale Earnhardt impression.

Shares got killed after the company posted a larger-than-expected loss (spoiler: Lyft turned a profit) and dropped guidance that didn’t impress the Street.

+ The Uber for other people’s houses (…which definitely have spy cams in the bathroom) suffered a similar fate on Wednesday…

Airbnb (-1.2% // -8.4% after hours) stumbled after hours thanks in large part to guidance that was weak af.

+ Ok, well chip designer Arm definitely mooned on the day, right?

Nope. In what has to be one of the most puzzling reactions to an earnings report in recent memory, Arm shared blowout earnings and current guidance that bested the Street’s expectations. Still, shares fell almost 9% on the day.

Arguably the only red flag was that full-year guidance was roughly in line with analysts’ estimates.

+ Why it’s sometimes okay to go with the flow, says this CEO (Read)

+ Americans are sitting on a record amount of tappable home equity at $11 trillion — here’s how much cash is trapped in your home (Read)

+ Amazon Prime ads are about to get more annoying (Read)

Yesterday, we were keeping an eye on earnings reports from Airbnb, Uber, Shopify, Arm, Duolingo, and AMC. You can check out all the results above.

Here's what we’re keeping an eye on today...

+ Warner Bros. Discovery, Roblox, Yeti, and Papa John's report this AM

+ Dropbox and Marathon Digital report after the close

+ Snap, Meta, and Reddit leadership will speak at Bloomberg’s Tech Conference

+ Weekly jobless claims report drops

Yesterday, I asked, “What’s the best energy drink in the game?”

The top 3:

Celsius (by a mile)

Red Bull

Monster

Here’s today’s question…

Because I cannot believe Duolingo has 30M active users…

How many languages can you speak?

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional