Hey there weekday warriors,

Here’s what we’re getting into today…

Another Boeing CEO crashes and burns

Truth Social is set to start trading

Adam Neumann makes a play for WeWork

Enjoy the next 4 minutes and 27 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

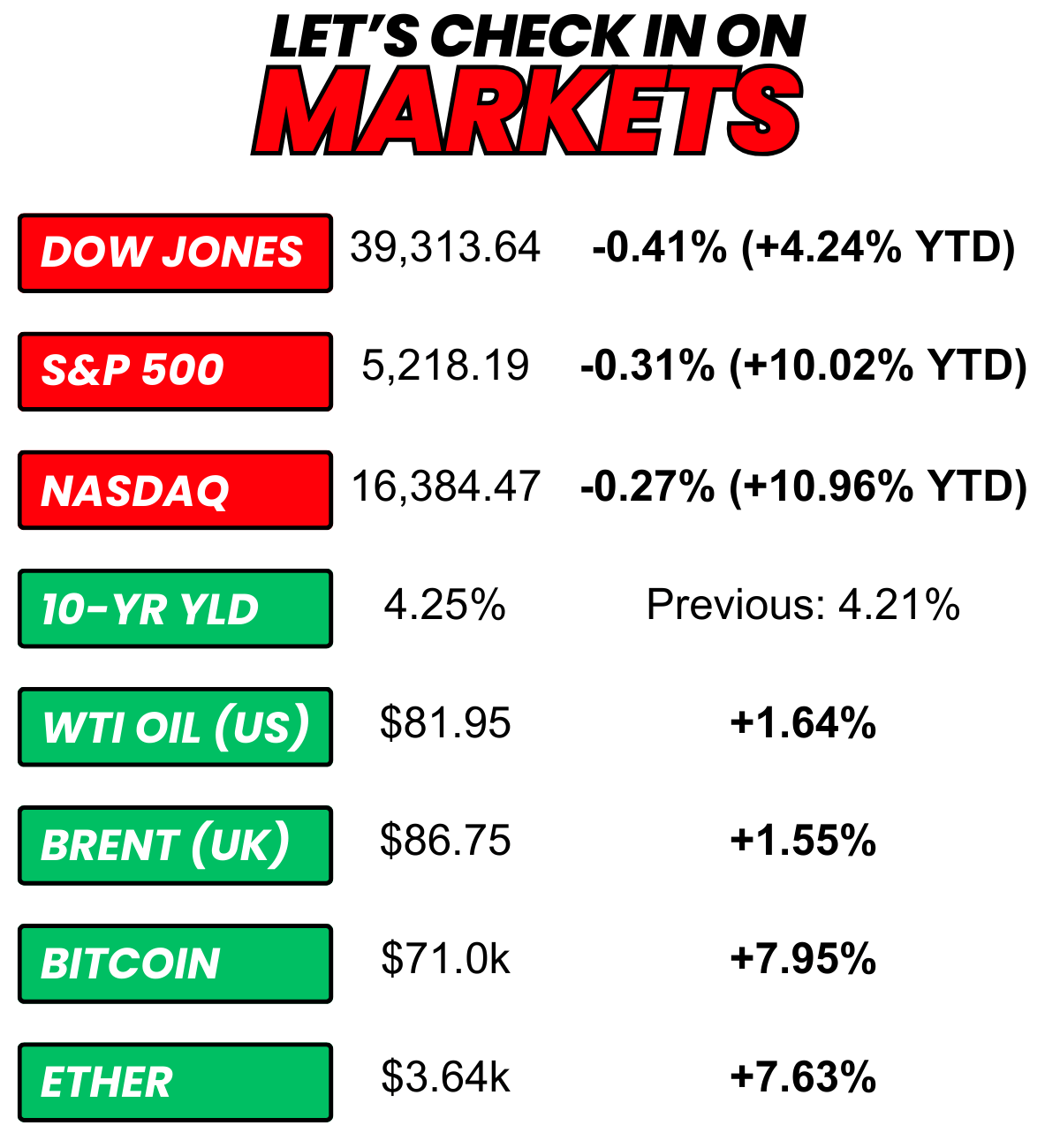

+ US stocks “slipped Monday to start a shortened trading week as the rally that brought Wall Street to record levels took a breather.” (CNBC)

+The 10-year Treasury yield “rose slightly on Monday as investors awaited fresh economic data slated for this week that could provide hints about the state of the economy.” (CNBC)

+ Oil “settled higher on Monday as orders from the Russian government to curb oil output, and attacks on energy infrastructure in both Russia and Ukraine offset the United Nation's demand for a ceasefire in Gaza.” (Reuters)

+ Bitcoin “spiked to start the final week of March, reclaiming the $70,000 level.” (CNBC)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Digital World Acquisition Corp. +35.2% 2) Nvidia +0.7% 3) Reddit +30.0%

Which has you sweating more?

A) Your gym session

B) Your boss just put a random meeting on your calendar (without an agenda)

Whichever it is, it's time to recover with LMNT.

LMNT is a delicious electrolyte drink that replenishes your body with its science-backed ratio of 1000mg sodium, 200mg potassium, and 60mg magnesium to help prevent dehydration.

Oh, and right now you can get a FREE sample pack with any purchase.

This is a sponsored post. The best way to support The Water Coolest is by showing our ad partners some love (think: clicking, taking a look around, etc.).

The market moves you need to know about…

– I have some bad news if you thought your next car was going to be a Fisker. Shares of the EV maker crashed 28.1% on news that the major automaker it had been negotiating with has pulled out of talks. Translation? Fisker is almost certainly headed for bankruptcy…

+ Reddit is already getting its meme stonk on. After a brutal second day of trading on Friday, the newly minted social media stock climbed 30.0% on Monday.

– Wait, what? Vimeo fell 27.2% because… well, no one actually knows why.

Flight risk

(Source: Giphy)

RIP Dave Calhoun.

He’s not dead or anything… but his career probably is.

The CEO of Boeing (+1.3%) announced that he plans to step down at the end of 2024. He said it was 100% his decision… which means it 100% was not.

And everybody is thinking the same thing… how did it take so long to make arguably the most obvious personnel move of all time? Friendly reminder: the Alaska Airlines door plug blowout happened on January 5th…

It might have had something to do with pressure mounting from the manufacturer’s biggest customers. Airline execs have pushed for meetings with Boeing to demand answers.

And in recent weeks, a handful of Boeing’s partners made very public announcements that the plane maker’s inability to, you know, make planes, would negatively impact their financial situation.

Oh, and a series of other near misses that got a TON of media attention (see: landing gear falling off a Boeing jet, etc.) probably didn’t help Calhoun’s cause.

Dave isn’t the only one whose career is death-spiraling, though…

Larry Kellner, the current chairman of the board won’t run for re-election and Stan Deal, the President and CEO of Boeing’s commercial biz is out immediately.

The search for a new CEO will be led by the new chairman of the board. And we can all agree there is only one man for the job, right?

Tyler’s take… There is a 0.0% chance Calhoun will make it until the end of the year.

+ 34-year-old making $49,000 a month in passive income: What I always tell people who want to build successful side hustles (Read)

+ Some of the Best Credit Cards for Balance Transfers (Read)

+ An engineer who landed a $300,000 job at Google shares the résumé that got him in the door — and 3 things he'd change on it today (Read)

BTW, some of these links contain affiliate offers.

+ FTX? *takes drag of cigarette* I haven’t heard that name in years…

Good news, FTX bag holders… the FTX estate is getting liquid. SBF’s former crypto exchange is unloading about two-thirds of its stake in AI startup Anthropic for ~$800M. FTX had bought a minority stake in Anthropic for $500M back in 2021.

The UAE’s sovereign wealth fund will take more than $500M worth of Anthropic shares off of FTX’s hands. Fidelity, HOF Capital, and Jane Street will also get in on the action. Yes, the same Jane Street where SBF and Caroline Ellison worked and met…

+ Define “key person risk”…

On Friday, shares of DWAC (+35.2%) got their cheeks clapped on fears that Donald Trump would use his roughly $3B stake in the company to finance his legal fights.

Welp, on Monday, shares jumped 35% after a NY appeals court cut his $454M bond payment to just $175M.

ICYMI, DWAC will officially merge with Trump Media and Technology Group today and begin trading under the ticker symbol DJT.

+ Time really is a flat circle. Hall of Fame corporate villain Adam Neumann has officially made a ~$500M bid to buy WeWork (+216.4%) out of bankruptcy. Last month, Adam sent a note to WeWork’s board indicating that he planned to make an offer. At the time, Neumann name-dropped Dan Loeb’s Third Point as a partner, but it’s still not clear if that’s who is financing the deal.

+ Welp, we’re about to find out who the “cool parents” are in Florida. The state passed a law that would bar minors under 14 from having social media accounts. Sorry 13-year-olds, you’re not grandfathered in. Apps will be forced to delete accounts for anyone they believe to be under 14.

14 and 15-year-olds can annoy their parents to sign off on an account. But if they can’t convince their legal guardians (or fake their signature) they too will be banned.

This would likely be a nightmare for social media platforms to manage and would expose them to all sorts of legal pitfalls. On the bright side, a Federal judge in Arkansas blocked a similar law last year…

Here's what I'm keeping an eye on today...

+ GameStop reports… in case anyone still cares

Yesterday, I asked, “If you’re a manager…. do you care if your employee is microdosing at work?”

Welp, I know that I wouldn’t want to work for at least 65.3% of you guys. Most weekday warriors would rather an employee not microdose on the job…

Here’s today’s question…

Ok, so this isn’t exactly finance-related, BUT… Shohei Ohtani finally addressed allegations that his interpreter stole $4.5M from him to cover gambling debts. So…

Shohei Ohtani is definitely the one with the gambling problem, right?

Oh, and…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.