TOGETHER WITH

Hey there weekday warrior,

AirPods are getting a new feature (… that Google had like 5 years ago).

Enjoy the next 4 minutes and 30 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Do you understand the words that are coming out of my mouth?

RIP to the Duolingo owl (for real this time)…

Apple $AAPL ( ▼ 3.21% ) is (reportedly) about to roll out an upgrade that would allow AirPods to translate language(s) in real-time. Essentially, your phone would be able to listen to someone speaking a different language and play it through your headphones live in your native tongue. Absolute game changer for people who look like extras in White Lotus hoping to berate their cleaning people in real time.

Sound familiar? That's probably because Google Pixel Buds have been doing this for years. Tim Cook gonna Tim Cook. Oh, and, yes, you have been able to translate on your phone thanks to Apple’s (you guessed it…) Translate App since ~2020.

According to “sources,” you might be able to get your hands on the new feature in H2 2025 when iOS 19 drops. Of course, if the Apple Intelligence rollout and Siri AI overhaul are any indication, it could be a minute.

Why does it matter?

With slowing iPhone sales, Apple is increasingly relying on services and accessories (like the Polishing Cloth… and AirPods).

Although Apple doesn't break out sales numbers by product, Bloomberg estimated that in 2023 AirPods hauled in $18B in revenue. Makes sense considering it takes approximately 3 days to lose one of them. To put things in perspective, that means if AirPods were their own company they’d have a bigger top line than Spotify, Airbnb, and a bunch of other big swingin' d*cks.

So it isn't a shock that Apple continues to make minor upgrades (see: last year’s "hearing aid" add-on) in hopes of slinging more earbuds.

But wait, there’s more!

In addition to the live translation software update, Apple has a new generation of AirPods hardware in the works including a pair that will feature an AI camera… because, of course, it has an AI camera…

This Company Just Had The Best Nasdaq Debut In a Decade

Last week, Diginex (NASDAQ:DGNX) was at the Nasdaq to celebrate the best-performing IPO of the past decade. A huge thumbs up from the global investment community.

Nasdaq’s representative, Kristina Ayanian, gave a welcome speech, commenting on Diginex’s successful IPO: “This exceptional growth makes Diginex one of the best performing small cap stocks so far In 2025, and distinguishes Diginex as one of the top-performing IPOs on the Nasdaq in the past decade.”

Diginex (NASDAQ:DGNX) is a technology company that helps organizations address important ESG issues, utilizing blockchain and AI-driven automation.

Their team of experts has partnered with multinational corporations such as Microsoft, Coca-Cola, HSBC, and Unilever to build their ESG and supply chain management solutions.

Diginex products and services include:

Diginex ESG: Provides businesses, who want to do better, with the tools that both help them be more responsible and to realize the commercial benefits of ESG solutions.

Diginex LUMEN: Setting a new standard for supply chain due diligence

Diginex APPRISE: Helps organizations align their approaches with emerging laws, including the German Supply Chain Act and the upcoming EU Directive on corporate sustainability due diligence

Diginex ADVISORY: For those times when clients need more in-depth advice or have specific challenges and projects, Diginex provides expertise and solutions that are tailored to their precise needs.

Following its successful IPO, Diginex maintains a debt-free balance sheet, positioning itself for long-term growth and strategic expansion. Want to be part of the future of ESG and supply chain management?

+ Tiger Woods isn’t the only one looking to get in bed with a Trump…

Binance is hoping to “collab” with the Trump family. Friendly reminder: founder Changpeng Zhao stepped down as CEO in 2023 and pled guilty to money laundering as part of a $4.3B settlement. Now he is looking for a pardon from #47. And the move might make sense for both sides.

Turns out CZ has been campaigning for a presidential pardon harder than the Tiger King since last year. And the Trump family may be willing to oblige… in return for a stake in Binance.

Trump family representatives (gotta be Barron) have reportedly been in talks to invest in Binance US… and allow the exiled exchange to open up shop in the US again.

SBF be like “ok, now do me!”

+ Tell me you don’t have a succession plan, without telling me. Luxury giant LVMH is hoping to raise the age limit for its CEO and chair positions from 80 to 85. The move that just screams ‘Weekend at Bernie’s’ will give them a little more breathing room with 76-year-old founder CEO Bernard Arnault.

And there is presumably nobody on earth more butthurt than Bernie’s son, Frederic. Wednesday, the 29-year-old nepo baby was named CEO of Loro Piana. And yesterday he was reminded that he’s merely the (third) ‘eldest boy.’

+ February PPI is in, and “hey, it could've been worse.” Prices were flat in February, despite expectations of a 0.3% increase. Core PPI actually *checks notes* decreased 0.1%. That’s the first time since July. So we’ve got that going for us…

+ Ladies and gentlemen, we got him [a frontrunner]. Oracle $ORCL ( ▼ 3.27% ) is reportedly in pole position as the leading contender to run TikTok US.

+ Adobe $ADBE ( ▲ 1.3% ) shares got roasted even after reporting an earnings and revenue beat on concerns that it’s not keeping up with AI advances. Have they considered a DeepSeek collab?

+ Mattel $MAT ( ▼ 0.76% ) has a plan for avoiding those costly tariffs: slash toy production, shrink its manufacturing operations, and make more Barbie movies. Bold strategy, Cotton…

+ 5 ways to get your tax refund faster. I swear to God… if #1 is ‘File earlier’…

FYI, TWC might be compensated if you click on the links above. So, what are you waiting for? Start clicking.

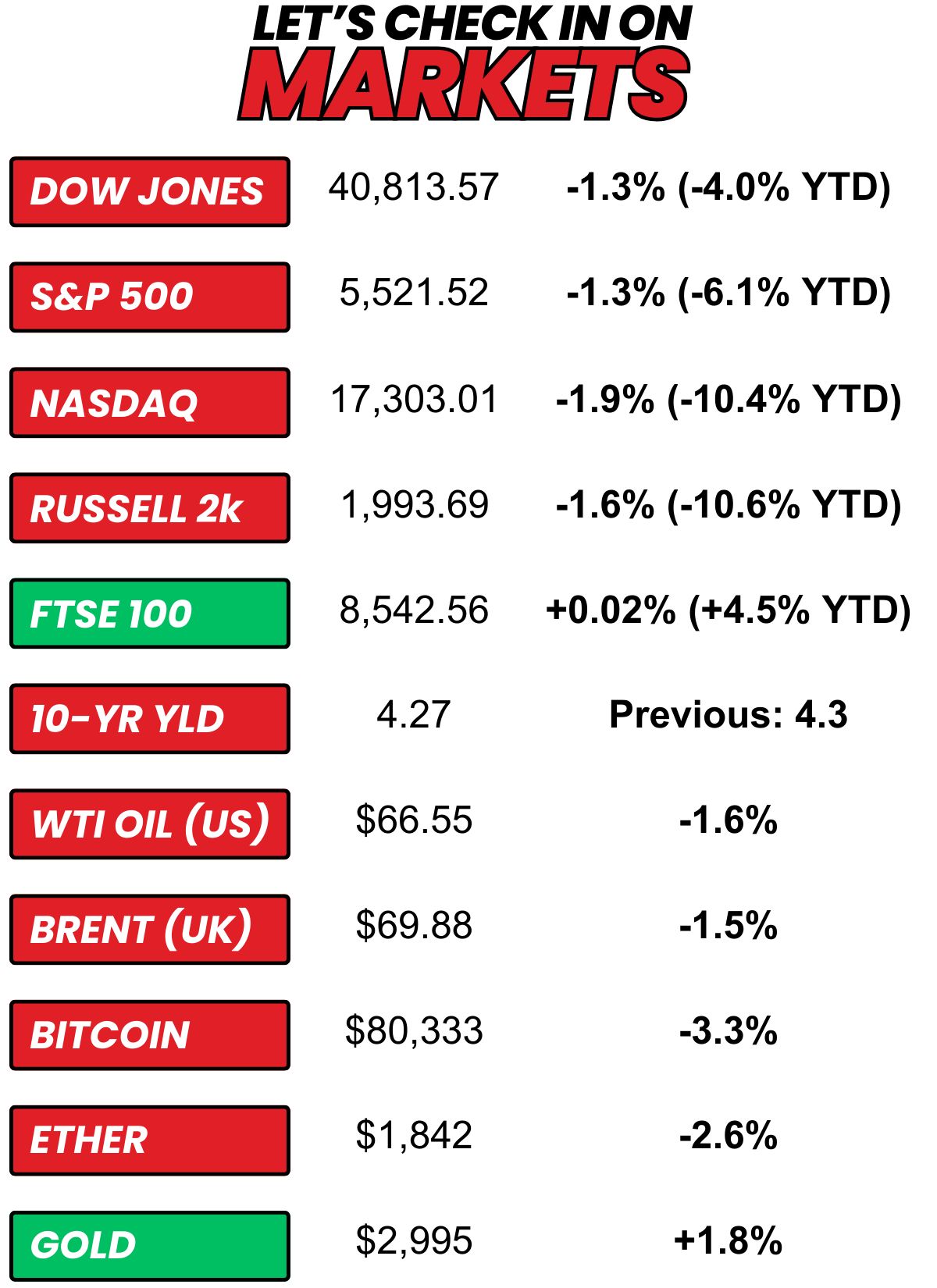

+ US stocks “fell on Thursday, with the S&P 500 officially entering into correction territory, as economic concerns grew and investors digested the latest inflation data, President Trump's trade offensive, and a looming US government shutdown.” (Yahoo! Finance)

+ The 10-year yield “slipped on Thursday as investors digested key data on wholesale prices.” (CNBC)

+ Oil “prices fell over 1% on Thursday as markets weighed macroeconomic concerns, including the risk that tariff wars between the U.S. and other countries could hurt global demand as well as uncertainty stemming from a U.S. proposal for a Russia-Ukraine ceasefire.” (Reuters)

+ Bitcoin “fell Thursday, as ongoing worries about a Trump-led global trade war soured risk sentiment, overshadowing softer-than-expected U.S. inflation data.“ (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Visa -1.2% 2) Nvidia -0.1% 3) Hims & Hers Health -7.0%

⏪ Yesterday…

+ D-Wave Quantum and Dollar General reported before the bell

+ Ulta, DocuSign, Rubrik, and Crown Castle reported after the bell

⏩ Today we’re keeping an eye on…

+ Bit Digital and Li Auto report before the bell

+ The University of Michigan will release its preliminary consumer sentiment report for March

Yesterday, I asked, “Do you use a Roomba?”

“No. That’s stupid.” won with 71.4% of the vote.

Here’s what some of you guys had to say…

No. That’s stupid.: “Who in their right mind would pay hundreds of dollars for hockey disc vacuum?!? Silly. Broom and dustpan never hurt anyone. Signed, Ye Olde Geezer ”

Yes. And I LOVE it.: “I love it. Wife hates it and we split the vacuuming. Not sure if this is fair. Plz weigh in.” Well, is your half done by the Roomba?

No. That’s stupid.: “I'd rather live in filth then have to get up off the couch every ten minutes to get one of those things unstuck.”

Yes. And I LOVE it.: “My cat enjoys also....low rider ”

And here’s today’s question…

You're either a Roomba family or not. No one is a casual Roomba user. You're either obsessed or think it's a dumb idea. So…

What's the biggest red flag email address?

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.