Hey there weekday warrior,

If you haven’t yet, I’d really, REALLY appreciate you proving you’re real by clicking below (literally the only way I know you’re real is if you click a link because email hasn’t been updated since Al Gore invented the internet).

Now, here’s what’s on the agenda today…

David Ellison might have to ask his dad (Larry Ellison) for a small loan, CPI data came in hot (as expected), and Microsoft and OpenAI are the most dysfunctional couple you've ever met.

Enjoy the next 4 minutes and 31 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who is not an AI generated bot and NEEDS The Water Coolest in their life. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste forward this to you? Subscribe here.

Do you know who my father is?

Live look at David Ellison…

Name something worse than your insufferable nepo baby kid stealing your thunder by proposing a multibillion-dollar media mega-merger just a day after you were on the receiving end of one of the biggest one-day net worth increases in human history…

That’s right… him asking you for money to make the merger happen.

Just 24 hours after Oracle $ORCL ( ▼ 3.27% ) CEO Larry Ellison’s net worth spiked by $100B (in one trading day), news dropped that his ungrateful son David’s company, Paramount Skydance $PSKY ( ▲ 20.84% ), has a fever and the only prescription is more content.

The newly formed Paramount Skydance is reportedly considering a bid for Warner Bros. Discovery $WBD ( ▼ 2.19% ). And since I know what you’re thinking… yes, Warner Bros. and Discovery are going through a nasty divorce… but, no, it’s not finalized, which means they could be sold as part of a, well, bundle.

Spoiler: getting to the carcass before the rest of the vultures can rip it to pieces might be part of Davey Deal’s plan. Rumors have been swirling about bids for the separate Warner Bros. and Discovery assets, including Netflix considering a run at WB.

So, assuming Paramount makes the bid, Warner Bros. Discovery accepts, and regulators sign off… CBS, MTV, Paramount+, and Paramount Studios would team up with CNN, TNT, HBO Max, and Warner Bros. Studio to tag team the rest of the media industry. Basically, the Mark McGwire and Jose Canseco of mass media coming together to create one absolute freak of nature.

Ok, but how?

If it feels like the math ain’t mathing, that’s because it ain’t. You see, Warner Bros. Discovery is worth more than double PSKY…

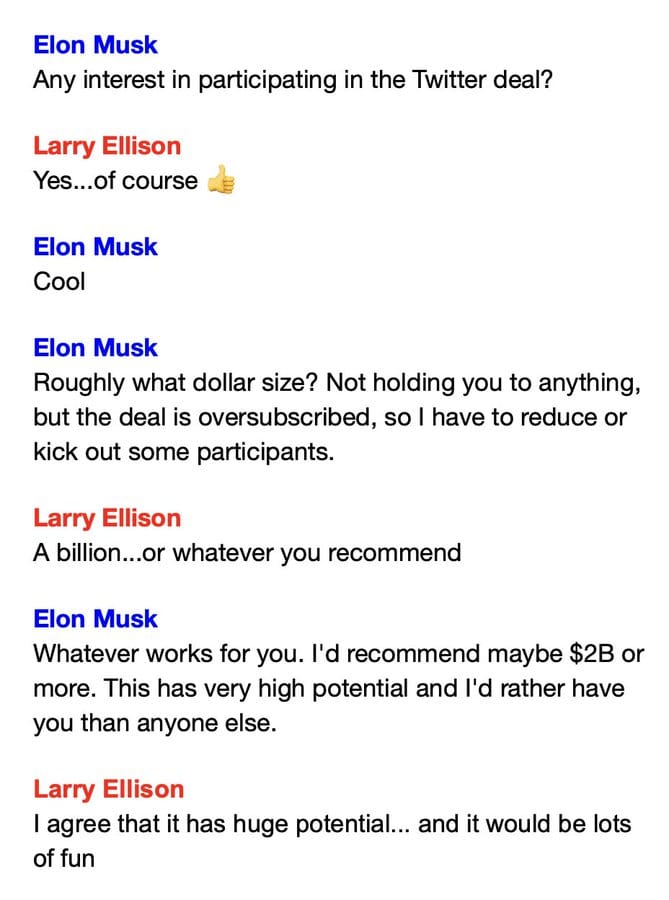

But you, my friend, are forgetting that David is daddy’s good little boy. The deal will likely be deducted from David’s allowance financed via Larry’s massive pile of f*ck you money. You might recall, he once sent this text…

It might sound crazy, but there's a much easier way to pay down debt faster…

Spoiler: using a credit card.

Here’s EXACTLY how to do it…

Find a card with a “0% intro APR" period for balance transfers

Transfer your debt balance

Pay it down as much as possible during the intro period

No interest means you could pay off the debt faster.

Now it’s time to find the right card…

Some of the top credit card experts identified one of their favorites that puts interest on ice until nearly 2027 AND offers up to 5% cash back on qualifying purchases.

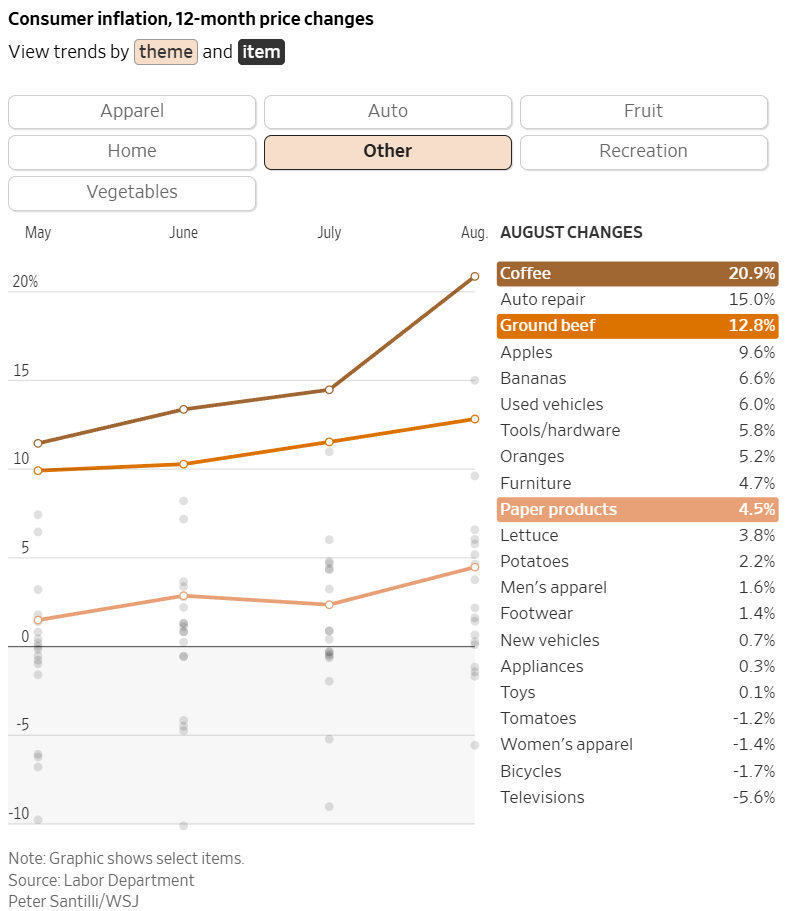

+ Bad day month to be a car enthusiast on the carnivore diet with a coffee addiction…

The good news is that Consumer Price Index data came in as expected. The bad news? It was up 2.9% year-over-year, which is the biggest price jump this year. Economists (and people with ‘economist’ in their Twitter profile) weren’t all that surprised. Pretty much everyone expected prices to creep up as companies passed on tariff price hikes.

WTF does it mean for us?

It was certainly a move in the wrong direction (spoiler: the Fed’s goal is 2% inflation). But, it probably wasn’t a big enough print to change J-Poww’s mind about lowering rates next week. The jobs situation, which is bleaker than the morning after a Diddy party, gives the Central Bank pretty much no choice but to slash rates.

+ You guys can stop searching. We did it. We found the worst CEO job in the US…

Shares of memestonk Opendoor $OPEN ( ▲ 0.19% ) went parabolic (+78%) after the company named former Shopify exec Kaz Nejatian as CEO and reinstalled co-founder Keith Rabois as chair of the board.

And if there is a worse Chief Exec job on earth, I can’t think of it. Opendoor set a (bad) precedent by letting the inmates run the asylum. Pressure from retail investors pushed ex-CEO Carrie Wheeler to resign in August. Godspeed, Kaz…

+ Satoshi Nakamoto punching air right now…

ICYMI, all those people you (ok, I) made fun of for buying gold at Costco are laughing at us (me) in rich. Gold just hit its inflation-adjusted all-time high. Friendly reminder: it’s up more than 40% this year.

+ “I’ve won, but at what cost?” - Satya Nadella probably

Microsoft $MSFT ( ▼ 2.24% ) has inked a new deal with the devil (Sam Altman). The company that took Clippy from us (and made up for it with Teams) announced a renewed partnership with OpenAI. And we know exactly zero details, except that it’s non-binding… which feels more risky than unprotected s*x with someone you met at the local genital warts support group.

In related news, it appears that OpenAI’s journey towards transitioning to a for-profit could be coming to an end. That is, until Elon sues to stop it, of course. Sam Altman has apparently settled on a structure where a non-profit OpenAI would control the for-profit OpenAI. Oh, and the non-profit would be seeded with an endowment of ~$100B for its troubles/to placate the haters.

The new structure would help the ChatGPT maker secure the metric f*cktons (that’s an industry term) of VC money it needs to keep the lights on/take over the world.

+ US stocks “closed at record highs on Thursday as the latest reading on inflation showed consumer prices ticked up in August and jobless claims rose to their highest level in nearly four years. Together, the data helped set expectations for the pace of interest rate cuts this year.” (Yahoo! Finance)

+ The 10-year yield “fell to 4% Thursday as investors assessed the latest inflation data, as well as a jump in jobless claims, that complicate the interest rate outlook.” (CNBC)

+ Oil “slid on Thursday, settling about 2% lower as concerns over possible softening of U.S. demand and broad oversupply offset threats to output from the conflict in the Middle East and the war in Ukraine.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 64% chance a Fed governor dissents at next week’s FOMC meeting. (Kalshi)

⏪ Yesterday…

+ Kroger reported before the open

+ Adobe and RH reported after the bell

+ The European Central Bank released its monetary policy statement

+ The Consumer Price Index report for August dropped

⏩ Today we’re keeping an eye on…

+ Take-Two Interactive will release the Borderlands 4 video game… and this is the first I am hearing that they made 2 and 3

Yesterday, I asked, “Will you send food back at a restaurant if it's the wrong item(s) or cooked incorrectly?”

52.3% of you said “Depends.”

Here’s what some of you guys had to say…

Depends: “Usually no! (It has to be the absolute wrong item and something I hate) because I know there's a very good chance that "Chef" is dragging his balls across my corrected plate.”

Nope: “Literally just had this happened with an overcooked steak... let the restaurant know about it but TOTALLY pussed out.”

Depends: “It depends on the spousal input.”

Depends: “Completely depends on the quality and cost of the restaurant. I ain't sending back a Big Mac because the burger isn't medium rare but I sure as hell am sending back a tomahawk ribeye that is cooked improperly.”

Hell yes: “Of course. Just don’t be a jerk about it. ”

Here’s today’s question…

Some ground rules…

This is only for YOU

Free food is only for you. You can’t feed your whole family or buy food and sell it.

Rides are only free for you. Everyone else in an Uber with you has to pay their fair share, even your immediate family. And no hailing Ubers for other people.

Nothing to see here…

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.