TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

Kraft and Heinz are calling it quits, Google gets a slap on the wrist, and Starbucks gets its gym bro on.

Enjoy the next 4 minutes and 33 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who can fit 4 Oscar Mayer wieners in their mouth. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste forward this to you? Subscribe here.

Divorce court

“Ok, grandpa, let’s get you to bed.” - Greg Abel to Warren Buffett after his comments about the Kraft Heinz $KHC ( ▲ 0.16% ) breakup

The Oracle of Omaha said he’s “disappointed” by Kraft and Heinz’s decision to split and unwind the decade old mega-merger. Assuming there isn’t a custody battle, one company will house sauces (think: ketchup), while the other will hold the likes of Kraft Singles, Lunchables, and Velveeta.

Friendly reminder: Warren orchestrated the deal back in 2015 with a little help from 3G Capital. Oh, and Berkshire is currently the largest shareholder of the company that’s headed for splitsville.

Warren argues that the breakup won’t fix the underlying problems… and investors argue that the old man should STFU before someone ends up with a broken hip. You see, the shares have lost more than 2/3 of their value since the deal closed. Warren out here redefining synergy.

Where did they go wrong?

Shares began to tumble not long after the decision to join forces, at least partially because people started to give a damn what they put in their bodies. Kraft and Heinz’s ultra-processed packaged goods haven’t exactly fared well with more health-conscious consumers.

KHC also colossally f*cked up its branding efforts. And by that I mean cutting costs instead of investing in their aging portfolio in the aftermath of the deal.

Hiring shouldn’t slow you down

Forget the resume pile, drawn out interviews, and awkward small talk. Upwork helps you find top freelance talent fast so you can stay focused on the work that matters.

Whether you're building a side hustle or scaling something big, Upwork connects you with vetted pros across AI, design, marketing, and more.

With Upwork, you can expect:

Skilled freelancers

Flexible terms

Only pay for approved work

Smart businesses are keeping lean and moving fast. Now you can too.

+ Bad news, for Perplexity…

The odds of Google $GOOG ( ▲ 1.39% ) selling Chrome to them just went from “so you’re telling me there’s a chance” to “no chance in h*ll” (not entirely sure what the protocol is for sharing Vince McMahon content since he’s been canceled).

A judge finally handed down Google’s punishment after it lost an antitrust case related to its search monopoly last year. And I don’t know what Google pays its outside counsel… but it’s not enough. The judge ruled that Google+ maker (the only real crime they ever committed was taking that away from us…) won’t be required to divest Chrome, which would have been an absolute nightmare scenario.

But that wasn’t the only major W. The company that regularly makes Bing its b*tch also won’t be forced to totally abandon its pay-to-play model. You might recall that one of the DOJ’s biggest bones to pick was that Alphabet paid Apple nearly $20B annually to make Google the exclusive search engine of iPhones and other Apple products.

Going forward, the company can’t pay to be the exclusive search partner… but it can pay to come preloaded on devices.

WTF does it mean for us?

The good news is that Perplexity or some PE syndication won’t f*ck up the greatest browser since Netscape Navigator.

Oh, and this certainly eliminates one of the concerns of Google investors, hence the nearly 7% pop after hours. Now if only they could score a similar outcome in their other antitrust case and solve the existential crisis they’re currently dealing with (read: how the hell do they effectively transition from printing money with their search engine and ad businesses to printing money with the AI products).

+ "Muscle Milk, HGH, Protein, Power Barssss." - ‘My New Haircut’ (the real ones remember)

Now, if you’re looking to get your protein intake up and your only option is Starbucks $SBUX ( ▼ 0.06% ), you don’t need to settle for one of those hard-boiled egg and 3 almonds adult Lunchables. Starting September 29, you can drink your protein. The coffee chain will debut a protein-infused cold foam. Depending on the size, you can expect between 19g and 36g of protein per serving. Brian Niccol didn’t strike me as a juice head…

+ Today I learned Pepsi $PEP ( ▲ 1.29% ) isn’t even a top 3 soda by volume in the US anymore. Coke, Dr. Pepper (*throws up in mouth a little bit*), and Sprite all sling more product. Which probably explains why shares have gotten shredded over the past couple years…

So it isn’t exactly surprising that the vultures are circling. Elliot Management took a $4B stake and is already sending strongly worded messages to management with demands to make Pepsi look a lot more like Coke.

+ You gotta spend VC money to raise more VC money. Isn’t that right, Sam Altman? OpenAI just paid $1.1B for Statsig, which looks like it might have been another talent coup vs. an acquisition in the traditional sense. Statsig helps OpenAI and other test features and implement data in real time… whatever that actually means.

+ After putting its IPO on the back burner amid “tariff uncertainty,” (cowards) Klarna is back, b*tches. The company has plans to raise up to $1.2B at a $14B valuation. That’s great news for everyone who invested early… and less than ideal for everyone who invested in the BNPL player at a $45B (I sh*t you not) valuation in ‘22.

+ Vogue just named Anna Wintour’s replacement: 39-year-old nepo baby Chloe Malle, who currently heads up .com. Impressive, but has she ever made a d*ck joke about monetary policy?

+ ICYMI (tbh, you’re lucky if you did) Elon Musk dropped his ‘Godfather 3’ of ‘Master Plans’. Elon got shredded for his 4th Tesla $TSLA ( ▼ 1.49% ) ‘manifesto’ outlining the future of the company. Partially because it read like it was written by ChatGPT (3, not 5) and because it indicates Elon is pretty much giving up on EVs and indicates the future is AVs and those Optimus robots (you know, the ones that were controlled by humans as recently as last year).

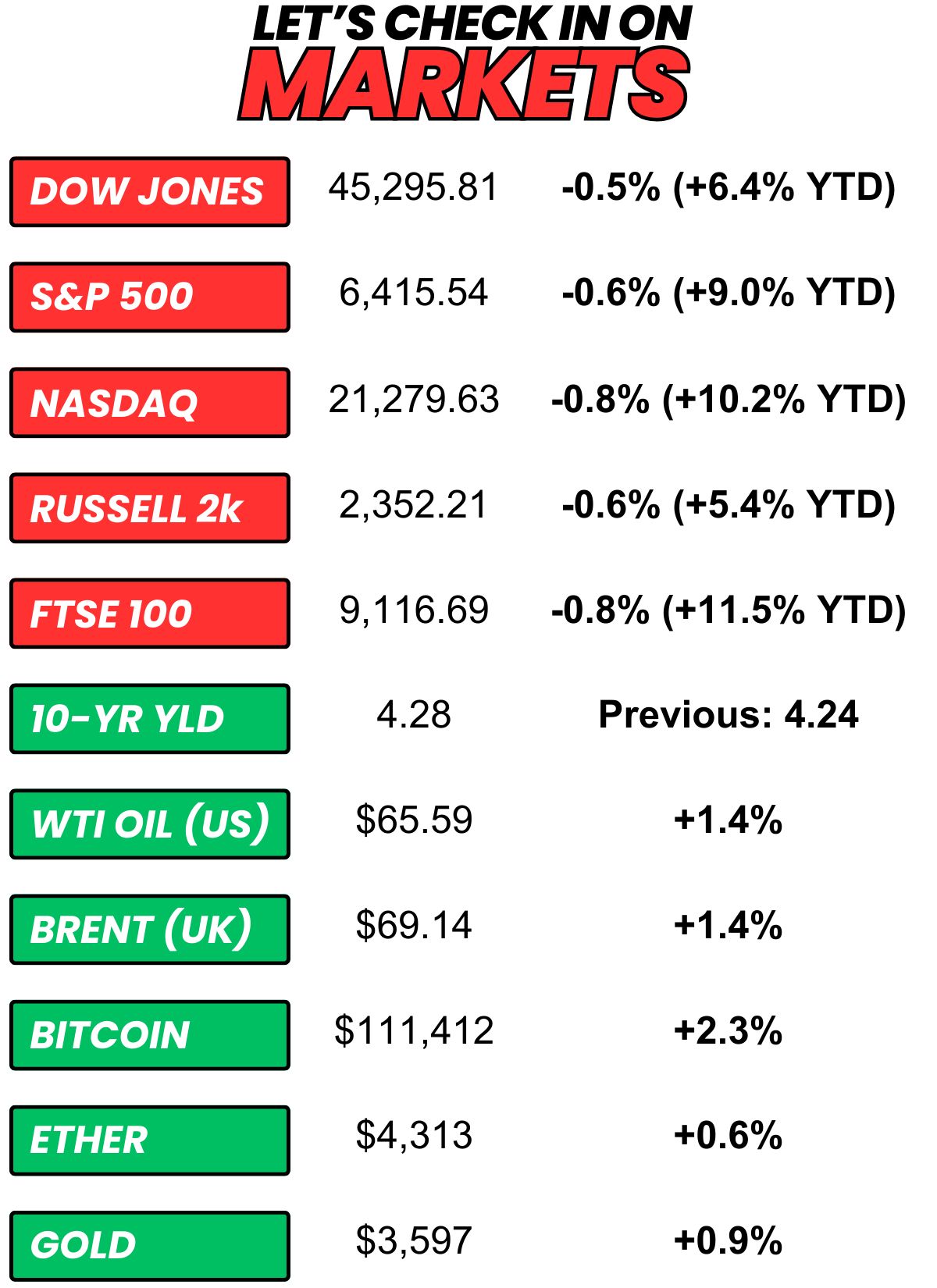

+ US stocks “closed lower on Tuesday, with investors weighing the latest developments on the trade front to kick off a seasonally poor month for equities. Rising yields also worried investors.” (CNBC)

+ The 10-year yield “jumped on Tuesday to begin September trading as a court decision knocking down most of the Trump administration’s tariffs raised the prospect of the government having to repay the money already brought in, stretching an already-stressed U.S. fiscal situation.” (CNBC)

+ Oil “settled up more than 1% a barrel on Tuesday after the U.S. imposed sanctions targeting Iran’s oil revenue stream, and ahead of an OPEC+ meeting on Sunday where analysts expect the group will not unwind remaining voluntary cuts.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 44% chance Ross Ulbricht (the Silk Road guy) will be on the Joe Rogan Experience before the end of the year. (Kalshi)

⏪ Yesterday…

+ Nio Inc reported before the open

+ Zscaler reported after hours

⏩ Today we’re keeping an eye on…

+ Dollar Tree and Macy’s report before the bell

+ Salesforce.com, C3.ai, Gitlab, Credo, Hewlett Packard, Asana, Figma, and ChargePoint report after the bell

Yesterday, I asked, “Are you gambling on the NFL this season?”

57.8% of you said “F*ck yes.“

Here’s what some of you guys had to say…

Yes: "Duh... as they say the Pope's Catholic (and a Bears fan)”

No: "Inflation is the new vice tax."

Yes: "Of course. Why the hell else would I subject myself to watching a Cleveland Browns vs. New York Jets game on a random Sunday afternoon?”

Yes: "Never trust a man with no vices..........."

No: "But only because I live in a state that doesn’t allow online gambling"

Here’s today’s question…

We haven’t done a hypothetical in a minute. So…

Would you rather be able to control the weather for the rest of your life (for the entire world) or control the stock market for 2 weeks?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.