TOGETHER WITH

Hey there weekday warrior. Here’s what’s on tap today… Eli is copying Novo’s homework, Shopify goes down, and Michael Burry chooses his next victim.

Enjoy the next 3 minutes and 33 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Diet starts tomorrow

The all-you-can-eat buffet industry is spiraling…

Eli Lilly $LLY ( ▲ 2.93% ) is slashing Zepbound prices to keep up with Novo’s recent cuts and pressure from Donny Politics to make GLP-1s more accessible to fat poors everyday Americans.

In a move that’s gotta have Martin Shkreli itching to get back in the game, LLY is competing with Novo to see who can cut those fat margins fastest and win the GLP-1 Wars. Friendly reminder: Eli Lilly is the leader in the clubhouse, even though we’ll continue to just call all these drugs “Ozempic.”

Reformed body-positivity icons (looking at you, Meghan Trainor and Amy Schumer) and other people ready to snap “before” pics can now get started on Zepbound for under $300 a month.

But weight, there’s more…

Eli is just around the corner from FDA approval on its multi-dose Zepbound pen, which should be conveniently available for purchase on “TrumpRx,” Donny Politics’ planned .gov direct-to-consumer drug website that’s scheduled for launch in January.

State of Trust: AI-driven attacks are getting more sophisticated

AI has unlocked new velocity for startups—and new visibility, too. The faster you grow, the sooner you’ll need to prove you’re secure enough to play with enterprise customers.

The tl;dr? You need compliance to sign deals.

Join Vanta for a session on how to make compliance work at your pace, without slowing momentum, stalling deals, or putting revenue at risk.

We’ll cover essential steps you can take now to prepare for your first audit in 2026—and enter the new year ready to earn customer trust (and deals).

You’ll walk away with:

Tips on identifying the right framework(s) for your startup

Advice on how to work security into your budget

Security best practices to implement now so you’re audit-ready next year

⚠️ Imagine scrolling by the ad above without supporting Vanta. They’re the reason the show goes on. Please show them some love by clicking here and checking them out.

+ You had one job…

Shopify $SHOP ( ▼ 4.14% ) went ahead and did the funniest possible thing yesterday. The online retail software giant pulled a CrowdStrike (read: massive outage) and went dark for thousands of users on Cyber Monday. Shares dipped 5%.

And sure, the intern responsible for the outage is having the worst day of their life… but the American consumer appears to be living their best life. Adobe Analytics is estimating $14.2B in online Cyber Monday sales, up 6.3% from last year.

+ Ladies and gentlemen, we have a front-runner

Traders on Kalshi are convinced that National Economic Council Director Kevin Hassett is the favorite of the five shortlisted candidates to succeed J-Poww in May. Donny Interest-Rates has declared that an announcement is forthcoming.

Scott Bessent (heading up the chair search) wants the Fed to (in the words of Dwayne ‘The Rock’ Johnson) know its role, and shut its mouth: “I think it’s time for the Fed just to move back into the background like it used to do, calm things down and work for the American people, set monetary policy on a good course.”

+ Michael Burry is far and away the front-runner for Playa Hater of the Year…

The Substack-er continued to go scorched earth on the tech space, calling Tesla $TSLA ( ▼ 1.49% ) ridiculously overvalued in a post late Sunday. Dr. Burry said, “the Elon cult was all-in on electric cars until competition showed up, then all-in on autonomous driving until competition showed up, and now is all-in on robots — until competition shows up.” Ok, fair…

Elon joins a hit list that includes Alex Karp (Palantir) and Jensen Huang (Nvidia)… which can only mean one thing: Trump Media and Technology Group $DJT ( ▼ 2.28% ) is next.

+ “Tell your friends I don’t want a lot. Just enough to wet my beak.” – Jensen Huang, probably

Nvidia $NVDA ( ▼ 4.17% ) just announced a yuge (think: $2B) purchase of Synopsys $SNPS ( ▼ 2.82% ) common stock… for some reason. It’s the start of a multiyear “partnership,” aka Nvidia providing Synopsys with new GPUs and Synopsys providing Nvidia with profits. Synopsys shares jumped 4% on the news.

+ Vanguard Will Now Allow Crypto ETFs on Its Platform (Bloomberg) I think I speak for all of us when I say, I’m just glad Jack Bogle isn’t around to see this…

+ Goldman Sachs acquires ETF firm for $2 billion in latest deal to bolster asset management division (CNBC) On the bright side, it couldn’t possibly go any worse than Marcus…

+ Steve Cohen Wins Approval for Casino Near Mets Stadium (WSJ) *New federal bribery charges loading*

+ OpenAI takes stake in Thrive Holdings to help accelerate enterprise (CNBC) Allow me to rewrite that headline: ‘OpenAI takes stake in Thrive Holdings, which is owned by Josh Kushner’s Thrive Capital, which owns a major stake in OpenAI’

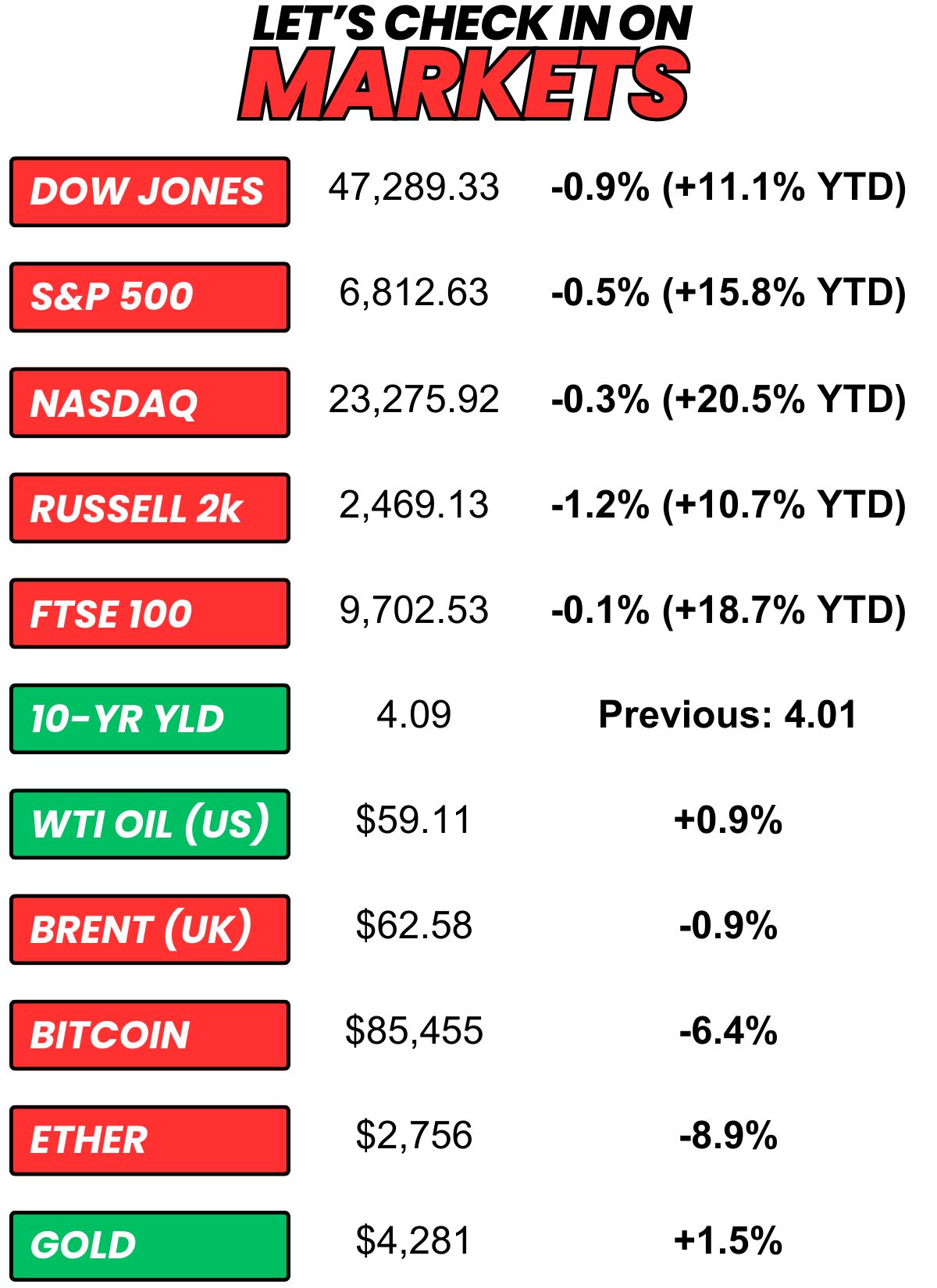

+ US stocks “slid on Monday, while bitcoin's slump deepened as Wall Street's strong late-November rebound took a rockier turn to begin December.” (Yahoo! Finance)

+ The 10-year yield “moved higher on Monday as traders began to anticipate slightly faster economic growth in 2026, helped in part by expectations that the Federal Reserve will again lower interest rates at the central bank’s final policy meeting of the year next week.” (CNBC)

+ Oil “prices ticked higher on Monday, bolstered by OPEC+’s reaffirmation that it will hold output steady during the first quarter, as well as renewed supply concerns stemming from geopolitical tensions.” (Reuters)

+ Bitcoin “declined sharply on Monday as the new month opened with renewed turbulence in the crypto market.” (Investing.com)

+ The “smart” money (prediction markets) thinks there’s a 24% chance we’ll get 3 rate cuts in 2026. (Polymarket)

⏪ Yesterday…

+ MongoDB and Credo reported after the close

+ Amazon’s AWS re:Invent got underway

⏩ Today we’re keeping an eye on…

+ Crowdstrike, Marvell, Okta, Gitlab, Pure Storage, Asana, and American Eagle drop earnings after the close

+ Salesforce will release its full Cyber Monday recap

+ The National Retail Federation will announce Thanksgiving weekend shopping results

Yesterday, I asked, “You can only save one Campbell's Company product, the rest are banned for being lab grown. Which are you saving?”

20.3% of you said, “Goldfish.”

Here’s what some of you guys had to say…

Goldfish: “As a parent of 3 young kids, we wouldn't survive without the goldfish.”

Rao’s Sauce: “Only Nonna makes a better sauce.”

V8: “Didn't expect it to be a popular pick, but V8 is the start of a good Bloody Mary!”

Campbell’s Soup: “Get back to your core business Cambell’s!”

Rao’s Sauce: “Obviously saving the GOAT of pasta sauces. Didn't even know this was in their portfolio. I learned something new today. Thanks, TWC! ”

Cape Cod Chips: “Pepperidge Farms remembers”

Here’s today’s question…

Some ground rules…

Yes, you can use the internet for work, but nothing remotely enjoyable

This includes ANY device, so you can’t even watch Netflix (hope you enjoy cable)

No workarounds like having someone surf the web for you while you watch

You get $750k to not use the internet for a year. If you accept the deal but then crack and use the internet, you lose access to your 10 favorite websites for 10 years. You taking the deal?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.