TOGETHER WITH

Hey there weekday warrior,

RIP NKLA.

Enjoy the next 4 minutes and 35 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

“Dad, what was Nikola like in 2020?”

Goodnight sweet prince.

Nikola, (-39.1%) you made us laugh, you made shareholders cry, but most importantly, you never really made a truck do anything except roll down a hill.

The EV company that has produced approximately as many cars as Apple has thrown in the towel and filed for Chapter 11 bankruptcy (ok, in their defense, apparently toward the end there, Nikola did actually churn out like 600 vehicles, most of which were recalled for defects).

The Tesla killer (lol) announced Wednesday that it will auction off its (mostly worthless) current assets, with ~$47M in cash to fund itself through bankruptcy. CEO and SPAC evangelist Steve Girsky blamed the market conditions and “macroeconomic factors” for putting the final nail in Nikola's coffin.

Friendly reminder that at its peak in 2020, the EV scam maker was valued at over $30B. Bring me back. That was right around the time founder and former CEO Trevor Milton was inking multibillion-dollar deals with GM (-0.6%) and dreaming up creative (read: illegal) marketing schemes.

The beginning of the end…

Everything really started to unravel for NKLA when Hindenburg Research released its Burn Book report in late 2020 which led to Trevor Milton’s resignation and eventual indictment for wire and securities fraud.

Rising interest rates and shifting consumer preferences did the rest…

But as we lay Nikola to rest, we can sleep easy knowing it didn’t die in vain. It taught us plenty of lessons along the way, like… hype isn’t the same as progress, fraud should not be filmed (if possible), and SPACs should never be invested in.

RIP, Nikola.

Data is the New Oil and Early Movers are Cashing In

Palantir just rocketed to $250 billion by helping companies extract value from user data.

The big data gold rush is here, but the company that stands to profit the most may not be Palantir…

A new disruption to smartphones gives users a share in the data profits, already facilitating +$325M in earnings and generating +$60M in revenue.

With 32,481% revenue growth, this company is gearing up for a possible Nasdaq listing (stock ticker: $MODE), and pre-IPO shares are available at only $0.26/share.

It’s a $1 trillion industry, and their disruptive EarnPhone is now being distributed by Walmart and Best Buy.

They have received over 90% of their February 20th $20M investment goal.

* See disclaimer below

+ Steve Jobs is rolling in his iGrave.

Not the Apple (+0.1%) product launch we wanted, but the product launch we deserve. The new iPhone 16e will go on sale this month. Essentially, what we’ve got here is a poor man’s Apple Intelligence-enabled iPhone 16. The Mini-Me will run on the same A18 chip as the other 16 models… so late adopters took the W on this one.

Tim Apple announced the 16e via a comparatively low-key launch (for Apple) with a post on X. Warren Buffett’s favorite stock has been on the ropes lately with p*ss poor iPhone 16 sales, so it makes some sense to go full send to try to move some product.

+ Corporate needs you to find the difference between Tasso and Theranos…

Hims & Hers Health (+17.5%) is getting into the blood testing game. The semaglutide slinger just acquired Trybe Labs, an at-home lab testing facility. No word on specific terms of the cash deal.

Over the next year, Hims will roll out at-home blood testing kits. Customers will be provided with a Tasso blood lancet (which gives major Grateful Dead logo vibes) to test for cholesterol, lipoprotein(a), and apolipoprotein (pretty sure 2 of those are made up…).

The move may even lead Hims to testing for and treating other conditions like low testosterone and menopause.

+ “You know what would be cooler than denying claims? Denying entry into the building…” - UnitedHealth’s new CEO

UnitedHealthcare is the latest in a growing line of companies executing (too soon?) more humane layoffs (read: offer buyouts before doing mass layoffs to replace people with bots).

UNH benefits division employees were offered the option to accept buyouts if they resign by March 3 or be “reassigned” to a new role (“We’re gonna need to go ahead and move you downstairs into Storage B”). If the insurance giant doesn’t hit its “resignation quota” voluntarily, they’ll move on to straight-up layoffs. You know, like we had in the old days when men were men and getting laid off wasn’t done via email.

United is attempting to cut costs despite reporting its highest-ever revenue in 2024 at $400B, up 8% year over year. CEO Andrew Witty labeled the cost-cutting his “modernization agenda” (spoiler: AI). To be fair, his life insurance gotta be bankrupting this company.

+ Tell us something we don’t know. January Fed minutes published Wednesday signaled (again) that we’re not gonna see rate cuts anytime soon.

+ Bumble (-30.3%) shares tanked Wednesday on a rough Q1 revenue forecast. Nature is healing, we’re meeting chicks in bars again…

+ Microsoft (+1.2%) is out here manipulating atoms and inventing new states of matter to make quantum computers *brain explodes*.

+ Maybe try Bumble? JetBlue (-5.3%) is getting a little desperate, DMing multiple airlines to find a lucky buyer.

+ The 49ers are looking to sell 10% of the team’s equity for $900M. The only real question is which PE shop is dumb enough to put up (almost) tres comas to eat stadium chicken fingers with Jerry Rice in an owner’s box at Levi Stadium?

+ How long $1 million will last in retirement in every U.S. state—the difference between Hawaii and West Virginia is 77 years. Take me home, country roads…

+ WNBA star Cameron Brink is grateful for $76,000 salary: ‘I do not take that money for granted’. Oh, you thought I was going to say something that would get me canceled?

🔥 Want to turn off the TV and pick up a book? This 5-second-rule will help you get it done, Mel Robbins says. Real talk: this is actually a pretty powerful life hack.

FYI, TWC might be compensated if you click on the links above. So, what are you waiting for? Start clicking.

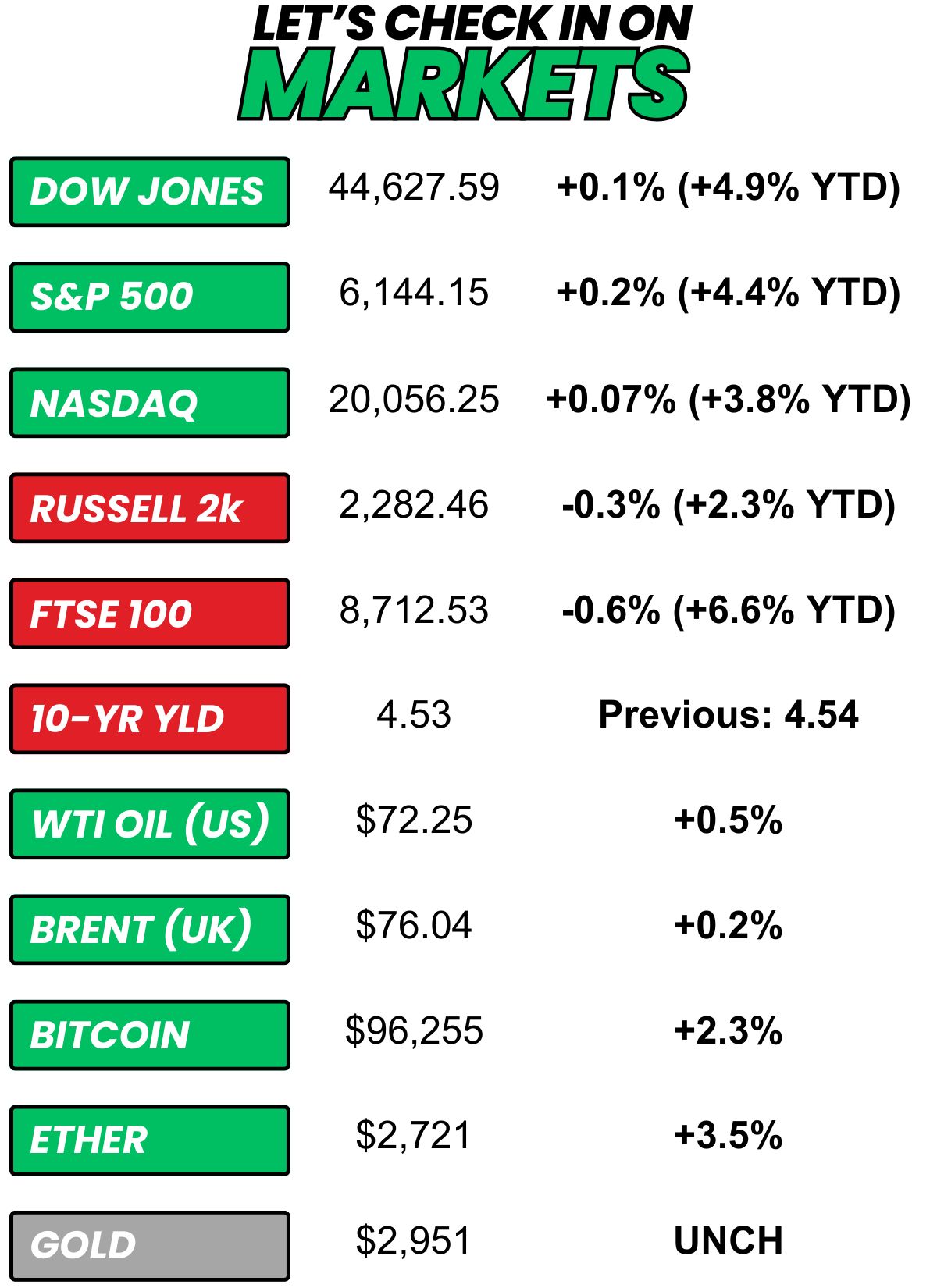

+ US stocks “closed higher on Wednesday as investors weighed President Trump's latest 25% tariff salvo and digested the Federal Reserve minutes for insight into future policy.” (Yahoo! Finance)

+ The 10-year yield “traded slightly lower on Wednesday as the Federal Open Market Committee meeting minutes showed officials were ready to hold interest rates steady until further improvement on inflation.” (CNBC)

+ Oil “prices held near a one-week high on Wednesday on worries about supply disruptions in Russia and the U.S., while the market awaited clarity on sanctions as Washington tries to broker a deal to end the war in Ukraine.” (Reuters)

+ Bitcoin “climbed marginally on Wednesday, steadying after days of consecutive declines, as risk sentiment remained subdued amid fresh trade tariff threats from U.S. President Donald Trump and cautious anticipation of the Federal Reserve’s latest meeting minutes.” (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Super Micro Computer Inc. +7.9% 2) Nvidia -0.1% 3) Tesla +1.8%

⏪ Yesterday…

+ Wix, Etsy, Analog Devices, Garmin, Fiverr, Wingstop, HSBC, Global-E, and SolarEdge reported before the bell

+ Carvana, Grab Holdings, Toast, Enovix, Vimeo, and The Cheesecake Factory reported after hours

+ Apple held a product launch event (which was about as underwhelming as promised…)

+ The FOMC dropped the minutes from its latest meeting

⏩ Today we’re keeping an eye on…

+ Walmart, Alibaba, Unity Software, Celsius, Mercado Libre, Block, Booking Holdings, VICI, Dropbox, Coca-Cola, Sprouts, Copart, Texas Roadhouse, and Indie Semiconductor report after hours

+ Boeing CEO Kelly Ortberg’s speech at the Barclays Industrial Select Conference

+ Visa holds its Investor Day

Yesterday I asked, “What's the best fried chicken chain in the game?”

Popeyes won with 41.7% of the votes. Hand up, I’ve never had Popeyes, Church’s, or Bojangles…

Here’s what some of you guys had to say…

Popeyes: “Love that chicken from Popeyes! And eff you KFC!”

KFC: “Waited in line too many times at Popeyes for the Spicy Chicken sandwich that they were always sold out of to ever go back. Now it’s the Colonel!”

Church’s: “If chain friend chicken was the only option, otherwise I’m doing local restaurant for homestyle cooking!”

Bojangles: “10% of my diet. Needs to be a national chain. ”

Other: “PJ Clucks on St Clair in Toronto. Hands down the best. Excellent take on Nashville hot, bonus they warm the hot sauce before adding to the sandwich. ”

And here’s today’s question…

Since it appears DOGE might be Making Stimmy Checks Great Again…

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.

*Advertiser Disclaimer

1. Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

2. The rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

3. A minimum investment of $1,950 is required to receive bonus shares. 100% bonus shares are offered on investments of $9,950+.