TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

Charlie Javice had her day in court (ok, well, technically she got sentenced), EA is (officially) going private, and maybe the government shutdown isn’t such a bad thing.

Enjoy the next 4 minutes and 34 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, loving The Water Coolest? Forward it to someone who still plays The Sims. If you CC me ([email protected]), I’ll send you both something.

PPS, did someone with great taste forward this to you? Subscribe here.

Cruel and unusual punishment

Charlie Javice f*cked around… and yesterday she found out.

The Forbes 30 Under 30 founder just got sentenced to 7+ years in prison for defrauding investors, including the biggest swingin’ d*ck on Wall Street (read: Jamie Dimon).

(Which means Masa Son and Softbank will be patiently waiting to write her a $50M check at a $1.2B pre-money valuation, circa 2032.)

Oh, and she’ll have to forfeit $22M and pony up $287M in restitution to JPMorgan. I’ll save you the Google search… the bank paid just $175M for Frank (the company Javice sold under false pretenses). I mean, in Jamie Dimon’s defense, that new $3B HQ at 270 Madison isn’t going to pay for itself…

If that seems like a girthy sentence…

That’s because it kinda is…

Seriously, if you ever find yourself on the wrong side of white collar criminal charges, please don’t use Charlie’s lawyers. She inexplicably managed to land herself in prison for longer than SBF’s ex. Caroline Ellison, the CEO of Alameda Research, is doing just 2 years in Club Fed. FFS, Elizabeth Holmes is only doing an 11-year bid…

In fact, at yesterday’s sentencing, Charlie’s lawyer played the Theranos card: “Ms. Javice’s sentence should be nowhere near Elizabeth Holmes.” I bet that sounded a lot better in his head…

ICYMI…

Charlie was found guilty of three counts of fraud and one count of conspiracy to commit fraud (listen, I never passed the bar, but being charged with “fraud” and “conspiracy to commit fraud” really feels like a double jeopardy type situation).

The entire case is related to f*ckery around the sale of her student loan fintech to JPMorgan for $175M back in the year of our lord 2021. The financial institution believed that it was buying a company that had served more than 5M students. Turns out most of them were just totally made up. The bank didn’t find out until it sent a marketing email to its millions of “new customers.” Frank actually had closer to 300k real users…

And listen, I don’t condone victim blaming, but can we all agree that whoever did due diligence at JPMorgan should at the very least be tarred and feathered?

News—for people who need to think for themselves

That’s you. You can’t afford not to.

You don’t need ideological narratives; you don’t need your worldview confirmed; you don’t need outrage that addicts you to media or bonds you to an in-group. You need context, connections, and the space to understand things on your own terms.

As one of our 100,000+ subscribers puts it, I appreciate that you leave conclusions for the reader to make for themselves. And our newsletter is free.

+ Nothing says “please forget about our questionable human rights record” quite like buying the company that produces Madden…

The Saudi Public Investment Fund, Silver Lake, and Affinity Partners made it official yesterday: they are taking Electronic Arts $EA ( ▼ 0.25% ) private at a $55B valuation in what will be the largest leveraged buyout of all time.

The investors will write a check for $36B and finance the rest. Hope you don’t mind paying $89.99 for FIFA FC ‘26…

+ That sound you heard was DTC brands shifting their entire strategy…

OpenAI announced “Instant Checkout” on Monday, which allows you to buy stuff “in chat,” because god forbid Sam Altman let us even consider visiting the open web ever again.

Etsy will be the first partner available, but according to the ChatGPT maker, more than 1M Shopfiy stores are set to go live “soon.” As you might have guessed, Etsy $ETSY ( ▼ 0.54% ) and Shopify $SHOP ( ▼ 4.14% ) mooned on the news.

+ Can’t have a bad jobs report if the government can’t release a jobs report…

Yesterday, VPOTUS Vance said, “we’re headed for a [government] shutdown” following a meeting between lawmakers from both sides of the aisle at the White House. If the two sides fail to get a bill over the finish line (spoiler: it appears they won’t), the government will officially shut down at 12:01 AM on October 1.

But, hey, look on the bright side… the Bureau of Labor Statistics won’t be able to hit publish on Friday’s September jobs report (and Thursday’s weekly jobless claims) if they can’t go to the office. Oh, and if this thing drags on, it could impact the October 15th CPI report.

+ Drugs are bad ok mmkay?

Cannabis stocks got their 2021 on yesterday. Tilray $TLRY ( ▼ 1.5% ) soared just shy of 69%, Canopy $CGC ( ▼ 1.75% ) was up 17%, and Cronos $CRON ( 0.0% ) popped 13%. And it was all thanks to the most boomer social post since your mom copy-pasted that “privacy notice” directed at Zuck. The President reposted a video promoting Medicare coverage of CBD. Ok, now do gas station b*ner pills…

WTF does it mean for us?

Literally nothing.

Even if Medicare did cover CBD, I promise it wouldn’t materially impact weed stocks. There isn’t a whole lot that could help weed stocks at this point, tbh. The whole industry is a godd*mn nightmare thanks to oversupply, capital constraints (see: illegal on the federal level), and some dude you went to high school with selling illegal weed at cheaper prices (…probably to kids at your high school).

+ “Shut up and take my money.” - me after finding out a company that makes baby food pouches is going public.

In case you haven’t reproduced, allow me to explain these fruit/vegetable puree-filled pouches in terms you might understand: kids under 5 consume them like dudes named Chad mainline Zyn. They are fiends for them.

Jennifer Garner is taking her baby food startup, Once Upon a Farm, public as sales approach nearly $200M… and the only IPO I could ever be more bullish on is Moonbug’s.

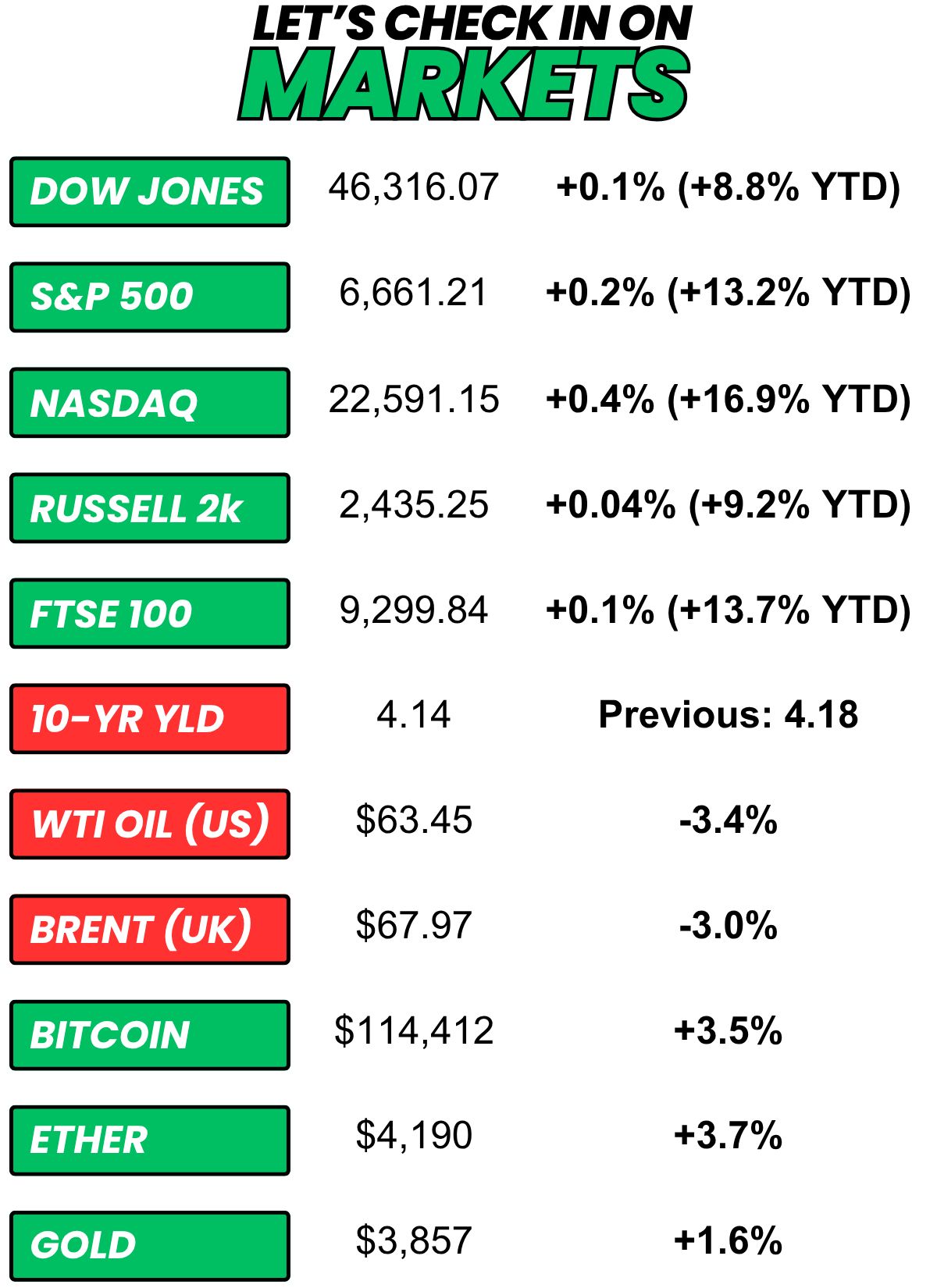

+ US stocks “posted modest gains on Monday as concerns mounted about a looming US government shutdown possibly delaying the release of key labor-market data that could provide clues about how fast the Federal Reserve will cut interest rates. Treasury yields fell across the curve.” (Bloomberg)

+ The 10-year yield “moved lower on Monday as investors look ahead to several economic releases this week including a key jobs report.” (CNBC)

+ Oil “settled 3% lower on Monday as OPEC+ plans for another increase to oil output in November and the resumption of oil exports by Iraq’s Kurdistan region via Turkey raised the global supply outlook.” (Reuters)

+ The “smart” money (prediction markets) thinks there’s a 59% chance the government shutdown lasts more than 5 days. (Kalshi)

⏪ Yesterday…

+ Carnival Corp reported before the bell

+ Sony Group spun off its financial services arm, Sony Financial Group

+ FedEx held its annual meeting

⏩ Today we’re keeping an eye on…

+ Paychex reports before the open

+ Nike reports after the bell

+ Amazon will hold a hardware reveal event

Yesterday, I asked, “It's Monday morning, so this seems fitting. You get $10M if you can get fired by the end of the day. Are you trying (bonus points for HOW you'd do it)?”

76.6% of you said “Oh yeah.“

Here’s what some of you guys had to say…

Oh yeah: “I’d send an email to all of my bosses telling them I hate them and think they’re bad at management with an attachment of a picture of my a$$. That should do it?”

Nope: “I work from home, everyone's barely paying attention and I'm not even sure my boss has the authority to fire me. Last thing I need is to fuck up and lose my job tomorrow morning without a payday.”

Nope: “Seems impossible as a govt employee ”

Oh yeah: “I could commit 10 fireable offenses before the end of the day but the corporate machine moves too slowly to process my termination by then”

Oh yeah: “I am close enough to retirement to where adding $10mil for getting blackballed is fine. So emailing every c level a pic of me giving double birds with a caption of “fuck you c@nts” would be a great way to finish one’s career imo.”

Here’s today’s question…

Your kid (think: under 5) can only watch one of their favorite shows for the rest of time. Which are you keeping?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.