Hey there weekday warriors,

No matter how good your day was, it definitely wasn’t as good as Elon’s.

Enjoy the next 4 minutes and 11 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

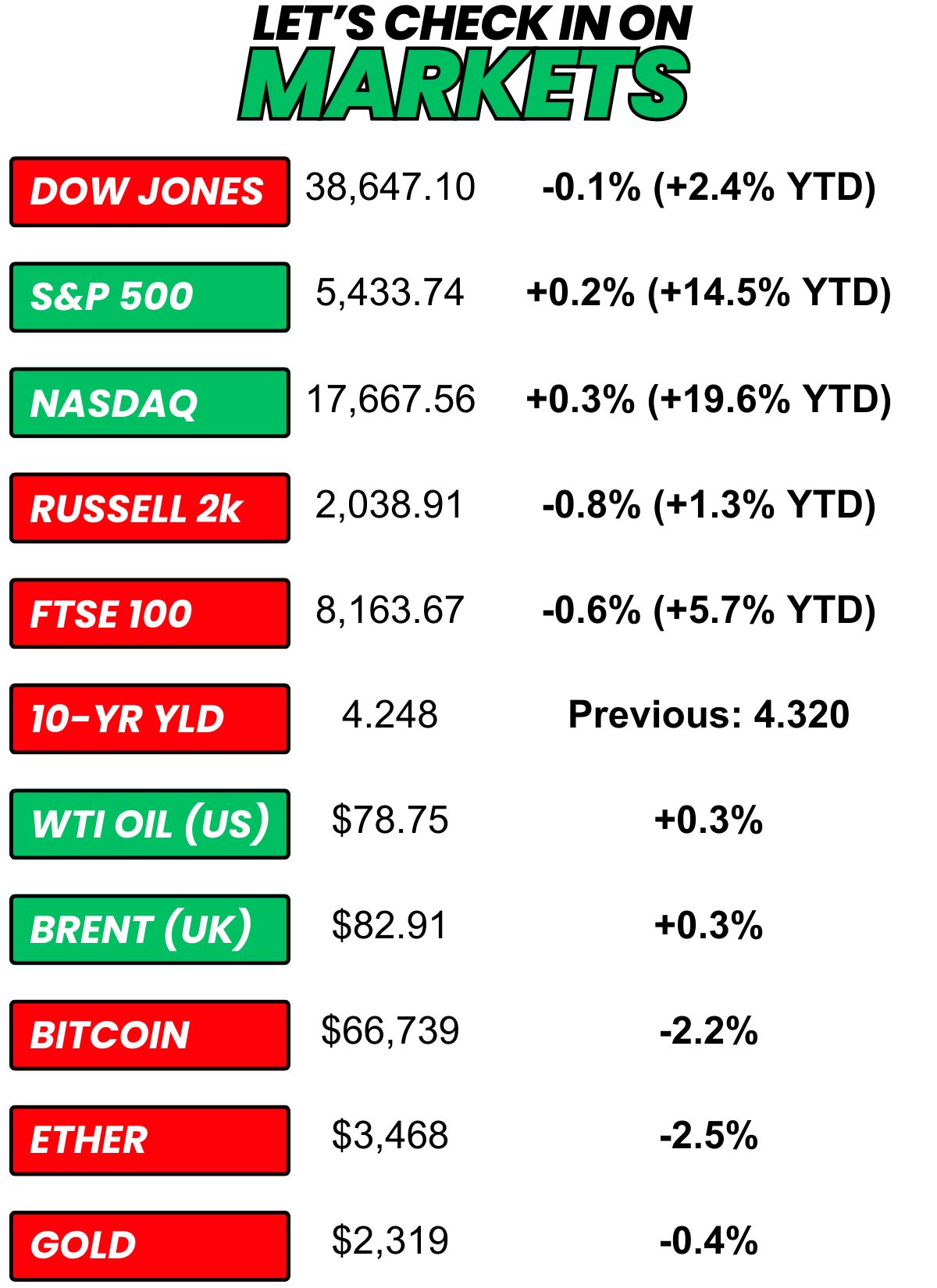

+ US stocks “rallied to a record close on Thursday as investors weighed the two-way pull of cooling inflation and a Federal Reserve pullback on interest rate cuts.” (Yahoo! Finance)

+ The 10-year Treasury yield “slipped once again on Thursday after the latest inflation data showed an unexpected drop." (CNBC)

+ Oil “rose slightly on Thursday in up-and-down trade, pressured by rising U.S. crude and fuel supplies and expectations of a delayed start to Federal Reserve interest rate cuts but supported by U.S. economic data showing an easing labor market and slowing inflation.” (Reuters)

+ Bitcoin “slipped on Thursday in a volatile session as a forecast from the Federal Reserve of high for longer interest rates largely overshadowed some signs of cooling near-term inflation.” (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia +3.5% 2) Tesla +2.9% 3) Apple +0.5%

The market moves you need to know about…

– The company formerly known as Restoration Hardware (RH) got its teeth kicked in after reporting that it swung to a loss and its cash fell to $101.8M from $1.5B. Shares were down 10.8% after hours.

+ You dropped this, King. Apple is back on top. After climbing another 0.5% to cap off its biggest three-day rally since 2020, Apple ended the day with a bigger market cap than Microsoft, reclaiming the throne as the most valuable company in the US.

– Not all stock splits are created equal. Isn’t that right, Workhorse? Shares of the EV maker fell 15.1% after it announced a 1 for 20 reverse stock split in hopes of keeping its stonk above the threshold needed to remain listed on the Nasdaq.

Cash Rules Everything Around Elon

Source: Giphy

“F*ck you, pay me.” - Elon

At yesterday’s Tesla (+2.9%) shareholder meeting, the company’s stakeholders signed off on Elon’s 2018 $56B comp package (again).

You might recall that earlier this year, a judge in Delaware overturned the massive pay package following a lawsuit brought by a butthurt investor.

The judge agreed that the board lacked independence from Musk when scheming up the comp offer. Plus, it wasn’t totally transparent about what was included before it sent it to a shareholder vote. Considering Tesla’s board is stacked with Elon’s homies, she’s probably not wrong…

“That’s so sick that a bunch of shareholders can overturn legal decisions now!”

Technically, the vote was just a glorified popularity contest (read: whether investors were in favor of Elon’s payday or not).

It doesn’t actually overturn the judge’s ruling and reinstate his fat stacks of cash and equity. Because, you know, that’s not how the judicial system works.

So what was the point of a vote that’s about as legally binding as a Twitter poll?

It was more a PR move than anything. It showed that investors were on board, after all.

According to legal experts, it could help sway the court since the vote indicates that shareholders were, indeed, willing and consenting participants in this bukake of comp rained down on Elon.

Not the only thing on the docket…

Elon may have dropped his fight against OpenAI, but the state of Delaware wasn’t so lucky. Following the Delaware judge’s decision to claw back his pay, Elon decided to get the hell out of dodge.

In probably one of his pettiest moves to date, Elon proposed moving Tesla’s state of incorporation to Texas from Delaware. Shareholders were more than happy to greenlight the move.

+ Haters will say it’s Photoshopped…

Adobe (-0.2% // +14.7% after hours) put on a clinic in its fiscal third quarter. The company that blessed us with PDFs beat on the top and bottom lines.

But that wasn’t what had investors ready to run through a wall. ADBE hiked its full-year guidance, despite most of its peers slashing expectations on economic weakness.

Apparently, Adobe’s users haven’t found out about DALL-E yet.

+ GameStop (+14.3% // -2.6% after hours) CEO, Ryan Cohen: “We want to be a tech-first e-comm leader.”

Also, GameStop: “We have to postpone our shareholder meeting due to technical issues.”

GameStop’s shareholder meeting pulled a Netflix ‘Love is Blind’ reunion. Citing overwhelming demand, the company running GME’s glorified Zoom cracked under the pressure of crayon eaters logging in.

Investors interpreted this exactly how you’d expect (read: bullish).

+ John Tyson is just built different… and I mean that in the worst way possible.

The Tyson (-1.5%) CFO/guy who gives nepo babies a bad name was just suspended from his role as head of finance. And I know what you’re thinking… what could the guy whose name is on the building possibly have done to end up in timeout?

He got arrested for the second time in two years. Back in 2022, he got busted for passing out drunk in the wrong house (who hasn’t?!). And this week, he was arrested for driving under the influence.

+ It’s called buying the f*cking dip. After the close, Roaring Kitty revealed that he bought a sh*t ton more GameStop stock (up to 9M from 5M).

Of course, we also learned that it was him unloading all of his calls Wednesday. His portfolio showed he exited all 120k call options.

+ Some workers using AI are worried that colleagues will see them as ‘lazy’ and ‘frauds,’ survey finds (Read)

+ Netflix co-founder says this weekly ritual keeps him successful: I’ve done it ‘for over 30 years’ (Read)

⏪ Yesterday, we were keeping an eye on PPI data and Tesla’s annual shareholder meeting.

+ Just a day after CPI data came in better than expected, PPI fell even more than expected (that’s right, it dropped). I don’t want us to get ahead of ourselves here… but inflation is canceled, right?

+ You can check out all the Tesla drama above…

⏩ Here's what we’re keeping an eye on today...

+ Pretty quiet day after what was a wild week. Take the rest of the day off, you earned it.

Yesterday, I asked, “Is Netflix becoming ESPN the Ocho?”

78.8% of you said yes.

Probably one of my favorite explanations of what you can expect from Netflix these days: “Netflix is closer to TJ Maxx than ESPN the Ocho. You do not know exactly what you will get. Maybe a Polo shirt for $35 or a cheap T-shirt that will last 3 washes.”

Here’s today’s question…

Wells Fargo fired at least a dozen employees for “faking work” by simulating keyboard and mouse activity.

What is it worse to get fired for?

One more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.