TOGETHER WITH

Hey there weekday warrior,

Here’s what’s on the agenda today…

Jensen Huang is the new Steve Jobs, OpenAI becomes a for-profit, and UPS announces massive job cuts.

Enjoy the next 4 minutes and 19 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

But wait, there’s more…

It is Jensen Huang’s world, and we’re all just living in it…

The sheer volume of announcements at Nvidia’s $NVDA ( ▼ 4.17% ) GTC conference was almost comical…

The soon-to-be-$5T company announced deals with Eli Lilly, Palantir, Hyundai, Samsung, and Uber.

Probably the biggest surprise was Nvidia’s announcement that it was investing $1B in Nokia $NOK ( ▲ 2.93% )… because apparently BlackBerry wouldn’t take its calls. The two companies will co-develop 6G technology (even though 5G still doesn’t work on my phone) and networking tech for AI.

Shares of Nokia popped 22% on the news, which should surprise absolutely no one.

Friendly reminder: this isn’t even Nvidia’s biggest investment in the past few months. It committed $5B to Intel and $100B to OpenAI in September alone.

But wait, there’s more…

Nvidia also announced a deal with the Department of Energy to build 7 new supercomputers and plans to build a new platform for connecting quantum computers.

If you’re thinking, “ok, but are all of these partnerships and deals going to pay dividends?” I’ll leave this right here… Nvidia expects $500B in revenue through 2026.

And in case you were wondering, no, Jensen does not think that AI is a bubble.

WTF could it mean for us?

Every lame stream newsletter tells you “wHaT iT MeAnS.” At The Water Coolest, we predict tomorrow’s headlines today…

🔮 Wall Street Journal headline on 11/6/25 (probably): "Nvidia Buys Uber for $247B"

Your business deserves better talent.

Upwork helps founders, builders, and dreamers find expert freelancers fast—so you can spend less time managing and more time growing. From AI and design to marketing and development, hire proven pros on your terms and only pay for approved work.

+ Amazon: “We’re laying off 14k employees.”

UPS: “Hold my beer…”

Everyone was waiting for yuge job cuts at Amazon $AMZN ( ▲ 1.0% ) to drop on Tuesday. And they did. But that had absolutely nothing on what UPS $UPS ( ▼ 0.57% ) delivered. United Parcel Service is cutting 48k management and ops jobs. That is not a typo. And yes, it’s in addition to the 20k back in April.

It’s probably not a coincidence that UPS and Amazon’s relationship continues to fray. In Q3 alone, UPS said its Amazon delivery volume was down 21%.

Speaking of Amazon $AMZN ( ▲ 1.0% )… Christmas is about to skip a lot of houses in the greater Seattle area. Andy Jassy kicked off what will likely end up being the largest fat-trimming exercise since Bezos got his hands on HGH.

The 14k job cuts on Tuesday could end up being as many as 30k when it’s all said and done (so, probably be EOW).

+ Don’t get any ideas. Save the Children….

OpenAI has completed its transition (I mean, it is 2025, after all…) from a non-profit to a for-profit (kinda). The ChatGPT maker’s for-profit subsidiary is officially a public benefit corporation. But the non-profit will live on…

OpenAI (the non-profit) will take a $130B stake in OpenAI (the public benefit corp.). And nobody is down worse than Elon right now.

As part of the split, OpenAI can more easily take on the f*ck tons of investment dollars it so desperately needs (…to give to Nvidia). Plus, it clears the path to a potential IPO. But I think we can all agree it will destroy the world before that.

And nobody was happier than Satya Nadella and Microsoft. You see, MSFT will own 27% of the new company that has free rein to light investor money on fire in the name of scale. Just how excited are investors? They pushed Microsoft’s market cap above $4T…

+ The founder of Lucid $LCID ( ▼ 5.57% ), which, for the record, sold just 10k cars last year, promised full self-driving will be available “definitely in the coming years.” Who is going to tell him you can basically already do this in a Tesla?

Lucid’s self-driving feature will be “mind-off,” which means humans can just kinda f*ck off (no need to intervene or even really pay attention). So, yeah, we’re a decade or so from “WFC” (“Hey team, I’m working from car today…”).

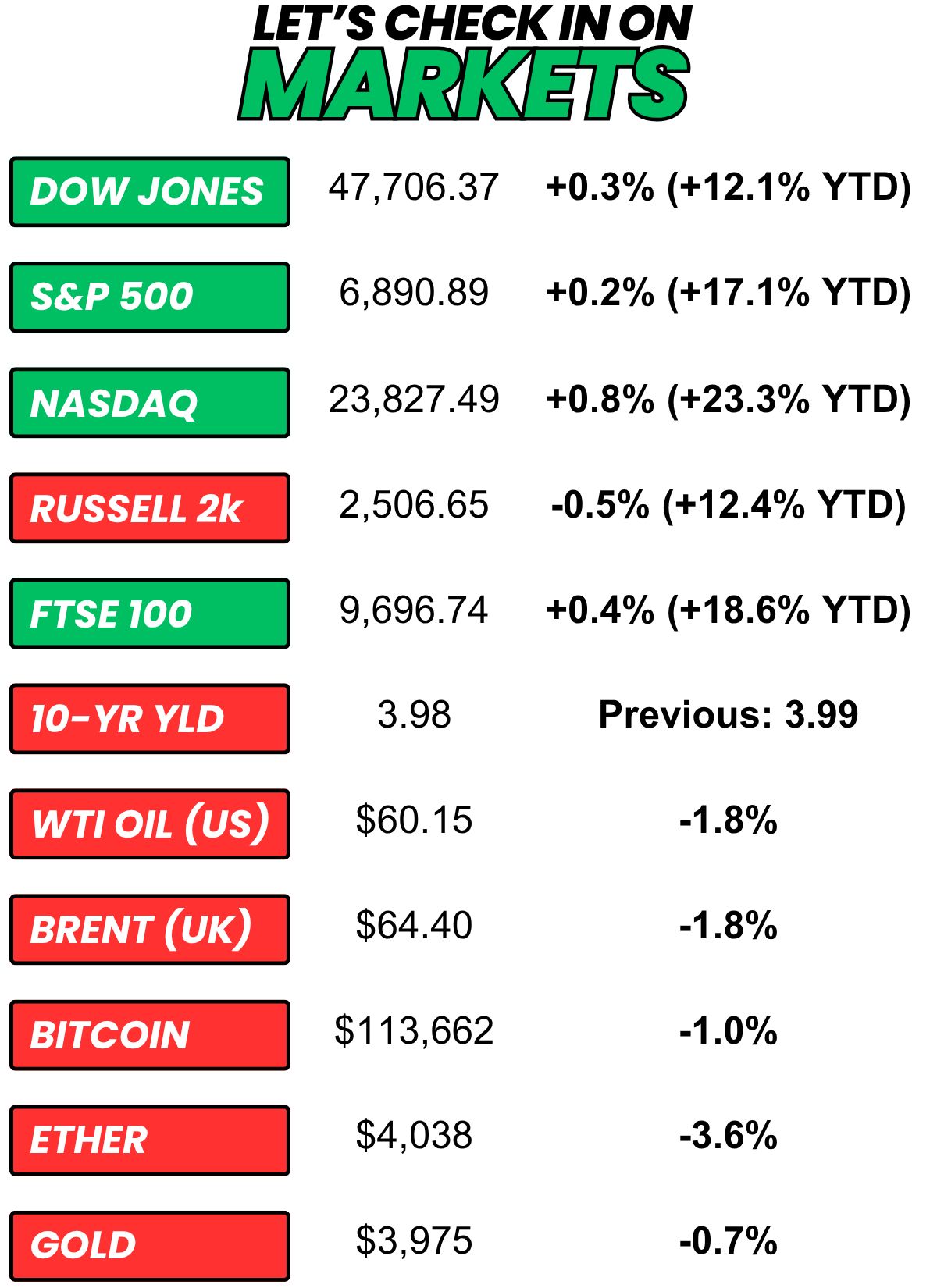

+ US stocks “hit fresh records on Tuesday as investors stepped further into the artificial intelligence trade a day before the Federal Reserve is set to announce its interest rate decision.” (CNBC)

+ The 10-year yield “slid on Tuesday as investors looked ahead to the Federal Reserve’s interest rate decision.” (CNBC)

+ Oil “slipped about 2% on Tuesday, marking a third straight day of declines as investors considered the impact of U.S. sanctions against Russia’s two biggest oil companies on global supply, along with a potential OPEC+ plan to raise output.” (Reuters)

+ Bitcoin “steadied on Tuesday as a recent rebound paused amid growing caution over upcoming high-level talks between the U.S. and China and a Federal Reserve meeting later this week.” (Investing.com)

+ The “smart” money (prediction markets) thinks there’s a 93% chance Tesla shareholders approve Elon’s $1T pay package next week. (Polymarket)

⏪ Yesterday…

+ SoFi, PayPal, UnitedHealth, UPS, Nextera Energy, MSCI, DR Horton, Royal Caribbean Cruises, Corning Inc., American Tower Corp, and Sherwin-Williams reported in the AM

+ Visa, Enphase Energy, Booking Holdings, Seagate Tech, Electronic Arts, The Cheesecake Factory, Bloom Energy, Mondelez, Teradyne, and Aurora Innovation reported after the bell

⏩ Today we’re keeping an eye on…

+ Caterpillar, Boeing, Verizon, CVS Health, Fiserv, Automatic Data Processing, Etsy, GE HealthCare, Garmin, Kraft Heinz, UBS, Phillips 66, Centene, GSK, and Brinker report before the bell

+ Microsoft, Meta, Alphabet, Starbucks, MercadoLibre, Chipotle, ServiceNow, TransMedics, Carvana, Coca-Cola, eBay, KLA-Tencor, Wolfspeed, Sprouts, Teladoc, Equinix, and Canadian Pacific Railway report after hours

+ J-Poww will (most likely) cur rates and (definitely) hold a press conference

Yesterday, I asked, “You just had a long day at a conference. You just got back to your hotel room. You have to meet your team in 30 minutes in the lobby for drinks and dinner. What are you doing for those 30 minutes?”

29.4% of you said, “Lying on bed, staring at the ceiling.”

Here’s what some of you guys had to say…

Lying on the bed, staring at the ceiling: “And also regretting the life choices that led me to this moment.”

Other: “Calling a fellow worker who didn’t have to attend the conference to bitch and then quick change my outfit so people think I spent that time showering bc I have my life together. (Lies)”

Shower: “Sh*t. Shower. No shave (already did that in the am). Then call the wife with 5 mins to spare.”

Lying on the bed, staring at the ceiling: “Bracing myself to wear a pasted-on smile and feign interest in people/topics which bore me to tears.”

Lying on the bed, staring at the ceiling: “Also, calling to check in with my wife and kids. The best time to do that is BEFORE the happy hour. Hard to explain to your wife that it is a boring conference when you can't stay on topic while slurring your words, and Flo-rida is blaring in the background. Trust me on this one.”

Hit the bar early: “If I lay in bed I'm not going to want to get back out of bed”

Here’s today’s question…

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.