Hey there weekday warriors,

Welcome back from the long weekend. Let’s snap some necks and cash some checks, shall we?

Today, we’re talking about Intel’s future (…or lack thereof).

Enjoy the next 4 minutes and 16 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

PS, want to get your company in front of more than 100k rich, good-looking, and intelligent newsletter subscribers for Q4? We’re booking ads for October, November, and December right now. Reach out via this form and I’ll be in touch.

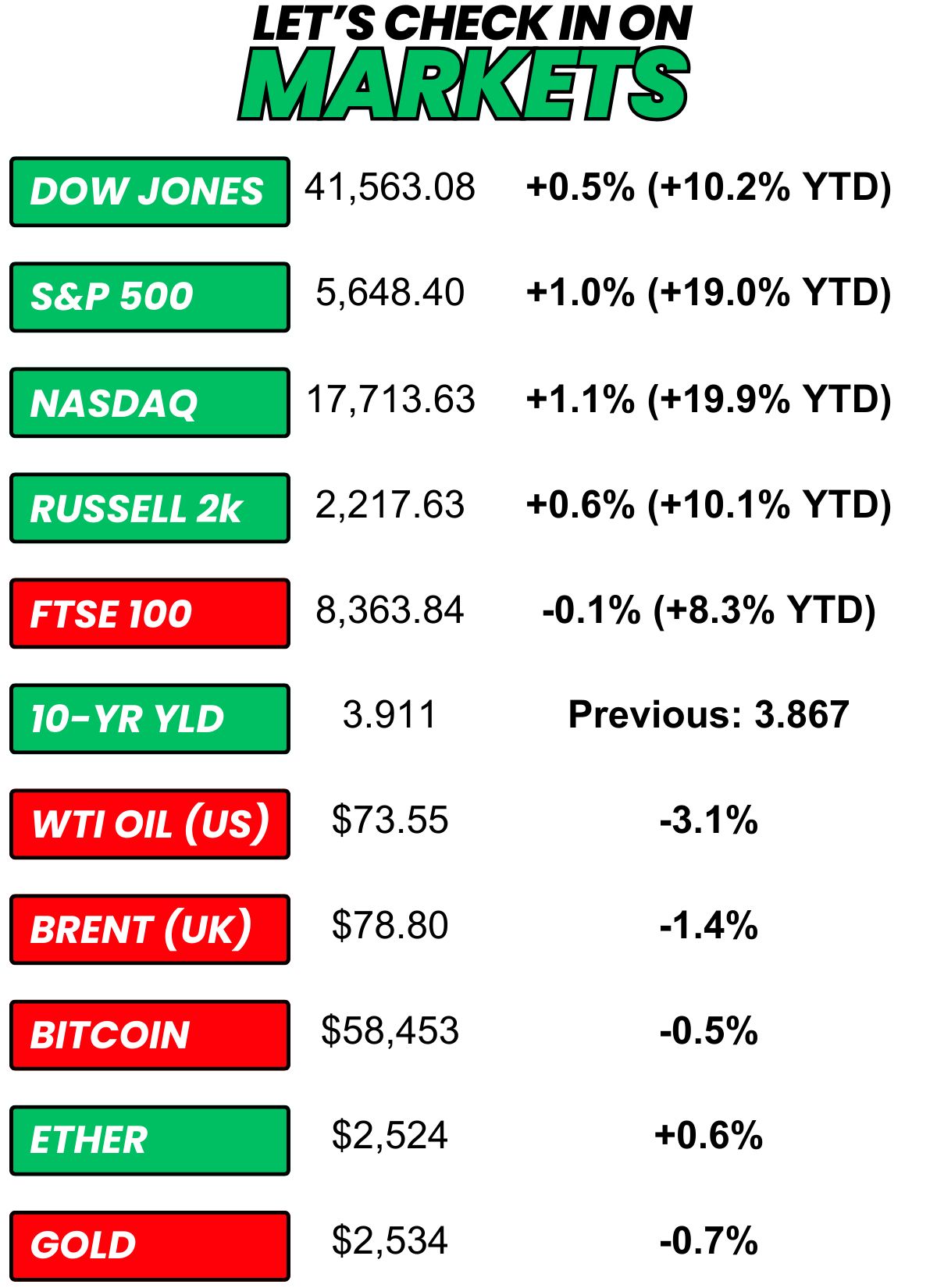

+ US stocks “rose on Friday, with the Dow Jones Industrial Average posting a fresh record high as investors ended a volatile month on a high note. Traders also mulled over crucial inflation data watched closely by the Federal Reserve.” (CNBC)

+ The 10-year Treasury yield “rose on Friday as investors digested the latest batch of inflation data.” (CNBC)

+ Oil “retreated on Friday as investors weighed expectations of a rise in OPEC+ supply starting in October, alongside dwindling hopes of a hefty U.S. interest rate cut next month, following data showing strong consumer spending.” (Reuters)

+ Bitcoin appeared to be just as hungover as you on Labor Day…

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Nvidia +1.5% 2) Intuitive Machines +3.1% 3) Intel +9.4%

The market moves you need to know about…

+ MongoDB had a better Friday than you. Shares of the database platform jumped 18.3% on Friday after reporting a big beat and hiking guidance for the full year.

+ Alibaba is finally out of the dog house. After 3 years of ‘probation,’ China’s State Administration for Market Regulation (SAMR) said that the Amazon of Asia is once again compliant with antitrust regulations. BABA rose 2.8% on the day.

Are you bullish or bearish on Alibaba over the next 12 months? Vote below (I’ll share the results tomorrow)…

+ GE Vernova just went full spin zone. And investors bought it hook line and sinker. After a manufacturing issue was identified at one of its US-based wind turbines, there were major concerns that it was widespread. On Friday, the company said a mishap in the UK was related to a storm and not a manufacturing flaw. Shares were up 5.0% on the news.

Bad Intel

Source: Giphy

Tell me you’re about to update your LinkedIn to “Former CEO,” without telling me…

Intel’s (+9.4%) CEO Pat Gelsinger is in the “strategic options” phase of Intel’s collapse turnaround. For those of you who don’t know how this movie ends, this is the CEO’s pathetic attempt to save the company his job.

On Friday, shares of the struggling chipmaker jumped nearly 9.5% on news that Pat and his C-Suite were drawing up plans to right the ship. They could be presented to the board this month.

Intel has been overpaying bankers (and presumably McKinsey) to offer up strategic options after activist investors began looking at Intel board seats like you were looking at glizzys and cold ones this weekend.

So, what’s in Pat’s plan?

Given just how bleak things are, nothing is off the table.

It probably wouldn’t be a turnaround without some layoffs, amirite? Although the company did announce it was laying off ~15k employees during its last earnings call.

Selling off and shuttering businesses could make sense too. The programmable chip business Altera could find itself on the chopping block. Intel bought it (read: overpaid for it) in 2015 for $16.7B.

Then, of course, there is Intel’s foundry biz, which it has a love-hate relationship with. It’s ramping the manufacturing arm back up after shuttering it once already.

Of course, the most glaring problem might be management’s incompetence. But something tells me that finding a new leader might not be at the top of CEO Pat Gelsinger’s list…

+ Not unlike summer, inflation is over.

On Friday, we got the latest inflation print that just screams ‘rate cuts.’ Core PCE rose just 0.2% month over month and 2.6% vs. the same period in the year of our lord 2023. The monthly figure was in line with expectations, and the annual print was… wait for it… below expectations.

A rate cut this month is set in stone (seriously… markets are pricing in a 100% chance of a cut). The only real question is whether we’ll get 25 or 50 basis points. After Friday’s report, the odds of a 0.5% cut dropped ever-so-slightly.

+ Look on the bright side, LSU fans… at least you didn’t have to witness any hopes of a national championship season fade away in real time…

Just minutes before the LSU-USC college football game kicked off Sunday during prime time, DirecTV satellite customers lost access to Disney’s (+0.6%) stable of channels, including ESPN and ABC. And if you’re still subscribing to satellite TV in the year of our lord 2024, perhaps this is the wake-up call you needed…

DIS pulled the plug on DirecTV just before its programming deal expired. The two haven’t been able to reach an agreement on a renewal… obviously. The House of Mouse is butthurt that DirecTV won’t pay more for stuff like college football and Disney Channel original movies like, say, ‘Brink.’

Meanwhile, the satellite TV provider is calling bullsh*t on the price hikes since Disney continues to put more content on its streaming platforms. To be fair, they’ve got a point.

These things usually get sorted out in a few days. And DirecTV has tens of millions of reasons to bend to Disney’s will. Monday Night Football and an ABC Presidential Debate are quickly approaching.

+ I’m not sure who needs to hear this, but don’t take financial advice from TikTok…

Some finance influencers on social media reported that they discovered an ‘infinite money glitch’ at Chase Bank.

Here’s how it works…

One deposits a fraudulent check at an ATM. The bank will make a certain % of the deposit immediately available. You’ll immediately withdraw the newly available funds before Chase figures out the check is fake.

If this sounds a lot like check fraud, that’s because it is…

Oh, and…

+ Amazon makes its AI partner choice for (paid) Alexa revamp. Imagine paying for Alexa.

+ Shohei Ohtani signs trading card deal with Fanatics-backed Topps. No word on whether there will be any game-used bet slip cards…

+ Highly persuasive people are great at arguing—they use these 3 tactics, says Ivy League psychologist. “Always call your opponent ‘chief.’”

+ Gold is outperforming tech stocks this year for good reason. Where the gold at?

+ Costco hikes membership rates for first time in 7 years — see if you’re affected. ‘We’re Costco guys, of course we pay more to get access to our double chunk chocolate chip cookies now.’

+ It might be time to put your savings into a high-yield account before it’s too late. Friendly reminder: the smart money expects a rate cut in September…

🔥 79% of Americans who make this one move won’t run out of money in retirement, researchers say. And to the rest of you: enjoy living in a dumpster…

FYI, TWC might be compensated if you click on the links above. So, what are you waiting for? Start clicking.

⏪ Yesterday, markets were closed in the US, but on Friday we got the core PCE price index.

⏩ Today we’re keeping an eye on…

+ Zscaler, GitLab, and Asana report after the bell

+ We get a bunch of manufacturing data (S&P and ISM manufacturing PMI)

+ Chinese EV makers release monthly sales data

On Thursday, I asked, “Send me a GIF that best explains how to plan to spend the last weekend of summer…”

Here are some of my faves…

Technically not a GIF, but I’ll let it slide…

Some classics…

Here’s today’s question…

I had a friend who chose to spend his Labor Day at Six Flags (he’s in his 30s and has a wife, but no kids) with another friend (same age and status)…

When does it get weird to go to an amusement park (without kids)?

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.