Hey there weekday warrior,

Here’s what’s on the agenda today…

AWS goes down and takes the entire internet with it, Apple is selling a lot of iPhones (apparently), and Amazon hops on the GLP-1 craze.

Enjoy the next 4 minutes and 43 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Broke the internet

“My bad…” - Andy Jassy

AWS had a case of the Mondays.

Amazon’s $AMZN ( ▲ 1.0% ) cloud platform broke the internet (and I mean that in the worst way possible), taking down thousands of sites for millions of interweb users. And those were just the ones who went to DownDetector to complain.

Pretty much everything worth a damn (see: McDonald’s, Robinhood, Reddit, etc.) on the internet was dealing with outages. And a bunch of stuff that is pretty worthless, too (think: Gov.uk and Amazon Alexa).

Notably, X and Starlink were NOT impacted…

What the hell happened?

Around 3 AM EST Monday, reports started rolling in that AWS had gone off the rails. More than 14 services in the US-EAST-1 region were dealing with "operational issue." The on-prem fanboys and girls be like “told ya so…”

A couple hours later, Amazon admitted it done f*cked up (the first time). It fixed the initial issues by mid-morning… but another issue sprung up in the afternoon. AWS pinky promised its Azure killer was fully operations by 6 PM EST. For the most part, the internet was back.

“I’ve won… but at what cost?” - Andy Jassy, realizing the entire internet relies on AWS

The good news is that Amazon controls ~37% of global cloud market share. The bad news is that pretty much all of Al Gore’s internet relies on AWS staying online…

As you might have guessed, experts are all saying the same thing: “no one man cloud infrastructure provider should have all that power.”

WTF could it mean for us?

Every lame stream newsletter tells you “wHaT iT MeAnS.” At The Water Coolest, we predict tomorrow’s headlines today…

Diversify yo cloud provider…

🔮 Bloomberg headline on 12/17/25 (probably): "Microsoft Azure Announces 15% Market Share Gain as Enterprises Rush to Diversify After AWS Outage"

+ “We are working with the geologists to assess whether these deposits could become commercially viable” is the new “AI enabled”…

Shares of Cleveland Cliffs $CLF ( ▼ 3.53% ) popped more than 20% after the steelmaker said it’s considering getting into the rare earths mining biz, in what has to be the best thing to happen to the city of Cleveland since the last 10 minutes of Major League…

You might recall that so much as mentioning rare earths is the 2025 equivalent of hinting at a pivot to crypto in 2018. Uncle Sam has been taking stakes in rare earth miners as concerns grow about America’s inability to get its hands on the metals needed for EVs and phones.

+ Imagine if they were showing a movie from this century…

Remember the Sphere $SPHR ( ▲ 2.31% )? You know, that stadium in Vegas your one friend won’t STFU about. Well, it just announced that it has sold 1M tickets to a remastered ‘Wizard of Oz’ that opened in August. Adam Aron and AMC be like “f*ck my life.”

+ Amazon: “Sorry for bringing the internet and the US economy to its knees… here’s lightning fast GLP-1 delivery.”

Great news for all the caloriemaxers out there… now you can get your GLP-1s from WeightWatchers $WW ( ▼ 2.34% ) delivered by Amazon $AMZN ( ▲ 1.0% ). Amazon Pharmacy will partner with WW to get your Ozempic (and other drugs) delivered as quickly as it does the food items that got you in this mess. WW mooned on the news as you might expect…

+ “I’m about to say ‘super cycle’ so mf loud” - every Wall Street analyst

It’s happening, you guys. Everyone finally decided to upgrade their iPhones. According to research firm Counterpoint, the “iPhone 17 series outsold the iPhone 16 series by 14% during the first 10 days it was available in China and the U.S.”

Shares of Apple $AAPL ( ▼ 3.21% ) jumped nearly 4% on the news, which moved the company to #2 spot in the market cap league tables. Sucks to suck, Microsoft.

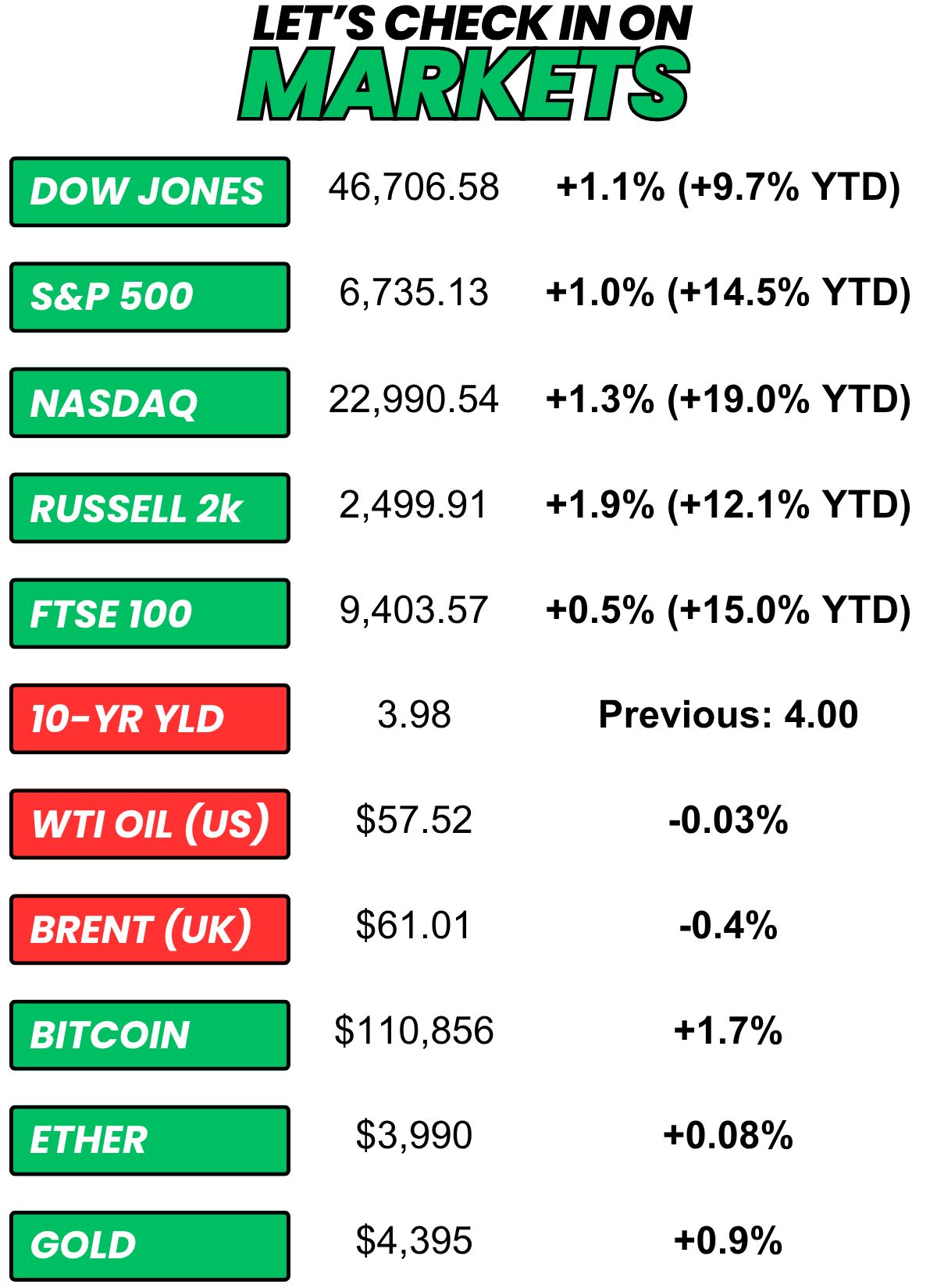

+ US stocks “rallied on Monday as Wall Street braced for a packed week of high-profile earnings and the delayed release of key inflation data.” (Yahoo! Finance)

+ The 10-year yield was “modestly lower Monday, with the benchmark 10-year note yield again dropping below 4%, as investors weighed the state of the U.S. economy and the government shutdown approached its fourth week.” (CNBC)

+ Oil “settled at their lowest since early May on Monday as investors weighed a potential global glut, with U.S.-China trade tensions adding to concerns about an economic slowdown and weaker energy demand.” (Yahoo! Finance)

+ The “smart” money (prediction markets) thinks there’s a 38% chance Oscar Piastri win the F1 Driver’s Championship (Max Verstappen has a 37% chance). (Kalshi)

⏪ Yesterday…

+ AGNC Investment reported after the close

⏩ Today we’re keeping an eye on…

+ Coca-Cola, Lockheed Martin, GE Aerospace, Raytheon Tech, 3M, General Motors, Philip Morris, Nasdaq, Elevance, Northrop Grumman, Danaher Corp, and Halliburton report before the bell

+ Netflix, Intuitive Surgical, Texas Instruments, Capital One Financial, and Chubb report after the close

+ Samsung Galaxy will hold its Worlds Wide Open media event

Yesterday, I asked, “Would you rather have $100M or the ability to teleport up to 15x per 24 hours for the rest of your life?”

61.8% of you picked “$100M.”

Here’s what some of you guys had to say…

$100M: “Money- it’s either your time or your money.”

Teleport: “Took me all day to decide on this one. Teleport. Because sometimes quality of life is worth more. The possibilities are truly endless.”

$100M: “at my age don't know how much longer i've got ”

Teleport: “Always able to get yourself out of a dangerous situation (e.g. car or plane crash, rip tide, etc.) plus you can travel anywhere in the world with the family with no time on a plane. I bet you could monetize this somehow too”

Teleport: “I think I can break even pretty quickly taking everyone to Disney with no entrance, flights, or hotels ”

Here’s today’s question…

Some ground rules…

You can pay to fix it, but no upgrading

Rather be stuck with your current phone for the rest of your life or your current car for the rest of your life?

Oh, and one more thing…

What did you think about today's newsletter?

Sent from my Amazon Fire Phone. Please excuse any mistakes and typos.

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.