Hey there weekday warrior,

Bill Chisholm out here putting up Wilt numbers.

Enjoy the next 4 minutes and 7 seconds of blue-chip news and commentary.

Keep on snapping necks and cashing checks,

Anything is possible

Stocks Sports team valuations only go up…

Imagine spending $6.1B and all anyone can talk about in the basketball world is McNeese State’s student manager…

A group of old rich dudes (how original) is buying the Boston Celtics for $6.1B in what will be a record for a US sports franchise. Friendly reminder: the Washington Commanders changed hands for $6.05B in ‘23.

The new owner group includes billionaire Bill Chisholm. Dollar Bill founded Symphony Technology (a PE shop). His LinkedIn reads like the wet dream of kids who roll up distressed HVAC companies: Dartmouth undergrad > Wharton > Bain > IB > private equity.

Rob Hale (a current owner), Bruce Beal Jr., and PE shop Sixth Street round out the stable of fat cat owners (*double checks* it does not include Chamath Palihapitiya).

They’ll take over from Wyc Grousebeck, who has owned the team since 2002 and will presumably put this $6 bil on his pile with his other f*cking bil.

And Wyc might’ve sold the f*cking rip. The NBA just inked a record-breaking 11-year $76B media deal… even though the only thing anyone can talk about is plummeting viewership and waning interest.

📚 Join the Duolingo for Investing

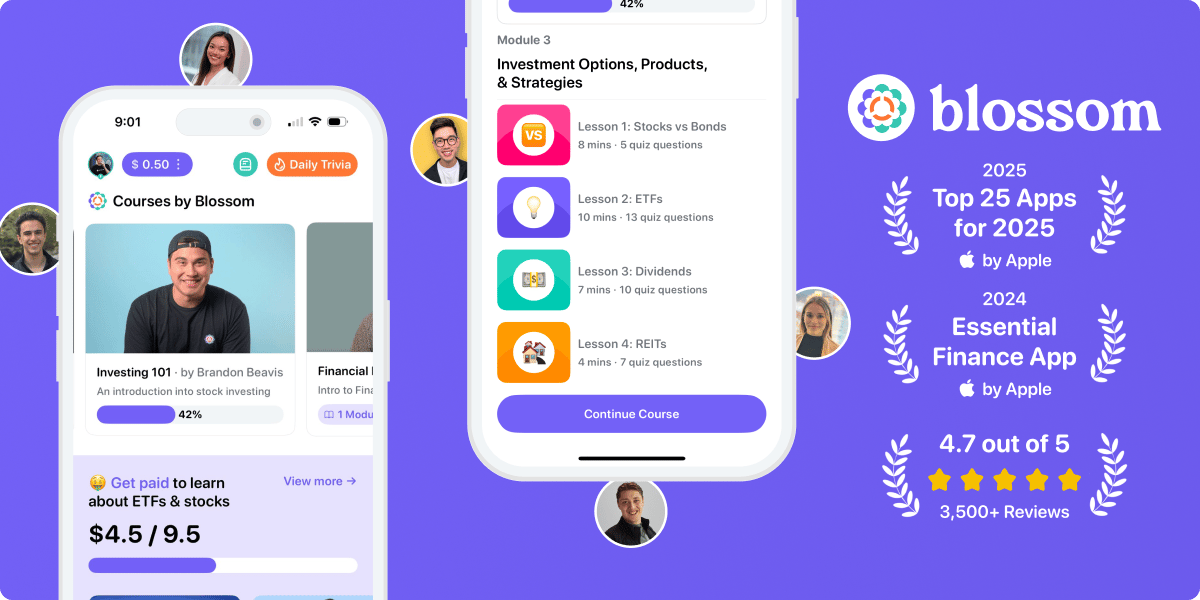

📈 Want to learn the fundamentals of investing? Check out the app Blossom where you can find over 50 hours of Duolingo-style lessons with videos and quizzes, taught by some of North America’s largest investing content creators. Courses like:

Investing 101

Trading 101

Personal Finance 101

Financial Metrics

and Getting Wealthy with Your 9-5

⭐️ With a 4.7 rating in the App Store and ranked an Essential Finance App of 2024 by Apple, Blossom is loved by over 250,000 members.

🤗 On top of the educational courses, Blossom is also a social network and community for investors where you can learn and get investing ideas from the community - all backed up by what people are actually investing in.

+ As if it wasn’t bad enough that they couldn’t get a job at McKinsey, Bain, or BCG, now Accenture consultants have to deal with DOGE. The community college of consultancies appears to be the first private sector casualty of the Department of Government Efficiency.

Accenture’s $ACN ( ▲ 0.65% ) CEO/the final boss of management consultants dropped this bomb during the company’s earnings call: “As you know, the new administration has a clear goal to run the federal government more efficiently. During this process, many new procurement actions have slowed, which is negatively impacting our sales and revenue.”

Shares fell more than 7% on the day, and in the immortal words of Chris Tucker, “you just got knocked the f*ck out.” Other consultancies with government exposure like Booz Allen $BAH ( ▼ 1.18% ) and Cognizant $CTSH ( ▼ 0.83% ) also got rekt.

+ The work is mysterious and unprofitable…

Despite producing the only watchable streaming series right now (I said what I said), Apple $AAPL ( ▼ 3.21% ) TV+ is reportedly losing tres comas (think: $1B per year). Turns out when it comes to the streaming wars, Netflix $NFLX ( ▲ 13.77% ) (301M subs), Disney+ $DIS ( ▲ 0.46% ) (124M subs), and Warner Bros Discovery $WBD ( ▼ 2.19% ) (116M) are the nuclear superpowers and Apple TV+ is more like North Korea (40M subs). Apple has spent around $5B each year on production since launching in 2019, and the math isn’t math-ing.

In other Apple failure pre-greatness news, Tim Apple just walked out to the mound to relieve the head of AI John Giannandrea of his oversight of Siri. You might recall that Apple has fallen behind its competitors in AI, and its Siri revamp has been a complete sh*tshow. While John starts updating his resume, Vision Pro creator Mike Rockwell (great baseball name, btw) is getting called in from the bullpen.

+ Nike $NKE ( ▼ 2.77% ) shares plummeted after it dropped some p*ss poor Q4 guidance. Shareholders “just did it” (read: sold) after the Swoosh warned of a double-digit percentage sales drop for the current quarter as it deals with tariffs and a rocky turnaround. Do you mean to tell me private equity legend Kim K didn’t turn everything around with the SKIMS x Nike collab?

Despite the bleak outlook, the Shoe Dogs crushed Q3 earnings and revenue estimates.

+ Donny Economy slammed the Fed on Truth Social for being a bunch of betas. #47 wants J-Poww to cut rates to ease economic pressure from the tariff war.

+ They’re going to write case studies about Klarna’s pre-IPO PR full-court press. After landing an exclusive deal to be Walmart’s $WMT ( ▲ 2.84% ) layaway provider, KLAR just locked in a deal to do the same with DoorDash $DASH ( ▼ 2.18% ). We’ve officially entered the ‘pay for pizza in installments’ phase of the economic cycle.

+ Peyton Manning just jumped on board with a group investing $45M in a new round of funding for YouTube channel Good Good Golf. Ok, cool, but have you seen the Happy Gilmore 2 Trailer yet?

+ US stocks “slipped on Thursday, failing to build on a Wednesday rally fueled by reassuring signals from Federal Reserve Chair Jerome Powell after the central bank held interest rates steady.” (Yahoo! Finance)

+ The 10-year yield “dipped on Thursday as investors weighed the state of the U.S. economy a day after the Federal Reserve held interest rates steady.” (CNBC)

+ Oil “prices rose on Thursday after the United States issued new Iran-related sanctions and renewed tensions in the Middle East countered strength in the dollar.” (Reuters)

+ Bitcoin “gave up gains Thursday, as post-Federal Reserve decision optimism ran out of steam.” (Investing.com)

+ The three most talked about stocks on WallStreetBets in the past 24 hours were: 1) Visa -0.1% 2) Nvidia +0.8% 3) Hims & Hers Health -2.9%

⏪ Yesterday…

+ PDD, Accenture, and Darden Restaurants dropped earnings before the bell

+ Nike, Micron, FedEx, Lennar, and Quantum Computing reported after the bell

⏩ Today we’re keeping an eye on…

+ NIO and Carnival drop earnings before the bell

Yesterday, I asked, “What's the GOAT Ben & Jerry's flavor?”

27.6% of you chose Half Baked. Honestly shocking it didn’t win by a bigger margin…

Here’s what some of you guys had to say…

Half Baked: “Regardless of if I am also half baked or not, still the best flavor ”

Americone Dream: “If you didn’t pick American Dream Cone you are clueless. Although nothing is better than Häagen-Dazs coffee…”

Phish Food: “Jam sesh? Yeah, I'm going to jam this ice cream into my mouth.“

Cherry Garcia: “Best served by the pint, hacked in half with a boning knife.”

Other (write in): “Bob Marley’s One Love. For those that know, it was fire. ”

And here’s today’s question…

Which of the professional services is most likely to make their job their entire personality?

Oh, and one more thing…

What did you think about today's newsletter?

Does this look like the face of a guy you should take financial advice from?

No, it’s the face of an individual who is financially irresponsible/dumb enough to be talked into spending money on a family photo shoot that he could have just done with his iPhone. So, act accordingly...

This is not financial advice. Nothing in this newsletter is an investment recommendation. All content is created for entertainment, educational, or informational purposes only. Do your own research, or do yourself a favor and hire a professional.